Callaway Golf company said first quarter 2015 net sales decreased slightly compared to its plan but its earnings were higher. As a result, the company is decreasing its full year revenue estimate to $840 million – $860 million (compared to its prior estimate of $855 million – $880 million). The company, however, is increasing its full year earnings per share estimate to loss of 3 cents a share to a profit of 4 cents, (compared to its prior estimate of a loss of 9 cents a share to a profit of 1 cent), as a result of continued manufacturing improvements and a better sales mix.

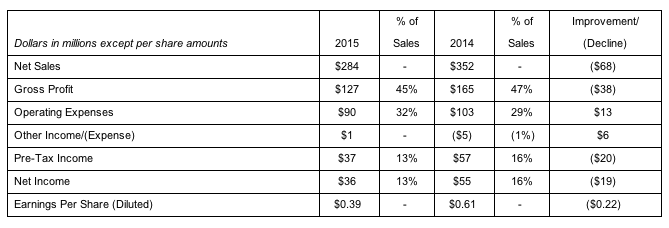

For the first quarter of 2015, the company reported net sales of $284 million, or a decrease of 19 percent, compared to $352 million in the first quarter of 2014. Most of this decrease was expected. The company had previously estimated that the decrease in first quarter 2015 net sales would be in the mid-teens (as a percent of net sales), primarily as a result of a planned strategic shift in product launch timing, but also as the result of weaker foreign currency rates and an anticipated decrease in first quarter sales in Japan due to the consumption tax increase which took effect in April 2014. Since providing such guidance, the U.S. Dollar strengthened further and market conditions, particularly in Asia, showed less improvement than anticipated. These factors ultimately resulted in a slightly greater than anticipated decrease in net sales for the first quarter of 2015, and the company has revised its full year sales guidance to reflect this decrease.

Also for the first quarter of 2015, the company reported earnings per share of 39 cents compared to 61 cents per share for the same period last year. This performance is better than anticipated due in part to better than expected gross margins and other income/expense. The company expects these results to carry through the year and therefore has increased its full year earnings guidance as discussed above.

“Although sales for the first quarter were slightly lower than we expected, overall I feel good about the business and our continued progress,” commented Chip Brewer, President and Chief Executive Officer. “Our brand momentum and market shares continue to improve and our profitability exceeded our expectations due in part to continued improvements in our manufacturing and supply chain along with tight cost management. The first quarter effect from the strategic shift in product launch timing and the consumption tax increase in Japan should smooth out as the year progresses. In addition, some regions are just beginning to open up for the new golf season and we are cautiously optimistic for improved market conditions as the year progresses.”

“We continue to realize the benefits from the many changes we have made in our business over the last few years,” continued Mr. Brewer. “As a result of these changes, we have generated increased consumer interest in our products, improved our operating efficiencies, and improved overall profitability. While there is certainly more work to be done, I believe we have set the foundation for steadily improved financial performance and long-term shareholder value.”

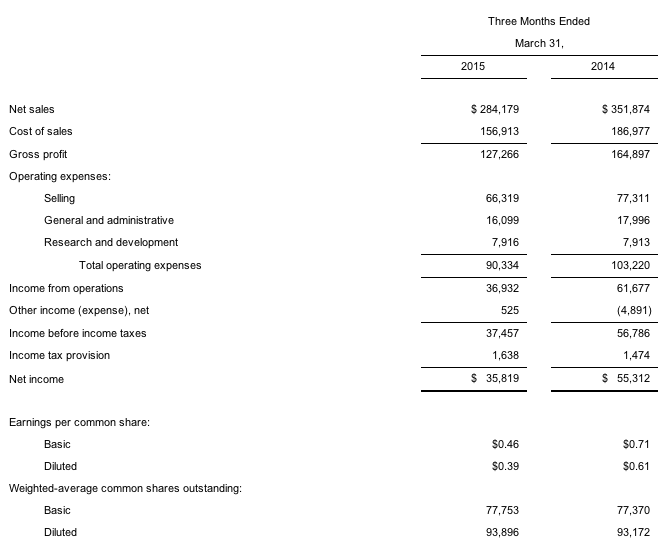

GAAP RESULTS

For the first quarter of 2015, the company reported the following results, as compared to the same period in 2014:

The company has included in the schedules to its press release the company's results on a constant currency basis.

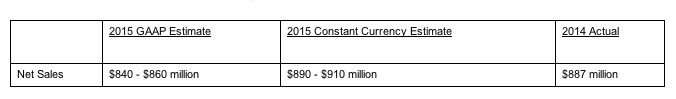

Business Outlook for 2015

Given the significant effects that foreign currencies will have on the company's GAAP results in 2015, the company has provided guidance on both a GAAP and constant currency basis. The GAAP guidance is generally based upon a blend of current foreign currency exchange rates and the exchange rates at which the company entered into hedging transactions. The company's hedging program will mitigate but not eliminate the effects of future foreign currency rate changes and therefore any such future changes will affect the company's GAAP guidance. The constant currency estimates are derived by taking the estimated local currency results and translating them into U.S. Dollars based upon the foreign currency exchange rates for the comparable period in 2014.

Full Year

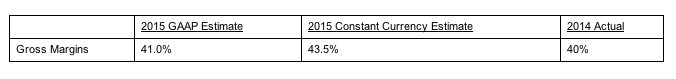

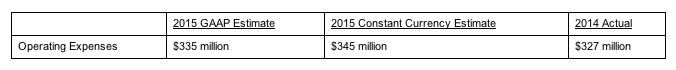

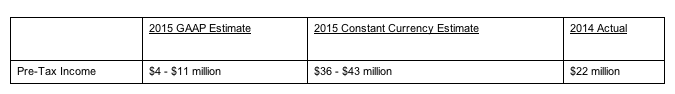

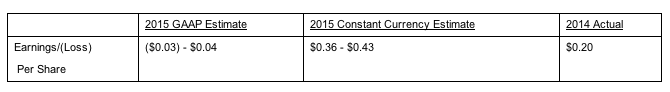

The Company provided the following estimated full year results for 2015:

The decline in the Company's estimates for full year net sales from its previous GAAP guidance of $855 million – $880 million is due to the amount by which first quarter net sales missed Company expectations as discussed above. A further strengthening of the U.S. Dollar for the balance of the year would also negatively affect the Company's sales estimates.

The Company estimates that its 2015 GAAP gross margins as a percent of sales will improve approximately 100 basis points from its previous guidance of 40.0% due to a stronger sales mix and continued operational improvements more than offsetting adverse foreign currency rates.

The Company estimates that its 2015 GAAP operating expenses will remain consistent with its previous guidance, despite the decrease in first quarter operating expenses. A majority of the first quarter expense savings is expected to be used in the second quarter with the balance used in the second half of the year.

The Company estimates that its 2015 Pre-tax income will increase from its previous guidance of ($1) million – $8 million due to improved gross margins more than offsetting the decline in net sales.

The Company estimates that its fully diluted earnings/loss per share will increase from its previous guidance of ($0.09) – $0.01 due to improved gross margins more than offsetting the decline in net sales. The Company's 2015 earnings per share estimates assume a base of 79 million shares as compared to 78 million shares in 2014.

Second Quarter 2015

The Company noted that net sales for the second quarter of 2015 are expected to be approximately 1% higher on a GAAP basis than for the second quarter of 2014, which would equate to approximately 8% sales growth on a constant currency basis.