HanesBrands, the parent of Champion and Hanes, lifted its outlook for the year after reporting stronger-than-expected third-quarter results. The quarter was marked by double-digit growth for net sales, adjusted operating profit and adjusted earnings per share.

The seventh consecutive quarter of record results was driven by continued acquisition benefits, global supply chain performance and core sales and margin growth in the Innerwear and Activewear segments.

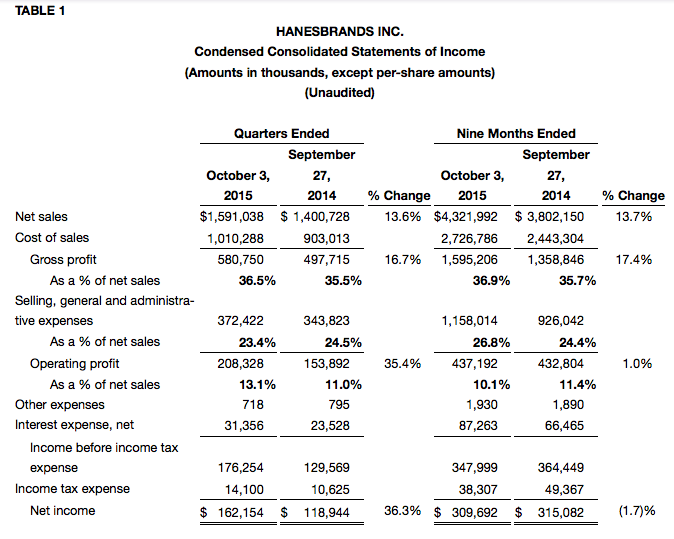

Net sales increased 14 percent to $1.59 billion in the quarter ended Oct. 3, 2015. Core sales, which exclude acquisitions and a retailer exit from Canada, increased 3 percent in constant currency.

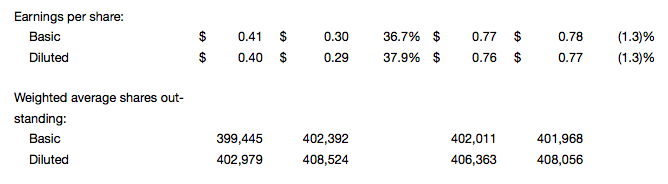

Adjusted operating profit excluding actions increased 16 percent to $251 million, and adjusted EPS excluding actions increased 16 percent to 50 cents a share. On a GAAP basis, operating profit increased 35 percent to $208 million and EPS increased 38 percent to 40 cents. (All adjusted consolidated measures and comparisons exclude approximately $43 million and $63 million of pretax charges related to acquisitions and other actions in the third quarters of 2015 and 2014, respectively.)

Hanes also expanded its strategic use of cash flow in the quarter by beginning to repurchase company stock in the open market. In the third quarter, the company purchased 10.7 million shares for approximately $311 million.

“We had another great quarter of double-digit growth that reflects our continued value-creation potential,” Hanes Chairman and Chief Executive Officer Richard A. Noll said. “We again have increased our operating profit and EPS guidance as we continue to drive growth and margin improvement through innovation and acquisition integration. We also reached another milestone in our strategic use of cash flow with the resumption of share buybacks.”

For 2015, Hanes has updated its full-year guidance, including increased expectations for adjusted operating profit and adjusted EPS. The company now expects full-year net sales of approximately $5.85 billion, adjusted operating profit of $880 million to $890 million, and adjusted EPS of $1.66 to $1.68. (Additional guidance commentary is contained in the guidance section later in this news release.)

Third-Quarter 2015 Financial Highlights and Business Segment Summary

Key accomplishments for the third quarter of 2015 include:

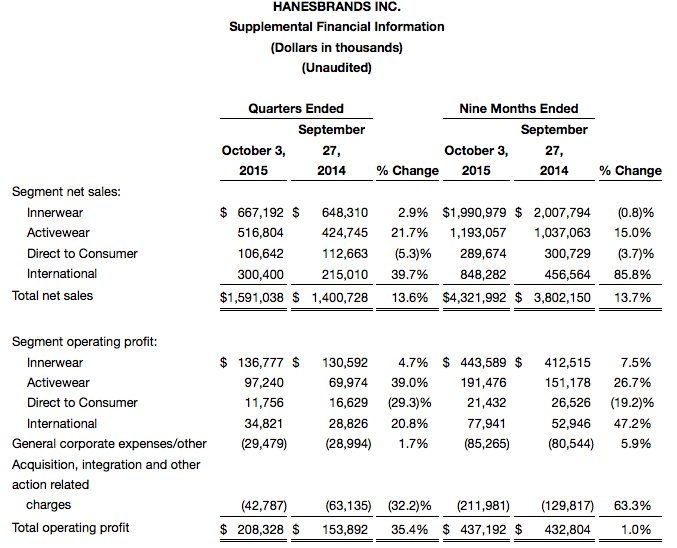

- Core Sales Growth. Innerwear sales increased 3 percent, and Activewear sales, excluding acquisition benefits, increased 2 percent. In constant currency, total company core net sales increased 3 percent, excluding acquisitions and the exit of a retailer from Canada.

- Significant Adjusted Operating Profit and Margin Growth. The company’s adjusted operating profit margin increased 30 basis points in the third quarter to 15.8 percent. Innerwear and Activewear operating profit margins increased by 40 basis points and 230 basis points, respectively, as a result of strong supply chain performance and Innovate-to-Elevate benefits.

- Acquisitions Contribute to Results and Integrations on Plan. The April 2015 acquisition of Knights Apparel, a licensed apparel leader, added net sales of $84 million to Activewear results in the third quarter. In the International segment, DBApparel, a leading marketer of intimate apparel and underwear in Europe that was acquired Aug. 29, 2014, contributed net sales of $179 million (€161 million) in the third quarter.

The integration of DBApparel is underway following the completion of consultations with appropriate works councils and unions, while implementation of the Knights Apparel integration plan will begin late in the fourth quarter of 2015.

Key segment highlights for the quarter include:

- Innerwear net sales increased 3 percent in the third quarter, and operating profit increased 5 percent. Sales of intimates rebounded with high-single-digit growth on strength in bras and shapewear. Sales of basics were up slightly versus the year-ago quarter, despite the expected inventory adjustment of a major retailer that was discussed with second-quarter results.

- Activewear results in the quarter were strong with net sales growth of 22 percent and operating profit growth of 39 percent driven by double-digit Champion growth and the acquisition of Knights Apparel. Core sales, which exclude acquisitions, increased 2 percent with growth of more than 30 percent for Champion in the department-store, midtier and sporting goods channels.

- International sales and operating profit increased significantly, despite negative foreign currency impacts, as a result of the acquisition of DBApparel in Europe and strong results in Japan.

2015 Financial Guidance

Based on year-to-date results and the outlook for the remaining quarter of the year, Hanes has refined its full-year 2015 guidance for net sales and increased guidance for adjusted operating profit and adjusted EPS.

The company expects full-year net sales of approximately $5.85 billion and fourth-quarter net sales of approximately $1.525 billion. Previous guidance for full-year net sales was slightly less than $5.9 billion. The growth of core sales, which exclude acquisitions and a retailer exit from Canada, are expected to be approximately 2 percent for the full year and 3 percent for the fourth quarter, when adjusting for currency fluctuations and the impact of last year’s 53rd week.

To reflect higher profit margins, the company has increased its guidance for full-year adjusted operating profit to a range of $880 million to $890 million, or approximately $231 million to $241 million in the fourth quarter. The previous full-year guidance range was $855 million to $875 million.

Hanes increased its full-year expectations for adjusted EPS to a range of $1.66 to $1.68, or $0.44 to $0.46 for the fourth quarter. Previous full-year guidance was $1.61 to $1.66. The increase reflects increased profitability and benefits of share repurchases that are expected to more than offset currency headwinds. Share repurchases are expected to add slightly less than $0.02 for the full year.

The guidance reflects full-year expectations for the acquisitions of Knights Apparel and DBApparel. Knights Apparel is expected to contribute net sales of approximately $160 million and adjusted operating profit of approximately $22 million (up from previous guidance of $18 million). DBApparel is expected to contribute approximately €630 million in net sales and approximately €40 million in adjusted operating profit.

The company has modified its expectations for full-year net cash from operating activities to a range of approximately $450 million to $500 million. The company has made a 2015 pension contribution of approximately $100 million, and capital expenditures are expected to be approximately $95 million.

Interest expense and other expense are now expected to total approximately $115 million, up from previous guidance of $100 million, with the increase partially mitigated by a slightly lower income tax rate. The 2015 full-year tax rate is expected to be approximately 12 percent.

For the fourth quarter, the company expects approximately 397 million fully-diluted weighted-average shares outstanding, and for the full year, the company expects approximately 404 million fully-diluted weighted-average shares outstanding. The repurchase of 10.7 million shares in the third quarter is expected to contribute $0.02 to adjusted EPS in 2015 ($0.01 in each of the third and fourth quarters) and is expected to contribute $0.02 to adjusted EPS in 2016 ($0.01 in each of the first and second quarters).

Charges for Actions and Reconciliation to GAAP Measures

Through the third quarter of 2015, Hanes incurred approximately $212 million in pretax charges related to acquisitions, primarily DBApparel and Knights Apparel, and other actions. In the comparable period in 2014, the company incurred approximately $130 million in pretax charges related to acquisitions, primarily Maidenform and DBApparel, and other actions. See Table 5 attached to this press release for more details on pretax charges for actions.

Adjusted EPS, adjusted net income, adjusted operating profit (and margin), adjusted SG&A, adjusted gross profit (and margin) and EBITDA are not generally accepted accounting principle measures. Adjusted EPS is defined as diluted EPS excluding actions and the tax effect on actions. Adjusted net income is defined as net income excluding actions and the tax effect on actions. Adjusted operating profit is defined as operating profit excluding actions. Adjusted gross profit is defined as gross profit excluding actions. Adjusted SG&A is defined as selling, general and administrative expenses excluding actions. EBITDA is defined as earnings before interest, taxes, depreciation and amortization.

Hanes has chosen to provide these non-GAAP measures to investors to enable additional analyses of past, present and future operating performance and as a supplemental means of evaluating company operations. Non-GAAP measures should not be considered a substitute for financial information presented in accordance with GAAP and may be different from non-GAAP or other pro forma measures used by other companies. See Table 2 and Table 5 attached to this press release to reconcile these non-GAAP financial measures to the most directly comparable GAAP measure.

For 2015 guidance, Hanes’ current estimate for pretax charges related to acquisition, integration and other actions is approximately $240 million. The company believes guidance for adjusted EPS and adjusted operating profit provides investors with an additional means of analyzing the company’s performance absent the effect of acquisition-related expenses and other actions.

On a GAAP basis, full-year 2015 diluted EPS will vary depending on actual performance, charges and tax rate. GAAP diluted EPS could be in the range of $1.14 to $1.17. GAAP operating profit for 2015 could be in the range of $640 million to $650 million.

HanesBrands, based in Winston-Salem, N.C., owns Hanes, Champion, Playtex, DIM, Bali, Maidenform, Flexees, JMS/Just My Size, Wonderbra, Nur Die/Nur Der, Lovable and Gear for Sports.