Holiday spending is expected to come close to last year’s results but could fall short by as much as 2.5 percent during the traditional November and December shopping season, according to Circana’s annual Holiday Purchase Intentions study. The outlook was slightly improved when holiday sales falling in October are included.

“Conflicted spending apprehension from the consumer, combined with the potential for a three-week long last-minute spending surge in December, makes Holiday 2023 a complex one to plan for and measure,” said Marshal Cohen, chief industry advisor of Retail at Circana, in the report.

Cohen noted that inflation continues to weigh on consumer spending for holiday spending. Through the first nine months of 2023, retail sales revenue, including discretionary general merchandise and CPG, increased 2 percent compared to 2022. Unit sales declined 3 percent.

“This holiday faces a newly established, lower discretionary spending baseline,” said Cohen. “The U.S. consumer has started to demonstrate fatigue over elevated prices. Continued declines in discretionary spending have become consistent, and gains are moderating across consumer-packaged goods (CPG).”

Circana’s accompanying survey to the study found that overall value for the price and special sale price grew as top factors influencing where consumers will shop for the holiday this year, identified by more than 40 percent of holiday shoppers.On a positive note, Cohen said the timing of major sale days could positively impact the holiday’s take.

“Christmas Day lands on a Monday this year, which will split Super Saturday shopping once again (between December 23 and the weekend before) while also giving consumers the ability to push their shopping right up to the last minute on Sunday, December 24,” said Cohen. “Retailers will need to wait for Christmas week results to get a true read on how the traditional season ended.”

Cohen also said an opportunity could arise from the year’s seasonal compression. “The trend toward flattening retail peaks, which was first noted in discretionary general merchandise last year, has continued through 2023 with traditional selling peaks failing to reach expected levels. While ongoing economic challenges have reinforced behavioral shifts related to how and when consumers make purchases, there is also potential for retail to benefit from pent-up demand,” said Cohen.

Based on an online survey of 3,429 U.S. adults in September, Circa forecasted an average holiday spend of $754 this year, slightly below last year’s $760 estimate. In 2021, amid a healthy pandemic-related recovery, the average spend was estimated to be $785.

Among the respondents, 24 percent plan to spend more than last year, 58 percent plan to spend the same as in 2022, and 18 percent plan to spend less. The spending intentions were in line with 2022’s survey.

Among product categories, the purchase intent held steady in most industries, but spending expectations were up. Among the respondents, the top planned physical gift category was clothing/footwear/accessories, with 55 percent planning to make a gift purchase within the category this holiday season, followed by tech/electronics, cited by 34 percent, entertainment, 31 percent; toys & baby products/supplies, 29 percent; home, 29 percent; beauty, 28 percent; food/beverage: 21 percent; and liquor/wine, 20 percent.

Based on the amount spent, the top category was tech/electronics, with a mean spend among planned purchasers of $899, followed by clothing/footwear/accessories, $441; home, $348; entertainment, $216; beauty, $210; toys & baby products/supplies, $191; food/beverage, $170; and liquor/wine, $125.

The survey found that offering “experiences” as a holiday gift continues to look to shift money away from traditional retail gift purchases.

Overall, 53 percent of consumers plan to purchase an experience/intangible gift, down 2 percentage points from last year; however, two top areas of experience spending showed increases. Of the respondents, 45 percent planned to offer a food/beverage experience as a holiday gift this year, up 4 points from 2022, while 29 percent plan to gift tickets to a sporting event, concert or theater event, also up 4 percent. Spa certificates and subscriptions lost ground as potential holiday gifts.

Early Holiday Shopping

Circana’s survey found that early November grew in importance among those looking to shop before Thanksgiving, with 37 percent of respondents planning to start shopping during September or earlier versus 39 percent in the 2022 survey; 27 percent planned to start shopping in October against 31 percent last year; and 31 percent scheduled to begin shopping in November, up from 25 percent in the 2022 survey.

Overall, half of consumers planned to start shopping this year by Thanksgiving Day; 4 percent will start on Thanksgiving Day; 18 percent on Black Friday; 6 percent over Thanksgiving weekend; and 3 percent on Cyber Monday. Among the procrastinators, 15 percent do not plan to start until early December, and 6 percent said they would wait until the last minute.

Circana’s study found that Black Friday continues to grow in importance. Of the respondents, 23 percent said this is the day they find the best deals.

Online Holiday Buying

Circana’s survey found that online shopping plans rebounded back to 2021 levels, again surpassing in-store shopping levels, albeit slightly. In-store holiday purchases had surpassed online purchases in 2021 as shoppers embraced in-store selling with pandemic-related concerns around crowds subsiding.

Overall, 82 percent of respondents planned to shop for holiday gifts online this year, up from 80 percent last year. Spending online for holiday gifts has grown significantly over the last decade. Only 59 percent of respondents planned to shop online in the 2014 survey.

Social Media Influence

The study found that YouTube and TikTok are growing in influence as holiday purchase drivers at the expense of Facebook.

Asked which social media platform they plan to use for pre-purchase research, the top response among respondents was YouTube, cited by 66 percent, up seven percentage points from last year. Also notably gaining ground was TikTok, cited as a likely pre-purchase research tool by 46 percent of respondents, up seven percentage points versus 2022. Facebook lost ground, with 59 percent planning to use the platform for holiday research, down from 67 percent last year.

Among other platforms, Instagram is expected to be used for pre-purchase research by 53 percent of respondents; Pinterest and Twitter/X by 27 percent; Reddit, 19 percent; Snapchat, 18 percent; and LinkedIn, 13 percent. Overall, 20 percent of consumers will use social media for pre-purchase research this holiday season, the same as last year.

The influence of social media on purchase behavior during the holidays was found to be significant, with brands (72 percent), retailers (65 percent), and product reviews (65 percent) being most likely to sway a follower’s decision to make a purchase, according to Circana’s survey. However, only 41 percent of those who follow a celebrity said they would be influenced to make a purchase, down 8 points from last year.

Spending Appears Only Slightly Affected By Economic Concerns

Circana’s survey found heightened economic concerns. Among the respondents, 65 percent viewed the economy as “Fair” or “Poor,” slightly up from 64 percent in 2022 and above prior recent years, with 56 percent feeling the economy was “Fair” or “Poor” in 2021, 57 percent in 2020 and only 37 percent in 2019.

Still, when asked what impact their financial situation and view of the economy would have on their spending this holiday season, only 28.3 percent said they planned to spend less, just below the 29 percent who indicated they would spend less in 2022 and below the 30 percent who planned to spend less in 2020. Amid the pandemic recovery, only 23 percent said they planned to spend less in 2021.

For 2023, 29 percent of respondents plan to spend more, and 42 percent plan to spend the same amount. Other findings around holiday spending patterns include:

- 52 percent of consumers will buy most holiday merchandise using credit, 4 pts more than last year;

- 25 percent of consumers did not make a purchase this year in hopes they would get it as a gift or find it on promotion during the holiday;

- 48 percent of consumers said free shipping and delivery influence where they shop, 4 points higher than last year;

- 25 percent of consumers are buying gifts for themselves as a form of retail therapy, 5 points lower than last year;

- 48 percent of consumers said they would spend less this holiday season because other expenses have increased, and

- 27 percent of consumers said retailer loyalty programs influence where they shop, 4 points higher than last year.

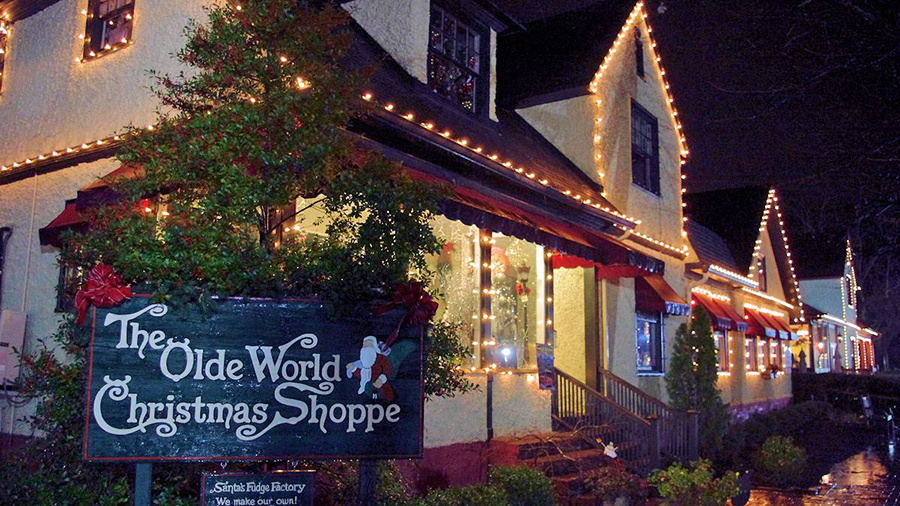

Photo courtesy Biltmore Village