In a new report, McKinsey & Co. predicts that nearshoring–or sourcing in the U.S. or countries close to the U.S.–will accelerate in the apparel industry in the years ahead. Many trends (e.g., speedy fashion shifts requiring quick turnarounds, advances in automation, sustainability concerns) are arriving to make nearshoring more attractive as others (e.g., rising wages in Asia, China tariffs) are making sourcing from Asia less so.

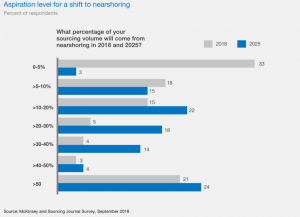

As part of the report, “Is Apparel Manufacturing Coming Home?” a survey of 188 apparel industry sourcing executives showed that 79 percent agreed “a step change in nearshoring for speed is somewhat or highly likely by 2025.”

When asked, “What will be your company’s most important nearshore market by 2025?” 30 percent of respondents cited the U.S. as the biggest potential winner when it comes to “nearshoring” for North America. Mexico followed with 20 percent.

The survey was conducted by McKinsey and The Sourcing Journal, the trade publication, in early September. Most of the respondents came from companies based in the Americas or Europe.

Asia Sourcing Costs Increasing

Among the factors reducing the advantage of offshoring cited in the study are rising wages for factory workers across Asia. Labor costs in China in 2005 were one-tenth of those in the U.S.; today, they are about one-third, according to the study. McKinsey wrote, “In some nearshore markets, the gap to offshore labor costs has even disappeared.” Mexico, for instance, offers lower average manufacturing labor costs than China.

A similar trend around wages is being seen overseas. Hourly manufacturing labor costs in Turkey were more than five times higher than those in China in 2005, the factor diminished to only a factor of 1.6 times by 2017.

A second reason sourcing from Asia is becoming less attractive is Asia’s rising demand for apparel. Apparel sales in Asia are projected to grow by 6 percent annually over the next several years accounting for about 40 percent of global sales by 2025. Wrote McKinsey, “This burgeoning local demand is creating competition for Asia’s apparel manufacturing capacity and changing the export balance. Though there are not yet substantial capacity issues, many Chinese manufacturers are switching their focus and producing for the local market since the demand is so high.”

Finally, the threat of tariffs is the newest factor reducing the allure of apparel offshoring. McKinsey wrote in the report, “The benefits of offshoring could shrink even further given geopolitical tension, which is driving uncertainty in trade agreements and exchange rate developments. Duties (of 9 to 12 percent) could increase and play a much more prominent role in the economics of sourcing and production.”

Tariffs on China Goods Likely to Stay

The impact of tariffs was a major topic at the Sourcing Journal Summit, held last week in New York City. The third tranche of tariffs, which went into effect on September 24, has had some effect on the apparel industry, but more tariffs hitting a wider range of apparel items are seen as inevitable, according to one panel at the conference.

“I believe [Chinese president] Xi Jinping is not going to back down, and I don’t believe the U.S. is going to back down,” stated Nicole Bivens Collinson, president of international trade and government relations at Sandler, Travis & Rosenberg, a law firm focused on international trade, customs and exports. “We’re stuck in this; I would say, 20 years. I don’t see any way out.”

Steve Lamar, EVP of the American Apparel and Footwear Association (AAFA), similarly foresees a lengthy reset of the economic relationship between China and the U.S. through tariffs. He said, “Tariffs, we believe, are a long-term thing.”

The Trump administration has already put a 10 percent tariff on a large number of Chinese goods, including certain accessories and footwear. The tariff rate will increase to 25 percent next year.

Lamar believes that one reason the tariffs will persist is because stakeholders will become accustomed to them. Lamar said, “Tariffs are a tax on consumers. But it’s hidden because people get used to them. As these tariffs become more of a normal thing, the supply chains get used to it, and the government users of that money get used to it. That’s another reason that tariffs will be with us for a long time.”

Need for Speed Favors Nearsourcing

On the other hand, the McKinsey report noted that the need for quicker turnarounds is making nearsourcing more beneficial.

McKinsey noted that mass-market apparel brands and retailers are increasingly competing with pure-play online start-ups that are able to replicate new styles and get them to customers within weeks. The pure-plays, such as Boohoo and Lesara, rely on short product development calendars, sourcing of small batch sizes and nearshoring

Furthermore, in most mass-market categories, trends have become more difficult to predict and tougher to estimate ahead of time with turnaround times as long as a year from Asia. Indeed, today’s hottest trends are determined by individual influencers and consumers rather than by the marketing departments of fashion companies.

McKinsey wrote, “In the past, consumers were spoon-fed trends via apparel companies’ ad campaigns. For decades, this ‘push’ model worked for apparel players. Today, however, in many segments in the mass market, trends are more likely to pop up from the street.”

Consumers take their style cues from Instagram, user reviews and their peers and individuals–whether celebrities or stylish consumers who have generated large followings on social media–have become the trendsetters and tastemakers.

Wrote McKinsey, “A new generation of consumer insights is gaining importance for the design and product development process. Even some of the traditional ‘fast-fashion’ companies have not been able to switch quickly enough from the ‘push’ to a ‘pull’ model–a model in which products are developed, tested and produced on demand. Traditional multi-label retailers are putting pressure on brands to increase their responsiveness, as the old preorder model is losing out to an increasing share of in-season open-to-buy approaches.”

As a result, McKinsey wrote that that speed and agility have become more critical skill-sets in the apparel space, and on-demand replenishment has increasingly become “a make-or-break capability.”

As a result, McKinsey wrote that that speed and agility have become more critical skill-sets in the apparel space, and on-demand replenishment has increasingly become “a make-or-break capability.”

McKinsey added, “By reducing time-to-market, apparel companies can act on nascent trends, scale up their winners and eliminate their losers–all within a single season. It used to be that a six-month fashion cycle was considered fast. Today, speedy time-to-market means no more than six weeks, and some retailers are able to do it even faster.”

The survey of supply chain executives in the report showed nearly two-thirds agreeing that speed to market and in-season reactivity are top priorities.

The traditional focus on producing high volumes of stock in bulk orders to sell based on plans generated many months ahead before the consumer sees them is also leading to overstocks and off-trend merchandise susceptible to markdowns. About 3 percent of unsold apparel is liquidated, the study noted.

Sustainability Concerns Support Nearby Manufacturing

The study also noted that consumers are becoming increasingly aware of the environmental impact of traditional linear apparel production modes, and the public outcry concerning overstock liquidation is becoming louder. Flying goods in from Asia for quicker turnarounds also carries a sizable carbon footprint.

In the survey, some 78 percent of apparel executives agreed that sustainability will also be somewhat/highly likely a key purchasing factor for mass-market apparel consumers by 2025. Adopting the position of a “truly circular fashion choice” was also seen as highly likely to be a winning strategy by 2025 by more than a quarter of respondents.

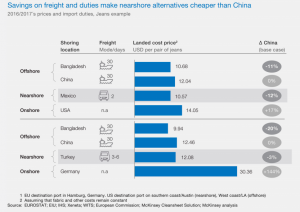

The study further found that even from a mere landed-cost price perspective, nearshoring can be economically viable in certain cases, mostly due to savings in freight and duties. For instance, a U.S. apparel company that moves production of basic jeans from either Bangladesh or China to Mexico can maintain or even slightly increase its margin, even without higher full-price sell-through.

Time saved also counts. A pair of jeans in 2016 and 2017, including 30-day ocean freight shipping, cost $12.04 a pair when made in China, but it cost only 17 percent more, or $14.05, to be made right in the U.S. That cost premium would be worthwhile, the study said, considering the shipping time saved and thus the possibility of selling products would more likely be on-trend and more likely to sell at or close to full price.

Factoring in two-day truck shipping, making that pair of jeans in Mexico actually cost just $10.57, or 12 percent less than making it in China, the McKinsey study said.

Infrastructure Hurdles

The main challenges to the shift to nearsourcing is poor infrastructure. The modern factories and expertise of China and other Asian marketswill be hard to replicate, according to the study. The current import volume from the five biggest “nearshoring” markets to the U.S. doesn’t make up even half of the U.S. import volume from China, the study said.

Another major challenge to nearsourcing is the sourcing of raw materials, fabrics and ingredients.

China plays a lead role as a supplier for yarns and fabrics, also for neighboring low-cost sourcing countries. In nearshore countries for U.S. and European apparel markets, the existing capacity is limited and local yarn and fabric supply varies greatly.

McKinsey said that building new yarn-spinning and fabric mills takes time, requires high capital expenditure and commitments by companies to order volumes. The survey found that some four-fifths of respondents believe that closed-loop recycling will scale up in the future. Overall, 63 percent believed it is likely that fabric production will move toward nearshore to support regional supply chains by 2025.

Regarding the possibility of own investment by apparel brands and retailers in fabric or garment factories, respondents are split: 49 percent have a positive leaning, and 48 percent are skeptical.

But advances in automation, including sophisticated 3D-printing and robotics, promise to support increased labor efficiency, throughput and flexibility in a more demand-focused sourcing model according to the study. For instance, up to 90 percent of the time spent sewing, the most labor-intensive part of making a garment, has the potential to be automated, McKinsey said.

More than four-fifths of the executives surveyed said that by 2025, they expect simple garments to be “fully automated,” translating to more than 80 percent of labor reduction according to the study. Digital printing could reduce labor for finishing garments by as much as 70 percent.

“Automation will be crucial to increasing the financial viability of on-demand nearshoring or onshoring models,” the study read. “Before being able to comprehend fully the prospect of automation for apparel manufacturing and its potential impact on nearshoring or onshoring, companies need to have a granular understanding of the technology landscape. But the message is clear: for certain products, automation not only makes nearshoring more attractive for European and U.S. apparel retailers and brands but also makes onshoring to the United States economically viable.”

The study did caution that mass-market apparel brands and retailers shouldn’t be looking to shift their whole production model to speedy, demand-based structures. Decisions about the future production footprint of each product type should be based on two main criteria: the cost reduction from nearshoring and the commercial value of reducing lead times.

McKinsey stated that firms “will have to strike the right balance in a multimodal sourcing strategy in which low-cost countries and traditional production will continue to play a big role.”

The McKinsey report is here.

Photo courtesy Maersk