Academy Sports and Outdoors, Inc. (ASO) saw an improving comp store sales trend in their fiscal fourth quarter, and while still negative, gave company management something to hold on to when assessing the company’s overall performance in the quarter and full year ended February 3.

“We would characterize the cadence of the quarter as reverting back to the traffic patterns and volume progression that we traditionally saw pre-pandemic,” said company CEO Steve Lawrence. “There was less pull forward of demand in early November than we’d experienced over the last couple years when customers shopped early based on scarcity of supply. We then saw the traditional acceleration in business, during Thanksgiving and Cyber Week, followed by a lull in traffic during the middle part of December.”

Lawrence said ASO finished holiday with a strong surge of sales and traffic the week leading up to Christmas and that sustained into the post-Christmas time period and early January.

“The sales increase we ran in December made it the strongest month of both the quarter and the past year, Lawrence shared.

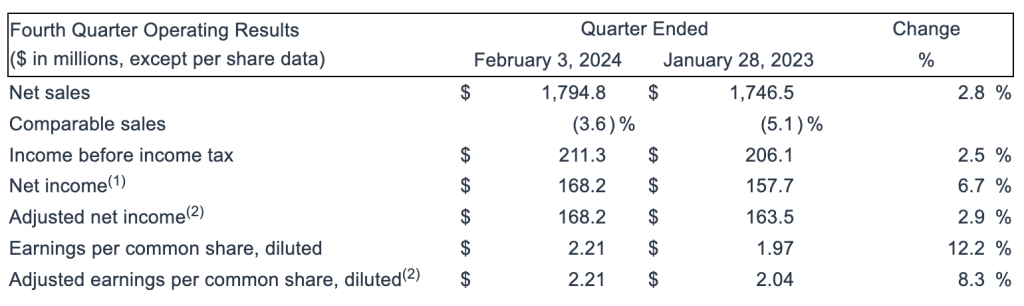

Fourth quarter net sales came in at $1.8 billion, with a comp of negative 3.6 percent, a clear improvement from the 8.0 percent decline in the third quarter and the 7.6 percent decline in the first three months of the fiscal year. Sales performance for Q4 was said to be at the upper end of expectations, led by December sales that were higher than the prior-year period.

“We were pleased with the trajectory change from prior quarters,” said company CFO Carl Ford. “While customers were financially stressed, they responded to our strong value message across a broad assortment of products.”

Ford said ticket size increased 1 percent for the fourth quarter, while transactions declined by 5 percent. E-commerce sales were 14.7 percent of total merchandise sales, compared to 13.5 percent in the fourth quarter of 2022.

The 2023 fourth quarter and year had an extra week as planned in the NRF 4-5-4 calendar. The 2024 fiscal year will go back to 52 weeks so the reverse will be true this year.

Category Summary

To provide some clarity in year-over-year (YoY) performance, ASO provided comparable sales by division for a 13-week quarter for a more accurate comparison.

Ford said that Outdoor was the best performing division for the quarter, with comp sales increasing 6.3 percent YoY, driven by strength in hunting and camping. Within camping, the standouts were said to be Stanley and Yeti. Obviously, the customers buying large tumblers weren’t using them for camping, and both brands were said to do “an outstanding job of driving newness through color and product extensions” such as the barware collection that Yeti rolled out prior to holiday.

- Apparel was the second best division, according to Ford, with a 6 percent sales decrease for the quarter.

“We saw growth in work apparel and fleece driven by Carhartt and Nike, offset by declines in outdoor and athletic apparel.”

- Footwear sales declined 8.8 percent for the fourth quarter.

“We continue to see outperformance in key brands such as Brooks, HeyDude, and Nike, Ford shared. “One area that struggled was our cleated business. Cleats were one of our last businesses to fully get back in stock, and we faced strong sales from Q4 of last year that were still being driven by some scarcity in the marketplace and the World Cup.”

- Sports & Recreation trailed the other three businesses, but not far behind the Footwear decline, with sales decreasing 8.9 percent in the Q4 period.

On a follow up call with SGB Executive, Chief Merchandising Officer Matt McCabe said the outdoor cooking growth came from Blackstone griddles and accessory cooking items like rubs and spices when asked how ASO grew the business when the big-ticket grills business has slowed so much in the marketplace after a strong couple of years due to Covid-induce growth. He said the gains in outdoor cooking and indoor games, helped offset declines in fitness and bikes.

Income Statement

The gross margin rate in the fourth quarter was 33.3 percent of net sales, a 50 basis-point increase compared to Q4 2022. Merchandise margins declined by 40 basis points and shrink was said to be 37 basis points worse than Q4 of last year. These declines were said to be offset by inventory and freight savings.

SG&A de-levered by 80 basis points in the fourth quarter.

“We are focused on managing our cost structure, while investing in the pillars of our long-term growth strategy,” Ford noted. “More than 75 percent of the dollars spent above last year were for investments in our growth initiatives, new stores, omni-channel, customer data, and supply chain.”

Ford said the company controlled inventory, promotions, and expense to deliver net income during the fourth quarter of $168.2 million, a 6.7 percent increase over Q4 2022.

GAAP diluted earnings per share was $2.21 for the fourth quarter. Adjusted EPS for Q4 was also $2.21 per share, an increase of 8 percent versus the prior-year quarter.

Full Year Summary

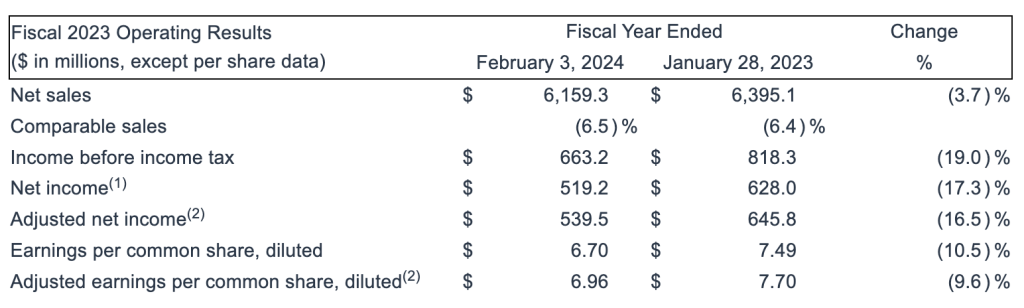

For the full year, net sales were $6.2 billion, with comparable sales of negative 6.5 percent. E-commerce sales were 10.7 percent of total merchandise sales, which was said to be the same as fiscal 2022.

Full year gross margin was 34.3 percent of sales. Freight savings were offset by merchandise margin and shrink declines, leading to a 30 basis point decline year-over-year.

“This is the third consecutive year that our gross margin rate has exceeded 34 percent,” said Ford.”This demonstrates that the merchandising and operational changes, made over the last few years, such as the investments made in price optimization and planning and allocation, as well as better clearance, and promotions management and disciplined inventory management, are now reflected in the long-term margin structure of Academy.”

He said they continue to find opportunities in these areas, to drive margin improvement, through technology enhancements, and stronger processes.

“For the full year, over 90 percent of the SG&A dollar growth was spent on our growth initiatives,” offered the CFO.

GAAP diluted earnings per share was $6.70 for fiscal 2023. Adjusted diluted earnings per share was $6.96 for fiscal 2023.

Balance Sheet and Cash Management

Inventory at year-end was $1.2 billion, a decrease of 7.0 percent in US$ terms compared to fiscal 2022. Total inventory units were down 7.2 percent, and this includes having an additional 14 stores, compared to fiscal 2022. On a per store basis, inventory units were down 11.8 percent.

“We have had a balanced approach to capital allocation since going public in October of 2020,” Ford said.

“The three pillars of our strategy, are maintaining adequate liquidity for financial stability, self-funding our growth initiatives, and increasing shareholder return,” he continued. “Our cumulative shareholder return, over this time period is more than 500 percent, driven by operational execution, and more than $1 billion of share repurchases.”

Ford said they have also reduced debt by almost $1 billion and paid more than $50 million in dividends.

“As a result of these actions Academy is one of the highest returning stocks from the class of 2020 IPOs,” he suggested.

During Q4 and fiscal 2023, Academy continued to generate positive net cash from operations.

“In Q4, we generated approximately $235 million, and $536 million for the full year,” he detailed. “We utilized the cash to pay down $100 million of the company’s term loan, reducing the outstanding balance to $91.8 million. After the pay down, we have $348 million in cash, $484.6 million of total debt, and no outstanding borrowings on our $1 billion credit facility, which was recently amended and extended through March of 2029.”

ASO repurchased approximately $3.0 million worth of shares in the fourth quarter. For all of fiscal 2023, the company said it decreased its net share count by 3.7 million through $204 million in share repurchases.

As of the end of the fiscal year, Academy said it has $697 million remaining on its share repurchase authorization.

The Board recently approved a 22 percent dividend increase to 11 cents per share, payable on April 18, 2024, to stockholders of record as of March 26, 2024.

“Heading into 2024, we have the cash to fund our growth initiatives and to continue to execute our capital allocation plan,” Ford said.

Outlook

Ford said that ASO expects to operate in a challenging economic environment as the current macro dynamics are still impacting its customers.

“We are going to run the business as efficiently as possible, while also making investments that support our long-term strategic opportunities, opening new stores, growing our omni-channel business, leveraging our customer data platform, and modernizing and scaling our supply chain,” Ford detailed.

He also said the company would no longer be guiding to adjusted net income or adjusted earnings per share. Any adjustments, such as stock compensation, will be provided in the quarterly results.:

Based on his outline, he said that Academy is providing the following initial guidance for fiscal 2024″

- Net sales ranging from $6.07 billion to $6.35 billion;

- At the midpoint, this is 2 percent growth compared to fiscal 2023, when excluding the $73 million in sales related to the 53rd week.

- Comparable sales of negative 4 percent to positive 1 percent. Gross margin rate between 34.3 percent and 34.7 percent;

- GAAP net income between $455 million and $530 million, resulting in GAAP diluted EPS ranging from $5.90 per share to $6.90 per share;

- The earnings per share estimates are calculated on a share count of approximately $77 million diluted weighted average shares outstanding, for the full year and do not include any potential repurchase activity.

- SG&A expenses, which include stock-based compensation expense of $30 million, or approximately 30 cents per share, are expected to be approximately 100 basis points higher than in 2023.

- Interest expense is expected to be $38 million, down from $46 million in fiscal 2023, due to ASO’s reduced debt levels.

- ASO expects to generate $290 million to $375 million of free cash flow, including $225 million to $275 million of capital expenditures.

“As we begin a new year, we are focused on addressing our opportunities to return to growth and delivering long-term value to our customers and stakeholders,” Ford concluded.

Image courtesy Academy Sports and Outdoors/Freely Activewear & Clothing