Moosejaw, the outdoor specialty retailer acquired by Dick’s Sporting Goods in March, is closing 11 of 14 stores in a realignment of Dick’s outdoor specialty business, including the company’s Public Lands’ store concept.

Moosejaw’s headquarters in Madison Heights, MI, is also closing.

According to the Detroit Free Press, the stores slated to close, along with Moosejaw’s headquarters, will occur in February 2024.

“After a careful review of our outdoor specialty business, we have decided to form one team that will support the operations of Public Lands and Moosejaw. The team will be based at Public Lands’ headquarters in Pittsburgh, PA, ” Sarah Cassella, a spokesperson for Dick’s, said Friday. “This move supports our business optimization efforts and will allow us to operate more efficiently, quickly leverage best practices across our outdoor business and drive our long-term success. We look forward to continuing to provide outdoor enthusiasts great gear and service on moosejaw.com, publiclands.com and at Moosejaw and Public Lands retail locations.”

The three Moosejaw stores that will remain open are located in Birmingham, MI, on Woodward Avenue, Salt Lake City, UT and Bentonville, AR.

The 11 Moosejaw stores that will close in February include seven in Michigan (West Maple Road in downtown Birmingham, Ann Arbor, Belmont, downtown Detroit, East Lansing, Grand Rapids, and Grosse Pointe) and in Olathe, KS; Chicago, IL; Boulder, CO; and Kansas City, MO.

A source told Crain’s Detroit that Moosejaw terminated 35 employees on Friday. It’s unknown how many employees will be affected once 11 of the 14 Moosejaw stores close.

When Dick’s announced the acquisition of Moosejaw from Walmart, (read SGB Media’s coverage here), which had purchased it for $51 million in 2017, the retailer had 240 employees. Dick’s did not disclose the purchase price. At the time, Dick’s expected Moosejaw to contribute approximately $100 million in net sales in 2023.

Dick’s expected the acquisition of Moosejaw to accelerate its push into the outdoor specialty category marked by the launch of its Public Lands outdoor concept opening in 2021. There are seven Public Lands stores operating in Kennesaw, GA; Framingham, MA; Melville, NY; Medford, OR; Pittsburgh, PA; Columbus, OH; and Charlottesville, VA.

Public Lands’ stores average around 50,000 square feet compared to Moosejaw’s 4,000 square feet. Todd Spaletto, president of Public Lands and the SVP at Dick’s, said at the time it announced the acquisition, “We admire what Moosejaw has accomplished over the past 30 years as leaders in the outdoor industry and look forward to the opportunity to share insights and learn from one another. We believe there’s potential to grow the Moosejaw business and provide compelling experiences and an expanded product assortment to its millions of loyal customers.”

Dick’s has not announced additional store openings for Public Lands following the retailer opening four stores last fall; however, it fast-tracked Dick’s House of Sport concept stores for expansion. In March, Dick’s announced plans to open 75 to 100 House of Sport stores by 2027.

On Dick’s first-quarter analyst call in May, CFO Navdeep Gupta noted that Public Lands stores were still in test mode. He said, “Public Lands, I would say, is still something we are continuing to refine our learnings. And especially with the Moosejaw acquisition, we are looking back and saying how best do we serve the athlete. It’s a $40 billion industry, which is highly fragmented. So, we see a long-term great growth opportunity there. We’ll just continue to learn and test with the Public Lands concept.”

Dick’s overall second-quarter results were impacted by its decision to markdown heavy inventories in the outdoor category. Lauren Hobart, Dick’s CEO, said the retailer faced a “very short window” in the quarter to optimally sell off the remaining seasonal outdoor merchandise and wanted to keep inventories lean. Overall inventories at the quarter’s close were down 5 percent year-over-year.

Hobart reaffirmed Dick’s commitment to growing the outdoor category. She said, “We were aggressive, but it doesn’t change our expectations on the outdoor category in general. We are very excited about reinventing the outdoor category and delivering a great consumer experience; this was a short-term issue this past quarter.”

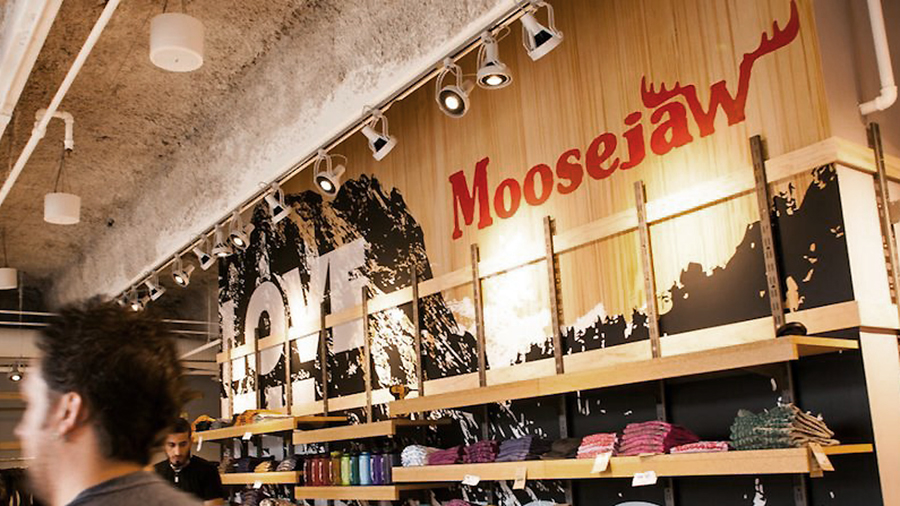

Photo courtesy Moosejaw