Sturm, Ruger & Company, Inc. reported second-quarter net sales were $142.8 million, compared to net sales of $140.7 million in the year-ago quarter.

Company President & CEO Christopher Killoy said on a conference call with analysts that second-quarter sales were “essentially flat compared to last year,” despite the softening demand in some product categories, including polymer pistols, bolt action rifles and modern sporting rifles.

“The estimated unit sell-through of our products from the independent distributors to retailers in the first half of 2023 decreased 7 percent compared to the prior year period,” Killoy shared. “Comparatively, NICS background checks, as adjusted by the National Shooting Sports Foundation decreased 4 percent from the first half of 2022.”

The NSSF reported that the NICS background checks, as adjusted by the National Shooting Sports Foundation continued to slide in July as well, falling 17 percent year-over-year to just over 1.02 million checks, the 48th month in a row the NICS figure had exceeded one million adjusted background checks in a single month, but still substantially down from the December 2022 figures that saw NICS checks at approximately 1.75 million for the month. Read SGB Media‘s coverage here.

“We continually review independent distributor sell-through data and inventory trends, and channel inventories of several of our product families remain below desired levels,” Killoy said. “We continue to adjust our level of production and the product mix to better align our output with current and expected consumer demand as we strive to capitalize on these opportunities and to better satisfy demand.”

The company uses the estimated unit sell-through of its products from the independent distributors to retailers, along with inventory levels at the independent distributors and at the company, as the key metrics for planning production levels. The company generally does not use the orders received or ending backlog for planning production levels.

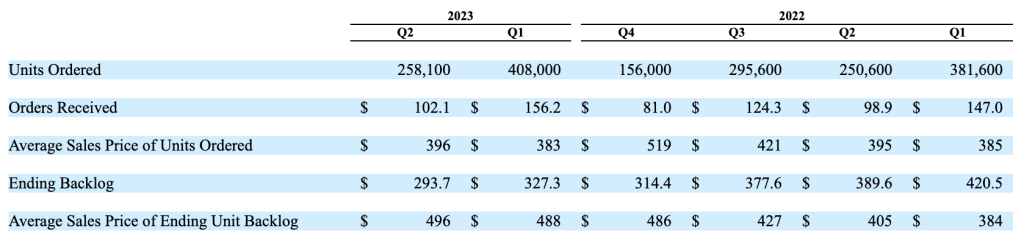

The units ordered, the value of orders received, the average sales price of units ordered, and the ending backlog for the trailing six quarters are as follows (dollars in millions, except average sales price): All amounts shown are net of Federal Excise Tax of 10 percent for handguns and 11 percent for long guns

All amounts shown are net of Federal Excise Tax of 10 percent for handguns and 11 percent for long guns

The company reviews the estimated sell-through from the independent distributors to retailers, as well as inventory levels at the independent distributors and at the company, semi-monthly to plan production levels. Consequently, the company’s overall production in the first half of 2023 decreased by 19 percent from the first half of 2022.

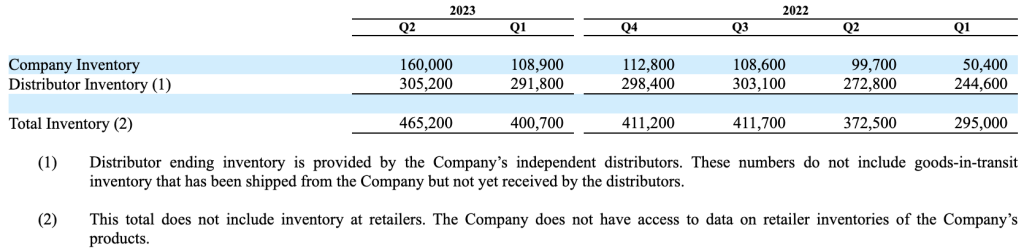

Firearms unit data for the trailing six quarters are as follows (dollar amounts shown are net of Federal Excise Tax of 10 percent for handguns and 11 percent for long guns):

During the second quarter of 2023, the company’s finished goods inventory increased by 51,100 units and distributor inventories of the company’s products increased by 13,400 units.

Inventory unit data for the trailing six quarters follows:

“One of the things when we look at our channel inventories, we don’t look at it just in terms of the aggregate amount, we also look at by product family,” Killoy said during the Q&A session on the call. “And there are certain product families that we’re still, frankly, working very hard to catch up. And there are others, who are satisfied with what’s out there and what we have in inventory. And, right now, when we look at the turns that our independent distributors have, they’re just about six times a year.” He said they were comfortable with that level.

However, he said that distributor inventories of several product categories are now below pre-pandemic levels, including virtually all of the company’s single-action revolvers, most of their double-action revolvers and several of their rifles, the Mini-14 and the Hawkeye product family in particular.

“And again, we think inventory is okay, where it is right now. Of course, we’d always like to see that inventory move into retail and move on to across the dealer’s counter to the consumer. But, right now, we’re okay with where things are at,” he said.

“In addition to these legacy families, new products consistently help drive demand,” Killoy added. “We had several new product introductions in the first half of the year. Most notably, we launched two new additions to the Marlin lever-action rifle family, the model 336 Classic, chambered in 30-30 Winchester, and the model 1894 Classic, chambered in 44 Magnum. These products have been received with great excitement by our customers, and Marlins continue to be the most talked about and requested products in our lineup.”

Sturm, Ruger & Company closed on the acquisition of the Marlin brand and assets in November 2020 (see SGB Media article here) from Remington Outdoor Company in a deal that emanated from Remington’s bankruptcy proceedings. The purchase price of approximately $28.3 million was paid with available cash on hand.

In April, Killoy said they launched a Super Wrangler steel frame single-action revolver, which comes with two cylinders, one for the inexpensive 22 Long Rifle ammunition and one for the more powerful 22 Magnum ammunition. He said the moderately-priced Wrangler family has remained popular since its introduction in 2019.

“New product sales, which include only major new products that were introduced in the past two years like the Marlins and Super Wranglers I just mentioned, totaled $63.3 million, or 23 percent of firearm sales, in the first half of 2023,” Killoy detailed. “This includes the MAX-9 pistol, the LCP MAX pistol, the 1895 Marlin lever-action rifle, the LC Carbine, Small-Frame Auto-loading Rifle, the Security-380 pistol, and the previously mentioned Marlin 336 Classic and the 1894 Classic lever-action rifles, and the Super Wrangler revolver.”

For the second quarter, sales of new products, including the LCP MAX pistol, Marlin lever-action rifles, LC Carbine, Small-Frame Autoloading Rifle, Super Wrangler revolver, and the Security-380 pistol, represented $33.3 million, or 24.4 percent, of firearm sales.

Killoy also said they were excited to introduce new pistols into California for the first time since 2014, due to some changes to the requirements for pistols to be sold in that state.

“Now, our customers in California are able to purchase a Mark IV pistol, the SR22 pistol, and the LCP pistol, all of which have been added to the California roster of certified handguns. We hope to add more in the second half of the year,” he suggested.

Gross Margin

Company CFO Thomas Dineen said profitability declined in the second quarter year-over-year as gross margin decreased from 31 percent of sales in Q2 last year to 27 percent of sales in the second quarter this year. Dineen said the lower margin was driven by:

- A product mix shift toward products with relatively lower margins that remain in stronger demand;

- Inflationary cost increases in materials, commodities, services, energy, and fuel; and

- Unfavorable deleveraging of fixed costs resulting from decreased production and increased sales promotional costs.

Net sales, cost of products sold, and gross profit data for the three months ended (dollars in millions)

Net Profit

Diluted earnings were 91 cents per share for the second quarter ended July 1, compared to $1.17 per share in the prior-year period.

“While down from the prior quarter, we are pleased that our profitability this quarter improved from the first quarter of 2023 on essentially flat sales,” Dineen offered. “Our continued focus on financial discipline and long-term shareholder value is evident in our strong debt-free balance sheet.”

Balance Sheet

Cash and short-term investments totaled $138 million at quarter-end. Short-term investments are said to be invested in United States treasury bills and in a money market fund that invests exclusively in United States treasury instruments, which mature within one year.

The company’s current ratio was 4.5 to 1 and RGR had no debt. Stockholders’ equity was $333.2 million, which equates to a book value of $18.80 per share, of which $7.77 was cash and short-term investments.

In the first half of 2023, the company generated $21.8 million of cash from operations and reinvested $4.9 million of that back into the company in the form of capital expenditures.

“We expect our 2023 capital expenditures to total approximately $20 million related to new product introductions, upgrades to our manufacturing equipment and improvements to our facilities,” Dineen concluded.