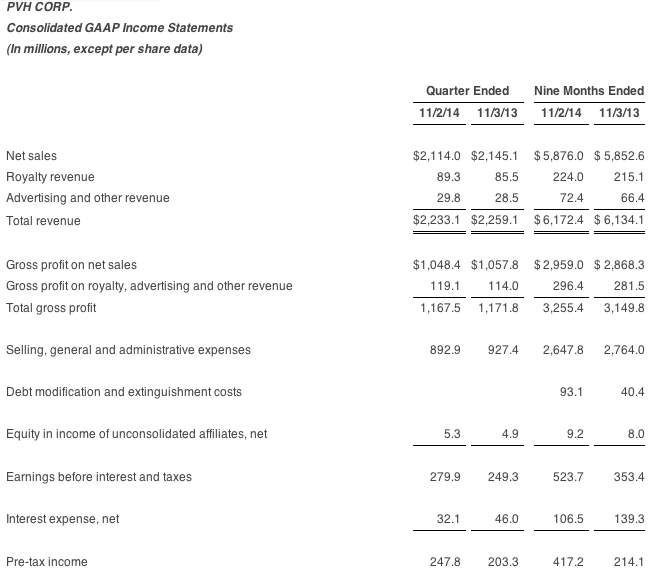

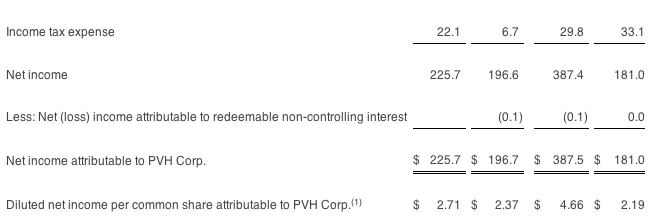

PVH Corp. reported third-quarter earnings rose 14.7 percent to $225.7 million, or $2.71 a share. Sales gained 2 percent with a 2 percent gain at Calvin Klein and 1 percent increase at Tommy Hilfiger. Its Heritage Brand segment, which includes Speedo and Izod, grew 3 percent.

Overview of Third Quarter Results:

- Earnings per share on a non-GAAP basis was $2.56, an 11 percent increase as compared to $2.30 in the prior years third quarter.

- GAAP earnings per share was $2.71, a 14 percent increase as compared to $2.37 in the prior years third quarter.

- Revenue was $2.23 billion, a 2 percent increase over the prior years third quarter amount excluding $67 million of revenue related to the Bass business (which was sold on the first day of the fourth quarter of 2013). Third quarter 2014 revenue was negatively impacted by approximately $30 million, or 1 percent, due to foreign currency translation. Revenue decreased 1 percent from the prior year period including the Bass revenue. Revenue changes by business from the prior year period included (i) a 2 percent increase in the Calvin Klein business, which includes a 1 percent negative impact from foreign currency translation; (ii) a 1 percent increase in the Tommy Hilfiger business, which includes a 2 percent negative impact from foreign currency translation; and (iii) a 3 percent increase in the Heritage Brands business excluding the $67 million of 2013 Bass revenue, or a 10 percent decrease in the Heritage Brands business including the 2013 Bass revenue.

CEO Comments:

Commenting on these results, Emanuel Chirico, Chairman and Chief Executive Officer, noted, Despite the anticipated difficult macroeconomic environment, we are very pleased with our third quarter performance, driven by the strength of our Tommy Hilfiger business and an improvement in our Calvin Klein business. During the quarter, we saw our global strategic initiatives in our Calvin Klein jeans business begin to take hold, with improved performance in our newly installed shop environments and store refits. Additionally, our acquisition integration efforts remain on track, with the last phase to be completed during 2015.

Chirico continued, We continue to plan the fourth quarter prudently. Given that the U.S. dollar has strengthened significantly against several major currencies over the last three months, we have revised our full year earnings per share guidance to $7.25 – $7.30. We believe the geopolitical environment and economic volatility experienced globally over the past nine months will continue and that we can successfully navigate through the upcoming holiday selling season, which we expect will be very competitive and highly promotional.

Chirico concluded, We remain firm in our belief that the strength of our brands, together with the strategic investments made during 2013 and 2014, along with our strong balance sheet and continued debt repayment, will position us to deliver long term global growth and stockholder value.

Third Quarter Business Review:

Calvin Klein

Revenue in the Calvin Klein business increased 2 percent to $816 million from $800 million in the prior year, including a 1 percent negative impact from foreign currency translation, principally attributable to the weaker Euro. Calvin Klein North America revenue increased 5 percent, due to retail comparable store sales growth of 5 percent and square footage expansion in company-operated stores. Also contributing to the revenue increase was moderate growth in the North America wholesale business, which was favorably impacted by the timing of shipments, as shipments planned for the fourth quarter of 2014 occurred in the third quarter. Calvin Klein International revenue decreased 1 percent compared to the prior year. This includes a 2 percent negative impact from foreign currency translation. Calvin Klein International retail comparable store sales declined 2 percent due to softness in Asia. Total Calvin Klein royalty revenue increased 2 percent over the prior year, driven principally by continued strength in womenswear.

Earnings before interest and taxes on a non-GAAP basis for the Calvin Klein business decreased to $142 million from $144 million in the prior years third quarter, as both revenue and gross margin improvements were more than offset by an increase in expenses related to the ongoing strategic investments in the acquired Calvin Klein businesses and advertising expenditures.

GAAP earnings before interest and taxes for the Calvin Klein business was $127 million as compared to $112 million in the prior years third quarter. The increase was principally driven by a reduction in integration and restructuring costs incurred during the third quarter of 2014 compared to the third quarter of 2013, combined with revenue and gross margin improvements, partially offset by the ongoing strategic investments in the acquired Calvin Klein businesses and increased advertising expenses.

Tommy Hilfiger

Revenue in the Tommy Hilfiger business increased 1 percent to $930 million from $921 million in the prior year period. This includes a 2 percent negative impact from foreign currency translation, principally attributable to the weaker Euro. Tommy Hilfiger North America revenue increased 3 percent, principally due to retail comparable store sales growth of 1 percent and square footage expansion in company-operated stores. Tommy Hilfiger International revenue decreased 1 percent, including a 3 percent negative impact from foreign currency translation. Revenue growth from square footage expansion in the Tommy Hilfiger Europe retail business was partially offset by a comparable store sales decline of 5 percent, principally due to a significant deceleration in traffic across the region in the middle of the quarter, combined with less promotional activity compared to the third quarter of the prior year. The Tommy Hilfiger Europe business experienced positive retail comparable store sales towards the end of quarter.

Earnings before interest and taxes for the Tommy Hilfiger business was $155 million, a 9 percent increase over earnings of $143 million on a non-GAAP basis in the prior years third quarter. The increase is principally attributable to the revenue increase mentioned above, combined with gross margin increases in both North America and Europe as a result of less promotional selling than in the prior years third quarter.

On a GAAP basis, earnings before interest and taxes for the Tommy Hilfiger business decreased 7 percent to $155 million from $168 million in the prior years third quarter. The decrease was principally driven by the absence of $24 million of income recorded in the third quarter of 2013 in connection with the amendment of an unfavorable contract, which resulted in the reduction of a liability recorded at the time of the Tommy Hilfiger acquisition.

Heritage Brands

Revenue for the Heritage Brands business increased 3 percent to $487 million compared to the prior year period excluding $67 million of revenue related to the Bass business. A 6 percent increase in the wholesale business was partially offset by a 6 percent comparable store sales decline in the retail business. Including the Bass revenue in 2013, revenue decreased 10 percent from the prior year period revenue of $539 million.

Earnings before interest and taxes on a non-GAAP basis for the Heritage Brands business was $36 million compared to $42 million in the prior years third quarter. The decrease was principally driven by a gross margin decline across all businesses attributable to increased promotional activity in order to drive traffic and revenue.

Earnings before interest and taxes on a GAAP basis for the Heritage Brands business increased to $32 million from $14 million in the prior years third quarter, driven by a reduction in acquisition, integration and restructuring costs incurred in 2014 as compared to the prior year period, partially offset by the gross margin decline discussed above.

Third Quarter Consolidated Earnings:

Earnings before interest and taxes on a non-GAAP basis increased to $309 million from $305 million in the prior years third quarter, driven principally by the continued strong performance in the Tommy Hilfiger business discussed above, offset, in part, by investments in the acquired Warnaco businesses and gross margin erosion in the Heritage Brands business.

Earnings before interest and taxes on a GAAP basis was $280 million as compared to $249 million in the prior years third quarter. The increase was primarily due to lower integration and restructuring costs compared to the third quarter of 2013 and strong performance in the Tommy Hilfiger business, partially offset by investments in the acquired Warnaco businesses and gross margin erosion in the Heritage Brands business.

Net interest expense decreased to $32 million from $46 million in the prior years third quarter due to lower average debt balances, combined with the effect of the amendment and restatement of the companys credit facility during the first quarter of 2014 and the related redemption of its 7 3/8 percent senior notes due 2020.

Nine Months Consolidated Results:

Earnings per share on a non-GAAP basis for the nine month period was $5.54 compared to $5.60 for the prior year period. GAAP earnings per share was $4.66 compared to $2.19 for the prior year period.

Revenue was $6.17 billion for the nine month period as compared to the prior year periods $6.16 billion on a non-GAAP basis and $6.13 billion on a GAAP basis.

The revenue increase was due to:

- A 2 percent, or $48 million, increase on a non-GAAP basis in the Calvin Klein business, driven principally by the ten additional days of operations in 2014 of the acquired Calvin Klein businesses compared to 2013 and an increase in royalty revenue, partially offset by a decline in the jeans business, primarily in North America and Europe. Retail comparable store sales increased 2 percent in North America and decreased 4 percent internationally. Revenue on a GAAP basis in the Calvin Klein business increased 4 percent, or $78 million, due to the increase discussed above, combined with the absence of $30 million of sales returns recorded in 2013 for certain wholesale customers in Asia in the acquired business in connection with an initiative to reduce excess inventory levels.

- A 5 percent, or $131 million, increase in the Tommy Hilfiger business. Tommy Hilfiger North America revenue increased 5 percent, principally due to low single-digit wholesale growth, retail comparable store sales growth of 2 percent and square footage expansion in company-operated stores. Tommy Hilfiger International revenue increased 5 percent, driven principally by European retail comparable store sales growth of 1 percent and square footage expansion in company-operated stores. Also contributing to the international revenue growth was the net positive impact of foreign currency translation for the nine month period, despite the Euro weakness experienced in the third quarter.

- Relatively flat revenue in the Heritage Brands business compared to the prior year period excluding $176 million of revenue related to the Bass business, as low single-digit growth in the wholesale business was offset by a 7 percent comparable store sales decline in the companys retail stores. Including the Bass revenue in 2013, revenue decreased 11 percent, or $171 million, to $1.35 billion from $1.52 billion in the prior year period.

Earnings before interest and taxes on a non-GAAP basis decreased to $718 million from $760 million in the prior year, principally due to:

- A $35 million decline in the Calvin Klein business, driven principally by investments in the acquired Warnaco businesses.

- A $27 million increase in the Tommy Hilfiger business, principally attributable to the revenue increase mentioned above, combined with gross margin improvement.

- A $31 million decline in the Heritage Brands business, principally attributable to the revenue decrease discussed above, combined with a gross margin decline resulting from increased promotional activity in order to drive traffic and revenue.

GAAP earnings before interest and taxes increased to $524 million from $353 million in the prior year period. The earnings increase was primarily due to a decrease of $213 million of costs from the prior year period, principally related to the Warnaco acquisition, integration and restructuring costs and debt modification and extinguishment charges. Also contributing to the earnings increase was an increase in the Tommy Hilfiger business, partially offset by the earnings decreases on a non-GAAP basis in the Calvin Klein and Heritage Brands businesses discussed above.

Net interest expense decreased to $107 million from $139 million in the prior year period due to lower average debt balances in the current year, combined with the effect of the amendment and restatement of the companys credit facility during the first quarter of 2014 and the related redemption of its 7 3/8 percent senior notes due 2020. During the third quarter of 2014, the company made debt repayments totaling $25 million on its outstanding term loans, which brings total year to date debt repayments to $245 million, most of which were voluntary. The company expects to make additional term loan repayments of approximately $155 million during the remainder of 2014.

2014 Guidance:

Please see the section entitled Full Year and Quarterly Reconciliations of GAAP to Non-GAAP Amounts at the end of this release for further detail and reconciliations of GAAP to non-GAAP amounts discussed in this section.

Full Year Guidance

As a result of recent unfavorable foreign exchange rates, principally the Euro, the company is revising its earnings per share guidance to $7.25 – $7.30, as compared to previous guidance of $7.30 – $7.40, each on a non-GAAP basis. The companys revised guidance represents an increase of 3 percent – 4 percent over its 2013 earnings per share on a non-GAAP basis of $7.03.

Revenue is currently projected to be approximately $8.3 billion, an increase of approximately 3 percent from the prior year excluding revenue of $176 million related to the Bass business, and reflects a negative impact from foreign currency translation compared to both the companys previous guidance and the prior year. Including Bass revenue in 2013, the revenue increase is expected to be approximately 1 percent over the prior year amounts of $8.22 billion on a non-GAAP basis and $8.19 billion on a GAAP basis. It is currently projected that revenue for the Tommy Hilfiger and Calvin Klein businesses will increase approximately 5 percent and 2 percent, respectively. Revenue for the Heritage Brands business is currently projected to be relatively flat to the prior year excluding revenue attributable to Bass, or decrease approximately 8 percent including the Bass revenue.

Net interest expense is expected to decrease to approximately $140 million, from $185 million in the prior year, due to lower average debt balances in the current year, combined with the effect of the amendment and restatement of the companys credit facility and the related redemption of its 7 3/8 percent senior notes in the first quarter of 2014. The company expects to make term loan payments totaling approximately $400 million in 2014, $155 million of which is expected to be paid in the fourth quarter.

The company estimates that its effective tax rate will be approximately 23.5 percent on a non-GAAP basis.

The companys earnings per share estimate on a non-GAAP basis excludes approximately $131 million of pre-tax costs associated primarily with the Warnaco integration and related restructuring and $93 million of pre-tax costs associated with the amendment and restatement of the companys credit facility and the related redemption of its 7 3/8 percent senior notes due 2020. (Please see section entitled Non-GAAP Exclusions for details on these pre-tax items.)

Fourth Quarter Guidance

Earnings per share on a non-GAAP basis for the fourth quarter is currently projected to be in a range of $1.71 – $1.76, or an increase of 20 percent – 23 percent, as compared to $1.43 in the prior years fourth quarter. Fourth quarter 2014 earnings per share reflects (i) a negative impact from foreign currency translation as compared to the prior years fourth quarter and the companys previous guidance, principally attributable to expected continued weakness in the Euro; and (ii) a shift in planned advertising expense from the third quarter into the fourth quarter in 2014.

Revenue in the fourth quarter is currently expected to be approximately $2.1 billion, an increase of approximately 3 percent compared to the prior year amount of $2.05 billion. Fourth quarter 2014 revenue reflects a negative impact from foreign currency translation of approximately 3 percent as compared to the prior years fourth quarter, principally attributable to expected continued weakness in the Euro. It is currently projected that revenue for the Tommy Hilfiger business in the fourth quarter will increase approximately 5 percent, which includes a 5 percent negative impact from foreign currency translation. It is currently projected that revenue for the Calvin Klein business in the fourth quarter will increase approximately 3 percent, which includes a 2 percent negative impact from foreign currency translation and reflects the negative impact of shipments shifting from the fourth quarter of 2014 to the third quarter. Revenue for the Heritage Brands business in the fourth quarter is currently expected to increase approximately 1 percent.

The company projects that fourth quarter net interest expense will be approximately $33 million and that the fourth quarter tax rate will be approximately 19.5 percent.

The companys fourth quarter earnings per share estimate excludes approximately $30 million of pre-tax costs associated with the integration and related restructuring of Warnaco. (Please see section entitled Non-GAAP Exclusions for details on these pre-tax costs.)

Non-GAAP Exclusions:

The discussions in this release that refer to non-GAAP amounts exclude the following:

- Pre-tax costs of approximately $131 million expected to be incurred in 2014 in connection with (i) the integration of Warnaco and the related restructuring, including a pre-tax gain resulting from the deconsolidation of certain Calvin Klein subsidiaries in Australia and New Zealand and the previously consolidated Calvin Klein joint venture in India; (ii) the sale of the Bass business, which closed in the fourth quarter of 2013 (as certain costs related to the sale were incurred in 2014); and (iii) the impairment of certain Tommy Hilfiger stores in North America in the second quarter of 2014. Of the total expected costs, $26 million was incurred in the first quarter, $46 million was incurred in the second quarter, $29 million was incurred in the third quarter and approximately $30 million is expected to be incurred in the fourth quarter.

- Pre-tax costs of $93 million recorded in the first quarter of 2014 associated with the amendment and restatement of the companys credit facility and the related redemption of its 7 3/8 percent senior notes due 2020.

- Discrete tax benefits of $55 million in 2014 primarily related to various Warnaco integration activities and the resolution of uncertain tax positions, of which $30 million was recorded in the second quarter and $25 million was recorded in the third quarter.

- A revenue reduction of $30 million in the first quarter of 2013 attributable to sales returns accepted from certain Warnaco Asia wholesale customers to reduce excess inventory levels.

- Pre-tax costs of $511 million incurred in 2013 in connection with the acquisition, integration and related restructuring of Warnaco, including costs associated with the debt modification and extinguishment completed at the time of the Warnaco acquisition, and the sales returns mentioned above, of which $224 million was incurred in the first quarter, $128 million was incurred in the second quarter, $61 million was incurred in the third quarter and $99 million was incurred in the fourth quarter. Approximately $215 million of the acquisition, integration and related restructuring charges incurred in 2013 were non-cash charges, the majority of which were short-lived valuation adjustments and amortization.

- Pre-tax income of $24 million recorded in the third quarter of 2013 due to the amendment of an unfavorable contract, which resulted in the reduction of a liability recorded at the time of the Tommy Hilfiger acquisition.

- A pre-tax loss of $20 million, including related costs, incurred in 2013 in connection with the sale of substantially all of the assets of the Bass business, which closed on November 4, 2013, of which $19 million was incurred in the third quarter and $1 million was incurred in the fourth quarter.

- Pre-tax income of $53 million recorded in the fourth quarter of 2013 related to recognized actuarial gains on retirement plans.

- A tax expense of $120 million recorded in the fourth quarter of 2013 in connection with an increase to the companys previously established liability for an uncertain tax position related to European and U.S. transfer pricing arrangements.

- A net tax expense of $5 million recorded in 2013 associated with various Warnaco integration activities and various adjustments to liabilities for changes in estimates in uncertain tax positions, of which an expense of $28 million was recorded in the second quarter, a benefit of $28 million was recorded in the third quarter and an expense of $5 million was recorded in the fourth quarter.

- Estimated tax effects associated with the above pre-tax items, which are based on the companys assessment of deductibility. In making this assessment, the company evaluated each item that it had identified above as a non-GAAP exclusion to determine if such item is taxable or tax deductible, and if so, in what jurisdiction the tax expense or tax deduction would occur. All items above were identified as either primarily taxable or tax deductible, with the tax effect taken at the statutory income tax rate of the local jurisdiction, or as non-taxable or non-deductible, in which case the company assumed no tax effect.