Tilly’s, Inc. saw fiscal second-quarter results exceed its previously-announced estimated outlook ranges for both net sales and earnings per share and the company reported on a conference call with analysts that the trend of comp sales results improved to a high-single-digit decline in both June and July following a negative 11.3 percent start in fiscal May.

“This improved sequential comp sales performance, coupled with diligent expense management, produced better bottom-line results than we anticipated for the quarter,” explained company President and CEO Ed Thomas. “Our spring/summer product categories performed better during the second quarter than in the first quarter of this fiscal year, resulting in improved relative performance across all geographic markets with the most significant improvement coming from our home state of California, where 40 percent of our stores reside.”

Comparable net sales, including both physical stores and e-commerce, decreased by 8.5 percent on top of the 16.5 percent decrease posted in the prior-year Q2 period. Comps decreased 17.5 percent in the fiscal first quarter so the Q2 trend is seen as a sequential improvement. The retailer saw early Q3 comps down in the low- to mid-single digits.

Second quarter comps were said to be positive in the retailer’s Northwest region, but single-digit negative in eight of the retailer’s geographic markets, including both Southern and Northern California, and double-digit negative in the remaining five markets. In terms of store transaction metrics, total transactions were down in the low double digits, while the average transaction value increased in low single digits compared year-over-year.

“All departments improved sequentially from their first quarter performance and most have then improved further from the second quarter performance during August,” Thomas shared.

Thomas said the overall girls and footwear businesses comped positive for the quarter, while the women’s and boys’ segments were single-digit negative while men’s and accessories were each double-digit negative on a percentage basis.

Second-quarter total net sales were $160.0 million, a decrease of 5.0 percent, compared to $168.3 million last year. Total comparable net sales, including both physical stores and e-commerce, decreased by 8.5 percent.

Net sales from physical stores were $129.8 million in Q2, a decrease of 5.3 percent, compared to $137.1 million in Q2 last year, with a comparable store net sales decrease of 9.3 percent. Net sales from physical stores represented 81.1 percent of total net sales compared to 81.5 percent of total net sales last year.

Net sales from e-commerce were $30.2 million, a decrease of 3.4 percent from $31.2 million in Q2 last year. E-commerce net sales represented 18.9 percent of total net sales in Q2 compared to 18.5 percent of total net sales in Q2 last year.

Gross margin, including buying, distribution and occupancy expenses, was reported at 27.7 percent of net sales, a 320 basis point decline compared to 30.9 percent of net sales in Q2 last year.

Buying, distribution and occupancy costs deleveraged by 170 basis points and increased by $0.9 million collectively, which was said to be predominantly from occupancy costs as a result of operating additional stores and carrying the costs against a lower level of net sales this year.

Product margins declined by 150 basis points compared to the prior-year second quarter, primarily as a result of “higher markdowns and estimated inventory valuation reserves, but improved by 90 basis points sequentially from this year’s first quarter.”

Selling, general and administrative expenses were $47.0 million, or 29.4 percent of net sales, in the second quarter, compared to $46.8 million, or 27.8 percent of net sales, in Q2 last year. Primary SG&A increases were said to be attributable to non-cash store impairment charges of $0.8 million and increased corporate payroll and related benefits expenses of $0.4 million due to the impact of wage increases associated with employee retention. These increases were partially offset by smaller savings across several expense line items.

The second quarter operating loss was $2.7 million, or 1.7 percent of net sales, compared to operating income of $5.2 million, or 3.1 percent of net sales, in Q2 last year.

Other income was $1.2 million in Q2, compared to $0.2 million in Q2 last year, primarily due to earning higher rates of return on marketable securities this year.

Net loss was $1.1 million, or 4 cents per share, in Q2, compared to net income of $3.8 million, or 13 cents per diluted share, in Q2 last year and an improvement of $0.36 per share sequentially from our first quarter results.

Outlook

The current third quarter, which includes the peak of the back-to-school season in August, total comparable net sales through August 29 – including both physical stores and e-commerce – decreased 3.9 percent versus the comparable period last year, continuing the sequential improvement in comp sales trends in recent months.

“We have seen back-to-school shopping patterns this year that seem to indicate that our customers have been shopping later than in prior years, even seeing stronger results following what we anticipated to be the peak back-to-school shopping weeks for certain stores before them seeing results start to soften in the post back-to-school period,” Thomas suggested, indicating that Q2 could have been stronger under historical trends.

Thomas said, given the backdrop of the second quarter and early Q3 trends, and amid the broader economic environment, Tilly’s is anticipating that comp sales results may likely revert to pre- back-to-school levels following what was a need-based purchasing period during August.

“Based on our quarter-to-date net sales results and current and historical trends, including August typically representing just over half of third-quarter net sales volume, we currently expect our total net sales for the third quarter of fiscal 2023 to be in the range of approximately $166 million to $171 million,” shared company EVP/CFO Michael Henry. He said they see “SG&A to be approximately $50 million pretax loss to be in the range of approximately $1.8 million to $4.3 million.”

The estimated income tax rate is expected to be approximately 26 percent and the loss per share to be in the range of 5 cents to 11 cents per share for Q3 and based on estimated weighted average shares of approximately 29.8 million.

“Overall, we feel good about our back-to-school and holiday merchandise assortment,” Thomas said. “And despite ongoing macroeconomic challenges, we are cautiously optimistic that we can produce a better comp store sales trend over the back half of the year than what we produced in the first half. We will continue to manage our business diligently relative to the environment with the goal of improving performance over time.”

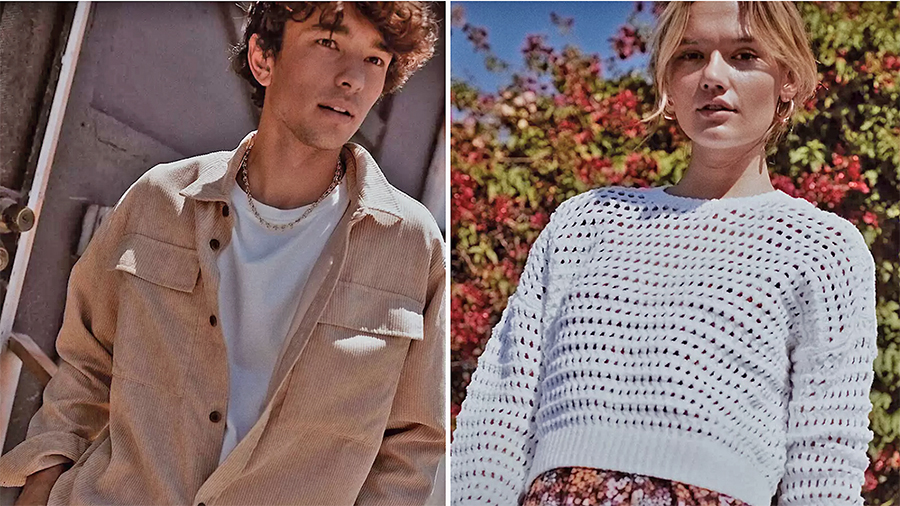

Photo courtesy Tilly’s