Columbia Sports Company (COLM) leadership set a defiant yet confident tone regarding the uncertainty gripping the active lifestyle market due to a lack of consistent messaging around the Trump tariffs.

Analysts who joined the company’s first-quarter earnings conference call may have discovered a company better positioned than its peers to take the tariff issues head-on after a year of focusing on the fundamentals of its business to build a solid balance sheet and exploit its strong operations capabilities.

Company Chairman, President, and CEO Tim Boyle began the conversation by suggesting that the company’s first-quarter net sales and earnings exceeded its guidance range. Revenue and earnings numbers also exceeded Wall Street’s consensus estimates.

“Globally, our Wholesale business was better than planned, driven by late season demand for winter products and early spring product shipments,” Boyle stated. “Our business outside of North America, which represents approximately 40 percent of our annual sales, remains strong,” he said, referencing “healthy growth” in nearly all of the company’s international markets with double-digit percent growth in the LAAP region and “high-single-digit percent constant-currency growth in the EMEA region.”

The U.S. and Canada were a drag on the quarter.

“Before the April 2 tariff increases were announced, our solid first quarter performance put us on track to achieving our full-year targets,” Boyle continued. “I’d like to begin this call by outlining our view on global trade and our plans to mitigate the impacts associated with the recent U.S. tariff increases.”

The CEO started the conversation by stressing the unprecedented level of public policy uncertainty that the industry faces in the United States, noting that Columbia has been in business since 1938 and has successfully navigated challenging environments.

“But our industry has never faced a period with the rules and regulations around trade with the United States simply unknown and unknowable,” he stressed. “I have never been more excited than I am today about our brands, our strategies and the overall strength of our company. We have a diversified supply chain and a team of experts with deep international trade experience.”

Boyle said the company began the year with a “fortress balance sheet, healthy inventories and building momentum” in the Columbia brand’s “Accelerate” growth strategy. “These strikes give me confidence in our ability to emerge from this period as a stronger company with an improved position in the marketplace,” he said.

“When the rules around trade are unknown, it’s impossible for any company to predict with confidence what the cost of U.S. products will be, with the returns on certain investments in the U.S. will be and, ultimately, how the U.S. marketplace will be impacted overall,” Boyle continued. “Quite simply, companies are unable to confidently plan and invest in their U.S. businesses until there’s clarity with respect to U.S. trade policy. History has shown that tariffs are designed to raise the price of imported goods.”

Boyle stressed that in the U.S. market, “well over 90 percent of all apparel and footwear is imported and is already heavily taxed under legacy trade laws.” He said the additional 10 percent universal tariff is on top of existing high duties.

“The magnitude of the additional proposed country-specific tariffs has the potential to profoundly impact our industry and significantly raise prices to U.S. consumers. For many consumers, the affordability of apparel and footwear will increasingly become a household issue. This will be further exacerbated if higher tariff rates go into effect,” he suggested.

The CEO said that before the April 2 tariff declarations, COLM domesticated all on-hand U.S. inventory through its long trade zone distribution centers, saving the company millions in potential tariffs.

For products impacted by the reciprocal tariffs, Boyle said the company is accelerating shipments to the extent possible to receive products during the 90-day tariff pause.

“Because it’s not practical at scale nor affordable, we do not intend to utilize airfreight as a solution to accelerate inventory seats,” Boyle added.

When asked in the Q&A session to clarify the sourcing shifts and future exposure to tariffs, Boyle noted that the company has significantly reduced its sourcing from China, mitigating direct tariff impacts.

Still, Boyle stressed that China remains a strategically important country for COLM, and it intends to continue leading its opportunities for increased product creation and manufacturing in China, not only for its China direct-to-consumer business but for other markets worldwide.

But, he said, the company has little direct exposure to tariffs on products manufactured in China.

“A low-single-digit percent of our finished good products imported into the U.S. are manufactured in China,” Boyle noted. “Given the exorbitant taxes on these goods, we will be diverting the vast majority of this product to other markets where it can be sold profitably.”

Boyle added that while much of the fall 2025 product has been ordered and sold, the company is still rationalizing inventory buys, where possible, to reduce the risk of excess inventory in a challenging environment.

“We’re also taking actions to restrain discretionary spending and, where appropriate, positive capital investments in the U.S. until we have clarity,” he added.

“For fall 2025, we’re focused on maximizing our marketplace opportunity. We’re working with our retail partners to deliver value to consumers and keep inventory and dealer margins healthy,” Boyle shared. “As a result, we expect to absorb much of the incremental tariff costs in 2025 at the current incremental 10 percent universal rate.”

For 2026, Boyle said the company is contemplating strategies to offset the impact of higher U.S. tariffs on its business.

“We have a team of experts exploring possibilities to mitigate the impact of increased tariffs, including redesign, redeveloping, resource, and repricing products, among other mitigation factors,” he explained. “Overall, we’re taking a multi-pronged approach to managing the business during this period of uncertainty.

“On the one hand, we’re taking decisive actions to preserve capital and to mitigate the impact of higher U.S. tariffs. We believe our brands and strong financial position can enable us to gain market share. The Columbia brand’s exceptional value will be a competitive advantage in this period of rising prices for U.S. consumers,” continued Boyle.

As part of the Columbia brand’s “Accelerate” growth strategy, Boyle said the company remains committed to increasing its investment in demand creation to bring new highly differentiated marketing campaigns and enhanced product assortments to life.

“Not only are we planning to invest more in marketing, but we’re also leveraging modern digital and social first strategies to be more efficient and effective with our demand creation investments,” the CEO said. “In this period of tariff turmoil, we have the opportunity to set ourselves apart.”

Outlook

Boyle announced that, given the heightened uncertainty regarding tariff rates and the impact on product costs and consumer demand, the company was withdrawing its full-year 2025 outlook.

“With that said, I’d like to provide some details on how we’re approaching the balance of the year,” he offered.

Before the tariff increases, the company was on track to deliver its full-year financial targets.

For the second quarter, COLM anticipates net sales to grow 1 percent to 5 percent year-over-year, which aligns with the company’s first-half net sales outlook provided in February.

- Net sales are expected to be $575 million to $600 million, compared to $570.2 million for the comparable period in 2024.

As of May 1, the incremental 10 percent universal tariff and the higher tariffs for China are in effect. Applying these tariff rates to the product that the company has yet to receive in the U.S. with a fall 2025 season would add between $40 million to $45 million to the cost of sales as the underlying inventory is sold.

“Given our focus on delivering exceptional value to consumers and maximizing the marketplace opportunity, we do not expect to offset these higher tariff costs in 2025,” Boyle announced. “Our tariff mitigation strategy will evolve in response to trade policy changes.”

Questioned on the impact of tariff costs on the company’s fall order book and pricing strategies, Boyle emphasized its flexibility to adjust pricing and capture market share.

Boyale said that COLM continues progressing on its profit improvement plan and has identified cost savings and profit-enhancing opportunities beyond the $150 million three-year target set in 2024.

“We expect the U.S. market to be challenging in the back half of the year,” Boyle noted.

“Consumers will be paying higher prices for many of the [goods] they buy, and we expect this to negatively impact consumer demand,” he suggested. “Our fall order book has not meaningfully changed since our call in February, but we anticipate retailers will be cautious with their inventory intake in this uncertainty. As a result, we’re planning our U.S. business conservatively, minimizing inventory risk and preserving profitability.”

Still, Boyle said the company has not seen a meaningful change in trends in most of its international businesses, which were “quite healthy in the first quarter.” He said it is not possible to forecast the extent to which U.S. tariff actions will impact international economic growth and consumer demand for COLM products globally.”

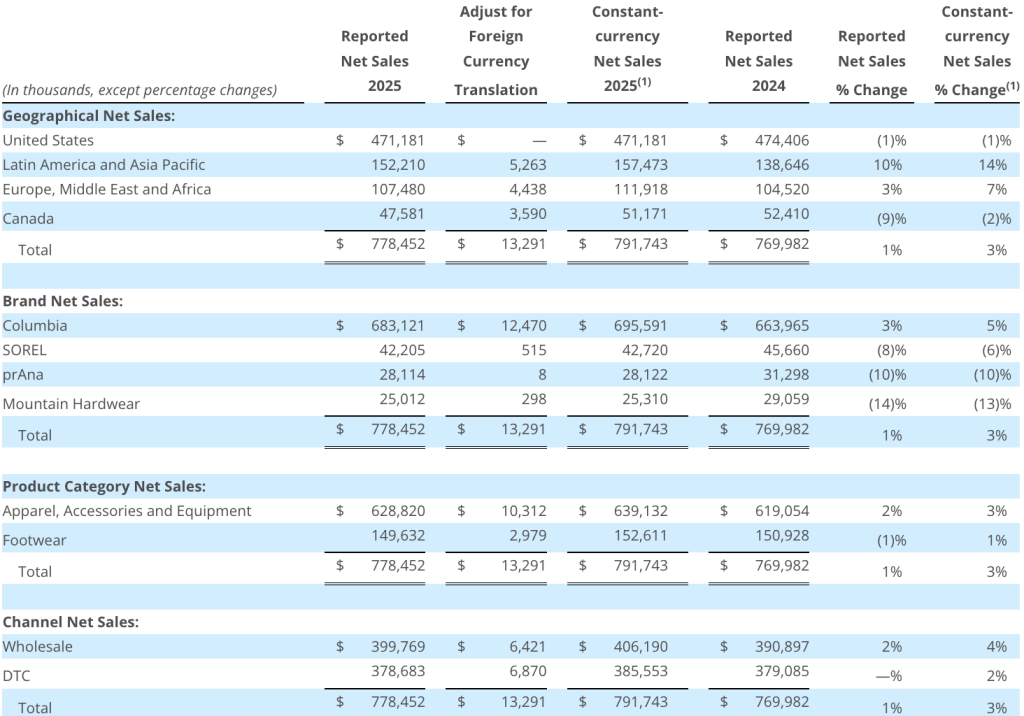

First Quarter Sales

First-quarter net sales increased 1 percent, or 3 percent constant-currency (cc), to $778.5 million, compared to $770.0 million for the comparative period in 2024. The increase was led by the Latin America/Asia Pacific (LAAP) and the Europe, Middle East and Africa (EMEA) regions, partially offset by declines in Canada and the U.S.

Global Wholesale net sales increased 2 percent year-over-year, while direct-to-consumer (DTC) was “flat.” On a constant-currency basis, global Wholesale sales were up 4 percent, and DTC grew 2 percent year-over-year.

United States

U.S. net sales decreased 1 percent year-over-year in the first quarter, with the U.S. Wholesale business relatively flat. Spring 2025 shipments were up modestly.

“During the quarter, winter weather boosted late-season fall product sales but entered early spring season sell-through,” Boyle noted. “In addition to weather, challenging outdoor category trends and consumer uncertainty at [indiscernible] season demand.”

United States DTC net sales declined low-single-digits, with e-commerce net sales nationwide down in the high-single-digits.

“We had an excellent winter clearance sale in February, but it was not enough to offset challenging market conditions,” Boyle added.

U.S. brick-and-mortar net sales were up in low-single-digits, driven by contribution from new stores.

The CEO said COLM exited the quarter with eight temporary clearance locations, down from 28 in the fourth quarter.

Latin America & Asia Pacific (LAAP)

LAAP net sales increased 14 percent in constant-currency terms in Q1.

China net sales increased in the low-teens cc, which was led by strong e-commerce growth.

“Through our product offerings, marketing activations and marketplace strategies, we’re working to create a more premium Columbia brand experience for Chinese consumers,” Boyle noted. “Building off the prior season’s success of our Transit line, we continue to expand our localized product offering designed to meet the unique needs of the younger Chinese consumers and the growing outdoor market.”

In Q1, Columbia opened its first High Street store in China on Huaihai Road in Shanghai.

“This celebrates Columbia’s deep heritage and drove consumer engagement through online impressions and in-store events. We remain committed to investing in our business in China,” he said.

Japan net sales increased in the mid-teens cc in Q1, “benefiting from strong demand for late season and winter product with growth across all channels,” Boyle shared.

“Our localized product in Japan blends style, functionality and performance to create wear anywhere product.”

The CEO said the company will open a Columbia High Street location in May in the center of Harajuku of premier retail areas in Tokyo. “I’m excited to see this premium expression of the brand come to life. Korea net sales increased low-single-digit percent, aided by late winter weather,” he added.

LAAP distributor markets were said to increase in the low 20s cc in the quarter, primarily reflecting robust Spring 2025 order growth.

“In both our LAAP and EMEA distributor markets, Omni-Max footwear has continued to be an incredible success story, demonstrating our great product, marketing activations and retail presentation. The Columbia brand is strong, and our partners are investing in retail door expansion,” he noted.

Europe, Middle East and Africa

EMEA net sales increased 7 percent year-over-year in constant-currency terms. Europe direct-net-sales increased in high-single-digit cc with growth across all channels, led by DTC stores.

“Across the European marketplace, our team is doing a great job evaluating the consumer experience with in-store marketing and brand-managed spaces in the concept of strategic partner,” Boyle added.

EMEA distributor business was said to be “down slightly” despite strong Spring 2025 orders, as the timing of shipments was more heavily weighted to the second quarter.

Canada

Canada net sales were down 2 percent cc in the quarter, with sales said to be down modestly across wholesale and DTC.

Brand Summary

Columbia Brand

Columbia’s net sales increased 3 percent year-over-year on a constant currency basis.

“On the product front, we introduced our lightest shoe ever, the Omni-Max Konos Featherweight, designed to perform on the trail and in the city with adaptive cushioning, flexible support and grippy outsole,” Boyle shared. “The incredible versatility of this product is being highlighted to consumers with a new footwear marketing campaign, “Every Surface is a Trail.”

Mountain Hardwear

Mountain Hardwear net sales decreased 14 percent cc in the first quarter.

“While full price selling was healthy across channels, we had lower closeout sales compared to elevated the FRS clearance activity last year,” Boyle explained. “We remain committed to investing in the Mountain Hardwear brand, including elevating our presentation at wholesale.”

For Spring 2025, the company opened several Mountain Hardwear branded retail stores in the specialty outdoor channel. Initial sell-through trends have reportedly been “promising” at these locations, and the company plans additional doors.

Prana

Prana net sales decreased 10 percent cc in the quarter, reflecting a challenging e-commerce performance.

“I remain excited about Prana’s product and marketing direction,” the CEO said. “As we head into the fall season, new product collections and refreshed brand image will be increasingly evident to consumers.”

The company opened a Prana retail store during the quarter to highlight key product franchises and elevate the brand story. The improved product assortment and presentation at retail are reported to resonate with consumers.

Sorel

Sorel net sales decreased 8 percent cc year-over-year in Q1. Boyle said the team is refreshing the Sorel product line with new styles like the Ana Ave sneaker and the Roam’n Clog, which Boyle said have the potential to become important product franchises in the coming seasons.

“Sorel’s evolution will continue into the fall season with new women’s styles and expanded selection, high-energy collabs, and refreshed brand imagery,” Boyle noted.

Income Statement Summary

Gross margin expanded 30 basis points to 50.9 percent of net sales in Q1 from 50.6 percent of net sales for the comparable period in 2024. Gross margin expansion reflected several factors, including lower outbound shipping expenses, higher closeout margins and favorable Spring 2025 product input costs, partially offset by unfavorable FX hedging rates.

SG&A expenses were $354.5 million, or 45.5 percent of net sales, compared to $349.3 million, or 45.4 percent of net sales, for the comparable period in 2024. The largest changes in SG&A expenses were higher direct-to-consumer (DTC) and demand creation expenses, partially offset by lower supply chain expenses.

Operating income increased 4 percent to $46.5 million, or 6.0 percent of net sales, compared to operating income of $44.7 million, or 5.8 percent of net sales, for the comparable period in 2024.

Interest income, net of $6.8 million, compared to $9.2 million for the comparable period in 2024.

Income tax expense of $12.6 million resulted in an effective income tax rate of 23.0 percent, compared to income tax expense of $11.8 million, or an effective income tax rate of 21.9 percent, for the comparable period in 2024.

Net income was relatively flat at $42.2 million, or 75 cents per diluted share, compared to net income of $42.3 million, or 71 cents per diluted share, for the comparable period in 2024.

Balance Sheet as of March 31, 2025

Cash, cash equivalents and short-term investments totaled $658.4 million, compared to $787.7 million as of March 31, 2024.

The company had no borrowings as of either March 31, 2025, or March 31, 2024.

Inventories increased 3 percent to $623.7 million at quarter-end, compared to $607.4 million as of March 31, 2024.

Cash Flow for the Three Months Ended March 31, 2025

Net cash used in operating activities was $32.0 million, compared to net cash provided by operating activities of $106.8 million for the same period in 2024.

Capital expenditures totaled $15.6 million, compared to $14.8 million for the same period in 2024.

Share Repurchases

The company repurchased 1,251,784 shares of common stock for an aggregate of $101.4 million in Q1, or an average price per share of $81.03.

At March 31, 2025, $526.1 million remained available under the company’s stock repurchase authorization, which does not obligate the company to acquire any specific number of shares or over any specified period.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash dividend of 30 cents per share, payable on June 5, 2025, to shareholders of record on May 22, 2025.

Image courtesy Columbia Sportswear