Foot Locker, Inc. President and CEO Mary Dillon was able to tick off a litany of key first quarter metrics that easily overshadowed the negative comp sales trend in the period as the health of the core Foot Locker business globally appears to be moving in the right direction. Wall Street took heart early in the day after the retailer first released its fiscal first quarter earning report, pushing FL shares up in the mid teens for the day.

The retailer saw comparable store sales decline 1.8 percent for the quarter, which was said to be in line with internal expectations of “down flat to low single digits,” but that metric also included a 220-basis-point headwind from the repositioning of the company’s Champs Sports banner.

“On a global basis, our Foot Locker and Kids Foot Locker banners comped up 1.1 percent, and we were pleased to see comps sequentially improve through the quarter led by our stores as customers responded to our fresh spring assortments,” Dillon shared on the conference call with analysts.

“Our average unit retail prices were nicely positive and gross margins were also in line with our expectations,” Dillon continued. “We delivered improvements in our markdown levels compared to the fourth quarter. We also saw a sequential moderation in our markdown levels throughout the first quarter as we began to dial down promotional levels.”

Dillon said the better-than-anticipated non-GAAP earnings per share of 22 cents reflects the company’s disciplined expense management as well as some favorable expense timing shifts from the first quarter into the second quarter.

“Importantly, our overall first half results are trending in line with our expectations and we still expect a return to positive comp growth and EBIT margin expansion this year as demonstrated by our reiterated $1.50 to $1.70 full year non-GAAP EPS guidance,” the CEO noted. “While we continue to expect the external environment to remain dynamic as our customers contend with prolonged inflation, reduced savings balances and higher interest rates, we remain committed to making progress this year towards our EBIT margin target of 8.5 percent to 9 percent by 2028.”

Looking ahead a bit, Dillon said cleaner well-positioned inventories provides Foot Locker with more flexibility in the second quarter and beyond as it pivots more of its open-to-buy towards higher productivity brands and franchises.

“We feel good about our brand diversification efforts and the composition of our inventory with our brand partners,” Dillon said. “We exited the fourth quarter with 40 percent of sales being generated outside of our top brand, Nike. We believe we currently have an appropriate mix in our business. And longer term, our intent is to deliver balanced growth across our entire portfolio of brand partners.”

Dillon said she expects to return to growth with Nike “later this year during the holiday quarter.”

They got to drink the Kool-Aid along with many other key retailers in Paris last month when Nike rolled out its near-term answer to its innovation dry spell, using the Summer Olympics as basecamp for the re-ignition of brand heat.

“Longer term, we believe we are well positioned to benefit as Nike refocuses on the Wholesale (B2B) channel as we continue to emphasize our sharp pillars with them of basketball, kids and sneaker culture,” Dillon continued. “We are confident that the investments we’re making in our business will continue to enhance our partnership as we collaborate and build our capabilities in digital and loyalty as well as through our investments in our in-store experience.”

She said Foot Locker will lean into its basketball business through The Clinic, a program with Nike and Jordan brand, which continues to evolve as they celebrate the culture of basketball on and off the court. She said they will continue to celebrate the culture of basketball, particularly with the “young multicultural consumer for whom the game is so important.”

She said they also see the running category as another powerful platform to expand sneaker culture by offering more choice and serving more consumers for more occasions.

“First, we were happy to participate in the launch of the Nike Air Max Dn in the first quarter,” Dillon shared. “We welcome it as an exciting innovation for the Air Max family and look forward to delivering it to more doors going forward.”

She also said they are seeing ongoing strength through the heritage running piece of the business, calling out New Balance as it continues its momentum through door expansions in both women’s and kids as well as like-for-like gains. Dillon also pointed to Asics where they see “strong global momentum” in multiple franchises across men’s, women’s and kids. She also said they were building on the momentum surrounding the Hoka and On brands on the performance side by increasing allocations and adding new doors, including with kids in both On and Hoka.

Lastly, she cited the lifestyle business, calling out Ugg and Adidas as key partners for growth. She said Ugg continues to be a large part of their plans, and they look forward to “a really productive back-to-school and holiday season” with our partners there as consumer insights continue to drive strategic door growth and improve consumer acquisition campaign targeting.

“And finally, as we drive greater distinction in our assortments, our exclusive penetration in the quarter was 13 percent, down 200 basis points year-over-year as we saw some impact from softer private label performance in part from our reduced Champs Sports store count,” wrapping up the product outline.

Company EVP and Chief Commercial Officer Frank Bracken jumped in to talk first quarter product and vendor performance, highlighting that footwear comped positive low single digits.

“Our basketball business was driven by both performance and lifestyle franchises throughout the quarter,” Bracken said. “Nike Sabrina 1, Ja 1 and Book 1 sold very well throughout Q1, flanked by a strong performance in Jordan’s Tatum 2. Meanwhile, our exclusive adidas AEI continued to connect with consumers as Anthony Edwards establishes himself as one of the NBA’s best players and sneaker became our fastest-growing signature franchise.”

He said as Nike rebalances supply in the marketplace to manage the critical Dunk, AF1 and Air Jordan franchises, he was confident that they are positioning Foot Locker to be a net winner.

On the running side, he mirrored some of what Mary Dillon discussed on the running side, calling out New Balance as it continues to drive consumer excitement while trending positively with consumers globally.

“Franchises like the 9060, the 2002R and the 530 are among our best sellers commanding full-price retails and connecting to consumers with exceptional marketing and storytelling,” Bracken said.

“Additionally, On running continues to fuel growth as that brand becomes younger and more multicultural through access to our Foot Locker customer base,” he added when talking about the innovative Swiss footwear brand that plans a real coming out party and this summer’s Olympic Games. “The Cloudmonster and Cloudtilt are two of the franchises that are bringing innovation, style and comfort that our customers are adopting as part of their sneaker wardrobe.”

Bracken said they more than doubled the Hoka business again in the first quarter as consumers increasingly get to know the performance and comfort characteristics of the brand.

“As momentum builds between our two companies, we are sharing consumer insights that will help us drive sustained growth through customer acquisition and inventory productivity,” Bracken said.

In lifestyle, Bracken said the Adidas brand continued to accelerate in Q1 across all of Foot Locker’s global retail divisions.

“This impressive growth was led by our women’s business, but also included strong global momentum in men’s and kids,” he said. “Samba, Gazelle and Campus have formed a formidable foundation upon which we will drive continued sales growth in Q2 and into the fall and holiday seasons. As we layer in strong marketing and improved in-store presentation in support of the Adidas brand, we are very pleased to have returned to offense with this critical partner.”

Bracken said challenges persisted in the company’s Apparel business in the first quarter, with comps down in the mid teens. He said they know they have work to do to stabilize the category, including delivering more innovation and more compelling brand stories and also improving transitions between seasons.

“We have seen some bright spots in our shorts and bottoms business as well as new collections from Jordan, New Balance and our private label offering,” he said.

Bracken said the Accessory business comped down in low single digits.

From a channel perspective, comparable sales in the Stores channel decreased 3 percent while traffic and transactions were down year-over-year. Average ticket saw nice gains led by increases in AURs as well as UPTs.

“Our store refresh program, alongside our new striker selling behaviors will continue to help drive better conversion, margin profile and overall store productivity,” Bracken highlighted.

Digital comps increased 4 percent.

In North America, overall region comps were down 2.5 percent, including a 320 basis point negative impact from the Champs Sports repositioning efforts.

“At Foot Locker North America, comps rose by 0.8 percent as customers responded to our fresh assortments into March and April, especially within our basketball, running and women’s categories,” Bracken detailed.

Kids Foot Locker comps were up 6.4 percent in the quarter as Bracken said they continue to see this differentiated concept demonstrate momentum and take share in the marketplace.

At Champs Sports, comps were down 13.4 percent in constant-currency terms as repositioning efforts are continuing to take hold.

“Importantly, while top-line results remained down year-over-year, results are in line with our expectations,” Bracken noted. “Also noteworthy, markdown levels at the Champs banner, meaningfully moderated as we moved throughout the quarter as customers are beginning to respond to Champ’s improved assortment and in-store presentation.”

The WSS banner delivered comps down 5.8 percent in the first quarter as ongoing inflationary pressures continue to impact the discretionary spend of the WSS shopper.

“The WSS management team continues to focus on delivering compelling value and selection to their core consumer including strengthening our assortments in the sub-$100 footwear, the culture of football as well as the work in private label categories,” Bracken explained.

In Europe, comps for the Foot Locker banner were up 1.6 percent in the quarter. Bracken said the environment in Europe remains dynamic across many countries, so they were pleased to grow in the region.

In Asia Pacific, comps were down 5.5 percent. The Foot Locker banner saw comps fall 8.7 percent, reflecting a challenging Australian marketplace as consumer confidence continues to be impacted by higher inflation.

At Atmos, comps were up 0.3 percent, reflecting a resilient domestic business in Japan. The team also opened two beautifully remodeled stores during the quarter, including our flagship property at Sendagaya in Tokyo, and our Shinsaibashi store in Osaka.

Income Statement

Gross margin declined by 120 basis points year-over-year, with markdowns sequentially moderating compared to the fourth quarter of 2023, partially offset by occupancy leverage.

SG&A amounted to $361 million in the quarter, compared to $431 million in the year-ago Q1 period. SG&A as a percentage of sales increased by 220 basis points compared with the prior-year period, with investments in technology and brand-building as well as higher inflation, partially offset by savings from the cost optimization program, ongoing expense discipline, and a shift in the timing of expenses into the second quarter from the first quarter of 2024.

First quarter net income was $8 million, or 9 cents per diluted share, compared with net income of $36 million, or 38 cents per diluted share, in the corresponding prior-year period.

On a non-GAAP basis, net income was $21 million, or 22 cents per diluted share, compared with $66 million, or 70 cents per diluted share, in the corresponding prior-year period.

Balance Sheet

Cash and cash equivalents totaled $282 million at quarter-end, while total debt was $446 million.

Merchandise inventories were $1.7 billion at quarter-end, down 5.6 percent year-over-year. Excluding the effect of foreign currency fluctuations, merchandise inventories decreased by 4.9 percent as compared with the first quarter of last year.

Store Base Update

During the first quarter, the company opened four new stores and closed 37 stores. Also, during the quarter, the company remodeled or relocated 16 stores and updated 13 to its current design standards, incorporating key elements of brand design specifications.

As of May 4, 2024, the company operated 2,490 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 206 franchised stores were operating in the Middle East and Asia.

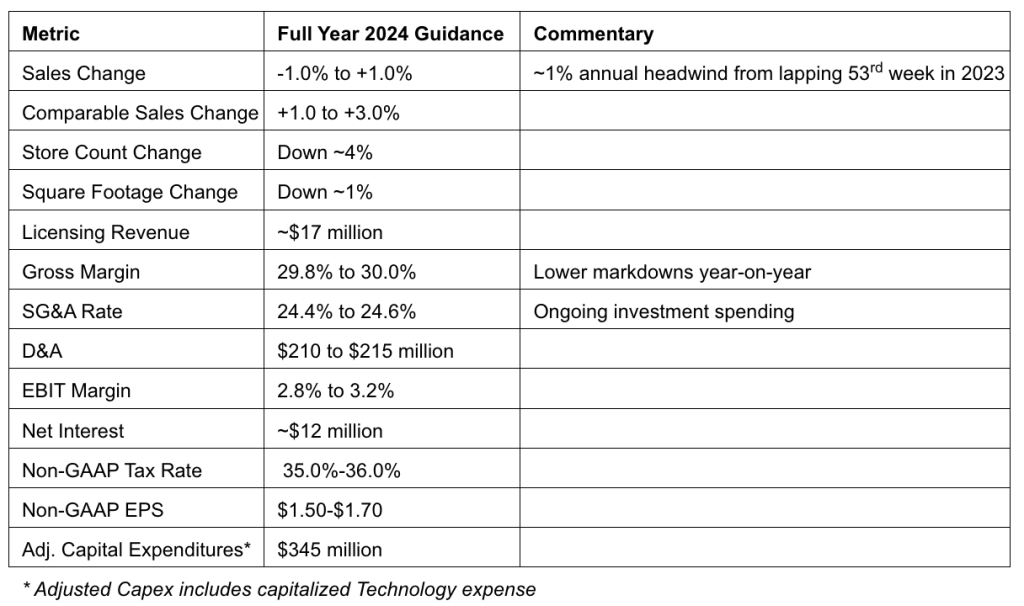

Reaffirming 2024 Financial Outlook

The company’s full-year 2024 outlook, representing the 52 weeks ending February 1, 2025, is summarized in the table below.

The full-year Non-GAAP EPS guidance of $1.50 to $1.70 includes an approximate 10 cents a share non-recurring charge in the second quarter of 2024 from the anticipated rollout to the rest of North America of the company’s enhanced FLX loyalty program. This charge is expected as the company converts loyalty points into additional benefits for the its customers.

Image under license with AdobeStock