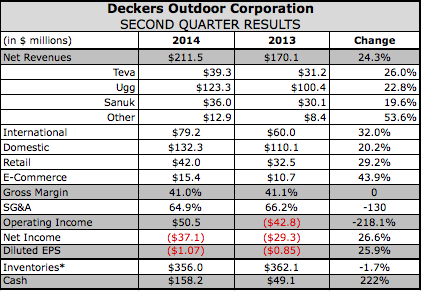

Deckers Outdoor reported fiscal first-quarter revenues jumped 24.3 percent, coming in well above Wall Street’s targets on the strength of strong double-digit growth for Ugg, Teva and Sanuk. With its loss in the traditionally small quarter for the company also coming in sharply lower than projected, Deckers raised its sales and earnings outlook for full year. In the quarter, the loss widened to $36.9 million, or $1.07 a share, from $30.6 million, or 95 cents a share, a year earlier, but ahead of its previous guidance calling for a loss of $1.33. The 24.3 percent sales gain was well above its guidance projecting a gain of 12 percent.

Deckers Outdoor reported fiscal first-quarter revenues jumped 24.3 percent, coming in well above Wall Street’s targets on the strength of strong double-digit growth for Ugg, Teva and Sanuk. With its loss in the traditionally small quarter for the company also coming in sharply lower than projected, Deckers raised its sales and earnings outlook for full year. In the quarter, the loss widened to $36.9 million, or $1.07 a share, from $30.6 million, or 95 cents a share, a year earlier, but ahead of its previous guidance calling for a loss of $1.33. The 24.3 percent sales gain was well above its guidance projecting a gain of 12 percent.

On a conference call with analysts, Angel Martinez, CEO and president, said the quarter benefited from a positive response to the delivery of “the most complete spring collections ever across our brand portfolio,” as well as efforts to build the company into a “world-class omni-channel organization.” The gains were led by its direct-to-consumer businesses.

By brand, Ugg’s sales increased 22.8 percent in the quarter to $123.3 million. Ugg saw gains across all primary channels, including higher global wholesale and international distributor sales, the sales contribution from new store openings and an increase in global e-commerce sales, partially offset by a decrease in same store sales.

At the start of the quarter, specialty classics, slippers and fashion boots sold well with the long winter.

“As temperatures turned more seasonable later in the quarter, sell through of fashion and casual sandals and casual shoes picked up and this momentum carried through July,” said Martinez. “The Ugg brand’s first quarter performance was also driven by higher initial fall shipments as many wholesale accounts and international distributors increased their orders for our expanded offering of transitional styles, which start to arrive on shelves in the coming weeks.”

Looking ahead, Martinez noted that Deckers had a successful fall pre-book with retailers responding to Ugg’s updated styling and sharper price points. He added, “The composition was a positive indication that our wholesale accounts and international distributors have a higher degree of confidence in the Ugg brand's expanded collection of fashion boots, casual boots, shoes, and slippers following strong sell through this past winter.”

An I-Heart-Ugg premium collection aimed at tweens was also launched in the quarter at Nordstrom, Zappos, and Dillards as well as two concept stores in San Francisco and Waikiki. Said Martinez, “We are very excited about the new line and feel very good about its growth prospects.”

Teva’s sales increased 25.7 percent to $39.3 million, driven by gains across all primary channels, including higher global wholesale and international distributor sales, an increase in global e-commerce sales and higher US retail sales.

Martinez said Teva continues to find success evolving beyond its traditional outdoor distribution into more mainstream retail in order to target a lot larger audience. Its flagship Originals line performed well in the first quarter despite the slow start of the warm spring weather.

“By focusing time, effort, and resources on key retailers that we believe fit our distribution strategy, we were able to drive double-digit sell through while also reaching new and influential consumers, “ says Martinez.

Sanuk’s sales increased 19.6 percent to $36.0 million. The increase was driven by sales gains across all primary channels, including higher global wholesale and international distributor sales, an increase in global e-commerce sales and higher US retail sales.

Martinez said Sanuk’s gains were due in large part to the continued success of women sandals, most notably the Yoga Sling series. Particularly encouraging has been the performance of the yoga franchise in larger national accounts including Nordstrom, Dillards, Journey's and DSW. He said Sanuk continues to make progress expanding its presence beyond the action sports lifestyle channel and evolving into a more year-round brand. He added, “The success of the spring line has helped us gain more shelf space for our fall offering, that now includes a broader selection of casual shoes and boots that can be comfortably worn during colder weather.”

Combined net sales of the company's Other Brands segment (Hoka One One, Tsubo, Ahnu, Mozo) increased 54.5 percent to $12.9 million. The increase was primarily attributable to a $4.5 million increase in sales for Hoka.

Martinez said Hoka continues to be a “disruptive force in the running shoe industry,” with a good response coming from its newest introductions, the Conquest and the Clifton.

“At this stage, we are still very much in seed mode and we plan to continue to limit distribution to the specialty running channel as we cultivate brand's authenticity,” said Martinez. “That said, we believe Hoka’s differentiated market positioning provides us the opportunity to develop a product line extensions for the larger national sporting goods chains and athletic specialty stores. This is something we are working towards for early next calendar year.”

Retail sales across brands climbed 29.4 percent to $42.0 million. The opening of 37 new stores after June 30, 2013 offset a comp decline of 2.8 percent. E-commerce sales leapt 43.7 percent to $15.4 million due to strong domestic and international sales for the Ugg, Teva and Sanuk brands, plus the domestic launch of a Hoka website and the addition of new international e-commerce websites. Direct-to-consumer comparable sales across retail and e-commerce grew 10 percent year over year.

Domestic sales increased 20.1 percent to $132.3 million while International sales jumped 32.1 percent to $79.2 million.

The wider bottom-line loss reflected increased spend on DTC, omni-channel infrastructure and marketing to supports its growth. Gross margins were basically even at 41.0 percent compared to 41.1 percent a year ago, which was slightly below expectations due to higher international distributor sales which carry a lower margin.

SG&A decreased 130 basis points, primarily attributable to the timing of expenses and leverage on higher sales. For its current fiscal year, Skechers is increasing its total company marketing spend as a percent of sales to approximately 6 percent from a little over 5 percent in its last fiscal year, partly to support the launch of Ugg’s first global brand marketing campaign and I-heart UGG.

For the full fiscal year through March 2015, Deckers now expects revenues to increase approximately 14 percent, up from previous guidance of 13 percent. Ugg’s revenues are now expected to increase 12 percent, up from a projection of 11 percent previously. Teva’s revenues are expected to gain 11 pecent and Sanuk, 15 percent, the same rate as its previous guidance. Companywide EPS is expected to expand 14.5 percent, up from the previous guidance of 13.5 percent.

Second quarter revenues are projected to increase approximately 18 percent. EPS is expected to reach 98 cents a share, up from 95 cents reported in the same period a year ago.