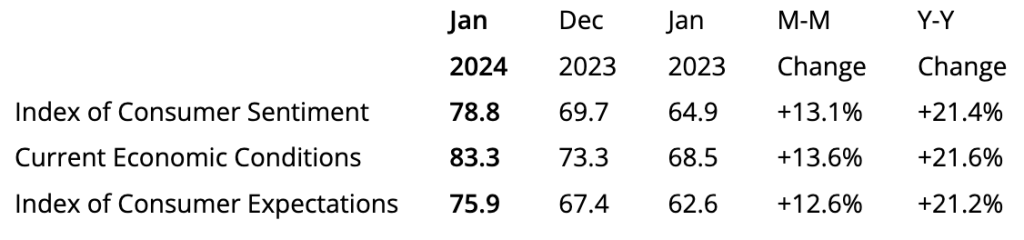

The University of Michigan’s preliminary results reported on the overall index of consumer sentiment came in at 78.8 for January, the highest reading since July 2021, compared to 69.7 in December and 64.9 in January 2023.

Economists polled by Reuters had forecasted a preliminary reading of 70.0. It was the second straight monthly increase and occurred amidst a strong stock market rally this month.

Preliminary Results for January 2024

“Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations,” offered Joanne Hsu, director of Surveys of Consumers at the University of Michigan. “Over the last two months, sentiment has climbed a cumulative 29 percent, the largest two-month increase since 1991 as a recession ended.”

Hsu said all five index components rose for the second straight month, with a 27 percent surge in the short-run outlook for business conditions and a 14 percent gain in current personal finances.

“Like December, there was a broad consensus of improved sentiment across age, income, education, and geography,” Hsu continued. “Democrats and Republicans alike showed their most favorable readings since summer of 2021.”

She said sentiment has now risen nearly 60 percent above the all-time low measured in June of 2022 and is likely to provide some positive momentum for the economy. Sentiment is now just 7 percent shy of the historical average since 1978.

The survey’s reading of one-year inflation expectations fell to 2.9 percent in January, the lowest level since December 2020. That was said to be down from 3.1 percent in December and put these inflation expectations within the 2.3 percent to 3.0 percent range posted in the two-year pre-pandemic period.

The survey’s five-year long-run inflation outlook edged down to 2.8 percent from 2.9 percent in December. It is now in the 2.9 percent to 3.1 percent range seen for 26 of the last 30 months, but slightly higher relative to the 2.2 percent to 2.6 percent range that prevailed in the two-year pre-pandemic period.

Easing inflation expectations are leading investors to come off the sidelines and re-invest in equities in anticipation of lower interest rates ahead, driving the stock market gains on Friday and into this week, driving the DOW over 38,000 for the first time.

Chart and data courtesy of University of Michigan, Surveys of Consumers