Descente Ltd. reported that net sales for the fiscal year ended March 31, 2024 increased by 5.3 percent to ¥127.0 billion reportedly due primarily to growth in direct-to-consumer (DTC) net sales expanded the channel composition ratio, sales growth in South Korea due to an increase in full-price sales, and China’s incorporation of Le Coq Sportif (NINGBO) Co., Ltd. (NLCS) into consolidated results from the previous fourth quarter.

Japan-based Descente reports financials in Japanese yen (¥).

In gross profit, in addition to the above-mentioned increase in sales, the promotion of DTC business in Japan and the strengthening of full-priced stores in South Korea contributed to a 9.2 percent increase compared to previous year to ¥75.6 billion, and gross margin reached a record high.

Selling, general and administrative expenses increased by 8.8 percent to ¥66.8 billion for the year, compared to the prior year, said to be due to the impact of the incorporation of NLCS and branding expenses such as the conclusion of a new contract with professional golfer Xander Schauffele for Descente.

Operating income increased by 12.2 percent from the prior year to ¥8.7 billion.

Ordinary income increased by 34.8 percent to ¥15.7 billion due to growth of equity in earnings of affiliates of Descente China Holding Ltd (DCH) and Arena Korea Ltd (AK).

In terms of extraordinary income and losses, the prior fiscal year recorded ¥2.1 billion of gain on step acquisitions of NLCS. In contrast, the company said it recorded an extraordinary loss mainly for restructuring charges in the fiscal year through March 2024.

Due to the increase in ordinary income, profit attributable to owners of parent company increased 13.9 percent year-over-year (YoY) to ¥12.0 billion.

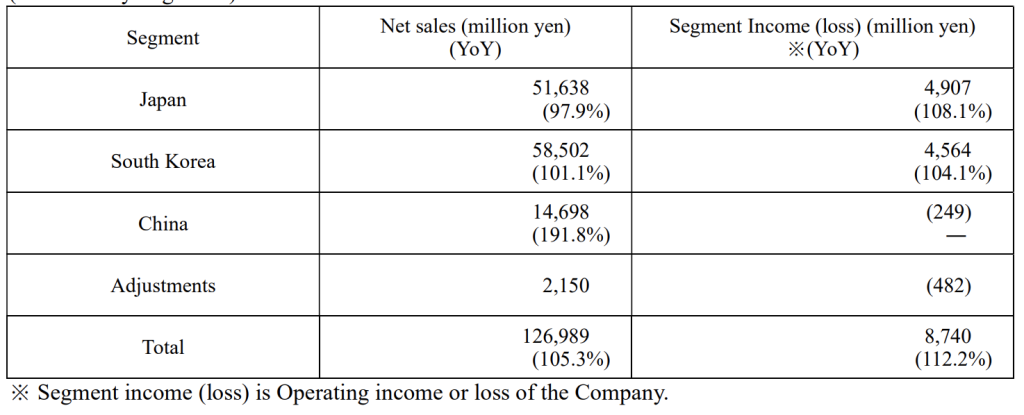

Japan Segment

Descente brand sales at directly managed stores reportedly grew substantially for the year, jumping approximately 70 percent over previous year, while sales of the Umbro and Arena brands continued to be strong, resulting in higher sales in the athletic wear category. Still, the comp0any said that due to the end of Marmot brand licensing contract in December 2022 and lower sales in golf wear categories, net sales declined 2.1 percent from the prior year to ¥51.6 billion. The company said the promotion of the DTC business improved gross margin, and SG&A expenses decreased compared to prior year partly due to the standardization of branding expenses and lower logistics expenses.

Resulting segment income increased by 8.1 percent compared to previous year to ¥4.9 billion.

South Korea Segment

Despite the continued impact of the rebound from the golf boom, the company said net sales increased by 1.1 percent YoY to ¥58.5 billion, reportedly due to growth in sales of Descente brand full-priced sales in the athletic wear category, continued strong sales of “umbro” centered on products for MZ generation, and the depreciation of the yen.

Expansion of the full-priced sales ratio contributed to an improvement in gross margin, resulting in a 4.1 percent increase in segment income compared with previous year to ¥4.6 billion. Although not included in the segment income, Arena Korea, an equity-method affiliate that operates the Arena brand, saw strong sales of leisure swimsuits in line with an increase in travelers going overseas.

China Segment

Net sales surged 91.8 percent YoY to ¥14.7 billion, said to be mainly due to higher sales resulting from the incorporation of Arena (Shanghai)Industrial Co., Ltd. and NLCS. Although gross profit increased due to the incorporation of the two companies, the segment loss was ¥249 billion reportedly due to an increase in SG&A expenses associated with rebranding. DCH, an equity-method affiliates that operates the Descente brand, reportedly remains strong, although it is not included in the segment income (loss).

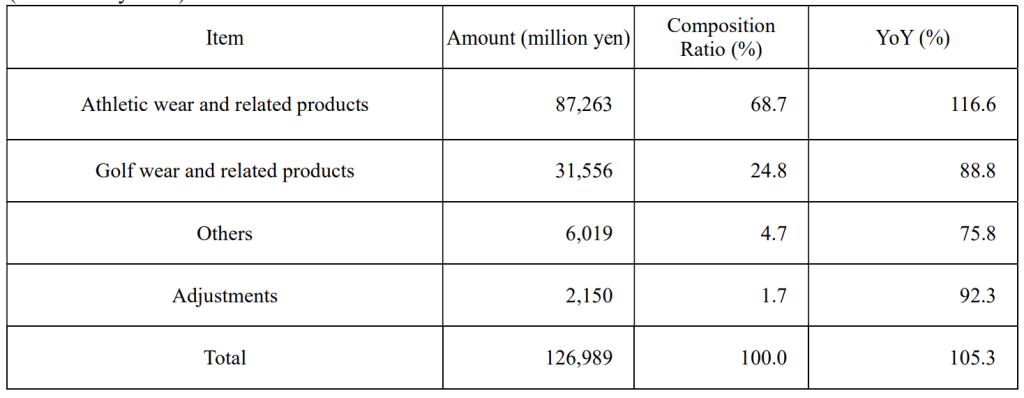

Category Highlights

Athletic Wear and Related Products Segment

Sales of Mizusawa Down, despite a warm winter trend in Japan, South Korea and China, remained strong. And sales were driven by “Descente”, which expanded its lineup of high-value-added products, such as shell jacket Creas, which contributed to sales as a mainstay product in the spring and fall. Sales of the Arena brand and the Umbro brand were also strong in all segments. As a consequence, net sales in this category increased 16.6 percent compared with previous year to ¥87.3 billion.

Golf Wear and Related Products

In Japan, sales reportedly grew at directly managed stores of the Descente brand, mainly due to the directly managed flagship store Descente Golf Complex Ginza (Ginza, Tokyo). Sales of R90 and Condor, golf-shoes developed in Disc Busan (South Korea), were strong in Japan, South Korea, and China, contributing to sales regardless of region. Still, net sales in this category fell 11.2 percent YoY to ¥31.6 billion, said to be despite the rebound of the golf-boom in Japan and South Korea.

Consolidated Financial Position

(Analysis of the status of assets, liabilities, and net assets)

At the end of the current fiscal year, total assets were ¥150.3 billion, up ¥16.7 billion from the end of prior fiscal year.

Current assets increased ¥4.7 billion from the end of the prior fiscal year to ¥87.2 billion. This was said to be mainly due to an increase in cash and deposits of ¥1.2 billion, an increase in notes and accounts receivable trade of ¥1.2 billion, and an increase in merchandise and finished goods of ¥1.4 billion.

Non-current assets increased ¥12.1 billion from the end of the prior fiscal year to ¥63.1 billion. This

was said to be mainly due to an increase in investment securities of ¥8.1 billion and an increase in right-of-use asset of ¥1.7 billion.

Total liabilities reportedly increased ¥3.3 billion from the end of prior fiscal year to ¥36.6 billion. This was said to be mainly due to an increase in long-term borrowings of ¥1.4 billion and an increase in lease liabilities of ¥1.9 billion.

Net assets increased ¥13.4 billion from the end of prior fiscal year to ¥113.7 billion, said to be mainly

due to an increase in retained earnings of ¥9.0 billion and an increase in foreign currency translation adjustment of ¥3.4 billion.

Consequently, equity ratio increased by 0.7 percentage points to 75.3 percent compared to the end of prior fiscal year.

Consolidated Cash Flows

(Analysis of Cash Flow Status)

Cash and cash equivalents at end of the fiscal year decreased by ¥5.5 billion to ¥29.2 billion compared to the end of prior fiscal year.

Cash flows from operating activities was net cash-inflow of ¥7.4 billion (prior fiscal year was net cash inflow of ¥12.9 billion). The main factors contributing to the result were income before income taxes ¥15.3 billion, depreciation ¥4.4 billion, equity in earnings or losses of affiliates ¥6.4 billion and income taxes paid equaling ¥2.6 billion.

Cash flows from investing activities was net cash-outflow of ¥9.6 billion (prior fiscal year was net cash outflow of ¥8.0 billion). This was mainly due to a decrease of ¥6.3 billion in time deposits, ¥1.63 billion in purchase of property, plant and equipment, and ¥1.5 billion of purchase of intangible assets.

Cash flows from financing activities was net cash-outflow of ¥3.6 billion (prior fiscal year was net cash outflow of ¥4.0 billion). This was mainly due to ¥3.0 billion in cash dividends paid, repayment of lease

obligation payable os ¥1.8 billion, and proceeds from long-term loans payable ¥1.8 billion.

Consolidated Performance Forecast

Since May 2021, the company has promoted mid-term management plan “D-Summit 2023” strategy. As a result, the company said ordinary income and profit attributable to owners of the parent company achieved a record-high for the second consecutive year in the fiscal year ended March 2024.

On May 13, 2024, the company formulated a new mid-term management plan, “D-Summit 2026,” and will promote various strategies to further increase earnings. In “D-Summit 2026”, Descente Ltd. said it will execute the plans of:

I. The Investment for Growth. This will which regional strategies in Japan, South Korea, and China; and

II. The investment for Strengthening Business Foundation. Through aggressive investment, the company said it aims to achieve sustainable growth as a group.

For the year ending March 31, 2025, Descente Ltd. is planning consolidated performance of following:

- Net sales ¥130.0 billion;

- Operating income ¥9.0 billion;

- Ordinary income of ¥17.0 billion; and

- Profit attributable to owners of parent company reaching ¥12.5 billion.

Image courtesy Descente Ltd.