Foot Locker, Inc. executives started their second quarter conference call with analysts in a bit of a defensive mode as the market wondered how the retailer could get their outlook for the year so wrong and under-performed the second quarter as they did. Questions apparently remain as FL shares fell 28.28 percent by the end of the day Wednesday to $16.64 a share.

The sales trends at Foot Locker Inc. continue to be a real problem as total sales and comps both registered high-single-digit declines for the quarter ended July 29. Much of the sales decline came from Champs which comped down in strong double-digits in the quarter on repositioning pain, exacerbating the mid-single-digit decline in the Foot Locker nameplate businesses, and the EMEA business suffered from the planned wind-down of the company Sidestep nameplate in Europe.

“Looking back to March, when we outlined our Lace Up plan and our longer-term targets, we were coming off a strong Holiday and had not yet seen the full weight of the macro environment on our lower income consumer,” explained company President and CEO Mary Dillon. “This became much more evident through the second quarter, including a weaker start to back-to-school.”

She said the store traffic and conversion challenges they began to see in late Q1 persisted through the second quarter as customers remained cautious with their discretionary dollars. As a result, Foot Locker promoted more heavily than initially planned to better compete for a share of the consumer’s wallet and manage inventory levels.

“Our second quarter was broadly in line with our expectations, despite the still-tough consumer backdrop,” said Dillon in an early morning release. “However, we did see a softening in trends in July and are adjusting our 2023 outlook to allow us to best compete for price-sensitive consumers, while still leaning into the strategic investments that drive our Lace Up plan. Importantly, we are continuing to make progress on our inventory levels and look to best position the business for the upcoming holiday season and into 2024.”

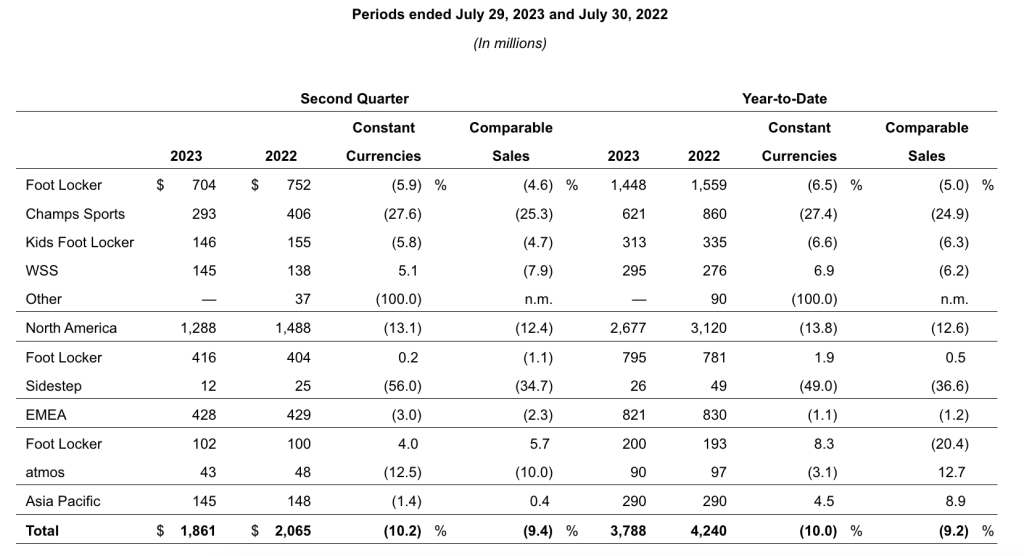

Total sales for the fiscal second quarter decreased 9.9 percent, to $1.86 billion, compared with sales of $2.07 million in the second quarter of 2022. Excluding the effect of foreign exchange rate fluctuations, total sales decreased 10.2 percent for the quarter.

Comparable-store sales decreased 9.4 percent for the period, driven by ongoing consumer softness, changing vendor mix, and the repositioning of Champs Sports.

- Consolidated comps in May were said to be down in low-double-digits and improved sequentially in June with a high-single-digit decline for the rate month. But July, during the kick-off for back-to-school shopping, took a step back and posted a low-double-digit decline for the month.

North America comps were down 12.4 percent in Q2 and EMEA region comps were down 2.3 percent for the period, while APAC region comps inched up o.4 percent in the quarter.

- Champs was clearly the problem in the North America market as comp store sales fell 25.3 percent for the second quarter as the company moved to reposition the business to be focused on the active athlete. The nameplate was also called out as the most affected by Nike allocation cuts. Champs did see good growth from performance brands such as Under Armour, Asics, Brooks and Saucony.

- Foot Locker nameplate stores comped down 4.6 percent, with the consumer and product headwinds offsetting “strength in the culture of basketball and running innovation.” Management said the power and community stores out comped the balance of the chain in Q2 by several percentage points.

- Kids Foot Locker comps declined 4.7 percent in the quarter. The House of Play doors are reportedly comping several points better than the balance of the KFL chain, giving management confidence that these expanded formats are connecting well with consumers. With the door expansions of New Balance and HeyDude during Q2 and the successful launch of On Running at KFL for back-to-school, management said they remain convinced that KFL is “a highly differentiated and competitive advantage for Foot Locker, Inc.”

- Hispanic urban specialty WSS business posted a 7.9 percent comp store sales decline in the quarter. WSS traffic was said to be down in the quarter but the business deployed tactical promotions to drive improved conversion as a partial offset. During the quarter, FL opened six WSS stores, bringing the total to 126 stores. They are on track to open approximately 25 doors for the year for growth of 20 percent.

In the EMEA region, Foot Locker Europe dipped 1.1 percent for the second quarter period but the Sidestep business fell 34.7 percent on a comp store sales basis as it closed down its business.

- The company announced on January 26 that it had decided to wind down the Sidestep banner and eliminate some corporate and support roles. Foot Locker said at the time the Sidestep wind-down was “consistent with the company’s broader efforts to focus on its core and growth banners” (read SGB Media coverage here). The elimination of jobs was said at the time to be “part of streamlining the organization and enhancing operational efficiency.” As a result of these role eliminations, the company expected to realize cost savings of approximately $18 million on an annualized basis beginning in fiscal 2023.

In the APAC region, Foot Locker nameplate stores comped up 5.7 percent for the quarter while the company’s Atmos chain saw comp store sales fall 10.0 percent for the period.

- Foot Locker Inc. completed the acquisition of Atmos, a digitally-led retailer headquartered in Japan, for $360 million in November 2021. Foot Locker said at the time it expected Atmos to generate low-double-digit sales growth annually and low-double-digit to mid-teens EBITDA margins over the first five years of the deal and be accretive to EPS in fiscal year 2021.

- Within Asia, FL closed its stores in Macau and Hong Kong and completed its conversion to a licensing model in Singapore and Malaysia.

Footwear comp store sales were down in high-single-digits for the quarter and Apparel comp store sales fell in the mid-teens year-over-year in the period. Accessories sales were down in low-double-digits on a comp-store basis in the second quarter.

- In footwear, Foot Locker is cycling through the second of four quarters of the Nike reset.

In basketball, the retailer said it seeing relative strength in court classics and retro styles from Nike and Jordan, which continue to be a meaningful connection point to the culture of basketball for their men’s, women’s and kids consumers. Company EVP/COO Franklin Bracken said they were pleased to help launch the Nike Sabrina 1, Nike’s first signature basketball shoe for a female athlete.

“As we think about expanding sneaker culture, we welcome the opportunity to broaden access to new consumers with great product innovation and storytelling like the Sabrina 1,” Bracken expressed. “I would also like to highlight our recent basketball partnership with the Nike brand this summer to celebrate the heart and soul of basketball here in New York City. We were proud partners of the New York versus New York City basketball program and were able to activate at retail, in local communities as well as digitally.”

Bracken said New Balance continues to drive impressive growth in consumer connectivity across all banners and geographies.

“We were pleased to gain market share with the New Balance brand in Q2 and point to great innovation, storytelling and in-store presentation as the key levers, including events like Gray Day as well as featuring New Balance in our back-to-school campaign sneaker season,” he said. “We are also thrilled with the performance of On Running and HOKA, two brands that continue to bring category-defining innovation and style to the marketplace. As we grew market share with both of these brands in Q2, we are excited that they are bringing even more female consumers into sneaker culture and our retail banners. And so we’re quite pleased to expand the door base in late Q2 to capture even more opportunity at back-to-school and holiday.”

Still, he said challenges remain within some core lifestyle running platforms.

“Our team managing our inventory levels and merchandise margins while we navigate through these challenges and move our open-to-buy dollars to more productive categories,” Bracken said. “One trend-driven footwear concept that we are excited about this fall in holiday is terrace or the local footfall. Led by the Adidas brand, we are seeing strong global sell-throughs of key silhouettes in our inventory.”

Bracken said that in Apparel, while it was down significantly, their vertical brands outperformed – comping down 1 percent and reaching 12 percent penetration or two points better than last year.

“We remain excited about our newer labels, Locker and Cozy as well as the launch of CSG active this fall season,” he said. “We’re also seeing very strong sell-throughs of the new Nike Tech Fleece collection at back-to-school, which we expect to continue into the back half.”

He also called out some products for the fall and holiday timeframes when they will see Nike signature basketball models at holiday during the NBA season tip-off and key icons like the Dunk, Rihanna’s collaboration with Puma that is launching again this holiday, an exclusive launch of Anthony Edwards signature basketball shoe with Adidas, increased supply of models like the Adidas Samba, Gazelle and Canvas which are gaining consumer momentum, and seasonally relevant classics and concepts from Ugg and the ongoing door expansion with On and Hoka.

Foot Locker Inc.

Sales by Banner

Mary Dillon also provided an update on their “Lace Up” initiative on the call, providing a rare behind-the-scenes look at how they planned, in part, to move beyond the heavy reliance on Nike.

Expand Sneaker Culture

Foot Locker laid out plans in the initiative to build up non-Nike product to represent over 40 percent of sales across all banners by 2026. The percentage was 31 percent of sales in Q2 last year and grew to 36 percent of sales in the most recent quarter. The other piece of the sneaker culture expansion was for brand or model exclusives, with a target 25 percent of sales in 2026 represented by exclusive product.

“Beyond our partnership with Nike, we’re making progress on diversifying our assortments to provide more choices to our customers in line with their evolving needs, including more sneaker occasion,” shared Dillon. “As a key example, we’re leaning into our partnership with New Balance, now our fourth largest brand and which grew well over 100 percent in the second quarter.”

She said they also remain excited about the trajectories of newer brands like On and Hoka in performance running.

“While we’re helping these brands extend their reach to our core shoppers, they’re also helping us expand our customer base, including a more affluent and female customer,” Dillon said. “And we continue to push ahead with our growth plans with these brands. On is now in 280 doors and on its way to 350 this year. And Hoka is currently in 100 doors and headed towards 150 by year-end.”

Dillon added that they also continue to see outperformance from brands like Puma, Crocs, Asics and Brooks as their customers are seeking out other brands with them.

Power Up Portfolio

The retailer has a target for off-mall locations in North America to reach 50 percent of square footage by 2026 and they have made some progress. Second quarter off-mall share was 36 percent this year compared to 32 percent in Q2 last year.

“Our second imperative power of the portfolio is about simplifying our portfolio of banners, creating clear lanes for each of them, while also transforming our real estate footprint through new formats and shifting off mall,” Dillon detailed. “Within simplifying and creating distinct lanes, first, we completed the wind down of our Sidestep banner, which will help us sharpen our focus on the Foot Locker brand in EMEA. And our transition of Champs Sports continues to make progress.”

She said that while the Champs Sports banner continues to be the most acutely impacted by changes in Foot Locker’s Nike allocation, the team is getting sharper with the brand’s positioning as it appeals to that active athletes.”

New Concepts are also part of the initiative’s goals, targeting 20 percent of square footage globally to be new concepts by 2026. New concepts represented 12 percent of square footage in the second quarter, up 300 basis points from the 9 percent level in Q2 2022.

“On real estate transformation, we opened or converted four new Foot Locker community and power stores across the globe in the second quarter, giving us approximately 185 stores in these newer formats, which allows us to offer a fuller expression of the category,” Dillon shared.

She said they remain encouraged by trends that they are seeing in these locations year-to-date with traffic levels, conversion rates and average tickets all outpacing the “core fleet.”

“These stores also help us reach consumers across channels with our digital trends outperforming the rest of the market when we open up one of these new store formats,” she said. “We’re also continuing to expand the footprint at WSS, our off-mall banner that is the leading retailer focused on athletic footwear for the Latino families.”

Foot Locker opened six new WSS locations, including three in the Miami metro area and they are said to be off to an encouraging start.

“We remain optimistic about our regional door expansion opportunities for WSS on its path to becoming a $1.3 billion business over time, up from $600 million in 2022,” she forecast. “Together with the off-mall locations in Foot Locker and Kids Foot Locker, we’re making strides with our overall shift to more off-mall exposure with penetration reaching of North American square footage up four points from a year ago and tracking well against our goal of 50 percent by 2026.”

Foot Locker Inc. closed 108 underperforming stores during the quarter.

Best In Class Omni

Foot Locker is falling behind in this goal as digital as a percent of total sales only grew 50 basis points year-over-year in the second quarter to 15.5 percent on the way to the company’s goal of 25 percent by 2026. The weak increase is expected as most retailers and brands are posting weaker-than-expected results – and many reporting declines, in its post-pandemic e-commerce business.

Gross Margins

Second quarter gross margin declined by 460 basis points year-over-year (YoY) to 27.1 percent of sales, driven by an increase in promotional activity, which included higher markdowns, as well as occupancy deleverage and higher shrink. The gross margin decline was a full 8 points from Q2 2021 but up 120 basis points for the Q2 2020 period.

- Merchandise Margin fell 300 basis points on higher markdowns and an increase in inventory shrink.

- Occupancy deleveraging cost FL 160 basis points.

SG&A expenses increased by 190 basis points as a percentage of sales to 23.8 percent compared with 21.9 percent in the prior-year period, with savings from the cost optimization program more than offset by underlying deleverage on the sales decline, inflation, and investments in front-line wages and technology.

- SG&A margin was up a full 4 points from the Q2 2021 period and up 520 basis points from the Q2 2020 period.

Foot Locker Inc. had a loss of $5 million in the second quarter, as compared with a net income of $94 million in the corresponding prior-year period. On a non-GAAP basis, net income was $4 million, as compared with $105 million in the corresponding prior-year period.

For the quarter, the company had a net loss of 5 cents per share, as compared with income of 99 cents per share in the second quarter of 2022. Non-GAAP earnings per share decreased to 4 cents per share, as compared with $1.10 per share in the corresponding prior-year period.

Balance Sheet

At quarter-end, the company’s cash and cash equivalents totaled $180 million, while debt on its balance sheet was $450 million.

Merchandise inventories were $1.8 billion at quarter-end, 11 percent higher than at the end of the second quarter last year and sequentially improved from the 25 percent increase at the end of the first quarter of 2023.

“We’ve continued to reduce our inventory position as a result of our promotional strategies, and our updated outlook for the year assumes we continue that progress to end the year flat to slightly down year-over-year,” offered Dillon. “This sets us up to be better positioned into the holiday season and to transition this well into 2024.”

Dividend and Share Repurchases

During the second quarter of 2023, the company paid a quarterly dividend of 40 cents per share for a total of $37 million. The company did not repurchase any shares during the second quarter.

To increase balance sheet flexibility in support of longer-term strategic priorities, the company is pausing its quarterly cash dividends beyond its recently approved payout on October 27 to holders of record on October 13.

Store Base Update

During the second quarter, the company opened 15 new stores, remodeled or relocated 16 stores, and closed 108 stores.

At quarter-end, the company operated 2,599 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 184 franchised stores were operating in the Middle East and Asia.

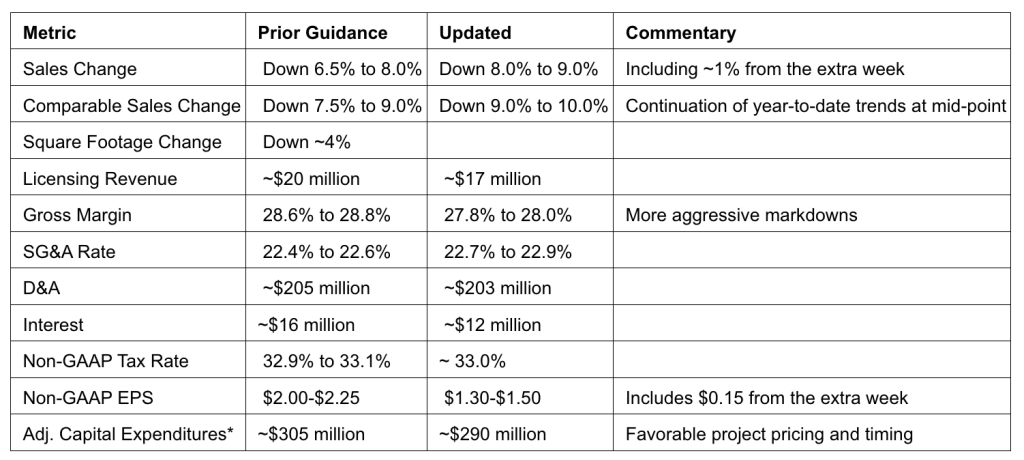

2023 Financial Outlook

Fiscal year 2023 represents the 53 weeks ending February 3, 2024. The company’s full-year 2023 outlook, which includes the 53rd week, is summarized as follows: