SGB Executive Footwear

Nike And Foot Locker Upgraded On Nike’s Innovation Pipeline

Nike was upgraded to “Buy” from Canaccord Genuity while Foot Locker was upgraded to “Outperform” by Wells Fargo. Both upgrades were tied to successful recent launches and bright prospects for future ones from Nike. Canaccord Genuity analyst Camilo Lyon also called Nike’s controversial Colin Kaepernick “Just Do It” anniversary campaign a “stroke of genius.”

One Week In: Nike’s Kaepernick Saga

It’s been a week since Nike caused an nationwide uproar over the company’s decision to make Colin Kaepernick the face of the thirtieth anniversary of the company’s “Just Do It” campaign. Boycott threats, shoe burnings, and at least two colleges vowing to stop wearing and one store vowing to stop selling Nike product have arrived so far. But praise, loads of media exposure and indications of a sales bump also came.

Retail Reports Roundup

Studies arrived showing Nike and Lululemon ranking high among favorite retailers for millennial and Gen Z consumers; Outdoor Voices landing among LinkedIn’s top startups and research on visual search, online personalization, Walmart’s online share gains and voice assistant shopping.

Moosejaw’s CEO Addresses Walmart Concerns In Open Letter

On Linkedin, Eoin Comerford, Moosejaw’s CEO, wrote an open letter to the outdoor industry asserting that the development of the Premium Outdoor Store on Walmart was done in the spirit of “inclusivity” and he’s “surprised by the vehemence of the attacks by some of our industry’s leading retailers and the threats to drop brands that participated.”

Journeys Powers Genesco Ahead In Q2

Driven by huge gains in revenues and profitability at Journeys, Genesco Inc. reported the company’s first positive store comp in eight quarters while posting a surprise profit in the second quarter. Said Bob Dennis, Genesco’s CEO, “Despite lapping positive comparisons when Journeys successfully emerged from the fashion shift a year ago.”

Aisle Talk Week Of September 3

Top headlines from the active lifestyle industry you may have missed this week, including the tragic death of Jason Hairston, the founder of the KUIU hunting apparel brand.

Zumiez Q2 Gets Boost From Vans

Zumiez delivered the company’s “strongest second quarter in several years,” according to Rick Brooks, CEO, with a big boost from Vans.

G-III Apparel Q2 Boosted By Donna Karen And Tommy Hilfiger

Driven by sales more than doubling for Donna Karan/DKNY and 60 percent growth for Tommy Hilfiger, G-III Apparel Group Ltd. reported second-quarter results that came out well ahead of guidance.

Dick’s Touts Strong Vendor Relationships

Despite aggressive shifts by many vendors to pursue growth in direct-to-consumer (DTC) channels and the widely-covered challenges the chain is facing with Under Armour, Ed Stack, Dick’s Sporting Goods’ CEO, told attendees at Goldman Sachs’ Annual Global Retailing Conference that the chain’s vendor relationship have “never really been better.”

Caleres’s Shares Sink On Q2 Miss

Shares of Caleres Inc., the parent of Famous Footwear, fell 7.9 percent on Wednesday after the company reported earnings and sales that both grew but just missed Wall Street’s targets. The report comes as competitors, DSW and Shoe Carnival, both sharply raised their guidance following robust Q2 results.

SGB Exec Q&A: Decathlon USA’s COO Sophie O’Kelly De Gallagh

Sophie O’Kelly de Gallagh, COO of Decathlon USA, talked to SGB about Decathlon’s return to U.S.retailing with the company’s “lab” store in San Francisco, the retailer’s unique vertically-integrated model and expansion plans.

Retail Reports Roundup

Studies arrived on retailers’ omnichannel concerns, kids influence on BTS purchases, Gen-Z’s and millennials mobile phone purchases, Gen-Z’s non-digital interests, expanding retail app usage and more.

Aisle Talk Week of August 27

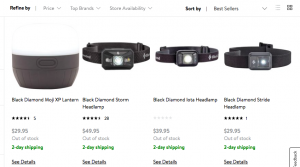

Top headlines from the active lifestyle industry you may have missed this week, including Black Diamond Equipment Ltd. sending Walmart a cease and desist notice in response to the launch of a new outdoor website on Walmart.com curated by Moosejaw.

Tilly’s Delivers Strongest Comp In Seven Quarters

Share of Tlly’s were trading up around 13 percent in mid-day trading Thursday after the action-sports themed retailer posted the company’s best comp since the third quarter of 2016 while exceeding profit guidance.

Dick’s Blames Q2 Top-Line Shortfall On Under Armour

Dick’s Sporting Goods reported earnings that easily topped Wall Street’s targets but sales came in well below as weakness from Under Armour continued to place a drag on sales. On a conference call with analysts, Ed Stack, CEO, said the company is “repositioning” its Under Armour business, including gaining more exclusives from the brand while finding other product to fill traditional Under Armour space.