With one of the hottest retail stocks of the last 20 years reporting quarterly results this week and the largest active lifestyle brand in the market reporting before month-end, Wells Fargo analyst Ike Boruchow stepped into the conversation this week with his firm’s shift to Nike and away from Lululemon as their top defensive stock pick in the active lifestyle space (read SGB Media coverage here).

Lululemon will report fiscal third-quarter results after the market closes on December 7 and Nike will report fiscal second-quarter results after the market closes on December 21.

Today, LULU shares are up 27x from its adjusted IPO price on July 1, 2007, while NKE shares are up 7.9x over the same period. Strong returns on both, especially if you roll in Nike’s dividends.

Placer.ai also entered the conversation about the two juggernauts this week, publishing new data that assesses retail traffic performance over the most recent quarter and how the two athleisure leaders have experienced the kickoff of the holiday season.

Nike’s and Lululemon’s Very Merry Outlook

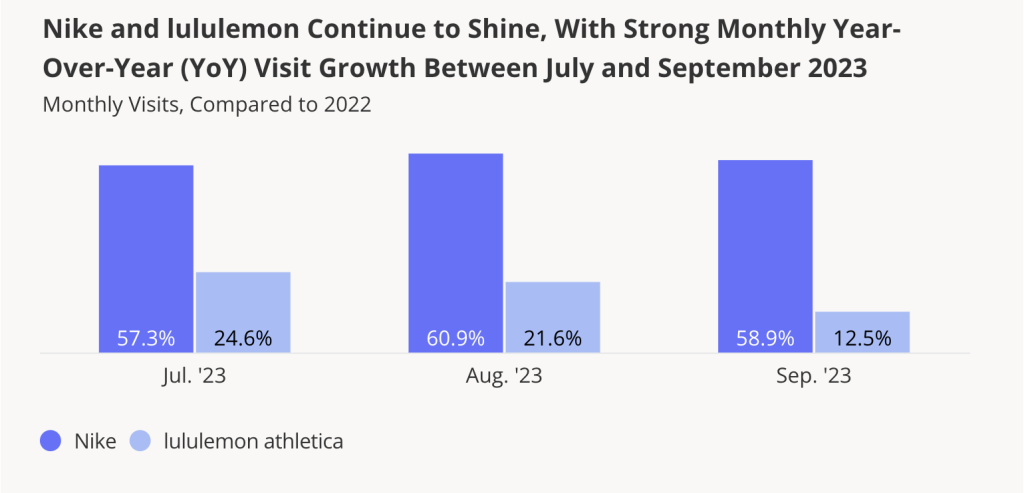

Placer.ai, the market research firm that tallies retail foot traffic trends, reported that in the calendar third quarter of 2023, Nike experienced dramatic visit growth, with foot traffic to the brand’s retail stores up 59.0 percent compared to the corresponding period in 2022. The research firm said Lululemon also made a strong quarterly showing, with year-over-year (YoY) quarterly visits up 20.2 percent.

On a monthly basis, both brands maintained consistently positive YoY visit growth for July, August and September 2023, despite lapping the year-ago third quarter that was said to be “extremely robust.”

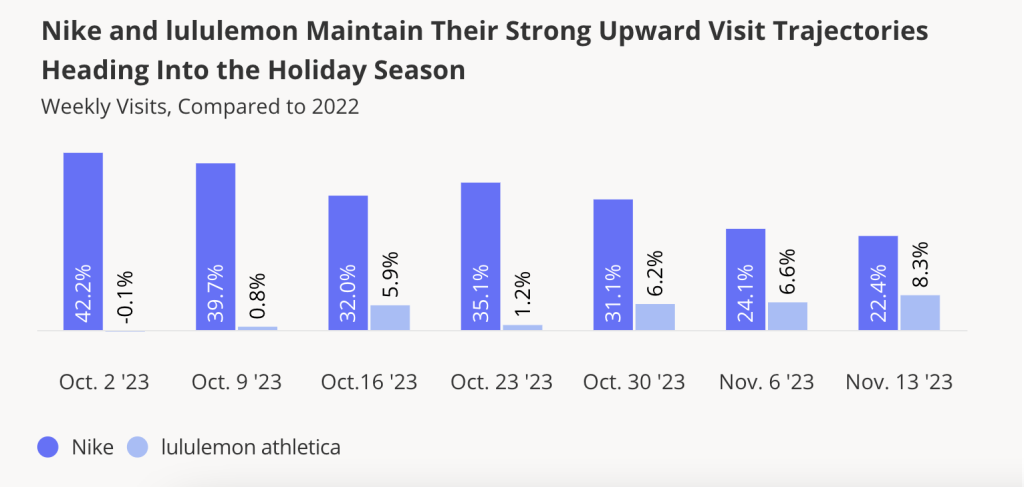

Placer.ai noted that the positive momentum for Nike and Lululemon at retail continued through October and into November this year, a trend the firm said exhibits how well-positioned the two brands are heading into the holiday season.

The research company went on to suggest in a blog post that Lululemon’s and Nike’s striking ability to keep up such strong visit growth in the face of waning consumer confidence is a testament to the two brands’ broad and ever-widening appeal, including among the much-coveted Gen Z demographic.

Placer.ai said Lululemon’s dual emphasis on quality and sustainability resonates powerfully with younger consumers. And though classically favored by women, the brand has also seen a steady increase in the share of men among its customer base. Nike, they said, is also beloved by younger consumers, citing survey data that shows teens prefer Nike to any other apparel or footwear brand.

A recent demographic survey from YPulse shows Nike ranked as the “Most Authentic” brand in the active lifestyle and fashion space among Gen Z consumers in North America and Western Europe (read SGB Media coverage here).

But like Lululemon, Placer.ai said Nike has diversified its audience in recent years, making inroads among less-affluent and less sports-obsessed consumers. Both brands have also worked to expand their brick-and-mortar footprints, growing their store counts while leaning into experiential retail.

A Stellar Black Friday Showing—and Boxing Day?

The Placer.ai report said that for both Nike and Lululemon, Black Friday is one of the most important sales days of the year, and “both brands knocked it out of the park this year.”

The Placer.ai data revealed that Nike drew 324.9 percent more retail store visits on Black Friday 2023 (November 24) than it did, on average, during the six-week period leading up to the retail holiday – the chain’s biggest visit spike since at least 2019. Lululemon, for its part, saw a visit bump of 467.7 percent on November 24, bringing the brand ever closer to its pre-pandemic Black Friday frenzy levels.

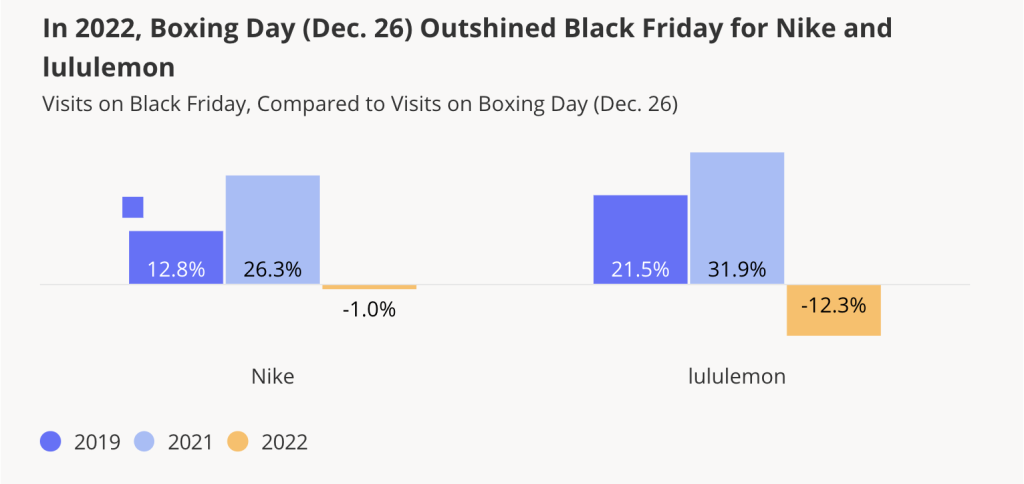

Zooming out on Nike’s and Lululemon’s broader holiday visitation patterns may show that the two chains could be in for even bigger visit bumps on Boxing Day, December 26 versus the numbers they posted on Black Friday, according to Placer.ai.

In 2019 and 2021, Black Friday was Nike’s and Lululemon’s busiest owned-retail day of the year, but in 2022 it was reportedly outpaced by December 26, the research firm noted.

Placer.ai called the shift “striking,” and suggested it may provide further evidence of the emergence of Boxing Day as an important U.S. retail milestone. Given how tricky it can be to buy clothes and shoes for other people, December 26 may be particularly important for higher-end athleisure brands like Lululemon and Nike. Consumers may flock to these chains on the day after Christmas to exchange their presents for something in the right color or size, or to use holiday gift cards or cash to splurge on something that would normally be out of reach.

For more retail traffic and visit analysis from Placer.ai, go here.

Illustration and charts courtesy of Placer.ai