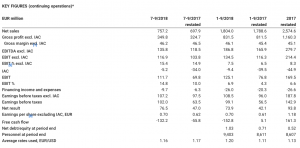

Amer Sports reported earnings in the third quarter jumped 47.0 percent as sales gained 8.5 percent.

July-September 2018 (continuing operations)

-

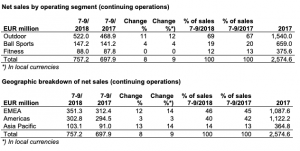

Net sales were EUR 757.2 million (July-September 2017: 697.9). In local currencies, net sales increased by 9 percent. Organic growth was 3 percent.

-

EBIT excluding items affecting comparability was EUR 116.9 million (103.8). Items affecting comparability were EUR -5.2 million (-34.0).

-

Earnings per share excluding IAC were EUR 0.70 (0.62). Earnings per share were EUR 0.66 (0.40).

-

Outlook for 2018 unchanged.

January – September 2018 (continuing operations)

-

Net sales were EUR 1,804.0 million (January-September 2017: EUR 1,788.6 million). In local currencies, net sales increased by 5 percent. Organic growth was 3 percent.

-

Gross margin was 46.1 percent (45.4).

-

EBIT excluding IAC was EUR 134.5 million (116.3). Items affecting comparability were EUR -9.4 million (-39.5).

-

Earnings per share excluding IAC were EUR 0.70 (0.61). Earnings per share were EUR 0.64 (0.36).

Outlook

In 2018, Amer Sports’ net sales in local currencies, as well as EBIT excl. IAC, are expected to increase from 2017. Due to ongoing wholesale market uncertainties, the quarterly growth and improvement are expected to be uneven. The company will prioritize sustainable, profitable growth focusing on its five strategic priorities (Apparel and Footwear, Direct to Consumer, China, US, and Connected Devices and Services) whilst continuing its consumer-led transformation.

Heikki Takala, President and CEO

“We delivered a solid quarter in line with our expectations, and we made broad-based progress across the portfolio with ongoing acceleration in Winter Sports Equipment, Sports Instruments and Ball Sports, whilst we also continued to pursue the distribution renewal in Footwear with adverse short-term impact but longer term improvement already in sight. Our strategic focus areas are delivering with Softgoods accelerating thanks to Arc’teryx which will deliver another year of double digit growth and now Peak Performance which gives us a further boost. Direct to Consumer remains on strong growth trajectory at high double digit growth, and building blocks are well in place for further acceleration, including significant enhancements in our mobile shopping and own retail expansion. Also, progress in China is strong, and we continue to ramp up our investment for ongoing acceleration. Encouragingly, the U.S. is now returning to a mid-single digit growth.”

“Early September, we hosted a Capital Markets Day, where we reconfirmed our strategic framework and presented our portfolio considerations. Our long term strategies are proven, and we can expect continuous, profitable growth and strong value creation boosted by the business transformation towards areas of faster growth, higher profitability and better asset efficiency. The vast majority of our businesses and priorities are working well, whilst we also have some areas where we intervene for the long term business health. We continue to drive our sustainable growth model.”