Urban Outfitters, Inc., the parent of the Anthropologie, Free People, FP Movement, Urban Outfitters, and Nuuly retail brands, posted a record third-quarter net income of $102.9 million and earnings per diluted share of $1.10 for the three months ended October 31, 2024.

For the nine months ended October 31, 2024, net income was $282.2 million and earnings per diluted share were $2.99.

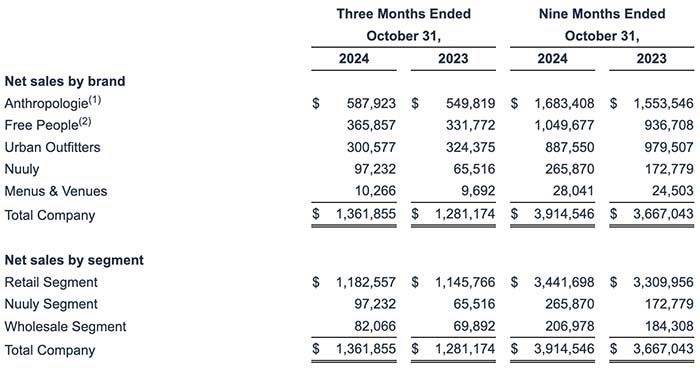

Total company net sales for the three months ended October 31, 2024, increased 6.3 percent to a record $1.36 billion. Total retail segment net sales increased by 3.2 percent, while comparable retail segment net sales increased by 1.5 percent. The retail segment’s comparable net sales increase was driven by low single-digit positive growth in both digital channel and retail store sales.

Comparable retail segment net sales increased 5.8 percent at Anthropologie and 5.3 percent at Free People. Comps decreased 8.9 percent at Urban Outfitters. Nuuly segment net sales increased by 48.4 percent, primarily driven by a 51 percent increase in average active subscribers in the current quarter versus the prior-year quarter.

Wholesale segment net sales increased 17.4 percent, driven by a 20.3 percent increase in Free People wholesale sales due to increased sales to specialty customers and department stores, partially offset by a decrease in Urban Outfitters wholesale sales.

For the nine months ended October 31, 2024, company net sales increased 6.7 percent to a record $3.91 billion. Total retail segment net sales increased 4.0 percent, with comparable retail segment net sales increasing 2.6 percent. The retail segment’s comparable net sales increase was driven by mid-single-digit positive growth in digital channel sales and low single-digit positive growth in retail store sales.

Comparable retail segment net sales increased 9.3 percent at Free People and 7.5 percent at Anthropologie; however, they decreased 10.6 percent at Urban Outfitters. Nuuly segment net sales increased by 53.9 percent, primarily driven by a 50 percent increase in average active subscribers in the current period versus the prior year period.

Wholesale segment net sales increased 12.3 percent, driven by a 15.1 percent increase in Free People wholesale sales due to increased sales to specialty customers and department stores, partially offset by a decrease in Urban Outfitters wholesale sales.

“We are pleased to announce record third-quarter sales and earnings, both of which exceeded our expectations. These results were driven by outperformance across all three business segments—Retail, Subscription and Wholesale,” said CEO Richard A. Hayne. “Additionally, we’re optimistic about the outlook for Holiday demand and believe total comparable sales could be similar to our third quarter results,” concluded Hayne.

Net sales by brand and segment for the three and nine-month periods were as follows:

*(1) Anthropologie includes the Anthropologie and Terrain brands. (2) Free People includes the Free People and FP Movement brands.

For the three months ended October 31, 2024, the gross profit rate increased by 105 basis points compared to the three months ended October 31, 2023. Gross profit dollars increased 9.4 percent to $497.3 million from $454.4 million in the three months ended October 31, 2023. The increase in gross profit rate for the three months ended October 31, 2024, was primarily due to higher initial merchandise markups for all segments, mainly driven by company cross-functional initiatives. Additionally, retail segment merchandise markdowns improved, driven by lower merchandise markdowns at Urban Outfitters, partially offset by an increase at Free People.

For the nine months ended October 31, 2024, the gross profit rate increased by 80 basis points compared to the nine months ended October 31, 2023. Gross profit dollars increased 9.2 percent to $1.40 billion from $1.28 billion in the nine months ended October 31, 2023. The increase in gross profit rate for the nine months ended October 31, 2024 was primarily due to higher initial merchandise markups for all segments primarily driven by company cross-functional initiatives. The increase in gross profit dollars for both periods was due to higher net sales and the improved gross profit rate.

As of October 31, 2024, total inventory increased by $72.3 million, or 10.0 percent, compared to total inventory as of October 31, 2023. Total retail segment inventory increased 8.1 percent due to a retail segment comparable inventory increase of 3.7 percent and planned early receipts of holiday merchandise. Wholesale segment inventory increased by 41.6 percent due to the timing of receipts and to support increased sales.

For the three months ended October 31, 2024, selling, general and administrative expenses (SG&A) increased by $23.2 million, or 6.7 percent, compared to the three months ended October 31, 2023, and expressed as a percentage of net sales, deleveraged 11 basis points. For the nine months ended October 31, 2024, SG&A expenses increased by $81.8 million, or 8.4 percent, compared to the nine months ended October 31, 2023, expressed as a percentage of net sales, deleveraged 42 basis points. The deleverage in SG&A expenses as a rate to net sales for both periods was primarily related to increased marketing expenses to support customer growth and increased sales in the retail and Nuuly segments. The dollar growth in SG&A expenses for both periods was primarily related to increased marketing expenses to support customer growth, increased sales in the retail and Nuuly segments and increased store payroll expenses to support the retail segment stores’ comparable net sales growth.

The company’s effective tax rate for the three months ended October 31, 2024 was 24.2 percent, compared to 24.3 percent in the three months ended October 31, 2023. The company’s effective tax rate for the nine months ended October 31, 2024, was 23.6 percent, compared to 24.5 percent in the nine months ended October 31, 2023. The decrease in the effective tax rate for the three and nine months ended October 31, 2024 was primarily due to the favorable impact of equity vestings in the current year.

Net income for the three months ended October 31, 2024, was a record $102.9 million or $1.10 per diluted share. Net income for the nine months ended October 31, 2024, was $282.2 million or $2.99 per diluted share.

On June 4, 2019, the company’s Board of Directors authorized the repurchase of 20 million common shares under a share repurchase program. During the nine months ended October 31, 2024, the company repurchased and subsequently retired 1.2 million shares for approximately $52 million. As of October 31, 2024, 18.0 million common shares remained under the program.

During the nine months ended October 31, 2024, the company opened 36 new retail stores, including 20 Free People stores (including 12 FP Movement stores), 9 Anthropologie stores and 7 Urban Outfitters stores; and closed 11 retail locations, including 5 Urban Outfitters stores, 4 Anthropologie stores and 2 Free People stores.

Urban Outfitters, Inc. offers lifestyle-oriented general merchandise and consumer products and services through a portfolio of global consumer brands comprised of 264 Urban Outfitters stores in the U.S., Canada and Europe and websites; 242 Anthropologie stores in the U.S., Canada and Europe, catalogs and websites; 216 Free People stores, including 50 FP Movement stores, in the U.S., Canada and Europe, catalogs and websites; 9 Menus & Venues restaurants; 7 Urban Outfitters franchisee-owned stores; and 2 Anthropologie franchisee-owned stores as of October 31, 2024.

Free People, FP Movement and Urban Outfitters wholesale sell its products through department and specialty stores worldwide, digital businesses and the company’s retail segment.

Nuuly is a women’s apparel subscription rental service offering a wide selection of rental products from the company’s brands, third-party brands and one-of-a-kind vintage pieces.

Image courtesy Urban Outfitters