American Outdoor Brands Corp., parent company of Smith & Wesson, on Thursday, reported earnings per share for the fiscal third quarter ended January 31 of 13 cents, which missed Wall Streets’ targets by 10 cents. Q3 revenue of $166.7 million was short $20.6 million.

The company’s quarterly earnings release comes as a big transition looms. AOBC reiterated that it is proceeding with its previously announced plan to spin-off its outdoor products and accessories business as a tax-free stock dividend to its stockholders in the second half of calendar 2020.

The transaction will create two independent publicly traded companies: Smith & Wesson Brands, Inc. (the firearm business) and American Outdoor Brands, Inc. (the outdoor products and accessories business). The consummation of the spin-off is subject to final approval of the company’s board of directors, customary regulatory approvals, and tax and legal considerations.

Third Quarter Fiscal 2020 Financial Highlights

- Quarterly net sales were $166.7 million compared with $162 million for the third quarter last year, an increase of 2.9 percent. It should be noted that a change required by the Tax and Trade Bureau related to the timing of federal excise tax assessment within the company’s Firearms segment favorably impacted net sales in the quarter by $10.1 million. That change had no impact on gross margin dollars or operating expenses. Further details related to that change are outlined in the company’s Form 10-Q filed concurrently with this press release.

- Gross margin for the quarter was 33.1 percent compared with 33.4 percent for the comparable quarter last year. Excluding the change required by the Tax and Trade Bureau related to the timing of federal excise tax assessment within the company’s Firearms segment, gross margin for the quarter would have been 35.3 percent or an increase of 190 basis points over the comparable quarter last year.

- Quarterly GAAP net income was $5.7 million, or $0.10 per diluted share, compared with a GAAP net loss of $5.7 million, or $(0.10) per diluted share, for the comparable quarter last year. Results for the comparable quarter last year included a $10.4 million, non-cash impairment of goodwill in the Outdoor Products & Accessories segment, which had a $(0.19) impact on basic and diluted earnings per share.

- Quarterly non-GAAP net income was $6.9 million, or $0.13 per diluted share, compared with $8.9 million, or $0.16 per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments for net income excludes a number of acquisition-related costs and other costs. For a detailed reconciliation, see the schedules that follow in this release.

- Quarterly non-GAAP Adjusted EBITDAS was $22.4 million, or 13.4 percent of net sales, compared with $24.4 million, or 15.0 percent of net sales, for the comparable quarter last year. Excluding the change required by the Tax and Trade Bureau related to the timing of federal excise tax assessment within the company’s Firearms segment, non-GAAP Adjusted EBITDAS for the quarter would have been 14.3 percent.

During the quarter, the company announced that its board of directors named Mark P. Smith and Brian D. Murphy as co-presidents and co-CEOs, following the separation of former president and CEO, James Debney.

Smith was most recently president of the Manufacturing Services Division of the company, while Murphy was most recently president of the Outdoor Products & Accessories Division.

Smith commented, “Third quarter revenue in our Firearms segment was favorably impacted by changes in the timing of our excise tax assessment, as well as the positive impact of our new M&P9 Shield EZ pistol, which is built for personal protection and every day carry, and was displayed at SHOT Show in January. That positive impact, however, was partially offset by lower than anticipated orders from certain strategic retailers across multiple product categories. We believe that consumer demand for handguns remained strong during the quarter, as reflected by adjusted National Instant Criminal Background Check System (“NICS”) background checks, but we also believe that demand was fulfilled with existing retail channel inventory of our handguns. Our revenue in long guns declined due to a reduction in our inventory by certain strategic retailers, decreased bundle promotions compared to the prior year, and close-out sales of discontinued products in the prior year.”

Murphy commented, “In our Outdoor Products & Accessories segment, third-quarter revenue increased as a result of increased shooting, hunting, and cutlery product sales, driven by demand from several large national retailers and the success of our strategy with certain retail customers to normalize the cadence of ongoing replenishment orders. Point of sale data, which we collect from many of our larger customers, appears to indicate that our products in these categories remain popular with consumers as well. Revenue increases in the quarter were partially offset by reduced OEM sales of our laser sight products, bankruptcy and financial distress of certain customers, and the acceleration of one brick-and-mortar retailer’s private label strategy for camping accessories away from our branded survival products. Excluding the impact of these items, revenue would have increased approximately $3.3 million, or 7.9 percent, over the comparable quarter last year.”

Jeffrey D. Buchanan, CFO, commented, “During the third quarter, we successfully refinanced our revolving line of credit to extend the maturity out to October 2021, securing our ability to spin off our outdoor products and accessories business without obtaining additional bank approvals. Concurrent with the extension of the revolving line of credit, we repaid our term loan that was due in June 2020 and, in January, we called our Senior Notes that were due in August 2020, thereby extending the maturity of all of the company’s debt out to 2021. We ended our third fiscal quarter with $46.1 million in cash and $200 million in revolving debt.”

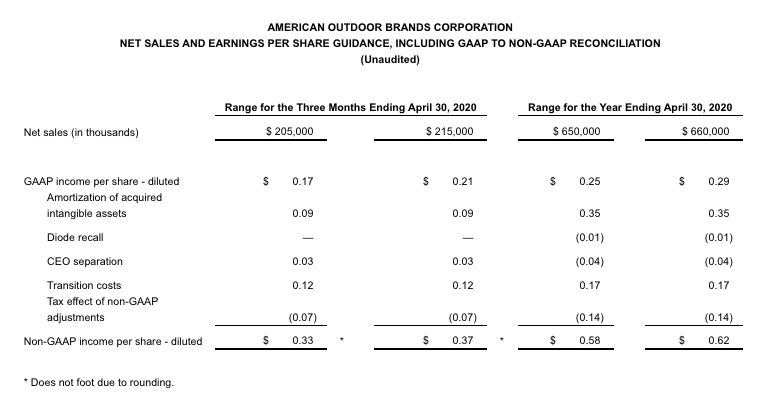

Financial Outlook

The company is also providing full-year revenue guidance for each of its business segments. Accordingly, the company expects full-year revenue for its Firearms segment to be between $502 million and $507 million and full-year revenue for its Outdoor Products & Accessories segment to be between $170 million and $175 million. The full-year revenue estimate for the Firearms segment includes additional revenue of $34 million to $36 million as a result of the change in timing of the federal excise tax assessment noted above and further discussed in the company’s Form 10-Q filed concurrently with this press release. Intercompany eliminations are expected to be approximately $22 million. This guidance takes into account several factors, including expected impacts from the Coronavirus, all of which are outlined in the company’s Form 10-Q.