Deloitte is forecasting that overall 2024 Holiday selling season (Holiday) spending will increase by 8 percent, supported by a favorable outlook for the U.S. economy. However, Deloitte also reported that consumers will bargain shop even if it means choosing value over loyalty. The business advisory firm also sees a ramp up in experience gifting with flat sales in traditional merchandise. Those observations and forecast, and much more, is based on a recent survey fielded between August 30 and September 6 that included responses from 4,114 consumers.

Increased spending on experiences, including travel, hosting gatherings, and attending holiday concerts and activities, underscores consumers’ shifting priorities; however, Deloitte noted the theme also creates new opportunities for companies.

“This holiday season, consumers plan to prioritize celebrating with friends and family through experiences. To do so, they are finding ways to make their dollars go further on the gifts they want to give and the events they want to experience,” said Brian McCarthy, principal at Deloitte Consulting LLP.

“With consumers leaning more into experiences and continuing to search for value, retailers have the opportunity to attract shoppers and better connect with customers by focusing on loyalty programs and offering unique incentives,” he continued.

Experiences to Drive Holiday Spend

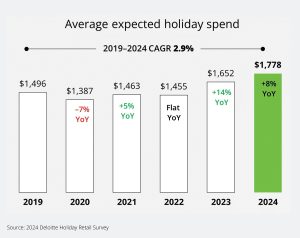

Surveyed respondents indicated their increased confidence in the economy and plans to allocate more money from their budgets to gifting experiences and non-gift purchases. Among those, 43 percent expect the economy to improve this year, up nine percentage points from last year. Overall, consumers plan to spend an average of $1,778, up 8 percent year-over-year, with the average number of gifts purchased this year at nine versus eight in 2023.

- Retail spending (gifts and non-gifts) will likely remain relatively flat year-over-year ($1,043 compared to $1,020 in 2023). However, it would still account for most (59 percent) of the average expected Holiday spend.

- Surveyed respondents expect to spend $536 on gifts, down 3 percent year-over-year, and $507 on non-gift purchases, up 9 percent year-over-year.

- Surveyed respondents plan to spend $735 on experiences, up 16 percent year-over-year.

- Participation in experiences is near pre-pandemic levels, 83 percent this year versus 86 percent in 2019. Overall, the five-year CAGR (2019-2024) for experiences is 4.3 percent compared to 3 percent for retail categories.

- All participants surveyed for Deloitte’s 2024 report making less than $200,000 and intend to spend more this season, with high-income earners, those making $100,000 to $199,999, seeing the most significant gains. The demographic plans to spend 17 percent more year-over-year.

- Among retail executive buyers surveyed, 8-in-10 expect sales growth this Holiday season, aided by increased in-store and online traffic.

- More surveyed respondents plan to gift food and beverages this year, up nine percentage points year-over-year. Although respondents plan to spend 10 percent less on clothing and accessories, the category remains at the top of their gift lists. Additionally, 4-in-10 respondents plan to gift experiences, including event tickets or vouchers to restaurants or spas.

- Hosting home gatherings were noted by 1-in-4 respondents as planned holiday activities, with, on average 10 guests and spending an average of $261. Of those, 70 percent of respondents are open to spending more on hosting with more convenient items and services. Respondents surveys, 47 percent, would ask their guests to bring food or beverages to offset costs, and 31 percent said they plan to invite fewer guests this year.

“Despite expectations of higher prices, all income groups are optimistic that the economy will improve next year and are willing to spend on delivering holiday cheer. Experiences are expected to fuel Holiday spending. To fund holiday experiences, value-seeking consumers plan to hunt for deals from stores and brands and trade down to stretch their wallets, keeping spending on overall retail categories flat year-over-year,” said Stephen Rogers, managing director, Deloitte Insights Consumer Industry Center, Deloitte Services.

Consumers Prioritize Value this Holiday Season

Among consumers surveyed, 7 in 10 expect higher prices, unchanged since 2022. Amid the perception of higher prices, those surveyed said they are between stretching their budget and being festive.

- Surveyed respondents will look for quality, great deals and variety when Holiday shopping, citing online-only retailers (71 percent) and mass merchants (55 percent) as the most preferred retail formats.

- Those looking for deals could challenge loyalty. 62 percent of respondents are willing to shift brands if the preferred brand is too expensive, and 48 percent said they would shop at more affordable retailers. Moreover, 80 percent of retail executives expect private label sales to grow faster than national brand sales this Holiday selling season.

- Nearly one-third (29 percent) of respondents plan to purchase gifts on a friend or family member’s wish list hosted on a retailer’s site.

- Last year, 48 percent of shoppers planned to buy gifts for themselves, but this year, Deloitte expects those planning to splurge on themselves to decline to 32 percent. Those surveyed who plan to self-gift expect this year will spend an average of $250 on clothing and accessories (63 percent), electronics and accessories (34 percent), health and wellness (32 percent), and experiences (22 percent). However, self-gifting is higher among younger respondents, with 47 percent of Gen Z and 32 percent of Millennials self-gifting.

- Multichannel presence continues to be essential for retailers to meet consumers where they are, especially as younger demographics gain purchasing power; 48 percent of those surveyed plan to shop on smartphones, while 13 percent will buy gifts on social media. However, Gen Z is embracing those channels more, with 58 percent of respondents planning to shop on a smartphone and 20 percent planning to buy gifts on social media.

The Bulk of Holiday Shopping Occurs in Late November and Early December

Despite heightened interest in October promotional events, November remains critical in the shopping season, with most consumers spending for the Holiday in late November.

- Over three-quarters (78 percent) of respondents plan to shop at least one promotional event, up from 61 percent in 2023.

- Although retailers are tempting 38 percent of consumers to shop during October promotional events, up from 24 percent in 2023, most spending will continue in late November and early December.

- Overall, over two-thirds (68 percent) of respondents plan to shop during Thanksgiving week to take advantage of deep discounts.

- The survey’s younger and higher income groups will shop the most during Thanksgiving week promotions. Those respondents earning $200,000 a year or more plan to keep their spending flat this year and shop Black Friday (53 percent) and Cyber Monday (60 percent).

- While the overall shopping window has been steady at 5.7 weeks, Gen Z consumers surveyed intend to wrap up their shopping in 4.6 weeks, down from 5.1 weeks in 2023. Gen X and Baby Boomers have the most extended shopping windows at 6.4 weeks and 6.3 weeks, respectively.

Methodology: Deloitte’s “2024 Holiday Retail Survey” is based on a company survey that included 4,114 consumers fielded between August 30 and September 6. Between June 12 and July 3, Deloitte also surveyed 45 retail industry executives, of whom 93 percent were retailers with annual revenues of $1 billion or more.