“The popularity of the Golfman Hoodie among PGA Professionals speaks volumes to the incredible fabric, super soft feel and consumer affinity for the Ashworth brand.” —Eddie Fadel, President, Ashworth Golf

Category: Apparel

EXEC: Puma Expects to Come Up Short in 2023; Tempers 2024 Outlook

The company points to the extraordinary 54 percent devaluation of the Argentine peso in December 2023 and the application of hyperinflationary accounting for a miss on its bottom line.

EXEC: Amer Sports Expects 2023 Full-Year Revenues North of $4.35 Billion

Revenue reportedly increased across all operating segments, geographic regions and channels, according to the company’s recently amended F-1 filing statement. The company sees its annual net loss contracting but EBITDA expanding for the year.

Circana to Acquire Golf Datatech

The transaction is subject to customary closing conditions and expected to be completed by March 2024. Under the terms of the agreement, Golf Datatech will operate as a wholly-owned subsidiary of Circana.

Academy Sports and Outdoors Appoints Chief Supply Chain Officer

Rob Howell will join the company as SVP and chief supply chain officer in February 2024, reporting to President Sam Johnson. He will oversee supply chain operations, distribution centers, and domestic and international logistics.

Pure Hockey Expands into Iowa with New Acquisition

The acquisition of JT’s Slap Shot in Urbandale, IA, marks Pure Hockey’s first entry into the state and “underscores the company’s commitment to serving the needs of hockey players across the U.S.”

Duluth Trading Appoints New CFO

Heena Agrawal will assume the role of SVP and CFO, effective February 12, 2024.

True Religion to Launch Footwear Range Under New License Deal

True Religion inked a footwear licensing agreement with Orly Corporation for its men’s, women’s, and kid’s footwear collection, which is expected to launch in Fall 2024.

Fanatics Sets Layoff and Closure Plan for JAX Fulfillment Center

The retailer, designer and manufacturer of licensed sports products has grown out of its hometown Jacksonville, FL fulfillment facility, resulting in the lay-off of 218 employees later this year.

EXEC: January Consumer Confidence Index Highest Since July 2021

The University of Michigan’s preliminary results reported on the overall index of consumer sentiment came in at 78.8 for January, the highest reading since July 2021, compared to 69.7 in December and 64.9 in January 2023.

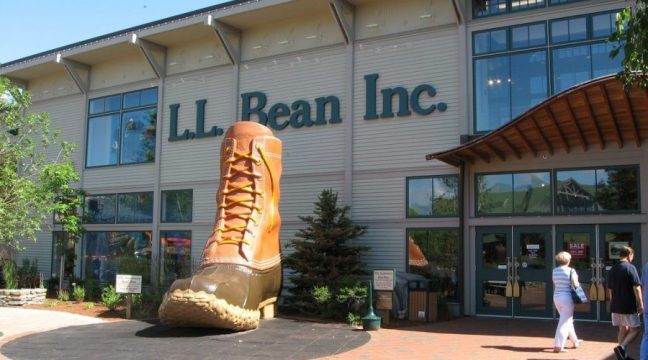

L.L.Bean Set to Open Eighth New York Store in Spring

The retailer’s first new store of 2024 will open in Kingston, NY, in March/April.

Vaude Appoints New Chief Financial Officer

With new CFO Melissa Wach and CEO Antje von Dewitz, the management team is now 50 percent female. Women hold prominent positions across the board in leadership roles at Vaude, constituting approximately 45 percent of executive positions.

Former Athleta CEO to Lead Beyond Yoga as Co-Founder Exits CEO Role

Nancy Green, former CEO and president of Athleta, will join the athletic and lifestyle apparel brand owned by Levi Strauss & Co. as CEO on February 1. Co-founder Michelle Wahler will step down as CEO and COO/CFO Jesse Adams will also depart.

Tilly’s, Inc.’s CEO Departs; Board Chair to Lead Retailer on Interim Basis

Ed Thomas retired as president, CEO and director of the company. Company Co-founder and former President and CEO Hezy Shaked was appointed as the company’s interim president and CEO until a successor is found.

Amer Sports Looks to Raise Over $1.6 Billion in IPO

Amer Sports, Inc., the parent of the Arc’teryx, Armada, Atomic, DeMarini, EvoShield, Louisville Slugger, Salomon, Wilson, and other sports and outdoor brands, launched an initial public offering of 100,000,000 ordinary shares.