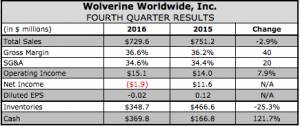

Wolverine Worldwide reported a loss of $1.9 million, or 2 cents a share, in the fourth quarter against earnings of $11.6 million, or 12 cents, a year ago. On an adjusted basis, EPS reached 33 cents a share compared to 33 cents in the prior year, exceeding Wall Street’s consensus target of 32 cents.

Wolverine Worldwide reported a loss of $1.9 million, or 2 cents a share, in the fourth quarter against earnings of $11.6 million, or 12 cents, a year ago. On an adjusted basis, EPS reached 33 cents a share compared to 33 cents in the prior year, exceeding Wall Street’s consensus target of 32 cents.

Adjusted financial results exclude restructuring and impairment costs, organizational transformation costs, and debt extinguishment and other costs. On a currency-neutral basis, adjusted earnings would have been 36 cents a share.

Reported revenue was $729.6 million, down 2.9 percent versus the prior year. Underlying revenue grew 0.1 percent versus the prior year. Underlying revenue are adjusted for the impact of foreign exchange, retail store closures and the exit of the Cushe business.

On a conference call with analysts, Blake Krueger, chairman, CEO and president, said both earnings and sales were in line with the high-end of its expectations. But he was most encouraged that several steps to jumpstart growth, including a doubling its investment in consumer insights, are starting to pay off.

“Our investments in key strategic initiatives like consumer insights, international expansion, and e-commerce growth are paying significant dividends, some of which we are just beginning to realize,” he said.

Reported gross margin in the quarter was 36.6 percent, compared to 36.2 percent in the prior year. Adjusted gross margin on a constant currency basis was 37.7 percent, up 110 basis points versus the prior year.

Reported operating margin was 2.1 percent, compared to 1.9 percent in the prior year. Adjusted operating margin on a constant currency basis was 7.3 percent, up 140 basis points versus the prior year.

Among its segments, underlying revenue in the Wolverine Outdoor and Lifestyle Group was down 1.7 percent compared to the prior year with Chaco driving very strong double-digit growth; Cat, up double digits; Hush Puppies, flat; and Merrell, down 7 percent.

“Merrell’s performance improved significantly in Q4 versus the third quarter, largely due to its key product initiatives and new collection introductions,” said Krueger.

He noted that Merrell’s performance outdoor category, fueled by a number of new products introduced this year, gained share in the U.S. marketplace and grew globally.

“The Arctic Grip collection like the Moab FST captured the attention of consumers with a true performance innovation story and sold-through extremely well,” added Krueger. “The brand’s active lifestyle category remains challenging and is a critical focus for the brand going forward.”

Backed by investments, Merrell’s e-commerce sales grew over 30 percent in the final quarter, on pace with its full-year growth rate.

“Looking ahead, we are confident in Merrell’s direction,” said Krueger. “Consumers love the brand, and the injection of updated product design and innovation to keep franchises was critical in 2016. This also provides a proven roadmap moving forward.”

Merrell just introduced the Moab 2 as well as the Siren Sport Q2, a light hiker designed specifically for women. Added Krueger, “The brand also anticipates launching its new technical and work program this spring responding to persistent consumer demand. We believe consumer lifestyle trends are evolving in the direction that favors Merrell.”

Krueger also noted that Todd Spaletto, formerly president of The North Face, officially joined Wolverine on Monday and will serve as president of the Outdoor and Lifestyle Group. Krueger added, “He’s a tremendous addition to our team.”

In the Wolverine Boston Group, fourth quarter underlying revenue grew 6.2 percent versus the prior year with Keds posting “very strong” double-digit growth, and both Sperry and Saucony up mid-single digits.

Sperry’s growth was fueled by the “exceptional performance” of its boot program, which claimed the top-selling style in the category for the second straight year. Both sperry.com and the brands international business up were also strong, up more than 20 percent.

“Sperry continues to make good progress on its strategic direction overall, building a more relevant brand and a diversified product offering and a more global distribution base,” added Krueger. “To capitalize on Sperry’s many global lifestyle opportunities, we recently appointed new leadership for the brand; Tom Kennedy, a seasoned executive with apparel, accessories, retail, and athletic experience, who has been with the company for more than a year.”

Saucony’s growth was boosted by its international business growing in the high-teens to represent almost half of total Saucony revenue. Saucony launched the Guide 10 early in the quarter and the new Freedom ISO in December. Said Krueger, “Initial sell-in and sell-through has been very strong and momentum is expected to ramp up into this spring. Saucony’s product engine, which we believe is among the best in the industry, only continues to get stronger.”

In the Wolverine Heritage Group, underlying revenue was down 6.1 percent year over year in the quarter with the Wolverine brand down low-single-digits and, Bass, down mid-single digits as a result of delays in Department of Defense contract awards.

The company reported last quarter that the Wolverine brand was in the process of realigning its distribution strategy by focusing on more premium channels. The move resulted in slightly lower revenue in Q4, but gross margin improved close to 500 basis points and operating margin was up at a very strong double-digit pace. In addition, market share grew in the premium distribution channel for Wolverine brand and wolverine.com grew well over 20 percent. Said Krueger, “Looking ahead, the Wolverine brand has a robust product pipeline and is poised to launch the largest introduction of new product in over 20 years.”

For the full year, Wolverine reported revenue of $2.49 billion, down 7.3 percent versus the prior year. Underlying revenue declined 4.9 percent versus the prior year. Earnings declined 28.5 percent to $87.7 million, or 89 cents a share. On an adjusted basis, EPS were $1.36, and, on a constant currency basis, $1.52, compared to $1.45 in the prior year.

For 2017, reported revenue is projected in the range of $2.27 billion to $2.37 billion, a decline of 9 percent to 5 percent. Underlying revenue is expected in the range of down 2.3 percent to growth of 1.9 percent, reflecting approximately $160 million to $180 million of impact from currency and store closures.

Slight gross margin improvement is projected due to lower product costs and supply chain efficiencies partially offset by negative currency impact and mix impact from fewer stores.

Reported operating margin is expected in the range of 7.9 percent to 8.5 percent and adjusted operating margin in the range of 9.9 percent to 10.4 percent, resulting from operational excellence initiatives focused on a supply chain optimization, omnichannel transformation, and operational efficiencies.

Reported diluted EPS is expected in the range of $1.19 to $1.29. Adjusted diluted EPS are expected in the range of $1.45 to $1.55. On a constant currency basis, adjusted EPS in the range of $1.53 to $1.63, which compares to $1.52.

Image courtesy Merrell