Athleta’s sales declined 18 percent in the third quarter against “heavy discounting” a year ago and are expected to decline double-digits in the fourth quarter as the retailer’s recovery from recent fashion miscues has taken longer than expected.

Sales reached $279 million in the quarter, down from $340 million a year ago. Comparable sales tumbled 19 percent.

On Gap’s third-quarter analyst call, CFO Katrina O’Connell said the company anticipates “a longer recovery timeline” for Athleta as it realigns assortments and reengages customers. She also noted the chain will continue to anniversary “elevated discounting” and that fourth-quarter sales “could be down in the low double-digit range.”

The same-store sales decline marked the fourth straight quarterly for Athleta, with comps down 7 percent in the second quarter, 13 percent in the first quarter and 4 percent in the fourth quarter of 2022. Comps were flat in the year-ago third quarter.

Gap blamed Athleta’s downtrend on product missteps, including color, print and pattern, and overly-emphasizing lifestyle pieces in a shift away from its roots in performance wear.

On the analyst call, Richard Dickson, the former Mattel executive who became Gap’s CEO in August, expressed enthusiasm about Athleta’s growth potential. He described it as “a brand with significant growth potential and the number five brand in the highly attractive U.S. women’s active segment. “More so than any of our other brands, Athleta has a clear and distinctive brand positioning rooted in the ‘Power of She,’ an authentic and highly differentiated platform that plays extremely well across performance, outdoor, and travel.” However, he said Athleta made some missteps that the company is slowly making progress to correct.

“The brand has gotten off track with challenged performance caused by a misfire on product, marketing that didn’t resonate, and retail execution that didn’t connect with customers,” said Dickson. “In the first half of this year, the team took action, marking down products and cleaning up the brand to pave the way for long-term success. We utilized the third quarter to reset the baseline of the brand by eliminating off-brand fashion products and focusing on our key categories.”

At the same time, Dickson said Athleta has recently begun refreshing store presentations and the brand’s website to better delineate its active segment “with narrative-based merchandising that pulls Athleta’s focus back to its performance roots and winning platform.”

Early indications are that customers are responding with positive NPS (net promoter scores) and positive sales growth “in certain key products that we marketed in the new brand voice.”

Dickson added, “Despite the favorable reaction to our cleaned-up brand aesthetic, lapping last year’s heavy discounting is weighing on performance. We see this headwind continuing at least through the fourth quarter. That said, I’m encouraged by the brand execution of new digital dialogue, store experience, and holiday product assortment. While we are progressing each quarter, we know that a full brand reset will require a more comprehensive approach and will take more time.”

In March, Mary Beth Laughton, who had been Athleta’s president and CEO since 2019, left the brand. In August, Chris Blakeslee, formerly Alo Yoga’s president, was hired as Athleta’s president and CEO to guide in the brand’s recovery.

In the Q&A session, Dickson said Gap “needed to make leadership changes to create a differential outcome for this powerful brand” and expressed confidence in Blakeslee. He said Blakeslee recently marked his 90th day as Athleta’s chief and has “orchestrated appropriate changes, which we feel confident will get the brand back on track.”

Dickson elaborated, “We’re going to be progressing each quarter. We know that a full brand reset will require a more comprehensive approach. It will take more time. It is early. I can’t quite commit to a timeline at this point. I can tell you that we are confident and excited about the long-term potential of the Athleta brand.

“That’s the number five brand in the U.S. women’s active segment, one of the industry’s largest segments. It has a clear and distinctive brand positioning rooted in the ‘Power of She,’ which is authentic and highly differentiated as a platform. And we know we’re lapping significant promotions and markdowns from last year, a dynamic that we expect to continue at least into the fourth quarter. But we are confident that the work we’re doing, specifically on product, has a more distinct narrative around performance-based narrative measures, and we’ve also begun to refresh store presentations.

“The brand’s website, which I encourage you to look at, really pulls Athleta’s focus back to its performance roots and, of course, the “Power of She’ platform. So look, these are early days. We’re seeing early indications that customers are responding, but there is more work to do,” concluded Dickson.

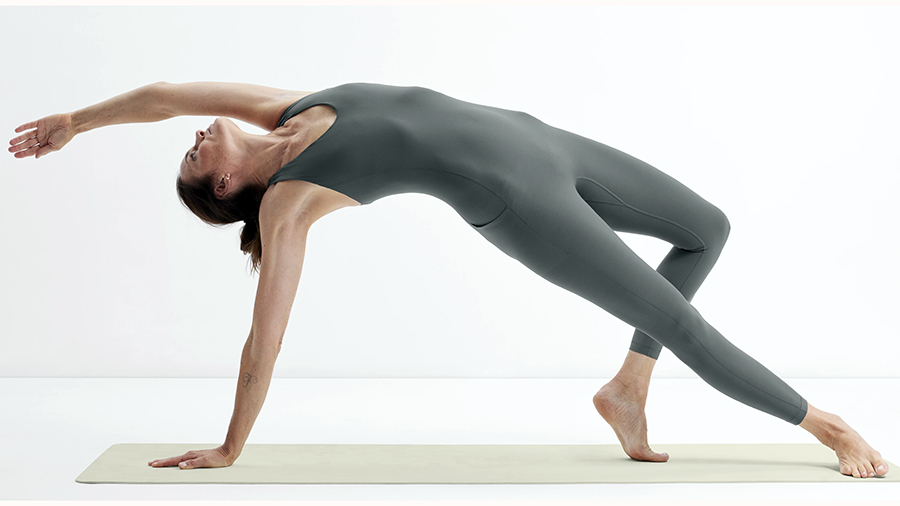

Photo courtesy Athleta