Yeti Holdings Inc. raised its outlook for the year after reporting revenues jumped 45 percent in the second quarter due to strong direct-to-consumer gains. Adjusted net income increased 68 percent in the period.

Matt Reintjes, president and CEO, commented, “Demand and passion for the Yeti brand remained robust during the second quarter. Net sales surged 45 percent during the period, driven by strong direct-to-consumer performance throughout the quarter including Mother’s Day and Father’s Day, significant year-over-year recoveries in channels such as wholesale that experienced outsized impacts during the pandemic, and a more than three-fold gain in our international business. This topline performance combined with better-than-planned operating margins fueled 66 percent earnings per share growth for the quarter.”

Reintjes concluded, “The ongoing momentum in the business continues to be supported by the incredible execution of our team and many brand partners. We remain diligent and thoughtful as we contain and mitigate global supply chain volatility and cost pressures with a focus on what we directly control—driving brand passion, consideration and demand. Our conviction and discipline in these areas support our increased full-year net sales and earnings per share outlooks for the year.”

For The Three Months Ended July 3, 2021

- Net sales increased 45 percent to $357.7 million, compared to $246.9 million during the same period last year. Wall Street’s consensus estimate had been $327.3 million.

- Direct-to-consumer (“DTC”) channel net sales increased 48 percent to $196.9 million, compared to $133.0 million in the prior-year quarter, driven by strong performance in both Drinkware and Coolers & Equipment. The DTC channel grew to 55 percent of net sales, compared to 54 percent in the prior-year period.

- Wholesale channel net sales increased 41 percent to $160.8 million, compared to $113.9 million in the same period last year, driven by both Drinkware and Coolers & Equipment. In the second quarter of 2020, wholesale channel net sales were adversely impacted by the temporary store closures due to COVID-19.

- Drinkware net sales increased 69 percent to $192.9 million, compared to $114.3 million in the prior-year quarter, primarily driven by the continued expansion of Drinkware product offerings, including the introduction of new colors and sizes, and strong demand for customization.

- Coolers & Equipment net sales increased 23 percent to $157.8 million, compared to $128.6 million in the same period last year, driven by strong performance in soft coolers, bags, outdoor living products, cargo, and hard coolers.

- Gross profit increased 52 percent to $209.1 million, or 58.5 percent of net sales, compared to $137.5 million, or 55.7 percent of net sales, in the second quarter of 2020. The 280 basis point increase in gross margin was primarily driven by a favorable mix shift to its DTC channel, product cost improvements and lower inventory reserves partially offset by the unfavorable impact of the non-renewal of the Global System of Preferences program on import duties and higher inbound freight.

- Selling, general and administrative (“SG&A”) expenses increased 50 percent to $136.7 million, compared to $91.0 million in the second quarter of 2020. The 2020 period included the benefit of cost reduction initiatives implemented in response to COVID-19. As a percentage of net sales, SG&A expenses increased 140 basis points to 38.2 percent from 36.8 percent in the prior-year period. This increase included a 220 basis points increase in non-variable expenses, primarily driven by higher marketing expenses. Variable expense leverage of 80 basis points on higher net sales positively impacted the quarter.

- Operating income increased 56 percent to $72.4 million, or 20.2 percent of net sales compared to $46.5 million, or 18.8 percent of net sales, during the prior-year quarter.

- Adjusted operating income increased 57 percent to $77.4 million, or 21.6 percent of net sales, compared to $49.3 million, or 20.0 percent of net sales, during the same period last year.

- Net income increased 68 percent to $56.2 million, or 15.7 percent of net sales, compared to $33.5 million, or 13.6 percent of net sales, in the prior-year quarter; Net income per diluted share increased 66 percent to $0.63, compared to $0.38 per diluted share in the prior-year quarter.

- Adjusted net income increased 68 percent to $60.0 million, or 16.8 percent of net sales, compared to $35.6 million, or 14.4 percent of net sales, in the prior-year quarter; Adjusted net income per diluted share increased 66 percent to $0.68, compared to $0.41 per diluted share in the prior-year quarter. Wall Street’s consensus estimate had been 55 cents.

For The Six Months Ended July 3, 2021

- Net sales increased 44 percent to $605.2 million, compared to $421.4 million in the prior year.

- DTC channel net sales increased 52 percent to $323.7 million, compared to $212.6 million in the prior-year period, driven by both Drinkware and Coolers & Equipment. The DTC channel grew to 53 percent of net sales, compared to 50 percent in the prior year.

- Wholesale channel net sales increased 35 percent to $281.6 million, compared to $208.7 million in the same period last year, primarily driven by both Drinkware and Coolers & Equipment. In the second quarter of 2020, wholesale channel net sales were adversely impacted by the temporary store closures due to COVID-19.

- Drinkware net sales increased 51 percent to $341.8 million, compared to $226.9 million in the prior-year period, primarily driven by the continued expansion of its Drinkware product offerings, including the introduction of new colors and sizes, and strong demand for customization.

- Coolers & Equipment net sales increased 34 percent to $251.3 million, compared to $188.1 million in the same period last year. The strong performance was driven by growth in outdoor living products, soft coolers, bags, hard coolers, and cargo.

- Gross profit increased 54 percent to $354.3 million, or 58.5 percent of net sales, compared to $230.0 million, or 54.6 percent of net sales, in the prior year. The 390 basis point increase in gross margin was primarily driven by a favorable mix shift to DTC channel and product cost improvements, lower inventory reserves and lower inbound freight.

- Selling, general and administrative expenses increased 45 percent to $241.8 million, compared to $167.3 million in the prior year, which included the benefit of cost reduction initiatives implemented in response to COVID-19. As a percentage of net sales, SG&A expenses increased 30 basis points to 40.0 percent from 39.7 percent in the prior-year period. This increase was due to an increase of 20 basis points in variable expenses, driven by the increased mix of its faster growing and higher gross margin DTC channel, which grew to 53 percent of net sales during the period, and an increase of 10 basis points in non-variable expenses.

- Operating income increased 79 percent to $112.5 million, or 18.6 percent of net sales, compared to $62.7 million, or 14.9 percent of net sales, during the prior year.

- Adjusted operating income increased 80 percent to $121.1 million, or 20.0 percent of net sales, compared to $67.4 million, or 16.0 percent of net sales, during the same period last year.

- Net income increased 107 percent to $86.8 million, or 14.3 percent of net sales, compared to $42.0 million, or 10.0 percent of net sales, in the prior year. Net income per diluted share increased 104 percent to $0.98, compared to $0.48 per diluted share in the prior year.

- Adjusted net income increased 105 percent to $93.3 million, or 15.4 percent of net sales, compared to $45.5 million, or 10.8 percent of net sales in the prior-year period. Adjusted net income per diluted share increased 102 percent to $1.05, compared to $0.52 per diluted share in the same period last year.

Balance Sheet and Cash Flow Highlights

- Cash increased to $233.8 million, compared to $127.5 million at the end of the second quarter of 2020.

- Inventory increased 60 percent to $221.7 million, compared to $138.8 million at the end of the prior-year quarter, primarily due to the inventory purchase order reductions taken in response to COVID-19 in 2020. The inventory increase represents a CAGR of 11 percent since the same period in 2019.

- Total debt, excluding finance leases and unamortized deferred financing fees, was $123.8 million, compared to $292.5 million at the end of the second quarter of 2020. During the first half of 2021, Yeti made mandatory debt payments of $11.3 million. At the end of the second quarter of 2021, its cash balance exceeded the total debt by $110.0 million.

Updated 2021 Outlook

For Fiscal 2021, a 52-week period, compared to a 53-week period in Fiscal 2020:

- Net sales are now expected to increase between 26 percent and 28 percent (versus the previous outlook of between 20 percent and 22 percent);

- Operating income as a percentage of net sales is expected to be approximately 19 percent, which remains unchanged from the previous outlook;

- Adjusted operating income as a percentage of net sales is expected to be approximately 20.5 percent, which remains unchanged from the previous outlook;

- The effective tax rate is now expected to be approximately 23 percent, (versus the previous outlook of 24.0 percent);

- Net income per diluted share is now expected to be between $2.25 and $2.29 (versus the previous outlook of $2.12 and $2.16), reflecting a 27 percent to 29 percent increase;

- Adjusted net income per diluted share is now expected to be between $2.42 and $2.46 (versus the previous outlook of $2.28 and $2.32), reflecting a 29 percent to 32 percent increase;

- Diluted weighted average shares outstanding is now expected to be approximately 88.6 million (versus the previous outlook of 88.5 million); and

- Capital expenditures are expected to remain between $55 million and $60 million, primarily to support investments in technology and new product innovation and launches.

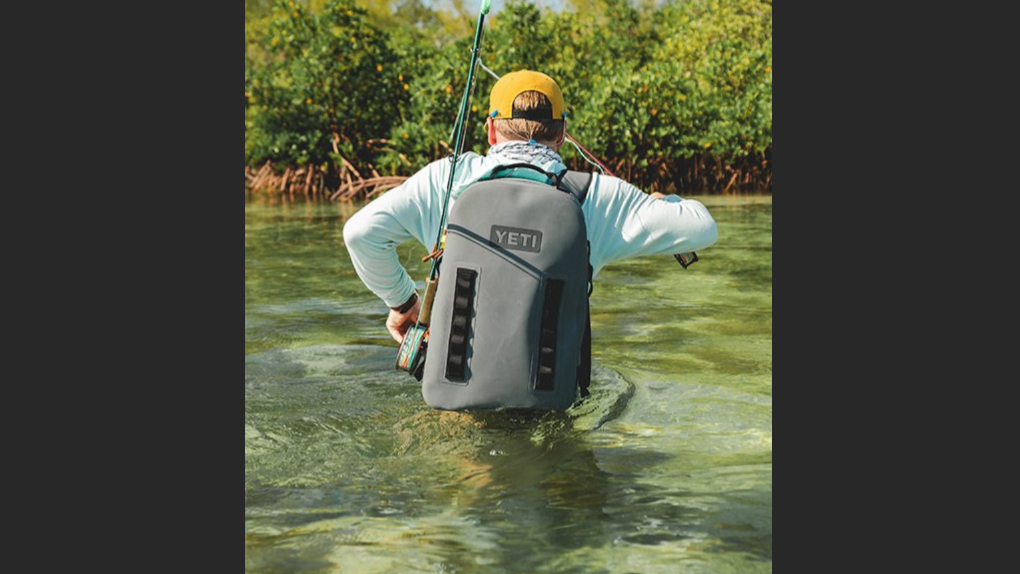

Photo courtesy Yeti