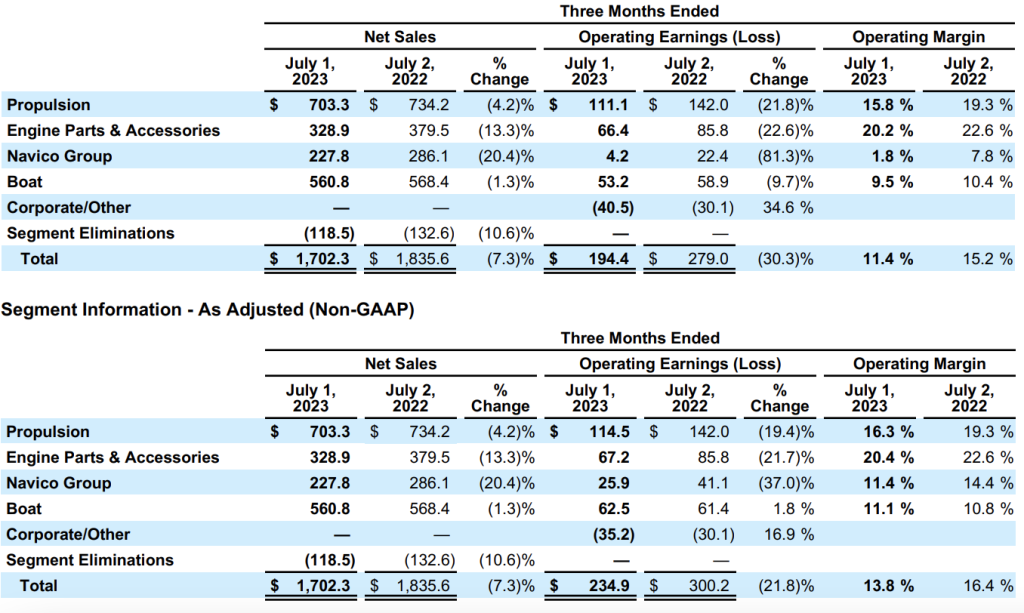

Brunswick Corporation reported consolidated net sales of $1.70 billion for the second quarter, down from $1.84 billion in the second quarter of 2022. Diluted EPS for the quarter was $1.91 on a GAAP basis and $2.35 on an adjusted basis. Second quarter sales were said to be below the prior year as a result of the lost production days due to an IT security incident, most significantly felt in the propulsion and engine parts and accessories businesses, along with softer market conditions, particularly in value boats and lower horsepower engine product lines, while sales in each segment benefited from the impact of annualized price increases and new product performance. Operating earnings benefited from prudent cost control measures across the enterprise which were offset by lower sales and higher input costs versus the prior year.

“Our businesses executed a strong second quarter, benefiting from market share gains, well-received new products, solid operational performance and diligent cost control,” said Brunswick CEO David Foulkes. “The new boat market remains challenging, and year-to-date new boat sales remain below 2022, but there has been relative improvement in recent months, with preliminary June U.S. SSI main powerboat retail turning positive and Brunswick outperforming the industry both in June and year-to-date.

“On June 13, the company announced it was impacted by an IT security incident, which ultimately resulted in financial results that were lower than initial expectations. The disruption associated with the IT security incident was most significant in our Propulsion and Engine Parts and Accessories segments and, because of the proximity to the end of the quarter, there was limited opportunity to recover within the period. Within nine days, the company announced that all primary global manufacturing and distribution facilities were fully operational, and there are no significant residual impacts. The speed at which the company recovered is a testament to the strength and resilience of our team. Despite the disruption and continued market challenges, we are relentlessly executing our strategic priorities, including advancing our ACES initiatives and maintaining a tight focus on generating strong free cash flow, which year-to-date is $144 million greater than in the first half of 2022.

The Propulsion segment reported a 4 percent decrease in sales resulting from the factors noted above, along with planned reductions in lower horsepower outboard engine and sterndrive engine sales and production, offset by a favorable product mix related to increased high-horsepower outboard engine demand, and higher sales to repower customers. Segment operating earnings in the quarter were also impacted negatively by timing related to capitalized inventory variances which was an equal benefit in the first quarter.

“Our Propulsion business results were below initial expectations solely due to the lost production days, particularly on high-horsepower outboard engines, resulting from the IT security incident,” Foulkes explained. “Prior to the disruption, our high-horsepower outboard engine production ramp-up was progressing and has since resumed, allowing us to increase shipments to repower customers and OEM partners.”

Folks said Mercury Marine continues to expand outboard propulsion retail market share around the globe, gaining 460 basis points of U.S. retail market share in the second quarter, and a total of 140 basis points year-to-date.

The Engine Parts and Accessories segment reported a 13 percent decrease in sales as solid product sales in the U.S. were said to be offset by more seasonal third-party Distribution sales as well as international market softness. Segment operating earnings were also impacted by the carry-over of start-up costs related to the newly opened distribution center.

“Our Engine Parts and Accessories businesses performed as expected, excluding the impact of the IT security incident, reflecting anticipated sales and earnings declines versus a record second quarter of 2022, although sales were up twelve percent versus second quarter of 2019,” added Foulkes. “Second quarter sales in the U.S. Products portion of the business remained resilient and would have been essentially flat to 2022 absent the impact of the IT security incident. We continue to progress the transition to the new Brownsburg, Indiana distribution center, however, sales were down versus 2022 as dealers and retailers continued to hold lower levels of inventory, although turns have improved into the season.

Navico Group segment reported a sales decrease of 20 percent, driven by lower retailer orders, together with slow recovery of RV OEM production, partially offset by strong new product performance. Segment operating earnings declined as a result of the common factors discussed in the other segments, which were said to be partially offset by accelerated cost reduction actions and reorganization efforts.

“As anticipated, Navico Group posted lower second-quarter sales versus the prior year as both marine and RV OEM orders slowed versus a record prior-year quarter,” said Foulkes. “Retailer stocking patterns showed improvement as we exited the quarter and we are also beginning to lap more favorable comparisons. Our new product launches, including the Lowrance HDS Pro fishfinder, are performing very well with retailers experiencing continued high consumer demand since initial stocking. Additionally, planned restructuring and cost reduction efforts continue to be accelerated, resulting in lower operating expenses versus the prior year.”

The Boat segment reported a 1 percent decrease in sales due to the impact of lower value product shipments and higher discounts although within expectations, partially offset by the favorable impact of prior year pricing actions and favorable performance in premium products. Adjusted operating margin was once again in the double-digits, enabled by the above factors, coupled with share gains and sustained operational productivity gains. Freedom Boat Club, which is part of Business Acceleration, had another strong quarter, contributing approximately 7 percent of sales to the

segment.

“The Boat business delivered a solid quarter with double-digit adjusted operating margins for the fifth consecutive quarter. Sales were slightly below the prior year while adjusted operating earnings were slightly above the prior year. Preliminary second-quarter U.S. SSI main powerboat retail unit sales improved sequentially from the first quarter with Brunswick picking up share in the period and year-to-date. Freedom Boat Club had strong same-store membership sales in the quarter and recently announced its 400th location. Freedom now has over 57,000 membership agreements covering more than 90,000 members network-wide, all while generating exceptionally strong synergy sales across our marine portfolio,” Foulkes concluded.

Cash Flow and Balance Sheet

Cash and marketable securities totaled $489.3 million at the end of the second quarter, down $123.7 million from 2022 year-end levels.

Net cash provided by operating activities of continuing operations during the first six months of the year of $254.4 million includes net earnings net of non-cash items and the seasonal impact of working capital build.

Investing and financing activities resulted in net cash usage of $373.7 million during the first half of 2023 including $173.4 million of capital expenditures, $132.2 million of share repurchases, and $56.8 million of dividend payments.

2023 Outlook

“We are pleased with the improved trends in new boat retail and continued high Mercury retail market share in the second quarter, as well as the tremendous progress towards our strategic initiatives and significant actions to lower our structural costs,” said Foulkes. “However, the impact of the IT security incident, combined with the continued pressure consumers are experiencing driven by elevated interest rates and higher prices resulting from cumulative inflation, lead us to be cautious regarding second-half financial performance. Additionally, we anticipate the ongoing uncertain market conditions are likely to create measured order patterns by our channel partners into the offseason. We continue to target marketing and promotional activities on select products to support the retail market and our channel partners while remaining steadfast in balancing inventory and pipeline levels throughout the second half.

The updated 2023 guidance anticipates:

- Net sales of between $6.7 and $6.8 billion;

- Adjusted diluted EPS of approximately $9.50;

- Share repurchases in excess of $250 million; and

- Third quarter 2023 net sales flat to down slightly versus Q3 2022, and adjusted diluted EPS

between $2.35 and $2.45 per share.

Photo courtesy Brunswick Corp.