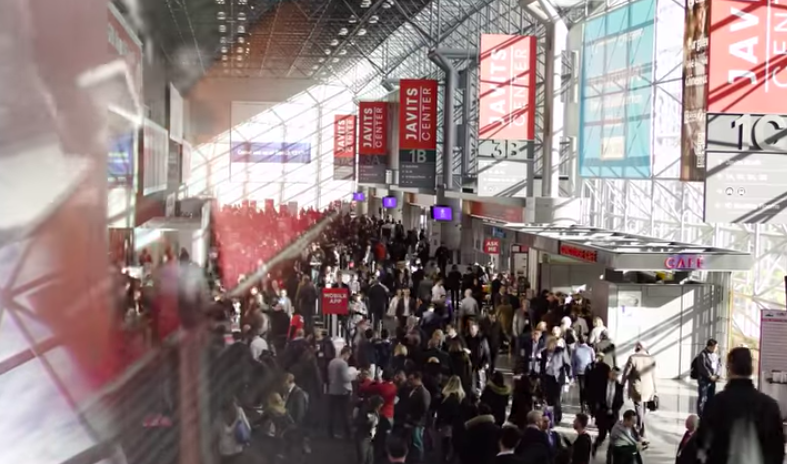

While the trade show floor was packed with many new retail technologies driven by artificial intelligence, the seminars at the NRF Big Show 2019 explored how those digital advances would work their way to retail’s selling floors.

BJ’s Wholesale Club chairman, president and CEO Chris Baldwin opened up the conference by reassuring attendees that the “retail apocalypse” remains a myth with retail seeing a bounce-back year in 2018.

“I would love to say that retail is back, but that would be wrong,” he said, according to Stores, NRF’s magazine. “Retail never went away. As I stand here today, I can say that our industry is more healthy, vibrant, innovative and exciting than ever.”

Brian Cornell, chairman and CEO of Target Corp, discussed four keys to retail success.

“You must always start with the consumer, in every decision that you make,” he said, according to Stores. “You have got to be willing to invest in both the present business and for tomorrow. Importantly, you have to be willing to reinvest in stores, in digital, in technology, in fulfillment and in your teams. And you have to be willing to disrupt yourselves.”

He said while digital has certainly been a disruptive force over the last decade, stores remain Target’s primary advantage by working as service centers, fulfillment hubs and showrooms for inspiration. He said, “In fact, this season, our digital business outperformed the industry by over 50 percent,” he said. “And that’s largely because three out of every four digital orders was fulfilled by a store.”

In a session focusing on “leading with conviction” at the NRF Big Show in New York, Best Buy’s CEO, Hubert Joly, admitted that believing he was ”the smartest person in the room” had been holding back his ability to create an environment for others to be successful.

Said Mr. Joly, according to RetailWire, “As I age, I believe that IQ is way overrated and that EQ is where it matters. It’s how you assemble a team and what kind of types of leaders you put in power.”

Being clear about your role as a leader is one of the five “be”’s of Mr. Joly’s leadership philosophy, which also includes being a purposeful leader. “Be clear about what drives you as an individual and what’s the meaning of your life and how it connects you to the company,” he said.

A good leader focuses on serving customers, not themselves or their “boss”, and is driven by their underlying values, added Mr. Joly.

Finally, leaders have to be authentic. He questioned the notion that “life happens outside of work” and encouraged executives to bring the “true version of yourself” to the workplace.

Overall, he believes a successful company must be about more than making money. He said, “You have to make money to be in business, but the purpose is to contribute to our customers, employees, shareholders and the communities we’re in. Magic happens when you can align people with the purpose of the company.”

At the same session according to SGBonline.com, Ed Stack, chairman and CEO at Dick’s Sporting Goods, discussed the retailer’s efforts to ensure a work/life balance for its employees and the retailer’s commitment to community that’s reflected both in its Sports Matter funding program and controversial decision to change its gun policy.

Stack said, ”People talked about it as a tough decision but actually it wasn’t because the right decisions are never tough decisions.”

According to SGBonline.com, Patagonia’s CEO Rose Marcario said in an interview at the show that the last decade “has been the best decade for us in terms of our business” even as the company has doubled-down on its commitment to sustainability and taken on risks by becoming more politically active around environmental issues. But she regarded Patagonia’s moves to take on hot-button issues as only “a proportional response to what’s going on.”

She also discussed how companies and organizations will have to collaborate more closely and be more transparent in order to improve the supply chain and help slow climate change. Patagonia, for instance, has a goal to become carbon neutral by 2025 but its goal is to be carbon neutral across the supply chain and not just in “owned and operated” facilities as many others are aiming for.

Marcario encouraged others to aim higher. “I think that’s where people need to really look and dive deep or we’re not going to have a world to live in that we’re going to love, that has diversity and beauty. So I think the number one thing is really looking deep into your supply chain and not just stopping at one level.”

Jeremy King, Walmart’s EVP and CTO, discussed at one session how separating the CTO to focus on the internal side of the business and the CIO to focus on the retail side has paid off for the retail giant.

“Customers, of course, don’t see the difference between Walmart.com and a Walmart store,” he said, according to Stores. “So that integration made it easier not only from an organizational standpoint, but it really made 100 percent sure that we were focusing on our customer.”

King noted how Wal-Mart is using machine learning to speed its reorder processes, virtual reality in training, and robots for unloading trucks. A core technology challenge for Wal-Mart is scale. King said, “I’m always talking to people about, ‘That’s a great idea. Now, how do you scale it to 5,000 stores?’”

At a panel on workplace diversity and inclusion, Shannon Schuyler, chief purpose officer for PwC, stressed the need for candid conversations in the workplace, understanding unconscious biases and sharing best practices across organizations. According to Stores, she said, “Diversity is no longer a competitive issue, or just a business issue. It is a societal issue.”

Carolyn Tastad, group president, North America, and executive sponsor of gender equality at Procter & Gamble, said society is still being held back by five harmful myths:

- Women are, as a group, less capable than men when it comes to leadership;

- There are simply fewer women in the leadership pipeline.

- Women are less good at, or anyway less drawn to, science, technology, engineering and mathematics.

- Maintaining the home, both tactically and emotionally, is primarily women’s responsibility.

- Sexual harassment is a “women’s issue.”

She said many perceive that women have a “confidence problem,” but said men are culpable. She added, “We don’t need to fix the women. We need to fix the system.”

Another similar session, entitled “Power of the Pack: Women Alone Can Be Powerful, But Together, Have Tremendous Impact,” discussed male privilege, entitlement and unconscious biases and the overall need to for men to get more involved solving women inequity hurdle with women largely leading that charge. According to Stores, being transparent about compensation between the sexes and recognizing the benefits in innovation and other areas that come from greater diversity should be stressed. Diane Dietz, president and CEO of Rodan + Fields and former EVP and chief marketing officer at Safeway, said, “We have to work in an environment where we feel we can bring our whole selves to work.”

At a session, “Product Paradigm Shift: Customer-centric Merchandising in the Age of Data and Decision Agility,” Michael Gilbert, EVP of product development at Kohl’s, cautioned not to overestimate digital connections. To him, the most meaningful learnings about customers had come through focus groups, surveys, conversations and other relationships to understand how those customers think and why they have the purchasing patterns that they do, rather than just what they’ve purchased. According to Stores, Gilbert said, “My advice is, make the customer the center of everything, but figure out where they’re going, and not just where they’ve been,” he said.

Tim Brown, co-founder of Allbirds, discussed the launch of the sustainable footwear brand in 2016, its challenge with copycats and how the company decided to open physical stores to further engage consumers.,

“I think everyone’s got some sort of childhood memory of going to their local shoe store and being fitted by an avuncular character, with metal sizing things that no one knows the name of,” said Brown, according to Stores. “People want to try on shoes.” The stores also help provide a deep connection with the customer — and foster greater understanding of the brand.”

Michael Rubin, founder and executive chairman of Fanatics, said in an interview that the company will generate a whopping $2.7 billion to $2.8 billion in revenue in 2019, and also indicated that the company’s next major revenue model will be selling on online marketplaces.

“For Amazon or any marketplace, they’d have the ability to have this enormous assortment of merchandise to best service their fans and take a commission like in so many sales they make. So we think that is the right long-term strategy. We think we’ll do that with dozens of marketplaces around the world,“ said Rubin, according to SGBonline.com.

Rubin also spent time talking about the evolution of Fanatics’ v-commerce model and its deeper partnerships with leagues that include deals to secure the rights to make fan merchandise and direct equity investments by many leagues into Fanatics.

The idea for v-commerce came while Rubin was running GSI Commerce around 2005 to 2007 as Rubin and the GSI team began recognizing that two players, Amazon and Alibaba, would eventually come to dominate e-commerce and competitors would need to take differentiation to another level. He said, “People ask me all the time what’s made us so successful, and I say we owe it to Amazon and Alibaba because we had so much respect for what they’re doing and we knew that if we didn’t completely differentiate ourselves, we’d be dead.”

Michael Evans, president of Alibaba Group, said Alibaba differs from Amazon because Alibaba is a marketplace and doesn’t compete with with brands or any retailers who use the site. “In fact, we share data with them,” he said, according to Stores.

At a session, Lee Peterson, EVP at customer experience specialists WD Partners, noted that foot traffic in stores has been declining 10 percent year-over-year “since the Great Recession” due to the shift to online selling, according to Stores. And although 90 percent of all retail purchases still take place in stores, the figure would be much higher excluding auto dealers, restaurants and other categories that don’t make sense for online selling.

But he said physical stores are becoming more important with click-and-collect and online order fulfillment and that brands such as Vans and Dr. Martens are turning them into social gathering places.

“Physical retail is no longer about the distribution of goods,” Peterson said, “but about building brand equity.”

Another difference is scale with Alibaba having 600 million consumers and more than 200,000 brands on the platform. Finally, more than 85 percent of Alibab’s customers are under 35. He said, “So, this is a young group of consumers, and nearly everything they do — more than 90 percent — is done over a mobile phone.

Image courtesy NRF