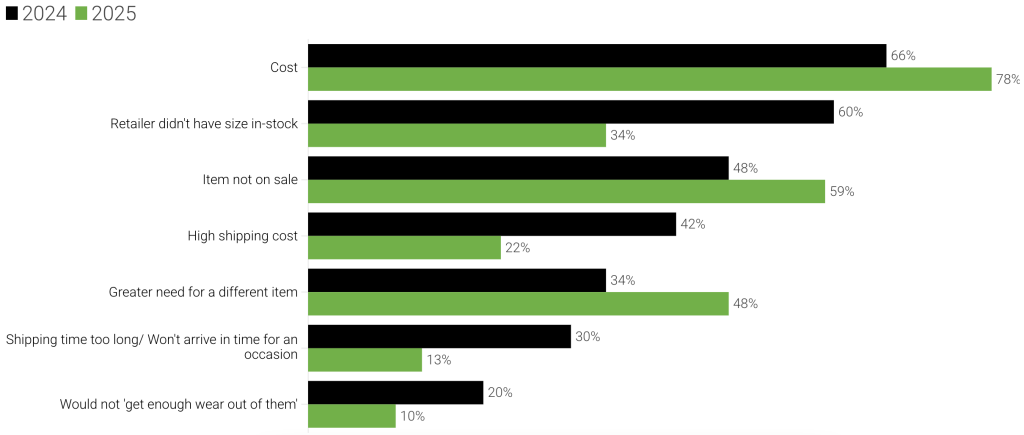

The new Spring 2025 U.S. Footwear Consumer Survey from AlixPartners and the Footwear Distributors and Retailers of America (FDRA) found that consumers are more likely to abandon a purchase due to “cost,” with 78 percent responding in the company’s latest survey they had stopped a purchase due to price, up 12 percentage points from 2024.

Fifty-nine percent said the “item not on sale” was a reason to ditch the purchase, up 11 percentage points from last year.

Reasons Consumers Abandon a Purchase

“For the first time in the four years, we have run this survey, consumers have signaled they plan to spend less on athletic footwear, the segment with the greatest endurance, usually,” AlixPartners wrote in its assessment of the data. “After two years of stubborn inflation, consumers are now faced with the prospect of pass-through costs from tariffs, and the wear is showing.”

Based on commentary from AlixPartners and the FDRA, consumers are wary and cognizant of the threat to prices from tariffs well before the U.S. warned of ever-higher tariffs in April. Even those in the footwear industry and the broader active lifestyle sector were surprised when the Trump Administration hit Vietnam, a primary sourcing country after China, as a target for tariffs during President Trump’s first term and carried forward by President Biden.

The survey was conducted from February 28 through March 10, 2025 when thoughts of high tariffs were just an idea thrown around by President Trump, the media and footwear industry advocates that took the new President at his word. Questions generally covered the season of Spring and Summer purchases.

Imports account for around 99 percent of shoe sales, with shoes carrying an average tariff of around 12 percent before the latest round of levies.

“We see tighter spending across categories, including the normally resilient athletic segment, which sees a net 9-point retrenchment in expected spending over spring and summer,” the survey report noted.

Based on the survey data, Fashion/Dress Footwear (-26 percent) and Work Shoes/Boots (-29 percent) are expected to take the biggest hits, followed by Athleisure or Multiactivity (-17 percent) and casual shoes (-16 percent). Forty-three percent of respondents expected to spend no money at all on Work shoes, indicating a cutback on core purchases by trying to extend the life of what consumers already have.

“With nearly 80 percent of consumers bracing for higher costs due to tariffs and nearly eight in 10 walking away from a shoe purchase because of the price tag, footwear is shifting from a necessity to a discretionary expense for many families. This, in turn, is likely to impact U.S. footwear businesses trying to meet shifting consumer demands,” explained Matt Priest, president and CEO of the FDRA, citing the FDRA’s Shoe Executive Business Survey.

“The uncertainty is the problem,” said Bryan Eshelman, partner and managing director at AlixPartners. “Consumers have been hit by inflation and supply-chain disruption in recent years, and now they’re worried about the price impacts of trade policy. In the immediate term, they’re cutting back across categories. Of those reducing their spend, 49 percent cite a focus on necessities as a big reason.”

“When consumers are focused on their budgets, they’re looking for sales and discounts—and brand loyalty becomes an afterthought,“ said Sonia Lapinsky, partner and managing director and leader of Fashion Retail at AlixPartners. “On top of that, our latest research shows that consumers think footwear loyalty programs are less effective than other categories’ programs, with only 5 percent saying footwear rewards prompt them to shop and spend more. That underscores how crucial it is for retailers to understand who their customers are and meet their expectations across product, price and experience.”

Key Findings

- Tariff Awareness Grows: Some 80 percent of consumers anticipate price hikes when new tariffs are enacted, and many expect retailers to absorb the brunt.

- Price Sensitivity Peaks: Nearly 6 in 10 (59 percent) of those surveyed said lack of promotion was a reason to ditch the purchase, up 11 percentage points from last year.

- If The Shoe Doesn’t Fit: Despite investments in AI features like fit finders and chatbots, online shoppers remain skeptical about these tools. In-store purchases continue to dominate due to fit reliability.

- Speed and Convenience Wins: Consumer demand for next-day delivery of shoes has doubled since last year. BOPIS and curbside pickup also have surged, though in-store shopping still leads.

- Loyalty Wanes: Only 5 percent of respondents say loyalty programs influence them to buy more, indicating weak returns from reward initiatives.

- Demographic Differences: Younger consumers (ages 18 to 44) are more willing to pay extra for customization, performance and tech features in shoes, with about 70 percent of this age group saying they would pay more for custom fit and personalization. Interest in these features drops significantly among those over 45 to less than 3 in 10. Older consumers (over 45) prioritize durability, most valuing robust construction. Surprisingly, both teens (18 and under) and midlife adults (45–to-54) show a strong willingness to pay more for stylish designs, whereas most other age groups focus on practicality and affordability.

The study’s authors concluded, “The imports account for around 99 percent of U.S. footwear, but some imports also rely on U.S. exports of shoe components. Under the new U.S. trade policy, big producers such as China, Vietnam, and Indonesia face higher levies on their output, with China most heavily affected. Brands must act decisively. Strategic cost management, sharper inventory decisions and better marketing alignment with consumer demand will be critical. Retailers and manufacturers that meet consumers where they are — balancing price, speed and value — will come out ahead.”

The Spring 2025 U.S. Footwear Consumer Survey was conducted online from February 28 to March 10, 2025, with 1,006 U.S. footwear consumers ages 15 and older representing a broad cross-section of demographics and regions.

Image under license with AdobeStock