Topgolf Callaway Brands said they posted a solid quarter in Q2, driven by strength across all the company’s business segments. On a conference call with analysts after reporting results for the quarter, company management seemed pleased that they had seen market share gains and brand growth in golf equipment, a stronger economic model, a proven growth algorithm in the Topgolf venue business, and continued growth in its apparel assets.

Company President and CEO Chip Brewer said in prepared remarks for the analyst call that the company also sees a resilient and engaged consumer across all its businesses. He said they remain on track to deliver strong EBITDA growth for the full year and to transition to being cash flow positive, but he also said the company recognizes there is “more quarterly noise in our results than would be ideal.”

“Most significantly, last year’s retail inventory catch-up in our golf equipment business and, separately, the post-COVID surge in the events business at Topgolf make year-over-year quarterly comparisons difficult and cloud the true progress we are making in improving the fundamental economic engine of our business,” he suggested.

Brewer noted that the company hopes to clearly explain the short-term volatility and highlight the long-term positive story of continued improvement in the earnings power of the business and the resilience of the core Modern Golf consumer.

“This is a business which is expected to add three to four million new off-course golf participants each year for every 11 new venues and will thus help drive growth across the entire Modern Golf ecosystem,” Brewer estimated. “With this growth, Topgolf will soon have more consumers visiting it than exist in all of U.S. on-course golf, including one-half of the total on-course golf population as many now participate in both on- and off-course golf.”

Topgolf Segment

Topgolf segment revenue reportedly increased 16.6 percent to $470.8 million in the second quarter, driven by the addition of 11 new venues and approximately 1 percent same-venue sales growth, which was said to be within range of guidance.

Company CFO Brian Lynch estimated that the impact of temporary venue shutdowns caused by fires in Canada was worth about a point of same-venue sales.

“We believe it is helpful to compare same-venue sales on a two-year stack basis because it removes some of the COVID-related volatility and demonstrates the strength of our venue business,” Lynch explained. “On a two-year stack basis, same-venue sales growth for Q2 was 9 percent. By comparison, Q1 2023 same-venue sales were 11 percent and on a two-year stack basis was 13 percent.”

Brewer also said the company had continued progressing on its “digital journey,” including reservations, and noted that U.S. venue digital sales penetration increased 8 points versus 2022 to approximately 34 percent.

“The largest driver of this growth is our digital inventory management system, PIE, which has now been rolled out to over half of our venues,” he explained. “This system allows us to maximize sales, improve the customer experience and optimize costs.”

Brewer said the company expects to have all venues on PIE by the end of the year. On an individual venue basis, he said it helps drive approximately a two-point increase in same-venue sales post-implementation. “Given the timing of the rollout, we estimate it will add at least one percent to same venue sales in Q4,” he suggested.

Brewer also said the company had, and is taking, incremental pricing in gameplay and food and beverage. “Based on our experience, as well as competitive positioning, we believe this will have at least a one percent positive impact on same venue sales, primarily in Q4,” he added.

Turning to its TopTracer range technology, Brewer said the company sees healthy demand for the product, with accelerating bay installations versus Q1, and is on track to install at least 7,000 bays in 2023, in line with guidance.

Topgolf segment operating income was $44.0 million in the quarter, mainly flat to last year’s quarter, due to planned investments in marketing and labor and partially offset by increased efficiencies in the venues.

Segment Adjusted EBITDA increased 6.7 percent year-over-year to $92.1 million due to the increase in revenues and improved operational efficiencies at the venues. Lynch said it was at the high end of the company’s guidance range due to solid performance in its new venues and improved operational efficiencies at existing venues.

“Importantly, the underlying earnings power of this business continues to increase, and we remain on track to achieve our four-wall Adjusted EBITDAR margin target of 35 percent by 2025, if not sooner,” he estimated.

Golf Equipment Segment

Golf Equipment segment revenue decreased 0.2 percent (+1.0 percent constant-currency) to $451.0 million in the second quarter due to a negative foreign currency impact of $5.5 million and an inventory fill-in at retail in Q2 2022 that did not recur in Q2 2023. These headwinds were offset mainly by increased golf ball sales due to improved supply and strong demand.

- Golf Club sales were down 7.5 percent (-6.2 percent constant-currency) to $340.3 million for the quarter; and

- Golf Ball sales jumped 31.6 percent (+32.7 percent constant-currency) to $110.7 million in the quarter.

“We delivered improved U.S. market share performance in the second quarter, in what has been an excellent year-to-date for our brand in both tour exposure and product performance,” Brewer said. “In June, we saw U.S. market share gains in every category in on- and off-course channels.

For both the month of June and year-to-date, our [Callaway] brand is No. 1 in drivers, fairway woods, hybrids, total woods, and irons. We are also No. 2 in putters and golf balls, with strong shares in these categories as well.”

Brewer said the Paradym line of clubs launched in Q1 was the primary driver of this success, suggesting it had the No. 1 selling driver and fairway wood model year-to-date in the U.S.

“Looking at the overall golf industry and the health of the game, the U.S. hardgoods market continues to hold up quite well, down just 1.6 percent June year-to-date, consistent with our expectations,” Brewer added. “In addition, all signs point to golf participation remaining robust with U.S. rounds played up 5.5 percent through June year-over-year, and strong demand for consumables in the quarter.”

Golf Equipment segment operating income was $96.4 million, a 3.9 percent decline versus Q2 2022, primarily due to unfavorable changes in foreign exchange rates. The result was partly offset by stronger gross margins, which increased approximately 100 basis points year-over-year primarily due to increased pricing and lower freight costs.

Active Lifestyle Segment

Active Lifestyle segment revenue decreased 0.8 percent, flat on a constant-currency basis, to $257.9 million in Q2, primarily due to the year-over-year difference of wholesale shipment timing in Europe in the first half of the year and was largely offset by continued strong growth at TravisMathew, which grew in double digits in the second quarter.

- Apparel sales, which include TravisMathew and Jack Wolfskin, increased 4.8 percent (+5.9 percent constant-currency) to $143.5 million in the second quarter; and

- Gear, Accessories and Other category sales decline 7.1 percent (-6.6 percent constant-currency) to $114.4 million in the period.

Lynch said the flat performance was largely due to a shift in the timing of wholesale shipments between Q1 and Q2 compared to 2022. Segment revenue for the first half of 2023 grew 13.3 percent.

The [TravisMathew] brand continues to open new retail stores, including five year-to-date, and totaling 46 overall,” said Brewer. “The team also continues to do a tremendous job executing the new women’s category expansion which has now grown to become a mid-single digit percent of overall sales, an early sign of success.”

Brewer said Jack Wolfskin “had a good first half, despite a choppy macro backdrop in Europe,” as well as earlier shipment timing this year versus last year, as supply chains corrected. He said Jack Wolfskin remained on track for steady growth in revenue and profits for 2023.

Active Lifestyle segment operating income decreased $3.0 million (or 13.3 percent) to $19.5 million due to planned operating expenditures to support business growth. It was offset partly by gross margin increases related to increases in price and a higher mix of direct-to-consumer business.

Consolidated income from operations decreased 10.1 percent. On a non-GAAP basis, income from operations declined by 3.4 percent and was flat on a constant-currency basis.

Net income increased $12.0 million on a GAAP basis, or decreased $15.7 million, to $77.8 million on a non-GAAP basis. This non-GAAP performance included a $20.3 million increase in interest expense related to higher interest rates and additional term loan debt.

Adjusted EBITDA of $206.2 million slightly exceeded the high end of the company’s guidance range, as compared to $207.3 million in the second quarter of 2022. This year-over-year performance was due to unfavorable changes in foreign currency rates and partially offset by operational efficiencies. On a constant-currency basis, Adjusted EBITDA increased by 1.7 percent.

Topgolf Callaway Brands completed a significant debt refinancing in March 2023, which added approximately $300 million of additional liquidity, reduced the company’s cost of the refinanced debt and extended the maturities of its credit facilities.

“We not only simplified and strengthened our capital structure but also gave ourselves flexibility on how to finance Topgolf venues, including self-financing, which provides us with another option as we decide how to finance future venues,” said Lynch.

As of June 30, 2023, available liquidity, comprised of cash-on-hand and availability under company credit facilities, was $648 million dollars compared to $415 million dollars at December 31, 2022, and compared to $640 million dollars at June 30, 2022.

At quarter-end, MODG had total net debt of $2.24 billion dollars, excluding convertible debt of approximately $258 million, compared to $1.44 billion at the end of Q2 2022. This increase relates primarily to incremental new venue financing, the additional $300 million term loan debt and the normalization of working capital for the non-Topgolf business.

Net Debt leverage, which excludes the convertible debt, was 4.1x at quarter-end, compared to 2.7x at June 30, 2022. The year-over-year increase was due to new venue development and increases in working capital. Net debt leverage ratio was said to be in line with March 31, 2023, which was reportedly a little better than the company discussed last quarter.

“We continue to expect our leverage to decline in the back half of the year as we generate free cash flow,” said Lynch.

Inventory balance increased to $840 million at quarter-end compared to $604 million at June 30, 2022, down from the December 31, 2022 balance of $959 million. The company’s active inventory management was credited with a reduction of $119 million in the first half of 2023.

“Continued momentum in our Golf Equipment and Active Lifestyle segments gives us confidence that we remain on track to be at more normal levels of inventory by the end of the year,” Lynch shared. “More importantly, we feel good about the quality of our inventory as much of our older inventory was cleaned up during the pandemic.”

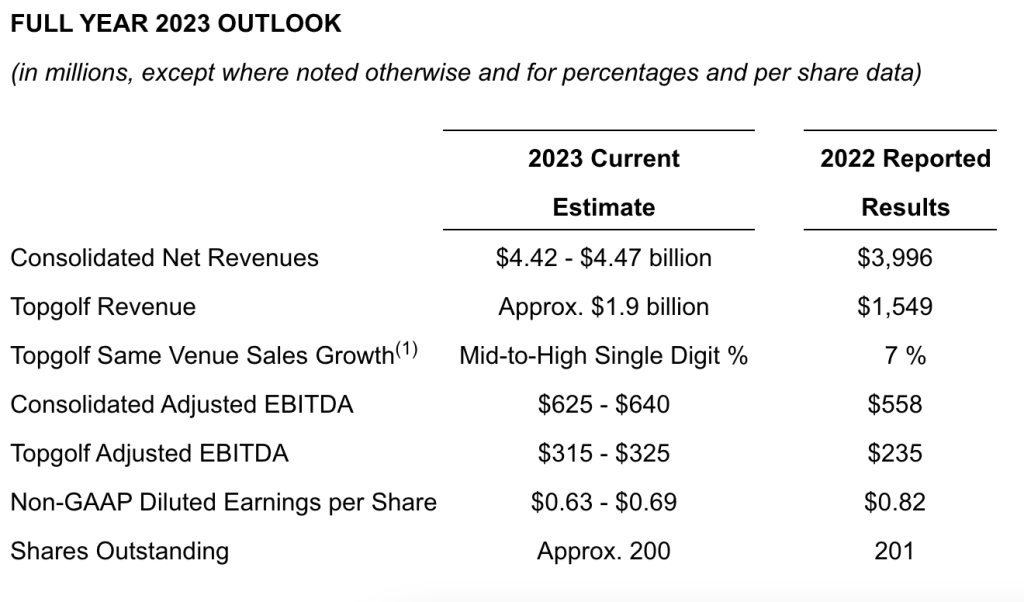

The company also reaffirmed its full-year guidance:

“In conclusion, we are excited about the strategic direction of our portfolio of global brands in the growing Modern Golf ecosystem,” Brewer closed with his prepared comments. “In the near term, our brands are strengthening, and we remain on track to deliver impressive EBITDA growth and transition to positive free cash flow this year. This inflection point is just the first step in what will be a strong, long-duration story of overall growth in both EBITDA and cash flow.”

“In conclusion, we are excited about the strategic direction of our portfolio of global brands in the growing Modern Golf ecosystem,” Brewer closed with his prepared comments. “In the near term, our brands are strengthening, and we remain on track to deliver impressive EBITDA growth and transition to positive free cash flow this year. This inflection point is just the first step in what will be a strong, long-duration story of overall growth in both EBITDA and cash flow.”

Lynch closed out his comments with a note that the company had identified unusual IT system activity and immediately took proactive steps in consultation with advisors to secure its systems.

“We activated our incident response plan and moved portions of our network off-line as a precautionary measure,” Lynch explained. “The majority of our systems are back online, and full access is expected to be restored in the coming days. Based on what we know now, we do not believe the incident will have a material effect on our business, operations, or financial results.”

Photo and table courtesy Topgolf Calloway Brands