Acushnet Holdings Corp., the parent of Titleist and Footjoy, lifted its 2021 earnings and sales guidance after reporting sales surged 108.3 percent in the second quarter and earnings improved significantly. Both earnings and sales in the second quarter topped Wall Street targets.

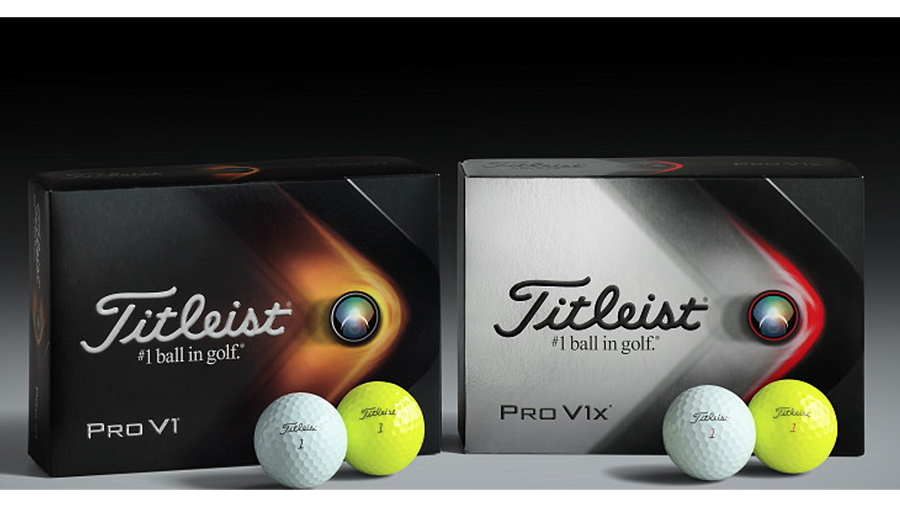

“Demand across all Acushnet product categories remains robust and contributed to another terrific quarter for the company,” said David Maher, Acushnet company’s president and chief executive officer. “Our strong performance was led by sales across our product portfolio, including new Titleist Pro V1 and Pro V1x golf balls, TSi drivers, and our FootJoy and KJUS brands. We look forward to building on our momentum in the second half with a wide range of product introductions led by new Titleist T Series irons and new FJ footwear and HydroKnit outerwear.”

Maher continued, “As we move into the second half of 2021 and see escalating positive COVID-19 cases in many regions, our highest priority remains the health and safety of our associates. While we expect golfer engagement to remain healthy, we do expect to face various levels of disruption within our supply chain. My Acushnet teammates are skilled at adapting and I have the utmost confidence in their ability to navigate these uncertainties with excellence as we seek to deliver the highest quality products and services to our trade partners and dedicated golfers around the world.”

Consolidated net sales for the quarter increased by 108.3 percent to $624.9 million. Wall Street’s consensus estimate had been $528.44 million. On a constant-currency basis, consolidated net sales were up 99.9 percent largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020 coupled with sales volume increases across all reportable segments, as rounds of play and consumer demand for golf-related products remained elevated during the second quarter of 2021. Sales volume growth of products that are not allocated to one of its four reportable segments also contributed to the increase in net sales.

On a geographic basis, net sales in the United States increased by 117.1 percent in the quarter driven by an increase of $65.8 million in Titleist golf balls, an increase of $43.7 million in FootJoy golf wear, an increase of $41.1 million in Titleist golf clubs and an increase of $17.1 million in Titleist golf gear, all driven by the same factors discussed above.

Net sales in regions outside the United States were up 100.0 percent and up 83.7 percent on a constant currency basis. The increase in net sales in all regions was primarily driven by increased sales across all reportable segments, driven by the same factors discussed above.

Segment specifics:

- 98.1 percent increase in net sales (91.6 percent increase on a constant-currency basis) of Titleist golf balls, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020 combined with higher sales volumes of its latest generation Pro V1 and Pro V1x golf balls launched in the first quarter of 2021.

- 111.0 percent increase in net sales (103.6 percent increase on a constant-currency basis) of Titleist golf clubs, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Also contributing to the increase were higher sales volumes and average selling prices across all product categories.

- 100.6 percent increase in net sales (92.9 percent increase on a constant-currency basis) of Titleist golf gear, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Sales volumes increased across all product categories.

- 141.0 percent increase in net sales (129.3 percent increase on a constant-currency basis) in FootJoy golf wear, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Sales volumes increased across all product categories and average selling prices were higher in apparel and gloves.

Net income attributable to Acushnet Holdings Corp. increased by $78.8 million to $81.1 million, or $1.08 a share, year-over-year, primarily as a result of an increase in income from operations, partially offset by an increase in income tax expense. Wall Street’s consensus estimate had been 77 cents.

Adjusted EBITDA was $127.8 million, up 286.1 percent year over year. Adjusted EBITDA margin was 20.4 percent for the second quarter versus 11.0 percent for the prior-year period.

Summary of first six months 2021 financial results

Consolidated net sales for the first six months increased by 70.1 percent. On a constant-currency basis, consolidated net sales were up 64.1 percent largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020 coupled with sales volume increases across all reportable segments, as rounds of play and consumer demand for golf-related products remained elevated during the first six months of 2021. Sales volume growth of products that are not allocated to one of its four reportable segments also contributed to the increase in net sales.

On a geographic basis, net sales in the United States increased by 75.2 percent in the six month period driven by an increase of $107.4 million in Titleist golf balls, an increase of $78.4 million in Titleist golf clubs, an increase of $57.1 million in FootJoy golf wear and an increase of $22.3 million in Titleist golf gear, all driven by the same factors discussed above.

Net sales in regions outside the United States were up 65.0 percent and up 52.8 percent on a constant-currency basis. The increase in net sales in all regions was primarily driven by increased sales across all reportable segments driven by the same factors discussed above.

Segment specifics:

- 72.1 percent increase in net sales (67.1 percent increase on a constant-currency basis) of Titleist golf balls, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020 combined with higher sales volumes of its latest generation Pro V1 and Pro V1x golf balls launched in the first quarter of 2021.

- 86.4 percent increase in net sales (80.7 percent increase on a constant-currency basis) of Titleist golf clubs, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Also contributing to the increase were higher sales volumes and average selling prices across all product categories.

- 55.6 percent increase in net sales (49.7 percent increase on a constant-currency basis) of Titleist golf gear, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Sales volumes increased across all product categories.

- 63.1 percent increase in net sales (56.3 percent increase on a constant-currency basis) in FootJoy golf wear, largely due to the adverse impact of government-ordered shutdowns in the second quarter of 2020. Sales volumes increased and average selling prices were higher across all product categories.

Net income attributable to Acushnet Holdings Corp. improved by $154.8 million to $166.0 million, year-over-year, primarily as a result of an increase in income from operations, partially offset by an increase in income tax expense.

Adjusted EBITDA was $263.0 million up 206.2 percent year over year. Adjusted EBITDA margin was 21.8 percent for the first six months versus 12.1 percent for the prior-year period.

Cash Dividend and Share Repurchase

Acushnet’s Board of Directors today declared a quarterly cash dividend of $0.165 per share of common stock. The dividend will be payable on September 17, 2021 to shareholders of record on September 3, 2021. The number of shares outstanding as of July 30, 2021 was 73,905,679.

During the quarter, the company repurchased 88,500 shares of common stock on the open market at an average price of $49.51 for an aggregate of $4.4 million. In addition, on April 2, 2021, the company repurchased from Magnus Holdings Co., Ltd., a wholly-owned subsidiary of Fila Holdings Corp., 355,341 shares of common stock for an aggregate of $11.1 million, in completion of the company’s previously discussed share repurchase obligations.

Impact of COVID-19 On Business

Acushnet said, “In March 2020, the World Health Organization declared a pandemic related to the novel coronavirus (“COVID-19”), which led to government-ordered shutdowns of non-essential businesses, travel restrictions and restrictions on public gatherings and, as a result, our results of operations for the second quarter and first half of 2020 were negatively impacted. As restrictions were eased, the game of golf experienced a surge in rounds of play around the world, which resulted in increased demand for our products. On a company-wide basis, we quickly began to experience demand pressures across all brands and product categories, which challenged and continue to challenge, our supply chain and our ability to service our trade partners and golfers.

“During the first half of 2021, rounds of play remained high and we continued to see an increase in demand for our products, leading to increased sales volumes across all reportable segments. However, during this period, we also experienced supply chain disruptions causing shortages of various raw materials and increased freight charges. While government-ordered shutdowns and restrictions have eased in most regions and mass vaccination programs are underway, the emergence of virus variants and resurgences of positive cases has led to a return to tighter restrictions in some regions and could prompt tighter restrictions in other regions which could further disrupt our supply chain. Although we have seen increased rounds of play and demand for golf-related products, over the course of the pandemic, this could change as mass vaccination programs continue to advance and restrictions are further eased on other activities.”

2021 Outlook

The company expects full-year consolidated net sales to be approximately $1,930 to $1,990 million and Adjusted EBITDA to be approximately $285 to $305 million. On a constant-currency basis, consolidated net sales are expected to be in the range of up 16.8 percent to 20.6 percent. The company’s outlook assumes no significant worsening of the pandemic, including incremental closures of global markets and additional supply chain disruptions.

When releasing first-quarter results on May 6, Acushnet said it expected full-year consolidated net sales to be approximately $1,795 to $1,875 million and Adjusted EBITDA to be approximately $255 to $285 million.

Photo courtesy Acushnet