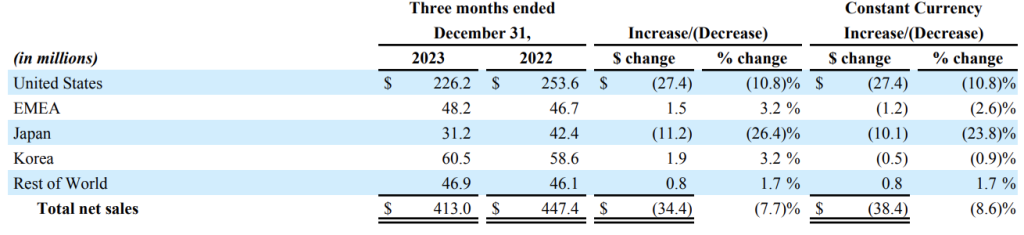

Acushnet Holdings Corp., the parent of the Titleist and FootJoy golf brands, reported consolidated net sales for the fourth quarter decreased 7.7 percent, or 8.6 percent, on a constant-currency (CC) basis. The decline was primarily due to a decrease in Titleist golf clubs following lower sales volumes of second model year TSR drivers and TSR fairways, which the company launched in the third quarter of 2022, and lower sales volumes in FootJoy golf wear, primarily footwear.

The decreases were offset partially by an increase in Titleist golf balls due to higher sales volumes and average selling prices of ProV1 and ProV1x golf balls.

On a geographic basis, consolidated net sales in the U.S. were lower as a result of a 22.3 percent decrease in FootJoy golf wear and an 18.4 percent decline in Titleist golf clubs. The decrease in FootJoy golf wear was primarily due to lower sales volumes in footwear and apparel. The decrease in Titleist golf clubs was primarily due to lower sales volumes of second-model year drivers and fairways.

Fourth Quarter Region Specifics

Net sales in regions outside the U.S. decreased by 3.6 percent (-5.7 percent CC), primarily due to net sales decreases in Japan, EMEA, and Korea.

- In Japan, net sales decreased primarily due to lower sales volumes in Titleist golf clubs due to lower sales volumes of second model-year drivers and fairways, as discussed above.

- In EMEA, net sales decreased primarily from lower sales volumes of products not allocated to one of the company’s four reportable segments, partially offset by net sales increases in Titleist golf balls, Titleist golf clubs and Titleist golf gear.

- In Korea, the decrease was primarily due to lower net sales of products not allocated to one of the company’s four reportable segments and lower net sales in FootJoy golf wear.

- In Rest of World, a net sales increase in Titleist golf balls was offset partially by net sales decreases in all other reportable segments.

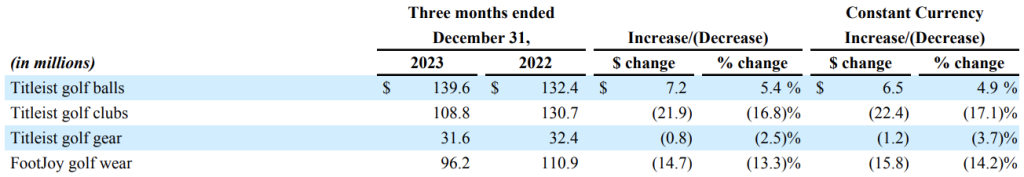

Fourth Quarter Segment Specifics

- Titleist golf balls saw a 5.4 percent increase in net sales (+ 4.9 percent CC), mainly due to higher sales volumes and average selling prices of ProV1 and ProV1x golf balls, partially offset by lower sales volumes of performance models.

- Titleist golf clubs posted a 16.8 percent decrease in net sales (-17.1 percent CC) as sales volumes of the new T-Series irons launched in the third quarter of 2023 were more than offset by lower sales volumes of TSR drivers and TSR fairways launched in the third quarter of 2022.

- Titleist golf gear net sales decreased 2.5 percent (-3.7 percent CC) primarily due to lower sales volumes in gloves and headwear.

- FootJoy golf wear net sales declined 13.3 percent (-14.2 percent CC) primarily due to lower sales volumes in footwear.

The net loss attributable to Acushnet Holdings Corp. for the quarter was $26.7 million, compared to a loss of $0.1 million for the corresponding Q4 period in 2022. This change was said to be primarily a result of a decrease in income from operations, partially offset by a decrease in income tax expense. The decrease in income from operations was due to lower gross profit, primarily due to decreased sales volumes in Titleist golf clubs and FootJoy golf wear, and higher operating expenses.

Operating expenses increased across all reportable segments, except FootJoy golf wear, primarily due to higher employee-related expenses.

Adjusted EBITDA was a loss of $1.5 million, compared to a gain of $25.4 million in the prior-year quarter. The adjusted EBITDA margin was negative 0.4 percent for the fourth quarter versus positive 5.7 percent for the prior year.

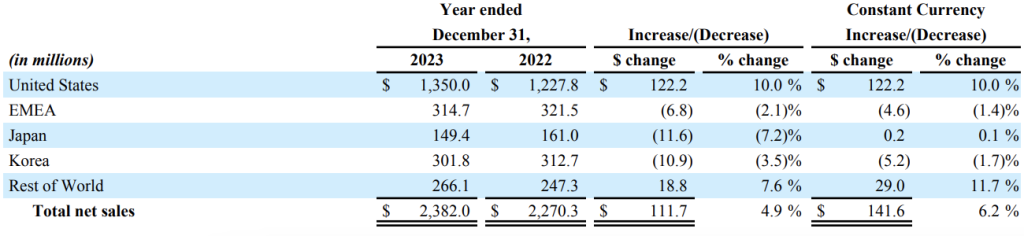

Full Year Results

Consolidated net sales for the full year increased 4.9 percent, or 6.2 percent on a constant currency basis, primarily driven by higher sales volumes in Titleist golf balls, Titleist golf clubs and Titleist golf gear, partially offset by lower sales volumes in FootJoy golf wear, mainly footwear, and products that are not allocated to one of our four reportable segments.

On a geographic basis, consolidated net sales in the U.S. were higher, driven by an increase of 14.2 percent in Titleist golf balls, 11.8 percent in Titleist golf clubs, 6.7 percent in Titleist golf gear, and 2.5 percent in FootJoy golf wear. Higher sales volumes and higher average selling prices of Pro V1 and Pro V1x golf balls primarily drove the increase in Titleist golf balls. The increase in Titleist golf clubs was driven primarily by higher sales volumes and higher average selling prices of our T-Series irons and Scotty Cameron Super Select putters, as well as higher sales volumes of our TSR hybrids, partially offset by lower sales volumes of second model year SM9 wedges. The increase in Titleist golf gear was primarily driven by higher sales volumes of golf bags and higher

average selling prices in travel. The increase in FootJoy golf wear was primarily driven by higher sales volumes of apparel and higher average selling prices of apparel and footwear, largely offset by lower sales volumes of

footwear.

Full-Year Region Specifics

Net sales in regions outside the U.S. were down 1.0 percent or increased 1.9 percent on a constant-currency basis.

- In Korea, the decrease was due to lower sales volumes of products that are not allocated to one of the company’s four reportable segments and lower sales volumes in FootJoy golf wear, partially offset by net sales increases in all other reportable segments.

- In EMEA, the decrease was due to lower sales volumes in FootJoy golf wear and lower sales volumes of products that are not allocated to one of the company’s four reportable segments, partially offset by increases in all other reportable segments.

- In Japan, net sales were flat with increases in Titleist golf balls and Titleist golf gear offset by net sales decreases in Titleist golf clubs and FootJoy golf wear.

- Net sales increased in Rest of World, partially offset by decreases in Korea and EMEA, on a constant-currency basis. The increase in Rest of World was said to be due to net sales increases across all reportable segments, primarily in Titleist golf balls and Titleist golf clubs.

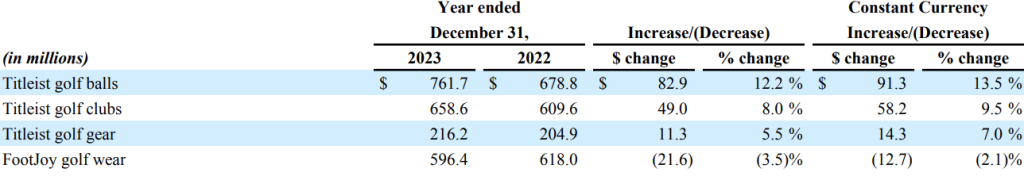

Full-Year Segment Specifics

- Titleist golf balls net sales increased 12.2 percent (+13.5 percent CC), largely due to higher sales volumes and higher average selling prices of the company’s latest generation Pro V1 and Pro V1x golf balls launched in the first quarter of 2023.

- Titleist golf clubs net sales grew 8.0 percent (+9.5 percent CC), largely due to higher sales volumes and higher average selling prices of its T-Series irons launched in the third quarter of 2023 and Scotty Cameron Super Select Putters launched in the first quarter of 2023, as well as higher sales volumes of our TSR hybrids launched in the first quarter of 2023, partially offset by lower sales volumes of second model year SM9 wedges.

- Titleist golf gear net sales increased 5.5 percent (+7.0 percent CC), said to be primarily driven by higher sales volumes across all product categories, except gloves, and higher average selling prices across all product categories.

- FootJoy golf wear posted a 3.5 percent decrease (-2.1 percent CC) in net sales for the year, said to be primarily due to sales volume decrease in footwear partially offset by sales volume increase in apparel.

Full-year net income attributable to Acushnet Holdings Corp. decreased $0.9 million to $198.4 million, down 0.5 percent year-over-year, primarily as a result of an increase in interest expense, net, partially offset by lower income tax expense and other expense, net, as well as higher income from operations.

Adjusted EBITDA was $376.1 million, up 11.1 percent year-over-year. Adjusted EBITDA margin was 15.8 percent versus 14.9 percent for the prior year period.

2024 Outlook

- Consolidated net sales are expected to be approximately $2,450 to $2,500 million;

- Consolidated net sales on a constant currency basis are expected to be in the range of up 3.2 percent to 5.3 percent; and

- Adjusted EBITDA is expected to be approximately $385 to $405 million.

Image courtesy Scotty Cameron/Titleist