BRP Inc., the Canada-based parent company of the Ski-Doo, Sea-Doo and Lynx power sports brands, said it continued to focus on reducing network inventory in the fiscal third quarter ended October 31 which resulted in reduced revenues versus the prior-year Q3 period.

“The decrease in the volume of shipments, the higher sales programs due to increased promotional intensity and the decreased leverage of fixed costs as a result of reduced production have led to a decrease in the gross profit and gross profit margin compared to the same period last year,” the company wrote in its Q3 report summary. “This decrease was partially offset by favorable pricing, production efficiencies and optimized distribution costs.”

BRP reports in Canadian dollars (CN$) currency.

Revenue Summary

The company reported Q3 revenues decreased 17.5 percent to CN$1.96 billion for the 2024 third quarter, compared to the CN$2.37 billion for the 2023 Q3 period. The decrease in revenues was said to be primarily due to a lower volume sold across all product lines, as a result of softer demand and continued focus on reducing network inventory levels, as well as higher sales programs. The decrease was reportedly partially offset by favorable pricing across most product lines. The decrease includes a favorable foreign exchange rate variation of CN$15 million.

Year-Round Products (53 percent of Q3 revenues):

Revenues from Year-Round Products decreased 12.2 percent to CN$1.04 billion for the 2024 third quarter, compared to CN$1.18 billion for the 2023 Q3 period. The decrease in revenues from Year-Round Products was said to be primarily attributable to a lower volume sold across all product lines, as a result of softer demand and continued focus on reducing network inventory levels, as well as higher sales programs. The decrease was partially offset by favorable product mix in SSV, and better pricing across all product lines. The decrease includes a favorable foreign exchange rate variation of CN$12 million.

Seasonal Products (32 percent of Q3 revenues):

Revenues from Seasonal Products decreased 29.1 percent to CN$615.9 million for the 2024 third quarter, compared to CN$868.7 million for the 2023 Q3 period. The decrease in revenues from Seasonal Products was said to be primarily attributable to a lower volume sold across all product lines, as a result of softer demand and continued focus on reducing network inventory levels, as well as higher sales programs on Snowmobile and PWC, and unfavorable product mix across all product lines. The decrease was partially offset by favorable pricing on Snowmobile and PWC.

PA&A and OEM Engines (15 percent of Q3 revenues):

Revenues from PA&A and OEM Engines decreased by CN$18.3 million, or 5.7 percent, to CN$303.4 million for the 2024 third quarter, compared to CN$321.7 million for the 2023 Q3 period. The decrease in revenues from PA&A and OEM engines was primarily attributable to a lower volume sold due to a high network inventory level in Snowmobile and to a decrease in retail in other product lines. The decrease was partially offset by favorable pricing on PA&A. The decrease also includes a favorable foreign exchange rate variation of CN$3 million.

North American Retail Sales

The company’s North American retail sales decreased by 11 percent for the 2024 third quarter compared to the same period last year. The decrease was mainly explained by softer demand in both Seasonal and Year-Round Products.

- North American Year-Round Products retail sales decreased in the high-single digits compared to the year-ago Q3 period. The North American Year-Round Products industry decreased on a percentage basis in the low-single digits over the same period.

- North American Seasonal Products retail sales decreased on a percentage basis in the mid-teens range compared to the year-ago Q3 period. The North American Seasonal Products industry decreased on a percentage basis in the mid-teens range over the same period.

Income Statement Summary

Gross profit decreased by CN$213.0 million, or 33.1 percent, to CN$430.0 million for the 2024 third quarter, compared to CN$643.0 million for the year-ago Q3 period. Gross profit margin percentage decreased by 510 basis points to 22.0 percent from 27.1 percent for the 2024 third quarter. The decreases in gross profit and gross profit margin percentage were the result of a lower volume sold, higher sales programs, decreased leverage of fixed costs as a result of reduced production, and higher warranty costs. The decreases were said to be partially offset by favorable pricing across most product lines, as well as production efficiencies and optimized distribution costs. The decrease in gross profit includes a favorable foreign exchange rate variation of CN$10 million.

Operating expenses increased by CN$9.6 million, or 3.4 percent, to CN$295.1 million for the 2024 third quarter, compared to CN$285.5 million for the year-ago Q3 period. The increase in operating expenses was mainly attributable to higher restructuring and reorganization costs, and impairment charges taken on unutilized assets. The increase was partially offset by lower R&D expenses. The increase in operating expenses includes a favorable foreign exchange rate variation of CN$3 million.

Normalized (Adjusted) EBITDA decreased by CN$198.7 million, or 42.9 percent, to CN$264.1 million for the 2024 third quarter, compared to CN$462.8 million for the year-ago Q3 period. The decrease in normalized EBITDA was said to be primarily due to lower gross margin.

Net income decreased by CN$62.8 million, or 69.7 percent, to CN$27.3 million for the 2024 third quarter, compared to net income of CN$90.1 million for the year-ago Q3 period. The decrease in net income was reportedly due primarily to a lower operating income, resulting from a lower gross margin. The decrease was partially offset by a decrease in financing costs, a favorable foreign exchange rate variation on the U.S. denominated long-term debt and a lower income tax expense.

Net loss from Discontinued Operations decreased by CN$6.5 million, or 24.1 percent, to CN$20.5 million for the 2024 third quarter, compared to CN$27.0 million for the year-ago Q3 period. The decrease in net loss was primarily due to lower operating loss, resulting from lower gross loss and lower operating expenses.

The company announced in October 2024 that it was initiating a process for selling its Marine businesses, including Alumacraft, Manitou, Telwater (Quintrex, Stacer, Savage and Yellowfin), and Marine parts, accessories and apparel. This process excludes all activities related to its Sea-Doo personal watercraft, Sea-Doo Switch pontoons and jet propulsion systems.

Liquidity and Capital Resources

Consolidated net cash flows generated from operating activities totaled CN$432.9 million for the nine-month period ended October 31, 2024 compared to consolidated net cash flows generated from operating activities of CN$1.05 billion for the nine-month period ended October 31, 2023. The decrease was mainly due to lower profitability and unfavorable changes in working capital, partially offset by lower income taxes paid. The unfavorable changes in working capital were the result of maintaining higher provisions, which reflected the industry’s promotional intensity, and maintaining inventory levels.

The company invested CN$299.4 million of its liquidity in capital expenditures for the introduction of new products and modernization of the company’s software infrastructure to support future growth.

During the nine-month period ended October 31, 2024, the company also returned CN$261.6 million to its shareholders through quarterly dividend payouts and its share repurchase programs.

Dividend

On December 5, 2024, the company’s Board of Directors declared a quarterly dividend of CN$0.21 per share for holders of its multiple voting shares and subordinate voting shares. The dividend will be paid on January 14, 2025 to shareholders of record at the close of business on December 31, 2024.

Outlook

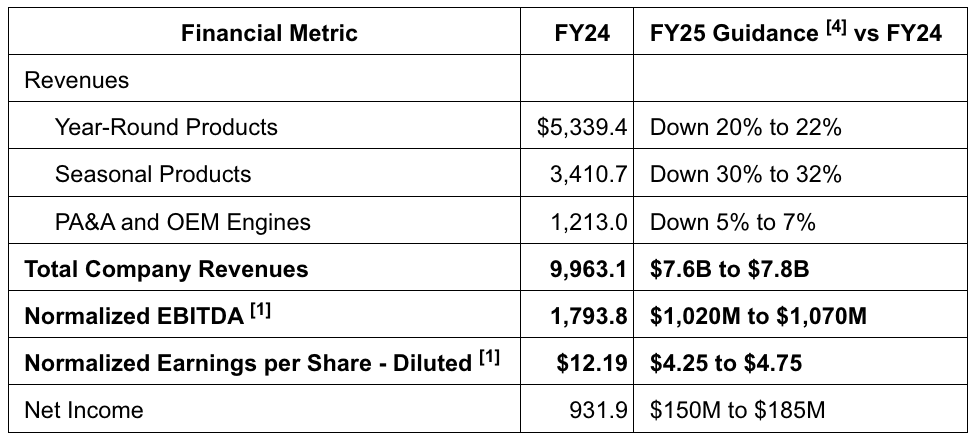

The company has adjusted its fiscal 2025 guidance to exclude the financial results of Marine discontinued operations.

Updated Outlook

Image courtesy Ski-Doo / BRP, Inc.