Winnebago Industries, Inc. went the way of the RV industry in the fiscal second quarter that ended February 24 as the post-COVID market conditions could almost guarantee a double-digit decline on the top line and a loss on the bottom.

Revenues for the fiscal second quarter were $703.6 million, a decrease of 18.8 percent compared to $866.7 million for the comparable fiscal 2023 period. Lower unit sales related to market conditions and an unfavorable product mix drove the decrease.

Gross profit was $105.3 million, a decrease of 28.3 percent compared to $146.8 million for the fiscal 2023 period. Gross profit margin decreased 190 basis points in the quarter to 15.0 percent of sales due to deleverage and higher warranty experience compared to the prior year.

SG&A expenses were $64.2 million, a decrease of 3.0 percent compared to $66.2 million in the prior-year second quarter, driven by lower incentive-based compensation.

Operating income was $35.4 million, a 53.8 percent decrease from $76.8 million in the second quarter of fiscal 2023.

Net loss was $12.7 million, or 43 cents per diluted share, compared to net income of $52.8 million, or EPS of $1.52 per share, in the prior-year quarter.

Results for the second quarter of fiscal 2024 included a charge of $32.7 million, or $1.12 per share, attributable to the loss on repurchase of a significant portion of the company’s 2025 convertible senior notes. Adjusted earnings per diluted share was 93 cents, a decrease of 50.5 percent compared to adjusted earnings per diluted share of $1.88 in the corresponding 2023 period.

Consolidated Adjusted EBITDA was $49.8 million in Q2, a decrease of 43.7 percent compared to $88.4 million in the prior-year fiscal Q2 period.

“Winnebago Industries performed in line with our expectations for the quarter, navigating the effects of ongoing softness in the RV and marine markets,” said President and CEO Michael Happe. “As anticipated, wholesale shipments were constrained in the quarter, as dealers continued to closely manage inventory levels amid a higher interest rate environment and seasonal demand trends. Despite these macroeconomic challenges, we continue to demonstrate resilient profitability and an unwavering commitment to operational discipline that is reflected in the company’s diversified portfolio of premium brands, investments in new products and technologies, and healthy balance sheet.”

* * *

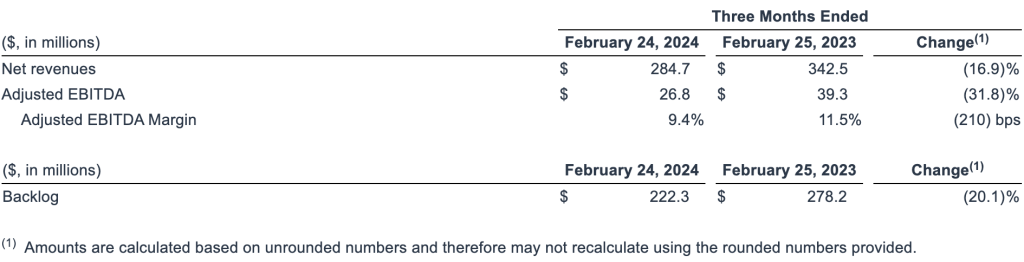

Towable RV

Revenues for the Towable RV segment were down compared to the prior-year period, primarily driven by a decline in unit volume related to market conditions and a reduction in average selling price per unit related to product mix and targeted price reductions, partially offset by lower discounts and allowances.

Segment Adjusted EBITDA margin decreased compared to the prior-year period, primarily due to deleverage and higher warranty experience compared to the prior year, partially offset by lower discounts and allowances.

The backlog decreased compared to the prior year due to current market conditions and a cautious dealer network.

* * *

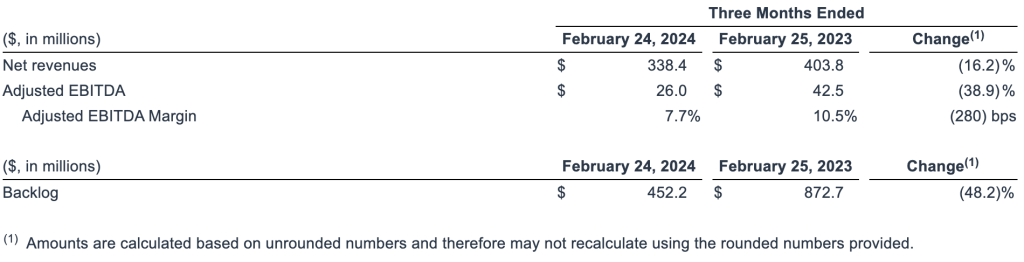

Motorhome RV

Revenues for the Motorhome RV segment were down from the prior-year period due to a decline in unit volume related to market conditions, higher discounts and allowances and unfavorable product mix, partially offset by price increases related to higher motorized chassis costs.

Segment Adjusted EBITDA margin decreased compared to the prior-year period, primarily due to deleverage, higher warranty experience, higher discounts and allowances, and operational efficiency challenges, partially offset by cost containment efforts.

The backlog decreased from the prior year due to current market conditions and a cautious dealer network.

* * *

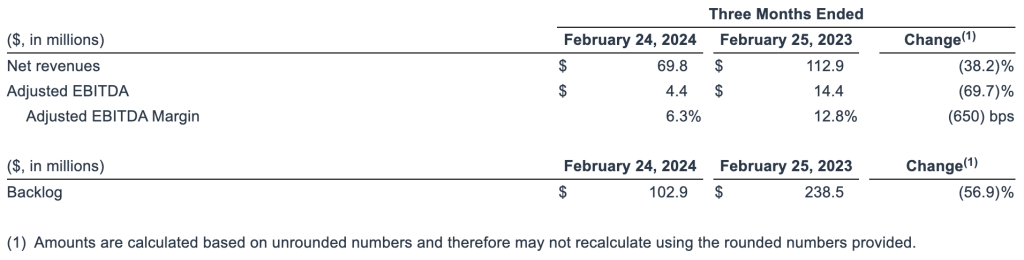

Marine

Revenues for the Marine segment were down from the prior-year period, primarily due to a decline in unit volume related to market conditions, an unfavorable product mix, and higher discounts and allowances.

Segment Adjusted EBITDA decreased compared to the prior-year period, primarily due to deleverage and higher discounts and allowances, partially offset by lower incentive-based compensation.

The backlog for the Marine segment was down from the prior-year period due to a cautious dealer network.

Balance Sheet and Cash Management

As of February 24, 2024, the company reported a total outstanding debt of $694.8 million ($709.3 million of debt, net of debt issuance costs of $14.5 million) and working capital of $649.0 million.

Cash flow provided by operations was $25.2 million in the Fiscal 2024 second quarter.

During the quarter, Winnebago Industries completed a $350 million offering of convertible senior notes for refinancing 2025 maturities. The company said the successful refinancing of its convertible senior notes underscores its strong operating performance and credit profile and provides financial flexibility for future growth.

“Purposeful innovation remains a core driver of our growth strategy, delivering customer-centric design and thoughtful, affordable technology to delight customers,” Happe continued. “In recent months, we have introduced new models and features across our motorized and towable RV portfolios, enabling Winnebago, Grand Design RV, and Newmar to further enhance our customer’s ability to be great outdoors. On the marine side, Chris-Craft recently launched a special 150th-anniversary edition of its iconic Launch 27, while our Barletta brand continues to expand its product reach as the industry’s fastest-growing pontoon business.”

Future Mid-Cycle Organic Growth Targets

Winnebago Industries revealed future mid-cycle organic growth targets in a press release. The company said the targets leverage the strength of its operating model, product innovation, business diversification, and long-term secular growth trends that drive consumer demand across the outdoor recreation markets. Market assumptions underlying the financial targets include North American RV retail volume at a mid-cycle, fiscal year range of 425,000 to 450,000 units and U.S. aluminum pontoon retail volume at a mid-cycle fiscal year range of 60,000 to 63,000 units.

Winnebago expects:

- Net revenues of $4.5 billion to $5.0 billion

- Gross margin of 18.0 percent to 18.5 percent

- Adjusted EBITDA margin of 11.0 percent to 11.5 percent

- Free cash flow of $325 million to $375 million

- North American RV market share of more than 13 percent

- U.S. aluminum pontoon market share of 13 percent

- Organic non-RV revenue mix representing 15 percent to 20 percent of total revenue

“Interest in the RV and boating lifestyles remains strong, creating a secular tailwind that supports the anticipated long-term growth of our portfolio of exceptional brands and aligns with our vision to be the trusted leader in premium outdoor recreation,” Happe said. “As we enter the second half of fiscal 2024, we are encouraged by data indicating that RV inventory levels are returning to an equilibrium stage, though we remain aggressive in managing production output and overall costs in a targeted manner. Looking ahead, we will continue to rely on our flexible, high-variable cost structure to drive improved operating leverage while capitalizing on innovation, product line expansion, channel partnerships, and operational excellence to achieve our future mid-cycle organic growth targets.”

Image courtesy Winnebago Industries