Safilo Group S.p.A. (Group), the parent of Smith Optics Belnders Eyewear, and the eyewear licensee for Carrera, Havaianas, Under Armour, Levi’s, David Beckham, BOSS, Tommy Hilfiger, Liz Claiborne, and Fossil brands, has reported that second quarter (Q2) net sales totaled €251.9 million, up 2.3 percent at constant exchange rates but down 1.1 percent at current exchange rates, said to be mainly due to the approximately 5 percent weakening of the U.S. dollar against the euro.

Consistent with Q1, sales performance in Q2 at constant currencies was said to be positive across most of the Group’s core brands, driven once again by the double-digit growth of David Beckham, BOSS, Tommy Hilfiger and Marc Jacobs, while Carrera and Carolina Herrera recorded high-single-digit increases.

Across product categories, the second quarter was reportedly underpinned by solid demand for prescription frames in all key markets, helping to offset the softer performance of sunglasses, influenced by more prudent consumer spending and continued promotional pressures, especially in the United States.

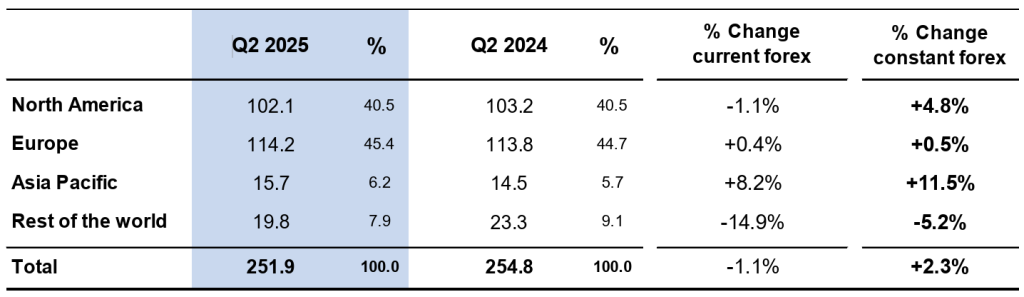

Second quarter and first half sales by geographic area reportedly confirmed positive trends in North America, Europe and Asia-Pacific, while the Rest of the World region remained in negative territory.

Second Quarter Regional Sales Performance

(in € million)

North America second quarter sales amounted to €102.1 million, up 4.8 percent at constant exchange rates but down 1.1 percent at current exchange rates due to the approximately 5 percent weakening of the U.S. dollar against the euro. In the second quarter, the U.S. market continued its recovery, driven by strong momentum in the Group’s contemporary and lifestyle brands across core wholesale channels. The positive performance was led by the double-digit growth in Carrera, David Beckham, BOSS, Marc Jacobs and Carolina Herrera’s collections, which significantly boosted prescription frame sales and helped sustain the sunglasses category in a challenging market environment.

In the direct-to-consumer channel, while Blenders continued to be impacted by promotion-driven demand in the entry-level price segment, its performance showed an improvement compared to the first quarter. In the Sports channel, Smith’s sales were held back by the Group’s strategic decision to temporarily limit imports of new winter items from China. This move, influenced by tariff announcements, resulted in the deferral of some deliveries to the second half of the year.

Europe sales amounted to €114.2 million in the second quarter, up 0.5 percent at constant exchange rates and 0.4 percent at current exchange rates. Sunglasses sales remained broadly stable, with the growth of the business through internet pure players, offsetting a more subdued and volatile performance in physical stores, particularly in Italy and Spain. Prescription frames posted low single-digit growth, fueled by the increasing adoption of the You&Safilo BtB platform among independent opticians and retail chains.

France was said to confirm its role as the region’s main growth driver, underpinned by a favorable business environment. Northern and Eastern European markets also continued to show solid momentum, supported by the Group’s key owned and licensed brands. Sales performance in Europe was also marginally impacted by the de-consolidation effect from the disposal of the subsidiary Lenti S.r.l. in June 2025.

Asia/Pacific Q2 sales amounted to €15.7 million, up 11.5 percent at constant exchange rates and 8.2 percent at current exchange rates. Momentum in the region was said to remain healthy, especially in China and across distributor-led markets, which continued to show solid demand and engagement across the portfolio.

Rest of the World region second quarter sales came in at €19.8 million, down 5.2 percent at constant exchange rates and down 14.9 percent at current exchange rates. The region’s performance was said to be mainly affected by the slowdown in business with Middle Eastern distributors, in a market environment made challenging by political tensions. In contrast, Q2 sales grew in Latin America, driven by a positive recovery of the business in Mexico.

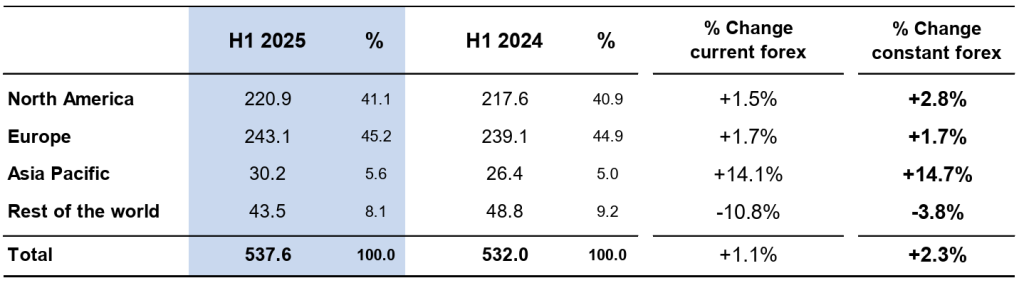

First Half Regional Sales Performance

(in € million)

Safilo closed the first half of 2025 (H1) with net sales of €537.6 million, up 2.3 percent at constant exchange rates and 1.1 percent at current exchange rates, compared to €532.0 million in the first half of 2024. First half sales in the core wholesale channels – namely independent opticians and retail chains – saw solid high-single-digit growth. The online business was said to be moderately positive in the H1 period, remaining stable at 16 percent of revenues. Solid growth in Smith’s direct-to-consumer channel and continued strong sales to internet pure players offset the subdued performance of the Blenders e-commerce business.

North America first half sales totaled €220.9 million, up 2.8 percent at constant exchange rates and 1.5 percent at current exchange rates compared to €217.6 million in H1 2024. This positive performance was driven by Smith’s high-single-digit growth across its core channels and product categories, alongside solid contributions from the Group’s leading eyewear brands in Wholesale distribution.

Europe H1 sales totaled €243.1 million, up 1.7 percent at constant exchange rates and current exchange rates compared to €239.1 million in H1 2024. The performance was underpinned by double-digit increases for David Beckham, Tommy Hilfiger, BOSS and Marc Jacobs, with solid results across both prescription frames and sunglasses collections. The semester in Europe closed with high single-digit growth for Carrera, while Polaroid recorded low single-digit growth.

Asia/Pacific first half sales in totaled €30.2 million, up 14.7 percent at constant exchange rates and 14.1 percent at current exchange rates compared to €26.4 million in H1 2024.

Rest of the World region first half sales totaled €43.5 million, down 3.8 percent at constant exchange rates and 10.8 percent at current exchange rates compared to €48.8 million in H1 2024.

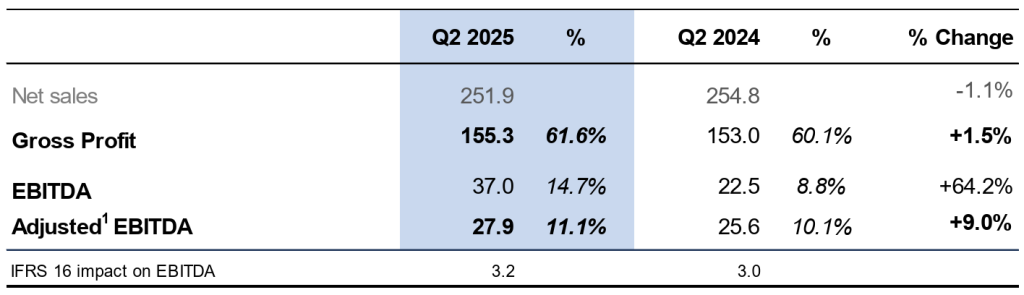

Profitability and Expenses

In the second quarter of 2025, Safilo continued its upward economic trajectory, marked by further improvement in profits and margins. The Group achieved a significant improvement in gross margin, mitigating the adverse impact of U.S. tariffs by maximizing the use of existing inventory to serve the region, alongside selective price adjustments and supplier negotiations.

During the quarter, gross margin also benefited from a favorable price/mix effect, as well as from a positive foreign exchange impact. While continuing to invest in marketing activities to support the development of its owned home brands, the Group was also able to convert a significant portion of its gross margin improvement into stronger operating performance.

In the second quarter of 2025, the Group’s EBITDA included a gain of €9.7 million from the disposal of the subsidiary Lenti S.r.l., which, together with other non-recurring items, is excluded from the adjusted results.