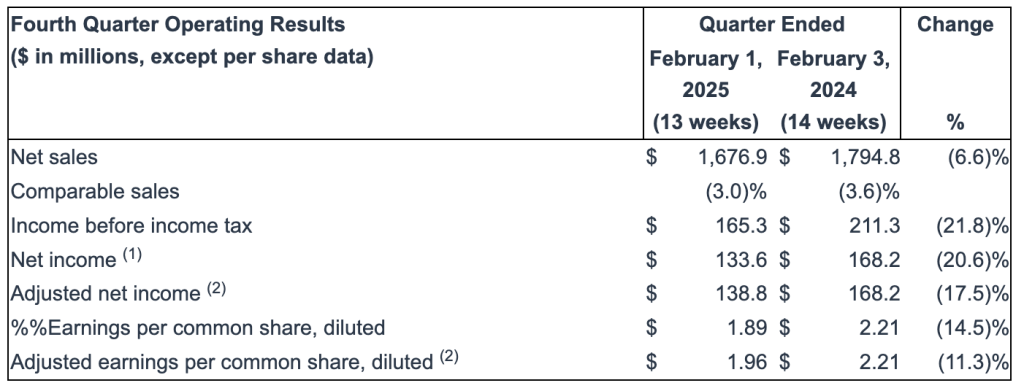

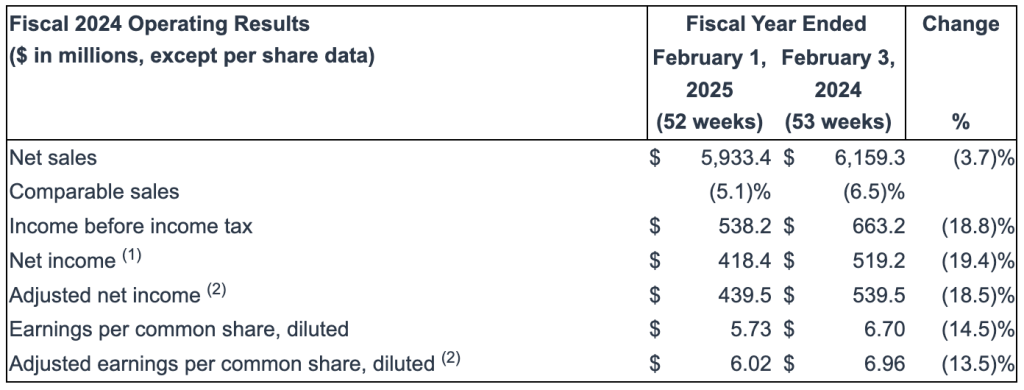

Academy Sports and Outdoors, Inc. reported financial results for the fourth quarter and fiscal year ended February 1, 2025. Fourth quarter and fiscal year 2024 included 13 weeks and 52 weeks, respectively, compared to 14 weeks and 53 weeks in fourth quarter and fiscal year 2023, respectively.

“Looking back on 2024, our team made significant strides toward achieving our long-term goals, all while thoughtfully navigating a challenging macroeconomic environment. As we head into 2025, we’re energized by the opportunities that lie ahead. The foundation for growth that we’ve built over the past year should yield meaningful results this year and into the future.” said Steve Lawrence, CEO, Academy Sports and Outdoors, Inc. “This year, we are introducing an exciting slate of new brands, including the launch of the Jordan brand with a focus on sport, with shops in men’s, women’s and kids. We’re also bolstering our targeted marketing capabilities, and rolling out new technology across our stores, all designed to elevate our ability to serve our core customers. These innovations, combined with our unwavering commitment to value leadership, position us for a pivotal year in which we anticipate a return to top-line sales growth.”

(1) Net income for the fiscal year ended February 1, 2025, includes a $15.0 million gain pertaining to a credit card fee litigation settlement and a $7.1 million gain on a sale-leaseback transaction, both of which occurred in the fourth quarter of fiscal 2024. Net income for the fiscal year ended February 3, 2024, included a $15.9 million net gain from a credit card fee litigation settlement which occurred in the fourth quarter of fiscal 2023.

(2) Adjusted net income and adjusted earnings per common share (EPS), diluted are non-GAAP measures.

Note: Fourth quarter and full year 2024 included 13 and 52 weeks, compared to 14 and 53 weeks in fourth quarter and fiscal year 2023, respectively. The extra week in 2023 added $73.3 million to net sales and 8 cents to GAAP EPS. We define comparable sales as the percentage of period-over-period net sales increase or decrease, in the aggregate, for stores open after thirteen full fiscal months, as well as for all e-commerce sales.

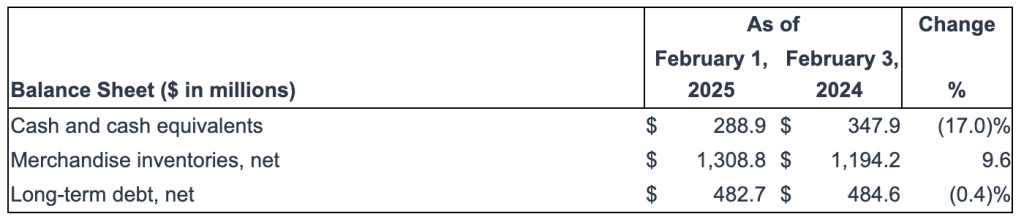

Balance Sheet Summary

Cash Dividend

Subsequent to the end of fiscal year 2024, on March 6, 2025, the Academy Board of Directors declared a quarterly cash dividend with respect to the quarter ended February 1, 2025, of 13 cents per share of common stock. This is a 18 percent increase from the previous quarterly dividend payment. The dividend is payable on April 17, 2025, to stockholders of record as of the close of business on March 25, 2025.

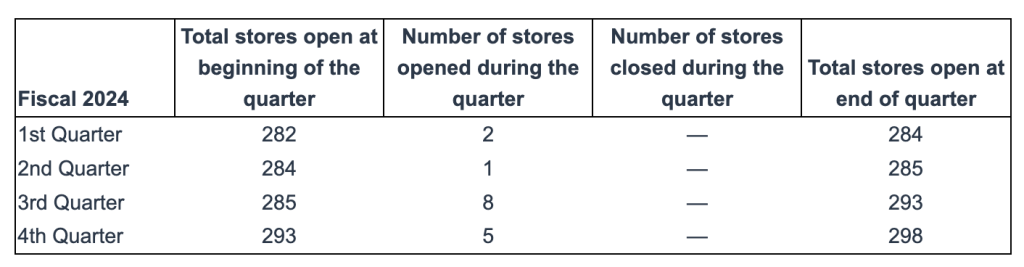

New Store Openings

Academy opened five new stores during the fourth quarter for a total of 16 new stores in 2024. In 2025, the company plans on opening 20-to-25 new stores.

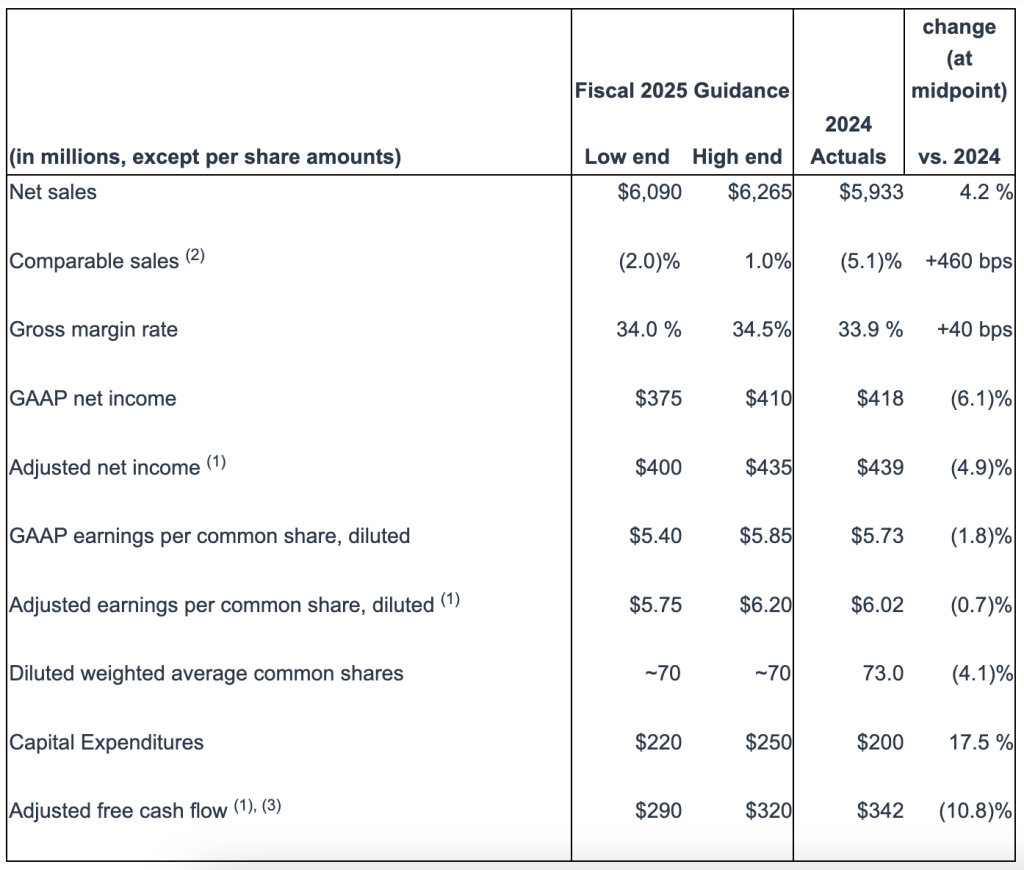

2025 Outlook

“The fourth quarter played out in-line with guidance, with customers relying on Academy to deliver value when it mattered most. Our profitability and cash flow from operations as a rate to sales is top quartile in retail. Our capital allocation mindset is unchanged, focusing on financial stability, investing into straight-forward growth strategies and returning value to shareholders through share buybacks and a modest dividend,” stated EVP/CFO Carl Ford. “We have seen sequential improvements in comp sales since the second quarter and we anticipate that will continue into 2025. We are focused on our long-range strategy of growing the company by opening new stores, improving the omni-channel experience, investing in new brands while remaining committed to value, utilizing customer data more effectively and leveraging our supply chain. We will leverage our strong balance sheet and use our cash flows to invest into these strategies, because we expect them to drive our long-term success.”

The company expects the first quarter to be the most challenging from a sales and earnings per share prospective as they plan to open five stores and transition to the new Jordan floor set. They further expect their internal initiatives to start to positively impact results beginning in the second quarter. Additionally, they expect the back half of the year to be stronger than the first half as their internal initiatives take hold.

Academy is providing the following initial guidance for fiscal 2025 (year ending January 31, 2026). This guidance takes into account various factors, both internal and external, such as the expected benefits of the company’s growth initiatives, current consumer demand, the competitive environment, as well as the potential impacts from inflation and other economic risks.

The earnings per share estimates do not include any potential future share repurchases and assume a tax rate of 22.0 percent to 23.0 percent.

Image courtesy Academy Sports and Outdoors, Inc.