Johnson Outdoors, Inc., parent of the Jetboil, Minn Kota, Humminbird, Old Town, and ScubaPro brands, among others, said challenging marketplace conditions and competitive pressures resulted in lower sales and an operating loss for the company’s 2024 fiscal year and fourth quarter ended September 27.

“Obviously, it was a tough year. Continued challenging marketplace conditions and competitive pressures significantly impacted our fiscal 2024 performance,” commented company Chairman and CEO Helen Johnson-Leipold. “Consumer demands for outdoor recreation products across all of our businesses remain soft. While we’re not seeing indicators that these challenging conditions are going away anytime soon, we have been aggressively leaning into our critical strategic priorities, innovation, our go-to-market strategy and operational efficiencies to enable future growth for our brands and businesses.”

The CEO said on a conference call with analysts that she was not going to “re-hash” the numbers reported in the company’s media release earlier in the day so additional details for the year were minimal. SGB Media will provide additional details once the company files its annual 10-K report with the SEC.

When the company reported its fiscal third quarter in August, the CEO alluded at the time to an evaluation of all aspects of the business to improve its financial results and redeploying resources to enable future growth, improve profitability and strengthen business operations.

Company CFO David Johnson said the company had a very deliberate operational cost savings program launched over a year ago, and that bore fruit for the company in fiscal 2024.

“We’ve really focused on the factories, increasing our efficiencies, reducing our scrap rates, driving down cost of goods, the materials come into the factory, logistics savings, those are the four big areas that we really worked on,” he ontinued, “And it drove about 2 points of benefit on the gross margin for us for fiscal ’24.

He said it was, unfortunately, masked by the full year results.

Johnson also shared that the company did a “job elimination” in the fourth quarter, which is expected to help the company going forward on the operational expense side of things. He said they expect to expand the operational cost savings program as well.

“I mean, we want to keep working on opportunities with sourcing and driving down product costs. So, we’ve got plans in place to continue that effort to expand that effort,” he said.

Fourth Quarter Summary

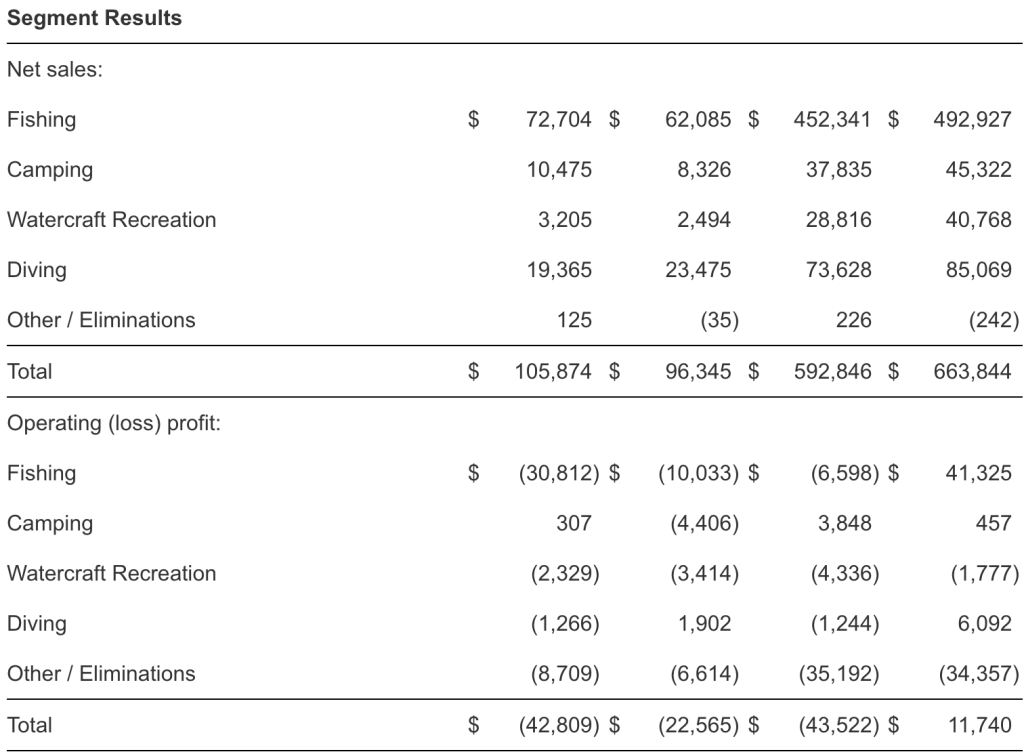

Johnson Outdoors reported net sales were $105.9 million in the fiscal fourth quarter ended September 27, an increase of 9.9 percent compared to $96.3 million in the prior fiscal year’s fourth quarter sales.

- Fishing segment (Minn Kota Cannon, Humminbird) sales grew 17.1 percent in the quarter to $72.2 million, compared to $62.1 million in the prior-year quarter

- Camping segment (Jetboil) sales increased 25.8 percent year-over-year to $10.5 million in a smaller quarter for the business.

- Watercraft Recreation (Old Town, Carlisle) segment sales also grew 25.8 million in the quarter, amounting to $3.2 million for the fiscal fourth quarter.

- Diving segment (ScubaPro) sales fell 17.5 percent to $19.4 million, compared to $23.5 million in the year-ago Q4 period.

Fiscal fourth quarter gross margin declined year-over-year, reportedly due to increased promotional pricing, changes in product mix toward lower margin products and inventory reserves on slow-moving and obsolete inventory.

Operating expenses increased $12.2 million year-over-year to $67.7 million in Q4, said to be primarily due to a non-cash goodwill impairment charge of $11.2 million recognized in the Fishing segment during the fourth quarter, increased bad debt reserves of $2.5 million, and increased severance costs of $1.5 million tied to the layoffs.

Loss before income taxes was $39.7 million in the 2024 quarter, compared to a loss of $22.1 million in the prior year’s fourth quarter.

Operating loss was $42.8 million in the fiscal 2024 fourth quarter, compared to a loss of $22.6 million in the prior-year fourth quarter.

The operating loss for the quarter was impacted a great deal by the Fishing segment and to a lesser extent, the Diving segment.

- The Fishing segment operating loss expanded 3X in the quarter to a loss of $30.8 million in Q3 2024, compared to a loss of $10.0 million in the prior-year Q4 period, due in part to the previously detailed non-cash goodwill impairment charge of $11.2 million.

- The Camping segment swung to an operating profit in Q4, albeit a small one in a small revenue quarter. The operating profit for the segment was $0.3 million, compared to a $4.4 million operating loss in fiscal Q3 2023.

- The Watercraft Recreation segment reduced its Q4 operating loss year-over-year to a loss of $2.3 million in fiscal 2024 compared to an operating loss of $3.4 million in the fiscal 2023 Q4 period.

- The Diving segment reported operating loss of $1.3 million in the fourth quarter after posting an operating profit of $1.9 million in the prior-year quarter.

Net loss for the fourth quarter was $34.3 million compared to a loss of $16.0 million in fiscal 2023.

Fiscal Full Year Summary

Total company revenue fell 11 percent to $592.8 million in fiscal 2024, compared to $663.8 million in fiscal 2023, as market challenges and competitive pressures resulted in weaker demand and sales across all segments.

- Fishing revenue decreased 8 percent, due to a tough marine market and competitive dynamics;

- Diving sales were down 13 percent, driven by softening market demand across all geographic regions;

- Camping revenue decreased 17 percent due primarily to general declines in market demand and $4.5 million in revenue from the prior year to Military and Commercial Tents product lines, which the company previously divested; and

- Watercraft Recreation sales were down 29 percent due to the ongoing decrease in demand in the overall watercraft market compared to the prior year.

Total company operating loss was $43.5 million in fiscal 2024, which compared unfavorably to operating profit of $11.7 million in the prior fiscal year.

Gross margin decreased to 33.9 percent in fiscal 2024, compared to 36.8 percent in the prior year. Cost savings initiatives were more than offset by unfavorable absorption of fixed overhead costs driven by lower sales volumes and changes in product mix toward lower margin products.

Operating expenses increased by $12.2 million from the prior year, said to be due primarily to a non-cash goodwill impairment charge of $11.2 million recognized in the Fishing segment during the fourth quarter, increased bad debt reserves of $2.5 million and increased severance costs of $1.5 million. Additionally, $3.8 million of higher deferred compensation expense due to marking plan assets to market value further drove the increase in operating expenses and was entirely offset by Other income. These increases were partially offset by lower incentive compensation and professional services expenses between years.

Loss before income taxes was $29.9 million in fiscal 2024, compared to profit before taxes of $25.8 million in fiscal 2023. In addition to the change in operating profit, Other income decreased slightly from $9.7 million in the prior year to $9.0 million in the current year. Net investment gains and earnings on the assets related to the company’s non-qualified deferred compensation plan, which are included in Other income, improved by $3.8 million over the prior-year quarter, which fully offset the increase in deferred compensation expense in operating expenses. The increase was more than offset by the net effect of a gain of approximately $6.6 million related to the divestiture of the Military and Commercial Tents product lines in the Camping Segment in the prior year and an increase of approximately $1.9 million on the sale of a building in the current year-to-date period.

Net loss for the fiscal year fell to $26.5 million, or a loss of $2.60 per diluted share, versus net income of $19.5 million, or EPS of $1.90 per diluted share, in the last fiscal year.

The effective tax rate was 11.1 percent compared to the previous fiscal year’s rate of 24.4 percent.

Other Financial Information

The company reported cash and investments of $162.0 million as of September 27, 2024, a $9.5 million increase from the prior year, with no debt on its balance sheet.

Depreciation and amortization were $19.6 million compared to $16.3 million in fiscal 2023.

Capital spending totaled $22.0 million in fiscal 2024 compared with $22.7 million in fiscal 2023.

In September 2024, the company’s Board of Directors approved a quarterly cash dividend to shareholders of record as of October 11, 2024, payable on October 25, 2024.

“In fiscal 2024, despite the operating loss, we drove positive cash flow from operations through prudent inventory management. Additionally, we focused on operational cost savings and efficiencies to mitigate impacts from challenging market dynamics. We will strategically manage costs in fiscal 2025 while at the same time making investments to strengthen the business. Our balance sheet remains debt-free and we remain confident in our ability and plans to create long-term value and consistently pay dividends to shareholders,” said CFO Johnson.

Image courtesy Jetboil/Johnson Outdoors