Dick's Sporting Goods Inc. reported earnings jumped 30.6 percent in the

second quarter, exceeding its guidance. Excluding restructuring charges

in the prior year, earnings rose 11.1 percent. Same store sales for the

Dick's Sporting Goods chain increased 1.5 percent,

against a strong base that included the World Cup. Golf Galaxy decreased

2.9 percent, representing sequential progress.

Highlights of the quarter include:

– Consolidated earnings per diluted share increased 15 percent to $0.77, up from $0.67, excluding golf restructuring charges in the prior year

– Consolidated same store sales for the second quarter increased 1.2 percent

– Company raises its full year 2015 earnings per diluted share guidance to $3.13 to $3.21

– Company declared a $0.1375 per share quarterly dividend

Second Quarter Results

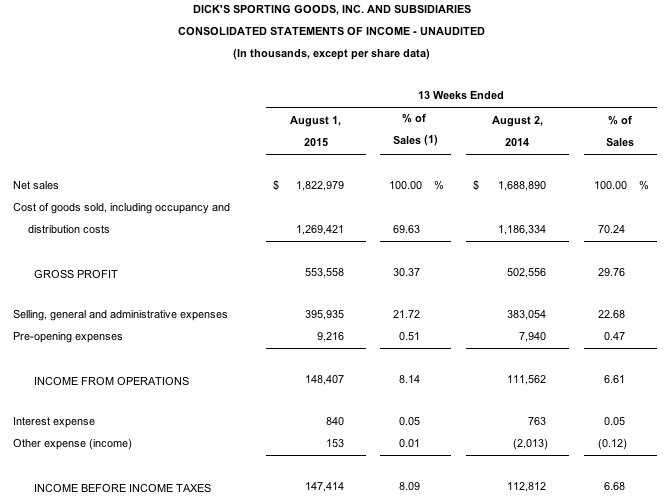

The company reported consolidated net income for the second quarter ended August 1, 2015 of $90.8 million, or 77 cents per diluted share, compared to the company's expectations provided on May 19, 2015 of $0.73 to 0.76 per diluted share. The company reported consolidated net income for the second quarter ended August 2, 2014 of $69.5 million, or $0.57 per diluted share. Excluding golf restructuring charges in the prior year, net income was $81.7 million, or $0.67 per diluted share.

Net sales for the second quarter of 2015 increased 7.9 percent to approximately $1.8 billion. Consolidated same store sales increased 1.2 percent, compared to the company's guidance of approximately flat to an increase of 2 percent. Same store sales for Dick's Sporting Goods increased 1.5 percent, against a strong base that included the World Cup. Golf Galaxy decreased 2.9 percent, representing sequential progress. Second quarter 2014 consolidated same store sales increased 3.2 percent.

“We are pleased with our second quarter results. We delivered a double-digit increase in earnings by leveraging our omni-channel presence to generate profitable revenue growth and meaningful margin expansion,” said Edward W. Stack, chairman and CEO. “We are seeing the benefits of our key growth pillars, as we continue to open very productive stores while winning online.”

Omni-channel Development

eCommerce penetration for the second quarter of 2015 was 7.3 percent of total net sales, compared to 6.3 percent during the second quarter of 2014.

In the second quarter, the company opened seven new Dick's Sporting Goods stores, one new Field & Stream store and closed three Golf Galaxy stores, as these leases expired. As of August 1, 2015, the company operated 619 Dick's Sporting Goods stores in 46 states, with approximately 33.1 million square feet, 75 Golf Galaxy stores in 29 states, with approximately 1.4 million square feet and 12 Field & Stream stores in seven states, with approximately 0.6 million square feet.

Store count, square footage and new stores are listed in a table later in the release under the heading “Store Count and Square Footage.”

Balance Sheet

The company ended the second quarter of 2015 with approximately $123 million in cash and cash equivalents and no outstanding borrowings under its revolving credit facility. Over the course of the last 12 months, the company continued to invest in omni-channel growth, while returning over $288 million to shareholders through share repurchases and quarterly dividends. Total inventory increased 13.9 percent at the end of the second quarter of 2015 as compared to the end of the second quarter of 2014. This planned increase was due primarily to earlier receipts of back-to-school merchandise and support for the outdoor business.

Also, the company has amended and extended its revolving credit facility prior to its expiration in December 2016, thereby benefiting from the attractive interest rate environment. The company has increased its limit from $500 million to $1 billion to support the continued growth of its business.

Year-to-Date Results

The company reported consolidated net income for the 26 weeks ended August 1, 2015 of $154.2 million, or $1.30 per diluted share. For the 26 weeks ended August 2, 2014, the company reported consolidated net income of $139.5 million, or $1.14 per diluted share. The company reported consolidated non-GAAP net income for the 26 weeks ended August 2, 2014 of $143.0 million, or $1.17 per diluted share. The GAAP to non-GAAP reconciliation is included in a table later in the release under the heading “Non-GAAP Net Income and Earnings Per Share Reconciliations.”

Net sales for the 26 weeks ended August 1, 2015 increased 8.3 percent from last year's period to approximately $3.4 billion, reflecting the opening of new stores and a 1.1 percent increase in consolidated same store sales.

Capital Allocation

During fiscal 2015, the company has repurchased approximately 2.6 million shares of its common stock at an average cost of $57.09 per share, for a total cost of $150 million. Since starting its $1 billion share repurchase authorization at the beginning of fiscal 2013, the company has repurchased over $605 million of common stock, and has approximately $395 million remaining under the authorization.

On August 12, 2015, the company's board of directors authorized and declared a quarterly dividend in the amount of $0.1375 per share on the company's Common Stock and Class B Common Stock. The dividend is payable in cash on September 30, 2015 to stockholders of record at the close of business on September 11, 2015.

Current 2015 Outlook

The company's current outlook for 2015 is based on current expectations and includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as described later in this release. Although the company believes that the expectations and other comments reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations or comments will prove to be correct.

Full Year 2015

Based on an estimated 118 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share in the range of $3.13 to 3.21. The company's earnings per diluted share guidance contemplates the $150 million of share repurchases executed in the first quarter of 2015. For the 52 weeks ended January 31, 2015, the company reported consolidated earnings per diluted share of $2.84. Consolidated earnings per diluted share for the 52 weeks ended January 31, 2015 were $2.87, excluding a gain on the sale of an asset and golf restructuring charges.

Consolidated same store sales are currently expected to increase in the range of 1 to 3 percent, compared to a 2.4 percent increase in fiscal 2014.

The company expects to open 44 new Dick's Sporting Goods stores and relocate seven Dick's Sporting Goods stores in 2015. The company also expects to open nine new Field & Stream stores and relocate one Golf Galaxy store in 2015.

Third Quarter 2015

Based on an estimated 118 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share in the range of $0.45 to 0.48 in the third quarter of 2015, compared to consolidated earnings per diluted share of $0.41 in the third quarter of 2014.

Consolidated same store sales are currently expected to increase in the range of 1 to 3 percent in the third quarter of 2015, as compared to a 1.1 percent increase in the third quarter of 2014.

The company expects to open 27 new Dick's Sporting Goods stores and relocate five Dick's Sporting Goods stores in the third quarter of 2015. The company also expects to open seven new Field & Stream stores in the third quarter of 2015.

Capital Expenditures

In 2015, the company anticipates capital expenditures to be approximately $245 million on a net basis and approximately $365 million on a gross basis. In 2014, capital expenditures were $247 million on a net basis and $349 million on a gross basis.