Boot Barn Holdings, Inc. reported earnings rose 39.7 percent in its third quarter ended Dec. 27 on a 13.1 percent sales gain.

Highlights for the quarter ended December 27, 2014, compared to the quarter ended December 28, 2013 were as follows:

- Net sales increased 13.1 percent to $130.5 million;

- Same store sales, which include e-commerce sales, increased 7.2 percent;

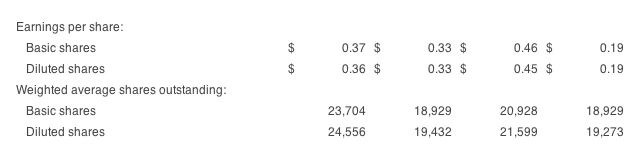

- Net income was $8.8 million, or $0.36 per diluted share, compared to a net income of $6.3 million or $0.33 per diluted share; and

- Pro forma adjusted net income (1) was $10.7 million, or $0.40 per diluted share compared to $8.9 million, or $0.35 per diluted share.

1) Pro forma adjusted net income is a non-GAAP measure. A reconciliation of GAAP net income to this measure is included in the accompanying financial data.

Jim Conroy, chief executive officer, commented, “Our third quarter performance was highlighted by the continued successful execution of our major growth initiatives. We expanded our nationwide footprint with the opening of eight new stores, increased our same store sales and built out our private brand portfolio with the launch of MoonShine Spirit by Brad Paisley. At the same time, we expanded our merchandise margin and delivered strong bottom line results. We are confident that we have the right strategies in place to take advantage of our leadership position in the marketplace and grow our business.”

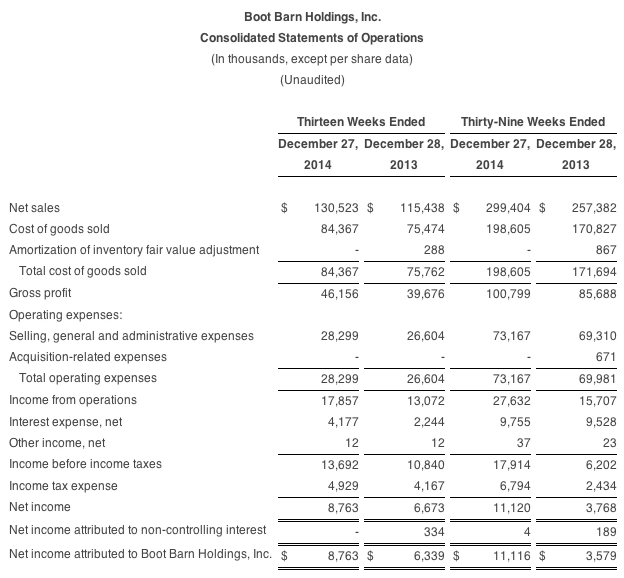

Operating Results for the Third Quarter Ended Dec. 27, 2014

Net sales increased 13.1 percent to $130.5 million from $115.4 million in the third quarter of fiscal 2014; same store sales, which include e-commerce sales, increased 7.2 percent. Net sales also increased due to contributions from 14 new stores opened during the last twelve months.

Gross profit was $46.2 million or 35.4 percent of net sales, compared to adjusted gross profit of $41.0 million or 35.5 percent of net sales in the prior year period, which excludes $1.3 million of one-time costs associated with the Baskins Acquisition. Merchandise margin grew in the quarter, primarily driven by improved mark-up across the store, increased penetration of private brands and the improvements the company made to the assortment and pricing at the former Baskins’ stores. This increase was offset by increases in store occupancy costs and depreciation expense associated with the higher store count compared to the prior year period, as well as an increase in procurement and distribution costs.

Income from operations was $17.9 million. This compares to $13.1 million in the prior year period, which included $2.5 million of expenses related to the Baskins Acquisition and a $0.5 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations was $17.9 million, compared to $16.0 million in the prior year period, reflecting an increase of 11.5 percent.

The company opened eight new stores and ended the quarter with 166 stores in 26 states.

Net income for the third quarter of fiscal 2015 was $8.8 million, or $0.36 per diluted share, compared to $6.3 million or $0.33 per diluted share in the prior year period. Pro forma adjusted net income increased 20 percent to $10.7 million, or $0.40 per diluted share compared to $8.9 million, or $0.35 per diluted share in the prior year period.

A reconciliation of the above non-GAAP financial measures to their nearest GAAP financial measures is included in the accompanying financial data. See also “Non-GAAP Financial Measures.”

Operating Results for the Thirty-Nine Week Period Ended December 27, 2014

Net sales increased 16.3 percent to $299.4 million from $257.4 million in the prior year period; same store sales, which include e-commerce sales, increased 7.3 percent. Net sales also increased due to contributions from 14 new stores opened during the last twelve months. The nine month period also included a nine month sales contribution from the Baskins stores, which the company acquired in May 2013, compared to a seven month sales contribution in the prior year period.

Gross profit was $100.8 million or 33.7 percent of net sales, compared to adjusted gross profit of $87.7 million or 34.1 percent of net sales in the prior year period, which excludes $2.1 million of one-time costs associated with the Baskins Acquisition. Merchandise margin grew during the period, driven by improved mark-up across the store, increased penetration of private brands and the improvements the company made to the assortment and pricing at the former Baskins’ stores. This increase was offset by increases in store occupancy costs and depreciation expense associated with the higher store count compared to the prior year period, as well as an increase in procurement and distribution costs.

Income from operations was $27.6 million, which included $0.9 million in non-recurring expenses related to a potential acquisition that the company chose not to pursue and a $0.1 million loss on disposal of assets. This compares to income from operations of $15.7 million in the prior year period, which included $6.1 million of expenses related to the Baskins acquisition and a $0.8 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations was $28.6 million or 9.6 percent of net sales, compared to $22.6 million or 8.8 percent of net sales in the prior year period.

The company opened 14 new stores in the thirty-nine week period.

Net income was $11.1 million, or $0.45 per diluted share compared to $3.6 million or $0.19 per diluted share for the prior year period. Pro forma adjusted net income increased 34 percent to $15.3 million, or $0.59 per diluted share compared to $11.4 million or $0.46 per diluted share in the prior year period. Pro forma adjusted net income per share excludes the effect of a cash payment of $1.4 million, or $0.06 per diluted share, to holders of vested stock options in the first quarter of fiscal 2015.

Balance Sheet Highlights as of December 27, 2014

- Cash: $3.6 million

- Total debt: $79.5 million

- Total liquidity (cash plus availability on $70 million revolving credit facility ): $41.6 million

Subsequent Events

On January 26, 2015, the company hired Greg Hackman as Chief Financial Officer and Secretary. Paul Iacono, formerly Chief Financial Officer and Secretary of the company, will be redirecting his efforts in a new role as Vice President, Business Development, focusing on further accelerating the company’s growth. He is also assisting Mr. Hackman to transition into the CFO role in an expedited manner by providing historical context.

“We are pleased to welcome Greg to the leadership team at Boot Barn. He is a highly capable finance leader with a strong background in the retail industry and his extensive experience managing the requirements of public company reporting will add tremendous leadership to the overall Boot Barn team. I had the opportunity to work with Greg for several years at Claire’s, and I am looking forward to working with him again,” commented Jim Conroy, CEO of Boot Barn. “Paul is a valuable member of the leadership team and, in his new role in Business Development, will leverage his institutional knowledge of the company and enable us to continue to execute on our growth initiatives.”

Fiscal Year 2015 Outlook

Based on the strong results in the third quarter, the company has further increased its outlook for the fiscal year ending March 28, 2015:

- 18 stores expected to open, adding four stores in the fourth quarter to the 14 stores opened year to date.

- Same store sales growth, including e-commerce sales, of approximately 6.5 percent to 7.0 percent.

- Income from operations between $33.0 million and $34.5 million, compared to the company’s prior outlook of $32.0 million to $33.5 million.

- Net income of $13.2 million to $14.1 million or $0.52 to $0.55 per diluted share based on 22.9 million weighted average diluted shares outstanding. The calculation of diluted earnings per share reflects a $1.4 million cash payment paid in April 2014 to holders of vested stock options.

- Pro forma adjusted net income of $17.5 million to $18.4 million, or $0.67 to $0.70 per diluted share based on 26.2 million weighted average diluted shares outstanding. Pro forma adjusted net income has been adjusted to include the full year impact of the initial public offering and subsequent repayment of a portion of the existing term loan.