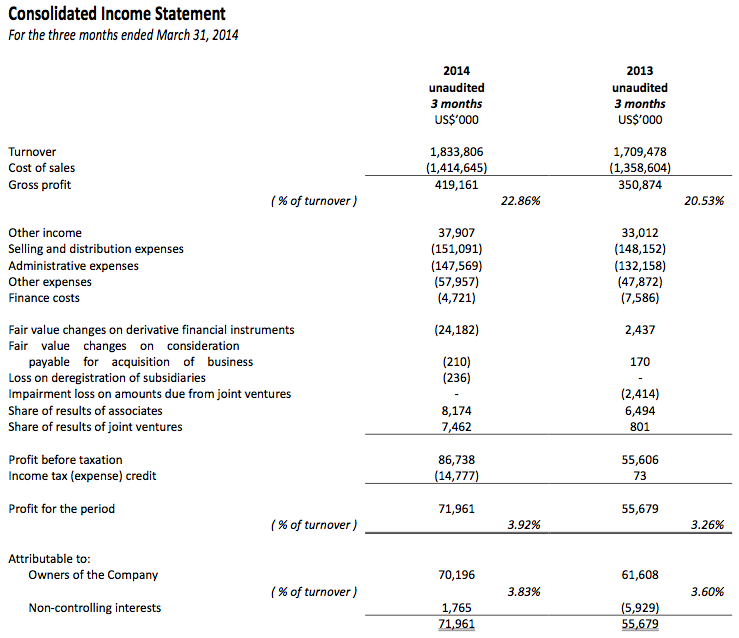

Yue Yuen Industrial Limited reported total revenues rose 7.3 percent for the first quarter ended Mar. 31, to $1.83 billion. Recurring operating profit attributable to owners of the company increased 56.2 percent to US$94.65 million compared to the same period last year.

Highlights of the quarter included:

- Turnover up 7.3 percent to US$1.83 billion compared to the same period last year P Gross profit up 19.5 percent to US$419.16 million compared to US$350.87 million in the same period

- last year

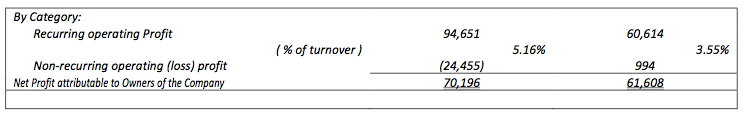

- Recurring operating profit attributable to owners of the company increased by 56.2 percent to US$94.65 million compared to the same period last year

- Non-recurring operating loss for the period amounted to US$24.45 million.

- Total net profit attributable to owners of the company amounted to US$70.20 million in 2014, up 13.9 percent compared to US$61.61 million in the same period last year.

The Group also had non-recurring operating loss of US$24.45 million for the period. When aggregating both categories of profit, the net profit attributable to Owners of the company for the first three months of fiscal year 2014 amounted to approximately US$70.20 million.

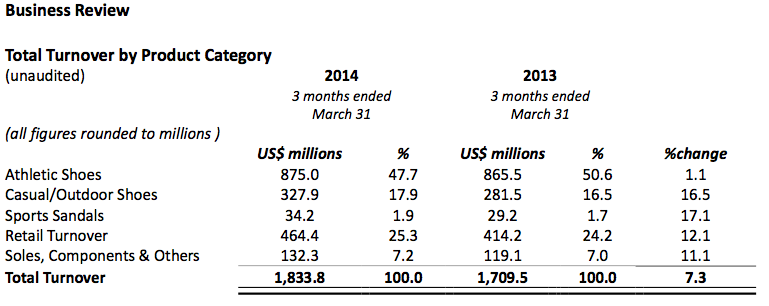

Turnover of athletic shoes and casual/outdoor shoes were up by 1.1 percent and 16.5 percent respectively year over year. Total shoe manufacturing volume was down by 0.5 percent to 75.97 million pairs for the three month period.

With regards to the retail and wholesale business of sportswear in the Greater China region, turnover increased by 12.1 percent to US$464.4 million in 2014 compared to US$414.2 million recorded in the same period last year.

Gross Profit

During the period, the Group¡¦s gross profit increased by 19.5 percent to US$419.16 million. When looking at the underlying business units, gross profit for the manufacturing operations involving international performance brands benefited from better control of production overhead and wage costs. When examined on a sequential basis, manufacturing margin was better on account of tighter control of material costs. Pou Sheng had a gross profit improvement of 18.3 percent to US$139.4 million due to its new structure of concentrating on the retail business.

Selling & distribution expenses and Administrative expenses

For the Group, Selling & distribution expenses grew by 2.0 percent year on year. Administrative expenses grew by 11.7 percent compared to the same period last year. For the manufacturing operations, Selling & distribution expenses and Administrative expenses increased by 3.6 percent and 5.1 percent respectively year on year. Based on Pou Sheng's announced figures, Selling & distribution expenses and Administrative expenses were up 1.4 percent and 53.0 percent respectively.

Share of results from Associates and Joint Ventures (” Share of A&JV ¡¨)

At the Group level, Share of A&JV grew by 114.4 percent to US$15.6 million. For the manufacturing operations, Share of A&JV increased by 47.8 percent to US$16.3 million. From Pou Sheng's announcement, share of loss from A&JV declined by 82.4 percent to a loss of US$0.7 million compared with the same period last year.