Wolverine World Wide, Inc., parent of Merrell, Saucony, Wolverine Brand and Sweaty Betty, reported that 2024 fourth-quarter revenue fell 5.8 percent year-over-year but rose 3.3 percent to $494.7 million when tallying the company’s ongoing business. Full-year revenue fell 12.3 percent year-over-year on an ongoing basis.

The top-line consensus estimate from Wall Street was for revenues to reach $487 million and the company had a clear beat on that line.

Operating margin swung to the positive in Q4, amounting to 8.0 percent of sales, compared to a negative 35.5 percent of sales in Q4 2023.

Diluted EPS was 29 cents per share in Q4, compared to a loss of $1.15 per diluted share in Q4 2023. On a constant-currency diluted basis, Adjusted diluted EPS was 42 cents for the fourth quarter, compared to Adjusted diluted EPS a loss of 26 cents per diluted share in Q4 2023.

So that’s the good news, and it was news most welcomed by the investor class. But it only told half the story as Wolverine Worldwide came up short on their top-line forecast for 2025 and that sent WWW shares tumbling over 17 percent on the day to close at $15.53 a share.

At issue was expectations. The Street was expecting a revenue forecast of $1.858 billion for 2025 and Wolverine came in with a range between $1.795 billion and $1.825 billion, an increase of 2.5 percent to 4.3 percent. This includes an estimated $40 million currency headwind against 2024. On a constant-currency basis and excluding the 53rd week, the company expects revenue to grow approximately 4.2 percent to 5.9 percent year-over-year.

The lower top-line guide fed a miss on the bottom line as WWW forecast Adjusted diluted EPS in the range of $1.05 to $1.20 per diluted share, while the Street set expectations at $1.34 per diluted share. Adjusted operating margin is forecast at 8.3 percent of revenue in 2023, a solid basis-point improvement from 2024, but that also fell short of the Street’s prior estimates for Adjusted operating margin at 9 percent of revenues for the year.

Still, this should settle down a bit as investors and analysts get into the new year more. Some are already suggesting it is a conservative guide, which should be expected coming off the issues of the past few years.

Unfortunately, the forecast issue got in the way a good story about the turnaround efforts here and what has been accomplished. No sleep for the weary. It’s hit the numbers and get challenged on what’s next.

“A year ago, we outlined an ambitious turnaround strategy composed of three chapters: stabilization, transformation, and inflection. We shared a plan to meaningfully strengthen the company’s balance sheet, expand profitability, and sequentially improve revenue trends – culminating with an inflection to growth in the final quarter of 2024,” said Chris Hufnagel, president and CEO of Wolverine Worldwide. “I’m pleased to report that we accomplished all of these objectives. In the fourth quarter, we exceeded our expectations for revenue and earnings and inflected to growth as a company – delivering better-than-anticipated results for 2024.”

Hufnagel said it is time to move from a turnaround story to a growth story, one with Saucony in the lead.

“I think as we think about 2025 specifically, we’ve obviously done a lot of work to stabilize the organization,” the CEO noted. “We’ve highlighted that, and we’re largely finishing talking about turnaround and now we can focus on the next chapter, which is growth. I think historically, we just haven’t invested enough in our brands and our platforms. And this year, we’re doing a step-up in those investments, leading with investments behind Saucony, because we think that is the brand with certainly the most momentum.”

New company CFO Taryn Miller provided more detail on the year ahead.

“As we look to the future, our 2025 outlook builds on the momentum gained in 2024, reflecting a return to growth and improved profitability,” she said. “This outlook highlights the strength of our focused portfolio and investments to support our brands and strategic initiatives. It also takes into account foreign currency headwinds and the impact of a 53rd week.”

The outlook does not include potential impacts from recent tariff changes.

“This is a dynamic situation that we continue to monitor closely. As it relates to the February 4 tariffs on U.S. imports from China, we believe the impact to 2025 is manageable given our current exposure and the actions we plan to take to mitigate higher costs,” she suggested.

For the full year 2025, revenue is expected to be in the range of $1.795 billion to $1.825 billion

The company expects the Active Group revenue to grow in high-single digits on a constant-currency basis. New product launches, lifestyle expansion and focused go-to-market initiatives, including key city activations are expected to drive growth in the Active Group. The following brand outlook is on a constant-currency basis.

- Saucony is expected to drive outsized growth, increasing in the mid-teens, reflecting category momentum, new launches in both performance and lifestyle products and expanded distribution.

- Merrell is expected to grow mid single-digits, building on second half 2024 gains. Management expects key products, including the SpeedArc Collection, Moab Speed 2 and Agility Peak 5 will continue to drive the overall category.

- Sweaty Betty is expected to deliver low-single digit top-line growth in 2025 as the company takes actions to further refine its retail footprint and product offering to focus on more profitable sales.

Work Group revenue is expected to grow in low-single digits on a constant-currency basis.

“Growth in the Work Group reflects gains from new products and strength in core franchises such as Wolverine, Trade Wedge and Rancher,” said Miller.

She said Adjusted gross margin is expected to be approximately 45.5 percent of revenues at the midpoint of the outlook range, an increase of 90 basis points from 2024 as the company continues to benefit from full price sales and product cost savings.

Adjusted operating margin is expected to be approximately 8.3 percent at the midpoint of the outlook range, up from 7.5 percent in 2024. Product costs and SG&A savings are expected to offset inflation and fuel investments for future growth. These investments are crucial for driving innovation, enhancing our competitive edge and expanding our market presence.

With the reduction in net debt over the past year, interest and other expenses are projected to be between $25 million and $30 million, down from $39 million in 2024.

“With more than 80 percent of debt now at a fixed rate, we are less affected by near-term interest rate fluctuations,” the CFO explained. The effective tax rate is projected to be approximately 18 percent.

As a result of these key assumptions, Adjusted diluting an 8 cents foreign currency headwind. Miller said this represents Adjusted diluted earnings per share growth of 25 percent to 41 percent on a constant-currency basis.

Operating free cash flow is expected in the range of $70 million to $80 million for 2025 with approximately $40 million of capital expenditures. This range reflects higher earnings over prior year and incremental investments to fuel brand growth, capabilities and technology modernization. In addition, as working capital normalizes, we anticipate this to be a modest headwind in 2025.

Turning to our outlook for the first quarter. As we transition from the stabilization phase to driving sustained profitable growth, we expect performance to accelerate throughout 2025 as it did in 2024. We expect first quarter revenue of approximately $395 million, an increase of 1.2% versus 2024. This reflects the impact of foreign currency headwinds and the kids business model change in May of 2024. On a constant currency basis and excluding the business model change, the projected first quarter revenue growth is approximately 5.1%.

First quarter gross margin is expected to be around 46.6%, approximately flat to last year’s gross margin, which included a discrete benefit related to a business model change. We expect first quarter adjusted operating margin to be approximately 4.6%, roughly flat to prior year on a constant currency basis.

Adjusted diluted earnings per share is expected to be approximately $0.10. The first quarter is expected to be the lowest revenue quarter of the year, which is consistent with historical trends. As revenue ramps up over the balance of the year, we expect operating leverage to be a key driver in the sequential step-up in operating margin as demonstrated in 2024.

In summary, in 2024, we completed the stabilization phase of our turnaround and the transformation is well underway. We anticipate that 2025 will build on this foundation with plans to begin to drive sustainable, profitable growth. We are thoughtfully balancing the need for earnings and cash flow improvement with essential reinvestment to accelerate demand creation, build critical capabilities and modernize our technology.

Although we acknowledge that more work lies ahead, we are encouraged by the positive momentum of our business. In this dynamic operating environment, we remain focused on what we can control, investing in our brands, our team and technology to build new capabilities, drive growth and deliver value to our shareholders.

2024 Results

Financial results for 2024 and comparable results from 2023, in each case, for the ongoing business exclude the impact of Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023, and the Sperry business, which was sold in January 2024.

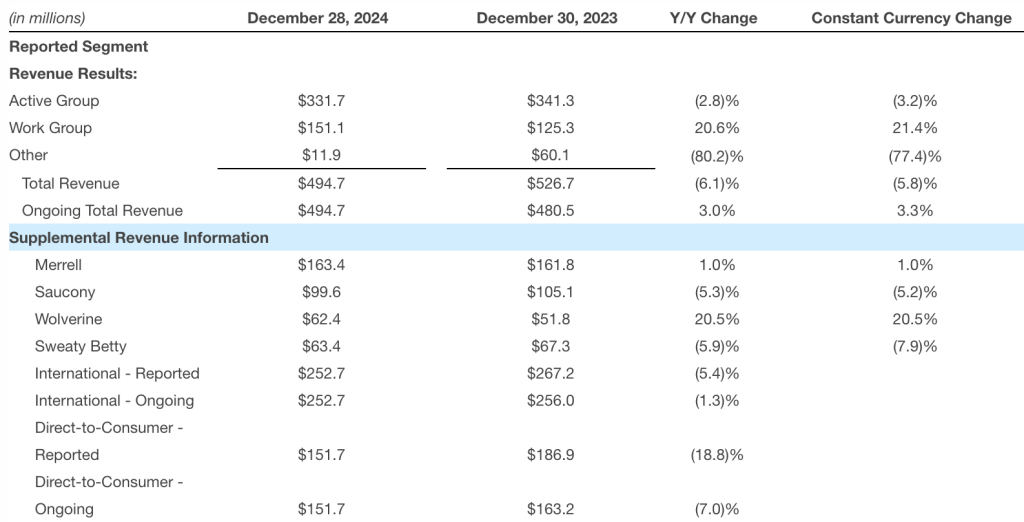

Fourth Quarter 2024 Sales Summary

For more detailed coverage of the Saucony and Merrell businesses, including product and regional trends, see linked articles at the bottom of this report.

Income Statement Summary

- Gross Margin improved significantly, improving 7400 basis points year-over-year (y/y) to 44.0 percent of sales, reportedly due to lower supply chain costs, product costs and lower sales of end-of-life inventory. Adjusted gross margin improved 620 basis points y/y to 44.0 percent of sales.

- Operating Expenses declined 46.8 percent y/y $177.9 million, compared to $379.9 million in the prior-year quarter.

- Operating Margin swung to the positive in Q4, amounting to 8.0 percent of sales, compared to a negative 35.5 percent of sales in Q4 2023.

- Diluted EPS was 29 cents per share in Q4, compared to a loss of $1.15 per diluted share in Q4 2023. On a constant-currency diluted basis, Adjusted diluted EPS was $1.02 for the fourth quarter, compared to Adjusted diluted EPS of 15 cents per share in Q4 2023.

Balance Sheet Summary

- Inventory at the end of the year was $241 million and was down $133 million, or approximately 35.6 percent, compared to the prior year-end.

- Net Debt at the end of the year was $496 million, down $246 million or approximately 33.1 percent compared to the prior year.

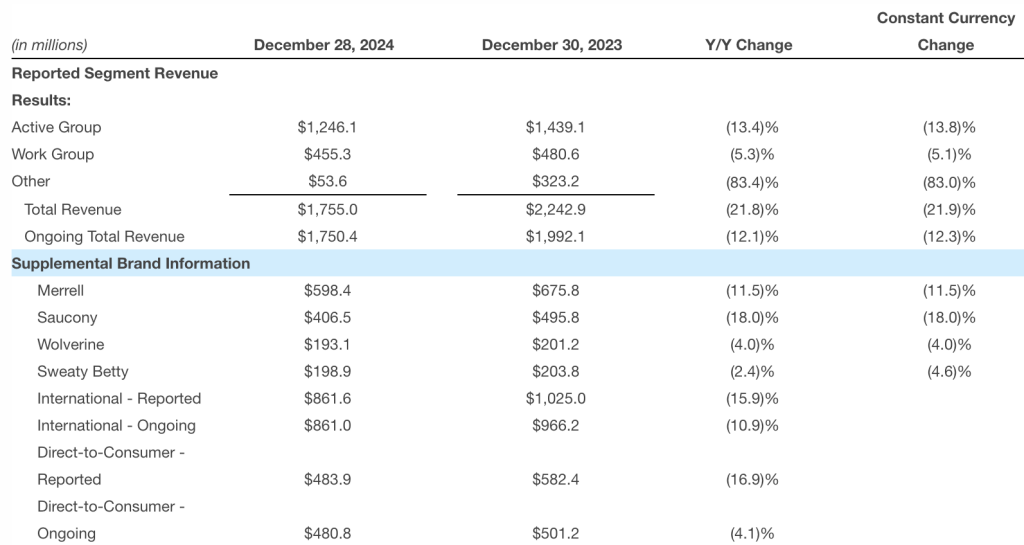

Full-Year 2024 Sales Summary

“2024 was a pivotal year for our 142-year-old company. While we haven’t yet reached our full potential, I’m encouraged by the progress we’ve made and thankful for our teams and partners around the world,” Hufnagel added. “The most important chapter is the next one, as we drive together to deliver better, more consistent returns for our shareholders.”

Image courtesy Merrell

EXEC: Saucony Tagged For Outsized Growth in 2025 After Strong 2024 Finish

EXEC: Merrell Looks at Life Beyond the Trail; Eyes the Mall for Lifestyle Growth