American Outdoor Brands Corp., the parent of Smith & Wesson, reported earnings on an adjusted basis rose 74.6 percent in the second quarter ended October 31 as sales grew 8.9 percent.

Second Quarter Fiscal 2019 Financial Highlights

- Quarterly net sales were $161.7 million compared with $148.4 million for the second quarter last year, an increase of 8.9 percent.

- Gross margin for the quarter was 34.9 percent compared with 34.2 percent for the second quarter last year.

- Quarterly GAAP net income was $6.7 million, or $0.12 per diluted share, compared with net income of $3.2 million, or $0.06 per diluted share, for the comparable quarter last year.

- Quarterly Non-GAAP net income was $11.0 million, or $0.20 per diluted share, compared with $6.3 million, or $0.11 per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments to net income exclude a number of acquisition-related costs, including amortization, one-time transaction costs, and fair value inventory step-up expense.

- Quarterly non-GAAP Adjusted EBITDAS was $26.7 million, or 16.5 percent of net sales, compared with $23.1 million, or 15.5 percent of net sales, for the comparable quarter last year.

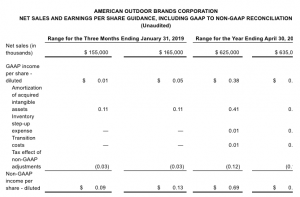

Revenues of $161.7 million topped the company’s guidance calling for sales between $150 million and $160 million. Earnings of 20 cents a share also topped guidance between 11 cents to 15 cents.

James Debney, American Outdoor Brands Corporation president and chief executive officer, said, “We are pleased with our second quarter operational and financial results, which reflect year-over-year increases in revenue and profitability in both our Outdoor Products & Accessories segment and our Firearms segment. Our Outdoor Products & Accessories segment, a strategically important market that we first entered just four years ago, generated approximately one-third of our revenue in the quarter. Sales growth occurred in both our Hunting & Shooting product categories, as well as our Cutlery & Tool product categories, and came from a variety of retailers, particularly our online retailers. We continued to expand our addressable market in electro-optic products with the launch of several new Crimson Trace products including rifle scopes designed for short, medium, and long-range applications, as well as five new, innovative red dot sights. In our Firearms segment, revenue growth reflected the success of our ‘bundle’ promotions booked earlier in the year and shipped in the second quarter. New firearm products, which we define as products launched within the past twelve months, represented 26.6 percent of our firearm revenue in the quarter and included strong sales of our M&P Shield 380 EZ pistol, which we launched in February of this year.”

“We made significant progress in the quarter on the completion of our new Logistics & Customer Services facility in Missouri – an important strategic initiative supporting our objective to be the leading provider of quality products for the shooting, hunting, and rugged outdoor enthusiast. This 632,000 square foot, state-of-the-art facility will serve as our centralized logistics, warehousing, and distribution operation, for all of our products, facilitating our growth, enhancing our efficiencies, and allowing us to better serve customers across our entire organization. We remain on track to begin ramping initial operations in the near future.”

Jeff Buchanan, executive vice president, chief financial officer, and Chief Administrative Officer, commented, “For the six months ended October 2018, we had positive operating cash flow of $9.1 million as compared with a cash outflow of $30.7 million for the six months ended October 2017. During the current quarter, we accessed $25.0 million of our $350 million line of credit, which is expandable to $500 million. Our balance sheet remains strong with approximately $36.4 million of cash and $148.1 million of total net borrowings, as compared with over $220.0 million of net borrowings at the end of the comparable quarter last year.”

Financial Outlook

The company raised its guidance for the year. For the year, American Outdoor Brands now expects earnings in the range of 69 cents to 73 cents, up from previous guidance of 62 cents to 66 cents. Revenues are expected between $625 million and $635 million, up from $620 million and $630 million previously.

American Outdoor Brands manufactures handguns, long guns, and suppressor products sold under the Smith & Wesson, M&P, Thompson/Center Arms, and Gemtech brands as well as provides forging, machining, and precision plastic injection molding services. The Outdoor Products & Accessories segment provides shooting, hunting, and outdoor accessories, including reloading, gunsmithing, and gun cleaning supplies, tree saws, vault accessories, knives, laser sighting systems, tactical lighting products, and survival and camping equipment. Brands in Outdoor Products & Accessories include Smith & Wesson, M&P, Thompson/Center Arms, Crimson Trace, Caldwell Shooting Supplies, Wheeler Engineering, Tipton Gun Cleaning Supplies, Frankford Arsenal Reloading Tools, Lockdown Vault Accessories, Hooyman Premium Tree Saws, BOG POD, Schrade, Old Timer, Uncle Henry, Imperial, Bubba Blade, and UST.

Image courtesy Smith & Wesson