Wolverine Worldwide Inc. reported second-quarter earnings slid 12.9 percent on an adjusted basis but easily came ahead of Wall Street's consensus target. Revenues grew 2.7 percent and 4.9 percent on a currency-neutral basis.

“The global demand for our family of brands remains strong and I am pleased to report that our top-line growth accelerated in the quarter and exceeded our internal expectations,” said Blake W. Krueger, Wolverine Worldwide chairman, CEO and president. “As we move into the second half of the year, we remain intensely focused on our consumers and further investing in our key strategic initiatives specifically our global brand-building efforts, omnichannel transformation and the continued expansion of our portfolio's international footprint.”

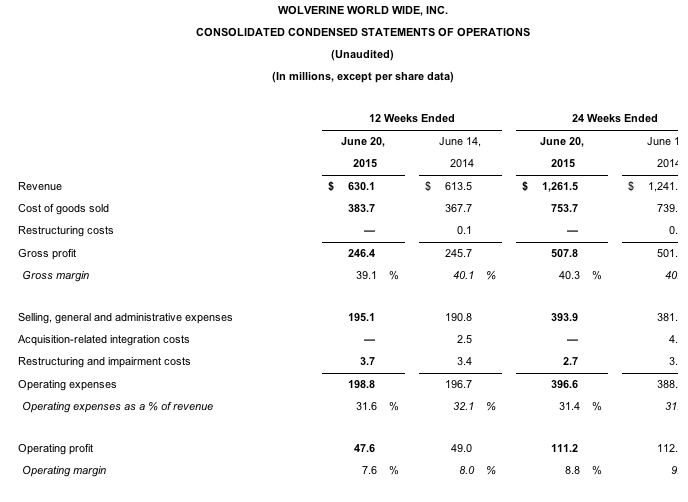

SECOND-QUARTER 2015 REVIEW

Consolidated revenue increased to a record $630.1 million, representing growth of 2.7 percent versus the prior year and 4.9 percent on a constant currency basis. Adjusting for the impact of foreign exchange, retail store closures and termination of the Patagonia license agreement, revenue grew 6.9 percent versus the prior year. Other highlights include:

- Growth of 12.2 percent from the Heritage Group (14.6 percent in constant currency) and growth of 5.7 percent from the Performance Group (9.4 percent in constant currency).

- U.S. wholesale revenue growth in the mid-single digits.

- Planned retail store closures and termination of the Patagonia license agreement reduced revenue $11.6 million versus the prior year.

- Gross margin was 39.1 percent, a decrease of 100 basis points versus the prior year's gross margin, in line with company expectations.

- Adjusted operating margin decreased 90 basis points, versus the prior year to 8.1 percent, due primarily to higher pension expense and planned incremental brand investment. Reported operating margin declined 40 basis points versus the prior year to 7.6 percent.

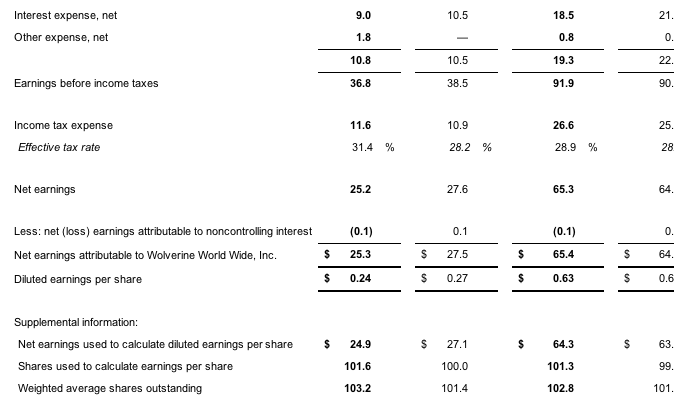

- Adjusted diluted earnings per share were 27 cents per share, compared to an adjusted 31 cents per share in the prior year, and well ahead of company expectations for the quarter. Reported diluted earnings per share were 24, compared to 27 per share in the prior year. Wall Street's consensus estimate had been 20 cents.

- Cash and cash equivalents were $220.7 million and net debt was $612.4 million, a reduction of $286.5 million from the same period last year.

- The company repurchased $5.9 million of its common stock in the quarter at an average price of $29.93 per share.

“The strong performance in the quarter was highlighted by mid-single digit revenue growth in our U.S. wholesale business, double-digit growth in EMEA and growth exceeding 50 percent in the Asia Pacific region, each on a constant currency basis,” said Mike Stornant, senior VP and CFO. “Revenue for the quarter also benefited from higher than anticipated international shipments that were initially expected to deliver in Q3 2015. Operating margin was also positive, relative to our projections heading into the quarter, aided by strong discipline around discretionary spending to protect our key brand investment initiatives. The company's global diversity and reliable fiscal discipline helped deliver another very good financial performance in Q2 2015.”

UPDATE ON KEY STRATEGIC INITIATIVES

Over the past year, the company has initiated several key strategies to accelerate growth and improve profitability.

In July 2014, the company announced a Strategic Realignment Plan for its consumer-direct operations. As part of this effort, the company announced plans to close approximately 140 stores by the end of fiscal 2015. Today, the company is announcing total closures by year end are expected to number approximately 120, and that approximately 55 additional under-performing stores are expected to be closed over the next five years at their natural lease expiration.

Also, as part of the Strategic Realignment Plan, the company is consolidating offices and infrastructure in Canada to streamline operations, further realize synergies and drive growth in this important market. The initiative was launched this past quarter and is expected to conclude by mid 2016.

As part of the continuing evaluation of the performance of brands within its portfolio, the company has decided to wind-down operations for its smallest brand, Cushe, and redeploy talent and resources to other higher-value opportunities. The company expects to incur $3.5 million of restructuring and impairment costs in fiscal 2015, of which $2.9 million was recorded in Q2 2015.

The company recently amended and extended its senior secured credit facilities. In addition to increasing the overall size of the company's borrowing capacity, the amended credit agreement extends the maturity date of the facilities, lowers the cost of the company's debt and increases flexibility with respect to stock repurchases and other restricted uses of cash.

FISCAL 2015 GUIDANCE

The company is narrowing its full-year revenue guidance and reaffirming its adjusted earnings per share guidance, as follows:

- Consolidated reported revenue is expected in the range of $2.82 billion to $2.85 billion, representing growth in the range of approximately 2 percent to 3 percent versus the prior year. Constant currency revenue growth is expected in the range of approximately 5 percent to 6 percent.

- Adjusted diluted earnings per share is expected in the range of $1.53 to $1.60. Constant currency adjusted diluted earnings per share is expected in the range of $1.68 to $1.75.

- The company now expects to incur total pre-tax charges of approximately $48 million to $51 million related to the previously announced Strategic Realignment Plan, exit of the Cushe business and debt extinguishment costs from the debt refinancing. Of this amount, $26 million was recorded in fiscal 2014 and $23 million of the charges are expected to be incurred in fiscal 2015, with the balance recorded in fiscal 2016. As a result, reported diluted earnings per share in fiscal 2015 is expected in the range of $1.39 to $1.46.

The company's portfolio of brands include Merrell, Sperry, Hush Puppies, Saucony, Wolverine, Keds, Stride Rite, Sebago, Cushe, Chaco, Bates and Hytest. The company is also global footwear licensee of the brands Cat and Harley-Davidson.