Bauer Performance Sports Ltd. reported revenues rose 13 percent in its third quarter ended Feb. 28, to

$62.2 million. Revenues were up 16 percent on a currency-neutral basis. On an adjusted basis, the EBITDA loss was trimmed to $3.2 million from $3.8 million.

All figures are in U.S. dollars.

The third quarter 2014 financial results are in line with the estimates previously provided in the company’s news release on March 19, 2014, which disclosed preliminary third quarter results in connection with the financing of the Easton Baseball/Softball acquisition.

Fiscal Q3 2014 Financial Highlights vs. Year-Ago Quarter

- Revenues up 13 percent to a record $62.2 million (up 16 percent in constant currency)

- Ice hockey equipment revenues up 13 percent (in constant currency, excluding Canadian tariff reduction)

- Lacrosse revenues up 11 percent

- Apparel revenues up 35 percent (in constant currency) with growth in all categories

- Adjusted Gross Profit up 21 percent to $19.8 million, or as a percentage of revenues, up 190 basis points to 31.8 percent

- Back-to-Hockey bookings vs. Year-Ago

- “Back-to-Hockey” bookings up 18 percent to $200.2 million (in constant currency) or up 12 percent to $190.1 million at current FX rates

Management Commentary

“Global demand for all of our BPS brands continued to accelerate, as demonstrated by the strong double digit revenue growth in our third quarter,” said Kevin Davis, president and CEO of Bauer Performance Sports. “Driving this record quarter, which is traditionally our weakest seasonally, was strong growth in hockey and lacrosse, as well as the contribution from COMBAT. We attribute these results to the strength of our product development platform, which is supported by authentic brands, deep consumer insight, world-class R&D and strong intellectual property.”

“In our hockey business,” continued Davis, “sell-through of our products remained strong as the retail marketplace continued to improve. Given this strengthening environment, together with the launch of several innovative new products, we recorded a significant increase in booking orders for our upcoming Back-to-Hockey selling season. We expect these bookings to help drive a strong Back-to-Hockey season despite the significant currency headwinds we face with the approximately 8 percent weaker Canadian dollar.

“We are excited about our recently announced definitive agreement to acquire the Easton Baseball/Softball business from Easton-Bell Sports. The transaction will immediately add the No. 1 market share brand in baseball/softball to our leading performance sports platform. Like BPS, Easton has a passion for improving the performance and safety of athletes. With this acquisition, we expect to raise the bar of innovation in every category as we’ve done for hockey and all of our high performance sports in the platform.”

Fiscal Q3 2014 Financial Results

Revenues in the fiscal third quarter of 2014 increased 13 percent to $62.2 million compared to $54.9 million in the same year-ago quarter. On a constant currency basis, revenues were up 16 percent. The increase was due to strong sales in ice hockey equipment, the addition of COMBAT, growth across all apparel categories and continued growth in sales of lacrosse. Apparel revenues grew 31 percent in the quarter (35 percent in constant currency) due to the addition of hockey, lacrosse and soccer uniform sales, as well as a 60 percent increase in hockey bags, a 36 percent increase in off-ice team apparel and an 11 percent increase in lifestyle apparel.

Adjusted Gross Profit (a non-IFRS measure) in the third quarter increased 21 percent to $19.8 million compared to $16.4 million in the year-ago quarter. As a percentage of revenues, Adjusted Gross Profit increased 190 basis points to 31.8 percent compared to 29.9 percent in the same year-ago period. The increase in adjusted gross margin was primarily driven by higher profit margins in ice hockey equipment (see “Non-IFRS Measures” below for further discussion).

Selling, general and administrative (“SG&A”) expenses in the third quarter increased 27 percent to $24.5 million compared to $19.4 million in the year-ago quarter, primarily due to higher acquisition-related costs, the addition of COMBAT and higher marketing costs as a result of the NHL lockout in Fiscal 2013. As a percentage of revenues and excluding acquisition-related charges, costs related to share offerings and share-based payment expense, SG&A expenses were 32.8 percent compared to 31.3 percent of revenues in the year-ago quarter.

R&D expenses in the third quarter increased 20 percent to $4.7 million compared to $4.0 million in the year-ago quarter, primarily due to product development efforts and the addition of COMBAT. As a percentage of revenues, R&D expenses were 7.7 percent compared to 7.2 percent of revenues in the year-ago quarter.

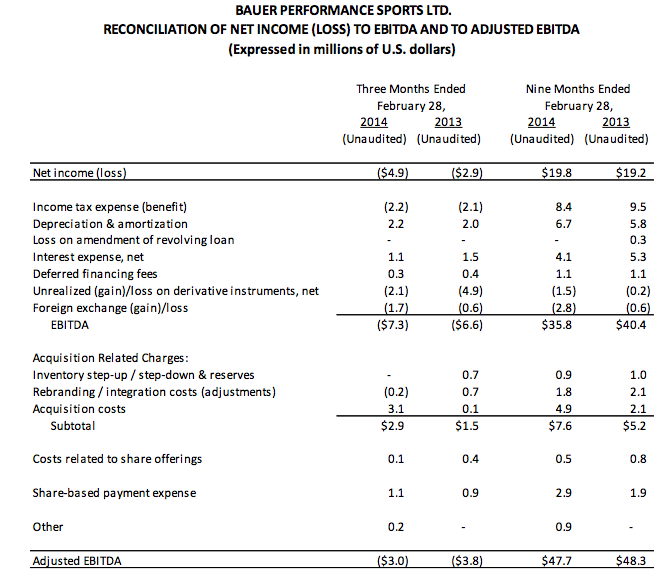

Adjusted EBITDA (a non-IFRS measure) improved to a loss of $3.0 million compared to a loss of $3.8 million in the year-ago quarter due to the higher Adjusted Gross Profit and favorable realized gains on derivatives.

Adjusted Net Loss (a non-IFRS measure) in the third quarter was virtually unchanged compared to the prior year at $4.2 million or ($0.11) per adjusted diluted share.

On February 28, 2014, working capital was $179.9 million compared to $160.1 million one year ago, primarily due to the addition of COMBAT as well as higher inventory and accounts receivable due to the growth of the business. Total debt was $130.8 million compared to $140.3 million at February 28, 2013. The company’s leverage ratio, defined as average net indebtedness divided by trailing twelve months EBITDA (a non-IFRS measure), continued to decline and stood at 2.51x as of February 28, 2014 compared to 2.76x one year ago.

Booking orders for the company’s 2014 Back-to-Hockey season (April – September) increased 12 percent over 2013 to $190.1 million. On a constant currency basis, booking orders were up 18 percent to $200.2 million.

Fiscal Q3 2014 Operational Highlights

BPS entered into an agreement with Easton-Bell Sports to acquire the Easton Baseball/Softball business for $330 million in cash, subject to a working capital adjustment and acquisition costs, which, upon closing, would make BPS the No. 1 market leader in both hockey and diamond sports. The acquisition is expected to close within two weeks.

Bauer Hockey unveiled BAUER OD1N, the most revolutionary line of equipment ever introduced to the sport of hockey. Taking two years to develop, the line includes the lightest hockey skate ever created, a fully personalized protective body suit and an ultra-lightweight goal pad constructed with advanced materials never before used in hockey.

COMBAT entered into an exclusive three-year agreement with Texas Tech University Softball to be its official supplier of elite softball bats and accessory products.

Nine Month Fiscal 2014 Financial Results

Revenues in the first nine months of fiscal 2014 increased 7 percent to $333.3 million compared to $312.9 million in the same year-ago period. On a constant currency basis, revenues were up 8 percent.

Adjusted Gross Profit in the first nine months increased 3 percent to $120.9 million compared to $117.1 million in the prior year period. As a percentage of revenues, Adjusted Gross Profit was 36.3 percent compared to 37.4 percent in the year-ago period.

SG&A expenses increased 16 percent to $77.8 million compared to $67.1 million in the same period a year ago. As a percentage of revenues, and excluding acquisition-related charges and share-based payment expense, SG&A was 20.3 percent compared to 19.2 percent of revenues in the year-ago period.

R&D expenses increased 15 percent to $13.1 million compared to $11.5 million in the same period a year ago. As a percentage of revenues, R&D was 3.9 percent compared to 3.7 percent of revenues in the year-ago period.

Adjusted EBITDA in the first nine months of fiscal 2014 was $47.7 million compared to $48.3 million in the same year-ago period.

Adjusted Net Income in the first nine months was $26.5 million, or $0.71 per diluted share, compared to $26.0 million, or $0.72 per diluted share, in the first nine months of fiscal 2013.

Bauer's brands include Bauer, Mission, Maverik, Cascade, Inaria and Combat.