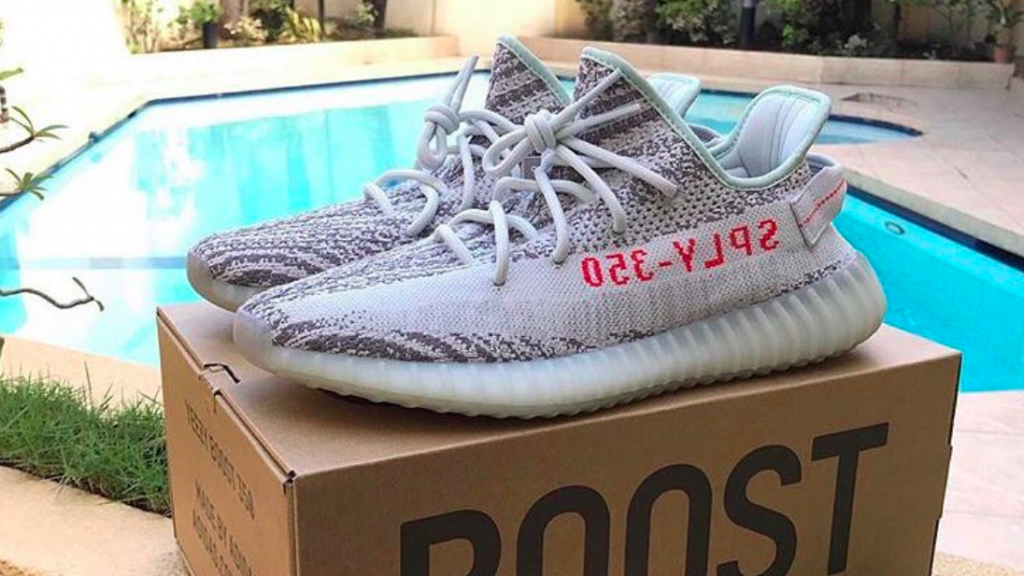

Wells Fargo raised its rating on Adidas to “Outperform” from “Market Perform” due to the success the brand is finding with its “democratization” of Yeezy, its sub-brand collaboration with Kanye West.

In a note, lead analyst, Tom Nikic, pointed to a number of positive recent developments related to Yeezy, including Adidas executing eight Yeezy launches year-over-year in the fourth quarter versus seven in the year-ago quarter and doing so with significantly more pairs per launch.

The analyst noted that NPD issued a press release stating that sales of Yeezy products in the U.S. grew six times in the fourth quarter and the 350 v2 silhouette was the 9th highest selling sneaker in the U.S. in 2018, marking the first time a Yeezy shoe ever made the top-ten list. Nikic noted that this is particularly noteworthy because the first general release colorway didn’t launch until late-September.

The analyst said that by his team’s “potentially-conservative math,” Adidas generated about €150 million to €200 million in year-over-year incremental revenue in Q4 from the Yeezy brand globally. That’s enough for Adidas to hit consensus estimates as the Street is modeling only €110 million of total-company growth year-over-year.

Finally, Nikic wrote that given that Yeezy is generally a full-price brand, the growth should provide a lift to Adidas’ gross margins.

Wrote Nikic, “So, while the company seems to have hit a ‘lull’ on new product launches for the core brand (amid renewed strength at their chief rival NKE), while simultaneously facing headwinds from the 2018 World Cup through 2Q19, we believe that these challenges are well understood by investors, and the less-appreciated factor is that ‘opening the faucet’ on the Yeezy brand can get them through these 2019 challenges (buying them some time to develop new, stronger Adidas-brand product) and allow for a ‘soft landing’ on the top line in 2019 (while continuing to generate margin expansion).”

The analyst further noted that given that the company trades at a “meaningful valuation” discount to peers (e.g. 21x P/E and 12x EV/EBITDA vs. Nike at 28x and 20x respectively), Adidas likely has “downside support to the multiple (tough to envision a global athletic brand trading below 20x P/E, in our view), with potential for multiple expansion if the top-line reaccelerates and/or margins come in better than plan.”

Wells Fargo raised its FY18 EPS estimate of Adidas to €8.44 from its prior target of €8.35. For 2019, its estimate was raised to €9.75 from €9.40. Wall Street’s consensus estimates are €8.37/€9.55, respectively.

Wells Fargo’s 12-month price target increased to €240 from €205. Shares of Adidas closed Tuesday at €213.80, up €3.90, or 1.9 percent, on the Frankfurt Stock Exchange.

Adidas is reporting fourth-quarter results on March 13.

Image courtesy Adidas