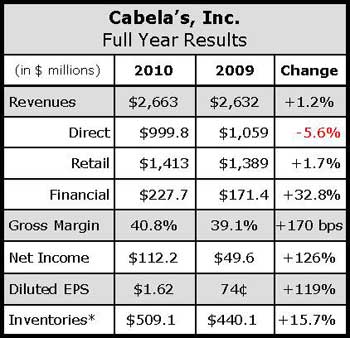

Cabela’s Inc. reported improved merchandise margins, increasing revenues and lower impairment charges in the fourth quarter ended Jan. 1 drove profit up more than 14% against a year -ago period that slumped on steep charges and liquidation costs.

In a conference call with analysts, management for the self-proclaimed Worlds Foremost Outfitter said margin improvement in ten of 13 sub-categories – especially in the footwear and apparel categories – drove merchandise margin 70 basis points for the quarter – marking the third consecutive quarter of margin improvement.

Total revenue for the quarter, adjusted for divestitures, edged up 1.7% to $934.4 million from $919.2 million a year ago. Earnings improved nearly four-fold to $66.3 million, or 95 cents per diluted share, from earnings of $16.6 million, or 24 cents, a year ago.

By outlet, the company rode strength from its bourgeoning retail stores, which saw revenues increase 3.2% to $478.8 million from $463.8 million and operating profit increase for the seventh consecutive quarter. Same-store sales improved 7.3% during the quarter. CEO Tommy Milner said the company made “additional investments in store labor during the quarter, which led to improved results in footwear and at the gun counter, among other departments. Milner added that the retail segment saw exceptional sales growth between Black Friday and Christmas due to a “deep commitment to key item inventories, better in-season management, a sharper focus on advertising effectiveness and a planned increase in store labor ”

Management confirmed the planned openings of stores in Allen, TX, Springfield, OR and Edmonton, Canada

In the Direct segment, revenues dip slightly to $386.9 million from $407.6 million a year-ago. Management attributed the slight decline to soft sales of ammunition in the Direct segment along with “greater than expected challenges” related to the revamped cabelas.com website and a new CRM system at the retailer’s call centers. “While the customer issues are largely behind is now, at times in the fourth quarter, our customers experienced longer than average wait times and slow response times while placing orders,” said Milner. Milner added that the company experienced planned declines in its catalog business, which was partially offset by double-digit gains in its internet businesses. Going forward, Milner said the “real opportunity” in the higher margin Direct segment would continue to come from e-commerce, which the company has invested heavily in over the past couple of years.

For the Financial Services segment, revenue increased 27.8% to $57.8 million from $45.2 million a year ago as the business recorded lower bad debt reserve releases.

In related news, subsequent to the quarter, World's Foremost Bank and the Federal Deposit Insurance Corporation (FDIC) agreed in principle to settle all matters related to the 2009 compliance examination. Cabela’s said it now expects the net impact of restitution and penalties to be $8 million pre-tax. The company recorded an $18 million pre-tax liability in the first quarter of 2010 related to this matter; therefore, the company reduced that liability in the fourth quarter by $10 million pre-tax. The liability reduction had a favorable 9 cents impact to reported earnings per share of 95 cents in the quarter. Excluding this item, earnings per share were 86 cents in the quarter.