Callaway Golf Company reported sales increased 6 percent in the fourth quarter. The net loss was cut to $41.5 million, or 54 cents a share, from $49.5 million, or 65 cents, a year ago. For the full year, despite challenging conditions that beset the golf

Callaway Golf Company reported sales increased 6 percent in the fourth quarter. The net loss was cut to $41.5 million, or 54 cents a share, from $49.5 million, or 65 cents, a year ago. For the full year, despite challenging conditions that beset the golf

industry for much of 2014, including unfavorable weather and changes in

foreign currency exchange rates, Callaway returned to profitability for

the first time since 2008.

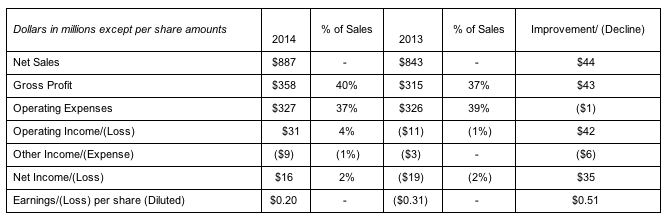

Callaway reported full year sales growth of 5 percent for 2014 driven by growth in most major product categories (woods +8 percent; irons +12 percent; golf balls +4 percent; and accessories and other +2 percent) and growth in all geographic segments (United States +5 percent; Japan +3 percent; Europe +11 percent; Rest of Asia +7 percent; and Other foreign countries +1 percent). Additionally, income from operations improved significantly to $31 million compared to a loss of ($11) million in 2013 and fully diluted earnings per share increased to $0.20 compared to a loss of ($0.31) in 2013. This positive turnaround was driven by the increase in sales, improvements in gross margins of 310 basis points, and flat operating expenses, all of which more than offset an approximately $6 million increase in other expense due to a decrease in foreign currency contract gains. The 2014 results also benefitted from a $17 million decrease in pre-tax charges related to the cost reduction initiatives that were completed in 2013.

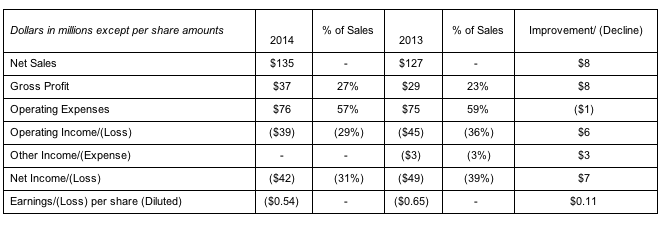

For the fourth quarter, 2014 sales were $135 million, an increase of 6 percent compared to last year due primarily to increased sales of woods (+21 percent), irons (+27 percent) and golf balls (+3 percent). The increase in woods and irons was led by a strategic change in product launch timing resulting in the fourth quarter release of the Big Bertha 815 family of woods and Big Bertha Beta Irons and Hybrids compared to no similar product launches in 2013. Although the company generally reports a loss during the fourth quarter due to the seasonality of its business, this increase in sales, together with a 440 basis point improvement in gross margins, allowed the company to reduce its net loss per share to ($0.54) compared to a net loss per share of ($0.65) last year. The 2014 results also benefitted from a $6 million decrease in pre-tax charges related to the cost reduction initiatives that were completed in 2013.

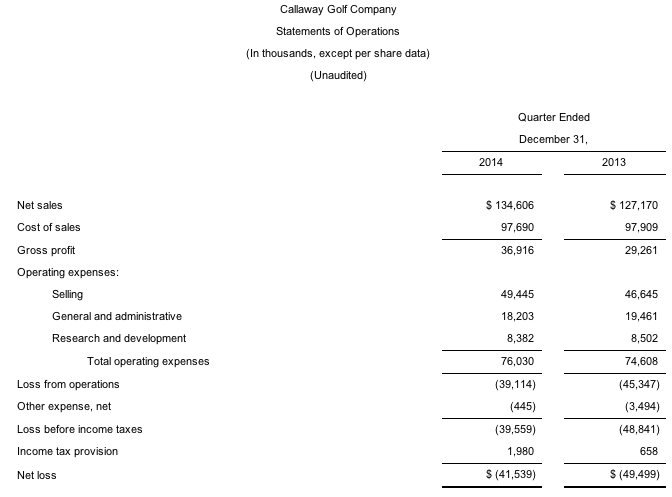

GAAP RESULTS

For the fourth quarter of 2014, the company reported the following results, as compared to the same period in 2013:

For the full year of 2014, the company reported the following results, as compared to the same period in 2013:

“We are pleased with our results for 2014,” commented Chip Brewer, President and Chief Executive Officer of Callaway Golf company. “Notwithstanding challenging market conditions for the golf industry as a whole, we were able to grow sales, increase our market share and return to profitability for the first time since 2008 – a significant milestone for us in our turnaround. Our return to profitability has clearly benefitted from the many actions we have taken during the last few years to improve our operating efficiencies, as evidenced in part by our 300+ basis point improvement in gross margins in 2014. Also, our continued emphasis on cost management has allowed us to increase our investments in tour and marketing and still hold our operating expenses essentially flat with 2013. All in all, we are pleased with how our turnaround has progressed thus far.”

“Looking forward, while the recent weakening of foreign currencies will adversely impact our 2015 GAAP results, we expect our underlying operational performance to continue to improve in 2015,” continued Mr. Brewer. “Given the strength of our product line for 2015, which was well received at the recent PGA show in Orlando, and anticipated additional improvements in our operations, we expect for 2015 on a constant currency basis not only sales growth and market share gains, but also further improvements in gross margins and profitability. Golf is a momentum business and fortunately momentum is now on our side.”

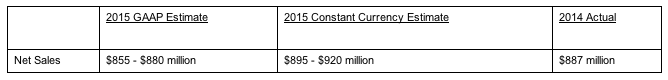

Business Outlook for 2015

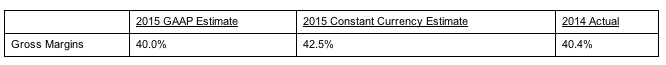

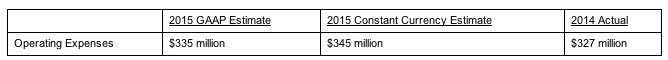

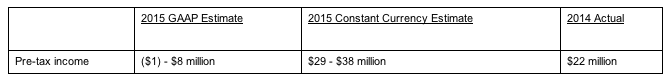

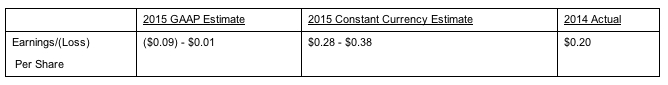

Given the significant effects that the recent weakening of foreign currencies will have on the company's GAAP results in 2015, the company has provided guidance on both a GAAP and constant currency basis. The GAAP guidance is generally based upon a blend of current foreign currency exchange rates and the exchange rates at which the company entered into hedge transactions. The company's hedging program will mitigate but not eliminate the effects of future foreign currency rate changes and therefore any such future changes will affect the company's GAAP guidance. The company provided the following estimated full year results for 2015:

The company estimates that its 2015 net sales will decline 1 percent – 4 percent due to significant changes in foreign currency rates compared to 2014. On a constant currency basis, net sales are estimated to increase by approximately 1 percent – 4 percent. This growth is being driven by an estimated 5 percent – 6 percent growth in the company's core channel business, partially offset by a change in product launch timing and a reduction in closeout sales compared to 2014.

The company estimates that its 2015 gross margins as a percent of sales will be about the same as in 2014. On a constant currency basis, the company estimates that gross margins will improve by 210 basis points as compared to 2014. This improvement is expected to result from continued supply chain improvements and a more favorable sales mix.

The company estimates that 2015 operating expenses will increase by 2 percent on a GAAP basis and by 6 percent on a constant currency basis. This anticipated increase, on a currency neutral basis, is primarily due to planned additional investment in marketing and tour as well as other normal annual cost increases, partially offset by the company's continued focus on cost management.

Due to the effects of changes in foreign currency rates, the company estimates that its GAAP Pre-tax income will decrease despite anticipated improvement in operational performance. On a constant currency basis, the company estimates that its pre-tax income will increase by 32 percent – 73 percent as compared to 2014. The company estimates that its 2015 income tax provision will be approximately $7 million on both a GAAP and constant currency basis.

The company estimates that its fully diluted earnings/loss per share will decline significantly – solely as a result of adverse changes in foreign currency exchange rates as compared to 2014. On a constant currency basis, the company estimates that its earnings per share would increase by 40 percent – 90 percent due to the strength of its 2015 product line and the many operational improvements implemented over the last couple of years. The company's 2015 earnings per share estimates assume a base of 79 million shares as compared to 78 million shares in 2014.