American Outdoor Brands, the parent of Smith & Wesson, reported profits rose 6.7 percent in the fourth quarter ended April 30 on a 2.6 percent revenue gain. Earnings were well above and sales slightly above guidance.

Fourth Quarter Fiscal 2019 Financial Highlights

- Quarterly net sales were $175.7 million compared with $172.0 million for the fourth quarter last year, an increase of 2.2 percent. Guidance had called for reveneus between$162 million and $172 million.

- Gross margin for the quarter was 36.1 percent compared with 33.4 percent for the fourth quarter last year.

- Quarterly GAAP net income was $9.8 million, or $0.18 per diluted share, compared with $7.7 million, or $0.14 per diluted share, for the comparable quarter last year.

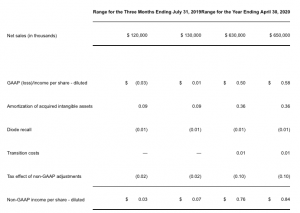

- Quarterly non-GAAP net income was $14.2 million, or $0.26 per diluted share, compared with $13.3 million, or $0.24 per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments to net income exclude a number of acquisition-related costs and other costs. Guidance had called for non-GAAP earnings in the range of 11 to 15 cents a share.

- Quarterly non-GAAP Adjusted EBITDAS was $31.9 million, or 18.1 percent of net sales, compared with $33.4 million, or 19.4 percent of net sales, for the comparable quarter last year.

Full Year Fiscal 2019 Financial Highlights

- Full year net sales were $638.3 million compared with $606.9 million a year ago, an increase of 5.2 percent.

- Full year gross margin was 35.4 percent compared with 32.3 percent last year.

- Full year GAAP net income was $18.4 million, or $0.33 per diluted share, compared with $20.1 million, or $0.37 per diluted share, last year.

- Full year non-GAAP net income was $45.9 million, or $0.83 per diluted share, compared with $25.1 million, or $0.46 per diluted share last year.

- Full year non-GAAP Adjusted EBITDAS was $111.3 million, or 17.4 percent of net sales, compared with $89.5 million, or 14.7 percent of net sales, last year.

James Debney, American Outdoor Brands Corporation President and Chief Executive Officer, commented, “Fiscal 2019 was a year that presented challenges for the firearms industry, including changes in the political environment and reduced consumer demand for firearms and for the accessories that are attached to them, such as lights, lasers, and scopes. Despite that backdrop, we delivered year over year growth in revenue and gross margin, and we believe we gained market share. At the same time, we made significant progress toward our long-term strategy with the construction and ramp up of initial operations at our new Missouri Campus, which will house our Logistics & Customer Services Division and our Outdoor Products & Accessories Division. This state-of-the-art, 633,000 square foot facility, which has now successfully commenced initial operations, will serve as the centralized logistics, warehousing, and distribution operation for our entire business, enabling growth, enhancing efficiencies, and allowing us to better serve customers across the organization. It will also serve as the office location for our entire Outdoor Products & Accessories business. When fully complete, the Missouri Campus will also have allowed us to eliminate 570,000 square feet of operations, office, warehouse, and third-party space across multiple locations, improving our efficiencies and generating capacity for future growth. This is an important strategic initiative supporting our objective to be the leading provider of quality products for the shooting, hunting, and rugged outdoor enthusiast.”

“In our Outdoor Products & Accessories segment, which generated 25 percent of our total yearly net sales, we delivered year-over-year sales growth of 3.3 percent and launched over 300 innovative new products, including the Caldwell Hydrosled, the Frankford M-Press, and the BOG DeathGrip Hunting Tripod. We introduced a new line of sights and scopes from our Crimson Trace brand, which not only broadened our product offering, but also greatly expanded our addressable market for this brand, and we launched an exciting re-branding initiative that expanded our BUBBA brand from a single product focus to an exciting lifestyle brand with a variety of new products that address the broader category of fishing gear and accessories.”

“In our Firearms segment, sales grew 6.3 percent over the prior fiscal year. While consumer demand remained weak throughout fiscal 2019, as indicated by Adjusted NICS background checks which were down 8.8 percent year over year, our units shipped into the sporting goods channel increased 4.2 percent. We introduced 106 new firearm skus, including 32 meaningful new products and numerous line extensions. At the end of the year we launched our Performance Center M&P 380 Shield EZ, a high performance version of our original Shield EZ, which has become a favorite for consumers seeking an easy-to-manage, personal protection firearm. Our Shield family products has become a consumer favorite, and by the end of fiscal 2019 we had shipped over 3 million Shield pistols. We are now approaching the $1 billion-dollar milestone for cumulative sales of the Shield family of handguns. Lastly, we introduced several bundle promotions, which combine a firearm with accessories from our Outdoor Products & Accessories segment, delivering customers a great value with brand names they know and trust.”

Jeff Buchanan, Executive Vice President, Chief Financial Officer, and Chief Administrative Officer, commented, “The strength of our balance sheet in fiscal 2019 supported a number of initiatives throughout the year. At the end of our fiscal year, our balance sheet remained strong with approximately $41.0 million dollars of cash and $115.4 million dollars of total net borrowings. I would note that we paid down $25 million dollars on our line of credit in the fourth quarter, resulting in no borrowings on the line of credit at the end of the year. We have reduced our net borrowings by nearly $100.0 million dollars in less than two years, while still investing heavily in our business, including small acquisitions and our new Logistics & Customer Services facility. Currently our long-term borrowings consists of $75.0 million dollars in Senior Notes due in 2020, and $81.4 million dollars on our Bank Term Loan A, also due in 2020.”

Financial Outlook

The company reports two segments: Firearms and Outdoor Products & Accessories. Firearms manufactures handgun, long gun, and suppressor products sold under the iconic Smith & Wesson, M&P, Thompson/Center Arms™, and Gemtech brands, as well as provides forging, machining, and precision plastic injection molding services. AOB Outdoor Products & Accessories is the industry leading provider of shooting, reloading, gunsmithing, gun cleaning supplies, specialty tools and cutlery, and electro-optics products and technology for firearms. This segment produces innovative, top quality products under the brands Caldwell; Crimson Trace; Wheeler; Tipton; Frankford Arsenal; Lockdown; BOG; Hooyman; Smith & Wesson Accessories; M&P Accessories; Thompson/Center Arms™ Accessories; Performance Center Accessories; Schrade; Old Timer; Uncle Henry; Imperial; BUBBA; UST; and LaserLyte.

Photo courtesy Smith & Wesson