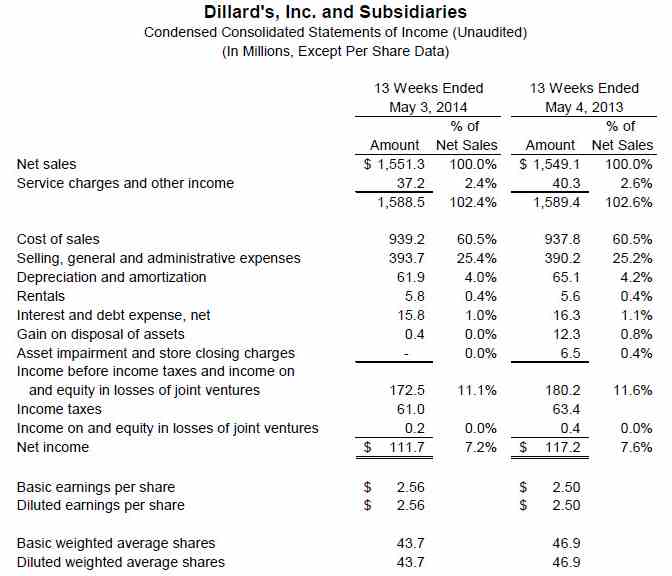

Dillard's Inc. reported first-quarter earnings slid to $111.7 million, or $2.56 a share, from $117.2 million, or $2.50 a year ago.

Summary of the company's First Quarter Performance

- A 2 percent increase in comparable store sales

- Diluted earnings per share of $2.56 versus $2.50

- Cash flow from operations of $161.9 million versus $136.9 million

- Share repurchase of $65.9 million (0.7 million shares) of Class A Common Stock

First Quarter Results

Dillard's reported net income for the 13-week period ended May 3, 2014 of $111.7 million ($2.56 per share) compared to net income of $117.2 million ($2.50 per share) for the 13 weeks ended May 4, 2013.

Included in net income for the prior year 13-week period ended May 4, 2013 is a net after-tax credit totaling $4.4 million ($0.09 per share) comprised of the following three items:

- A $7.6 million after tax gain ($0.16 per share) related to the sale of an investment

- A $1.0 million after tax credit ($0.02 per share) related to a pension adjustment

- After-tax asset impairment and store closing charges of $4.2 million ($0.09 per share)

Total merchandise sales for the 13-week period ended May 3, 2014 were $1.539 billion and $1.530 billion for the 13-week period ended May 4, 2013. Total merchandise sales increased 1 percent, and sales in comparable stores increased 2 percent for the first quarter.

Sales trends for the first quarter were strongest in the men's apparel and accessories category and the juniors' and children's apparel category followed by ladies' accessories and lingerie. Sales were weakest in home and furniture. Sales trends were strongest in the Central region, followed by the Eastern and Western regions, respectively.

Net sales (which include the operations of the company's construction business, CDI Contractors, LLC (“CDI”)) for the 13 weeks ended May 3, 2014 were $1.551 billion and $1.549 billion for the 13 weeks ended May 4, 2013.

Gross Margin/Inventory

Gross margin from retail operations (which excludes CDI) decreased 14 basis points of sales for the 13 weeks ended May 3, 2014 compared to the 13 weeks ended May 4, 2013. The decline resulted primarily from increased markdowns compared to the prior year first quarter. Inventory increased 1 percent at May 3, 2014 compared to May 4, 2013.

Consolidated gross margin remained unchanged as a percentage of sales at 39.5 percent for the 13 weeks ended May 3, 2014 and May 4, 2013.

Selling, General & Administrative Expenses

Selling, general and administrative expenses (“operating expenses”) were $393.7 million and $390.2 million for the 13 weeks ended May 3, 2014 and May 4, 2013, respectively, increasing 19 basis points of sales. Increased selling payroll was partially offset by decreased advertising expense during the quarter. Included in operating expenses for the prior year first quarter is a $1.5 million pretax credit ($1.0 million after tax of $0.02 per share) related to a pension adjustment.

Share Repurchase

During the quarter ended May 3, 2014, the company repurchased $65.9 million (0.7 million shares) of Class A Common Stock at an average price of $89.34 per share under the company's share repurchase plans. Remaining authorization under the share repurchase program at May 3, 2014 was $224.5 million.

Total shares outstanding (Class A and Class B Common Stock) at May 3, 2014 and May 4, 2013 were 43.2 million and 46.3 million, respectively.

Store Information

At May 3, 2014, the company operated 278 Dillard's locations and 18 clearance centers spanning 29 states and an Internet store at www.dillards.com. Total square footage at May 3, 2014 was 50.5 million.