Shimano, Inc. reported that the global economy started to show moderate growth on the back of subsided inflation during fiscal year 2024; however, uncertainty about the outlook increased due to rising tensions in Ukraine and the Middle East, a stagnant Chinese economy, and the changes in leadership in various countries. The observations came in the company’s year-end financial report for the fiscal year ended December 31, 2024.

“In Europe, personal consumption picked up as price hikes cooled down and the economy started to recover moderately,” Shimano stated in its report. “In the U.S., although personal consumption was firm, the pace of economic recovery remained somewhat sluggish as affected by a slowdown in the labor market and high interest rates. In China, the economy was lackluster due to the prolonged stagnancy in the real estate market and sluggish personal consumption.”

In Japan, where Shimano has its headquarters, the company said the economy followed a moderate recovery trend on the back of strong demand from inbound tourists and the improved employment and income environment.

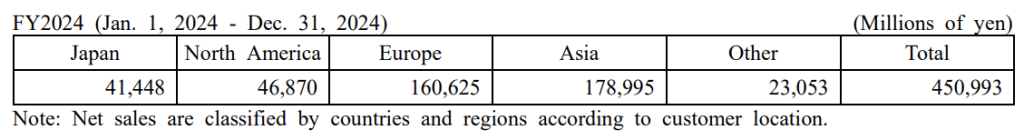

Shimano reported that demand for bikes and fishing tackle continued to be weak in 2024, resulting in net sales decreasing 4.9 percent year-over-year (y/y) to ¥450,993 million. Operating income for the full year decreased 22.2 percent to ¥65,085 million, ordinary income decreased 4.5 percent to ¥98,674 million and net income attributable to owners of the parent increased 24.8 percent to ¥76,329 million.

Reportable Segment Overview

Bicycle Components

While the strong interest in bikes continued as a long-term trend, Shimano said retail sales of completed bicycles were weak, and market inventories remained high.

- European market retail sales of completed bicycles softened due to unfavorable weather conditions in early spring, and market inventories remained high.

- In the North American market, although interest in bicycles was “firm,” retail sales of completed bicycles reportedly remained weak, and market inventories were said to be “somewhat high.”

- In the Asian, Oceanian and Central and South American markets, Shimano said the level of market inventories started to show signs of improvement. Still, the company said personal consumption remained sluggish, and retail sales of completed bicycles also remained weak. In the Chinese market, while the popularity of cycling as a sport continued to be high, the shipping volume of completed bicycles increased at the end of the season, and market inventories remained high.

- In the Japanese market, retail sales were reportedly “sluggish” as affected by the soaring price of completed bicycles, and market inventories remained “somewhat high.”

Still, Shimano said it received a favorable reception for its products, including Shimano 105, a component for road bikes, and a gravel-specific component Shimano GRX.

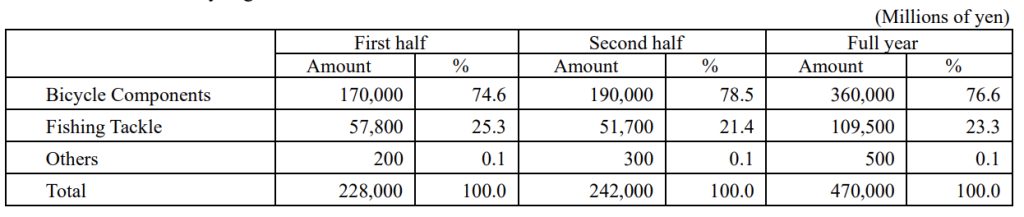

Net sales from the Bicycle Components segment decreased 5.2 percent y/y to ¥345,553 million, and operating income decreased 17.0 percent to ¥54,157 million.

Fishing Tackle

Shimano reported that demand for fishing tackle that had been “overly strong” globally cooled down, and sales remained weak in 2024, while adjustments of market inventories started to show signs of improvement.

In the Japanese market, buying motives among fishing enthusiasts were firm, and sales of high-priced products were strong; however, sales were generally lackluster, and adjustments of market inventories continued.

- North American market sales were said to be strong, backed by stable demand, and market inventories progressed toward an appropriate level.

- European market sales reportedly regained momentum, and adjustments of market inventories started to show signs of progress.

- Asian market sales were said to be weak, affected by sluggish personal consumption and adverse weather conditions, and market inventories remained at a somewhat high level.

- In the Australian market, backed by favorable weather and fishing conditions, sales were favorable, and market inventories remained at an appropriate level.

Shimano said the new Vanford spinning reels were well-received in the market. In addition, order-taking continued to be brisk for the Twin Power spinning reels and the Poison Adrena rods.

Net sales from this segment decreased 3.9 percent y/y to ¥104,990 million, and operating income decreased 40.6 percent y/y to 10,929 million.

Others

Net sales in the Fishing Tackle segment decreased 1.9 percent y/y to ¥449 million, and the company recorded an operating loss of ¥1 million by the top for the year, following an operating loss of ¥11 million for 2023.

Overview of Financial Position for FY2024

As of the end of fiscal year 2024, total assets amounted to ¥958,953 million, an increase of ¥87,221 million y/y from the previous fiscal year-end. The principal factors included an increase of ¥40,112 million y/y in cash and time deposits, an increase of ¥21,629 million in construction in progress, an increase of ¥8,299 million y/y in notes and accounts receivable-trade, an increase of ¥7,273 million y/y in work in process, an increase of ¥4,081 million y/y in buildings and structures, an increase of ¥2,859 million y/y in software in progress, an increase of ¥2,194 million y/y in others under current assets, and an increase of ¥2,111 million y/y in investment securities.

Total liabilities amounted to ¥75,339 million, an increase of ¥6,005 million y/y from the previous fiscal year-end. The principal factors included an increase of ¥12,151 million y/y in provision for product warranties under long-term liabilities, an increase of ¥5,085 million y/y in accounts payable-trade, an increase of ¥4,065 million y/y in income taxes payable, and a decrease of ¥14,843 million y/y in provision for product warranties under current liabilities.

Net assets amounted to ¥883,613 million, an increase of ¥81,216 million compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥50,718 million in foreign currency translation adjustments, an increase of ¥28,197 million in retained earnings, and an increase of ¥2,236 million in unrealized gain (loss) on other securities.

As a result, the shareholders’ equity ratio was 92.0 percent at year-end, compared with 91.9 percent as of the previous fiscal year-end, and net assets per share were ¥9,907.24 compared with ¥8,905.21 as of the previous fiscal year-end.

Overview of Cash Flows for FY2024

Net cash provided by operating activities amounted to ¥87,032 million, compared with ¥114,567 million provided for the previous year. The main cash inflows included income before income taxes amounting to ¥98,594 million, depreciation and amortization amounting to ¥25,037 million and interest and dividend income received amounting to ¥24,379 million. The main cash outflows included interest and dividend income amounting to ¥23,529 million, income taxes paid amounting to ¥18,475 million, foreign exchange losses (gains) amounting to ¥9,618 million, and notes and accounts receivable amounting to ¥6,944 million.

Net cash used in investing activities amounted to ¥35,810 million, compared with ¥31,760 million used for the previous year. The primary cash inflows included proceeds from maturities of time deposits amounting to ¥13,076 million. The main cash outflows included acquiring property, plant and equipment amounting to ¥36,824 million and acquiring intangible assets amounting to ¥8,753 million.

Net cash used in financing activities amounted to ¥49,476 million compared with ¥43,961 million used for the previous year. The main cash outflows included cash dividends to shareholders amounting to ¥26,630 million and the acquisition of treasury stock amounting to ¥21,488 million yen. As a result, cash and cash equivalents at the end of the year were ¥530,310 million.

Outlook

Although the global economy is forecasted to follow a moderate recovery trend, rising resource prices stemming from geopolitical risks, such as the situations in Ukraine and the Middle East, and supply chain disruptions caused by stagnation of logistics, as well as changes in government policies resulting from the national elections conducted across the globe in 2024, may put downward pressure on the economy.

As inflation subsided and personal consumption recovered, mainly in Europe and the U.S., the economy is expected to be on a moderate recovery trend. Nonetheless, Europe’s economy could be influenced by political instability in major countries, while in the U.S., the economy could be swayed by the new administration’s trade policies.

In China, economic recovery may remain lackluster due to the prolonged stagnation in the real estate market.

In Japan, personal consumption is expected to be firm, backed by the improved income environment and the government economic policies, and the economy is expected to recover moderately. However, the U.S. trade policies may impact the country’s economy.

In these circumstances, the company emphasizes “not only striving to develop and manufacture captivating products that bring sensations to many people as a development-oriented digital manufacturing company of Japanese origin that offers high-grade, attractive products by reflecting customers’ viewpoints, while closely monitoring trends in demand for bicycles and fishing tackle but also moving forward step-by-step as a value-creating company that continues to create a shared value between corporations and society.

“We will endeavor to further enhance management efficiency and strive for sustainable corporate growth by pursuing the creation of new cycling and fishing culture,” continued Shimano.

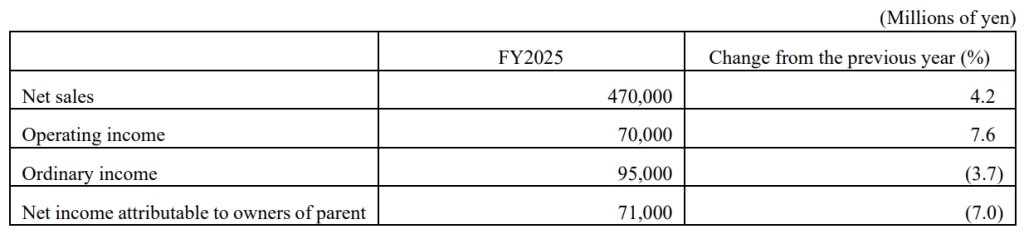

The company’s forecasted consolidated business performance for the fiscal year ending December 31, 2025, is indicated below.

Fiscal 2025 Sales Forecasts by Segment

Image courtesy Shimano