On Holdings circumvented supply chain challenges to deliver fourth-quarter results that easily surpassed Wall Street targets. The Swiss running brand also lifted its outlook for 2022, projecting sales to expand at least 37 percent on top of 2021’s 70.4 percent gain.

Author: Thomas J. Ryan

Thomas J. Ryan

Senior Business Editor | SGB Media

tryan@sgbonline.com | 917.375.4699

Inside The Call: DSW’s Push Into Athleisure Continues To Pay Dividends

Designer Brands reported a continued significant bounce-back in top-line growth for its flagship DSW chain in the fourth quarter as core dressier footwear categories continued to recover and the chain’s push into athleisure and active styles continued to gain market share. Athleisure sales penetration at DSW’s U.S. retail business was 44 percent in Q421 compared to 39 percent in Q419.

Inside The Call: Shoe Carnival Q4 Flies Past Wall Street Targets

Shares of Shoe Carnival, Inc. jumped Wednesday after the off-price footwear retailer reported fourth-quarter profit that blew past expectations to cap off a record year.

Inside The Call: Famous Footwear Record Q4 Boosted By Athletic Momentum

Famous Footwear’s fourth-quarter sales were up 15.9 percent year-over-year and grew 9 percent in the fourth quarter of 2019, despite entering a period with inventory down 24 percent. On a conference call with analysts, Diane Sullivan, Caleres’ chairman and CEO, said Famous’ athletic and sport categories continue strong with strength at Nike.

Dick’s SG Sees Strengthening Nike Partnership

Speaking at the BofA Securities Consumer and Retail Technology Conference, officials at Dick’s took a deep dive into the wide-scale benefits stemming from its transformation efforts that started in 2016 and the re-baselining of its business due to the pandemic. Dick’s also expressed little concern about losing Nike allocations as the brand has aggressively shifted to DTC.

Cowen Lowers Price Targets On Nike, Adidas And Puma On Potential War Impact

Cowen reduced its estimates and price targets for Nike, Adidas and Puma due to concerns over the fallout from the Russia/Ukraine war, including the impact on its EMEA businesses and heightened inflationary and supply chain pressures.

Inside The Call: Zumiez’s Shares Hit By Quarter Miss, Weak Guidance

Shares of Zumiez Inc. were trading down about 13 percent in mid-day trading Friday after the action-sports chain reported Q4 earnings that fell short of expectations while forecasting a steep decline in first-quarter earnings as sales sharply deteriorated in recent weeks.

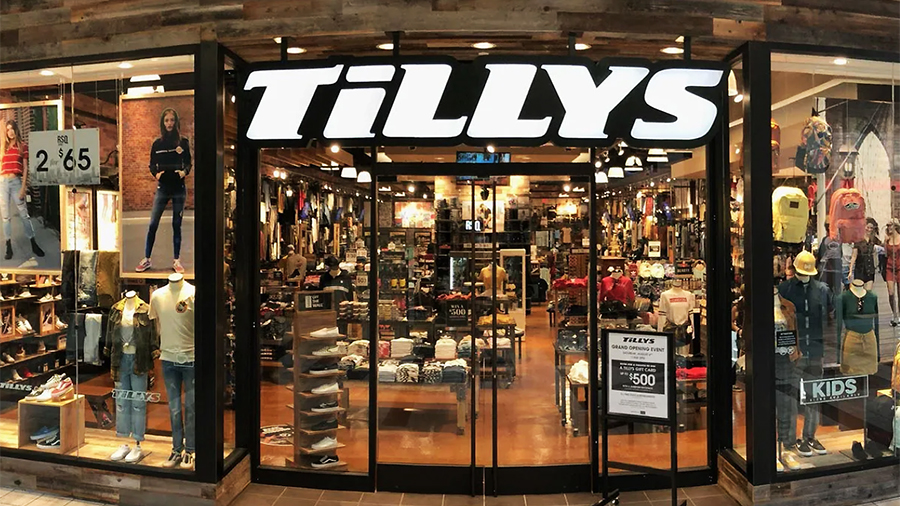

Inside The Call: Tilly’s Eyes Big Drop In First-Quarter Profits

Tilly’s Inc. reported fourth-quarter earnings that came in lower than guidance and forecast a significant decline in first-quarter earnings as it anniversaries last year’s federal stimulus payments and pent-up demand as the COVID-19 vaccine arrived.

American Outdoor Brands Goes Grilling In Outdoor Push

American Outdoor Brands announced plans to acquire Michigan-based Grilla Grills, a maker of grills and smokers, as part of ramped-up expansion efforts around outdoor lifestyle products. The acquisition comes as a downturn in shooting sports accessories caused a significant reduction in guidance for its current fiscal year. American Outdoor Brands, spun off from Smith & […]

Inside The Call: Genesco’s Q4 Profits Boosted By Full-Price Selling

Fueled by full-price selling and a recovery in in-store shopping, Genesco, Inc. reported fourth-quarter earnings that came in easily ahead of Wall Street’s targets. For the year, double-digit sales growth and record profitability were seen for its footwear companies, led by Journeys.

Inside The Call: Duluth Trading Sees Margin Gains Offset Delivery Shortfalls In Q4

Duluth Trading estimated that delivery delays cost the company between $15 to $20 million in revenues in the fourth quarter ended January 30, but strong full-price sales helped earnings surpass expectations. Dave Loretta, Duluth’s CFO, said, “Although inventory flow remains slower than normal, which we expect will impact sales in the first half of 2022, we are beginning to see some early signs that gives us confidence that supply chain congestion will improve by the second half of the year.”

Inside the Call: Adidas Looks To Accelerate Market Share Gains In North America

On his company’s fourth-quarter conference call, Kasper Rorsted, Adidas’ CEO, said the North America region spent the last two years focused on “getting a more balanced position between growth and profitability.” Now, the region is set to accelerate top-line growth, aided by DTC expansion, strengthened partnerships with strategic wholesale accounts and numerous collaborations from Jerry Lorenzo to Gucci.

Inside The Call: Dick’s SG Eyes New Profitable Growth Trajectory Following Two Record Years

Dick’s Sporting Goods delivered its seventh consecutive quarter that saw earnings and sales surpass Wall Street expectations to power two straight record years in 2020 and 2021. With the performance over the pandemic, the U.S.’s largest sporting goods chain said the company’s fiscal 2022 outlook provides a “new foundation” upon which it plans to build in the years ahead.

Inside The Call: Clarus’ Innovate And Accelerate Strategy Pays Off With Record 2021 Results

Boosted by strength at Black Diamond and ammunition businesses, Clarus Corp delivered another record quarter to close out a record-setting year of sales and earnings. The gains came despite a challenging supply chain environment. Clarus’ President John Walbrecht said, “We continue to be nimble and decisive at the brand level, which is critical in achieving this level of performance.”

Inside The Call: Hibbett Eyes Strong Return To Growth In Second Half

Hibbett, Inc. said fourth-quarter comps were negatively affected by 10 percent in the footwear category and 5 percent overall due to delivery delays. However, officials are bullish on a return to robust growth in the second half of 2022 due to improving inventory levels and strengthening partnerships with major vendors, including Nike.